Is Tesla an Auto Company or an AI-powered Robot Company?

The answer depends on whether you’re looking at today versus the future. Or whether you rent ("trade") or own ("buy and hold") the stock.

