After warning multiple times,

The Reserve Bank of India(RBI)🧵made a major move yesterday to check the fast growth of unsecured loans!

What did the RBI do?

What will be the effect on banks and NBFCs?

A thread🧵on the regulation changes by the RBI and who are winners?

Lets go👇

The Reserve Bank of India(RBI)🧵made a major move yesterday to check the fast growth of unsecured loans!

What did the RBI do?

What will be the effect on banks and NBFCs?

A thread🧵on the regulation changes by the RBI and who are winners?

Lets go👇

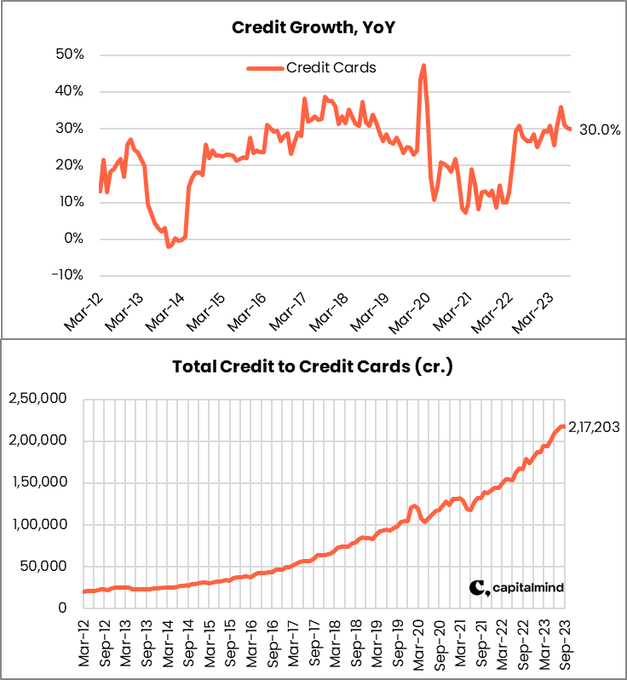

The fast pace of unsecured loans

Over the last 3 years, Banks have been growing very very fast on unsecured retail products like

🏦Personal Loans

🏦Credit Cards

Over the last 3 years, Banks have been growing very very fast on unsecured retail products like

🏦Personal Loans

🏦Credit Cards

Essentially every bank is trying to hand out unsecured loans ir-respective of credit underwriting to catch on the boom.

Unsecured loans are highly risky as they do not have any collateral in times of default

Unsecured loans are highly risky as they do not have any collateral in times of default

Banks and RBI warned multiple times on fast pace of growth:-

ICICI Bank:-

We pulled back on 50,000cr worth of unsecured loans

HDFC Bank

We are careful with unsecured retail credit

Bajaj Finance:-

We are careful about mispriced loans in unsecured space

ICICI Bank:-

We pulled back on 50,000cr worth of unsecured loans

HDFC Bank

We are careful with unsecured retail credit

Bajaj Finance:-

We are careful about mispriced loans in unsecured space

RBI Governor:-

There is a bubble in unsecured retail credit

But,

Small banks and NBFCs keep growing at a very fast space in unsecured retail credit!

The next waive of NPAs will come from

Unsecured retail loans i.e. personal loans and credit cards

There is a bubble in unsecured retail credit

But,

Small banks and NBFCs keep growing at a very fast space in unsecured retail credit!

The next waive of NPAs will come from

Unsecured retail loans i.e. personal loans and credit cards

So what are risk weights?

Rish Weights means the capital a bank has to set aside every time it gives out a loan

🏦Risk weights on Unsecured loans are higher

🏦Risk Weights on Secured loans are lower

This is a risk management tool

Rish Weights means the capital a bank has to set aside every time it gives out a loan

🏦Risk weights on Unsecured loans are higher

🏦Risk Weights on Secured loans are lower

This is a risk management tool

So what has the RBI now done?

RBI Acts now:-

🏦Consumer credit by banks and NBFCs to attract 125% risk weight, from 100% previously

🏦Credit card loans by banks to attract 150% risk weight from 125% previously

🏦Credit card loans by NBFCs to attract 125% risk weight

RBI Acts now:-

🏦Consumer credit by banks and NBFCs to attract 125% risk weight, from 100% previously

🏦Credit card loans by banks to attract 150% risk weight from 125% previously

🏦Credit card loans by NBFCs to attract 125% risk weight

So what this means?

Every time a bank gives out a credit card loan or a consumer loan.

they will have to set aside more capital to the tune of 25%.

This will now mean more capital will be required in order to fund the so.

Every time a bank gives out a credit card loan or a consumer loan.

they will have to set aside more capital to the tune of 25%.

This will now mean more capital will be required in order to fund the so.

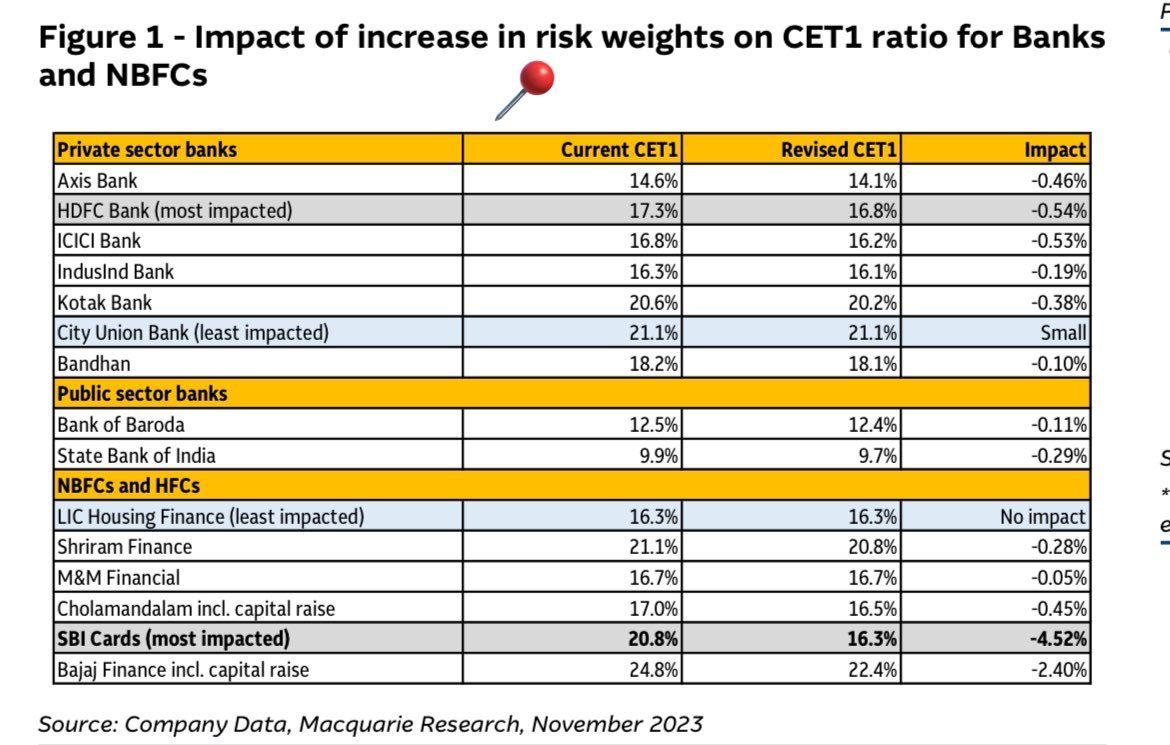

This will have a direct impact on the capital adequacy of almost all banks as more capital has to be set aside

Standalone Credit Card companies like SBI Cards will be the worst hit👇

Source:-Macqurie

Standalone Credit Card companies like SBI Cards will be the worst hit👇

Source:-Macqurie

So what will be the impact of this move and who wins out?

This is negative for all risk-taking NBFCs & Banks

This is positive for all Risk Averse NBFCs& Banks

This is particularly negative for NBFCs with very small base, no deposit franchise, and fast growth of unsecured loans

This is negative for all risk-taking NBFCs & Banks

This is positive for all Risk Averse NBFCs& Banks

This is particularly negative for NBFCs with very small base, no deposit franchise, and fast growth of unsecured loans

Cost of Capital will now become more expensive:-

As more risk weights mean more risk on the book,which means more capital needs to be raised

The cost of capital for NBFCs in particular will start to move up again.

Very negative for NBFCs

As more risk weights mean more risk on the book,which means more capital needs to be raised

The cost of capital for NBFCs in particular will start to move up again.

Very negative for NBFCs

Clear Winners are the larger banks?

Larger banks that have a balanced book and dont grow way too fast on unsecured loans are the clear winner in this scenario.

They have a strong profitability pool that they will be able to maintain capital even after this erosion in capital

Larger banks that have a balanced book and dont grow way too fast on unsecured loans are the clear winner in this scenario.

They have a strong profitability pool that they will be able to maintain capital even after this erosion in capital

Conclusion:-

RBI is wide awake to the systemic risk posed by unsecured lending!

They are checking the euphoria on lenders!

This is a good warning to the lenders

The RBI under Governor Das has done a brilliant job in regulating the system well!

Kudos to them!👏👏

RBI is wide awake to the systemic risk posed by unsecured lending!

They are checking the euphoria on lenders!

This is a good warning to the lenders

The RBI under Governor Das has done a brilliant job in regulating the system well!

Kudos to them!👏👏

It is time to ditch lends who are growing way to fast on the unsecured lending and move to lenders who have a balanced book of both unsecured and secured lending.

Keep following me -@AdityaD_Shah as I write daily to make you aware around:

📈Personal Finance

📈Investing

📈Stock Analysis

Go to my profile and hit the bell icon🔔to always stay updated

📈Personal Finance

📈Investing

📈Stock Analysis

Go to my profile and hit the bell icon🔔to always stay updated

Disclaimer:-

This is my own study

Not an investment recommendation

Please consult your own financial advisor before making any investment decisions

This is my own study

Not an investment recommendation

Please consult your own financial advisor before making any investment decisions

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter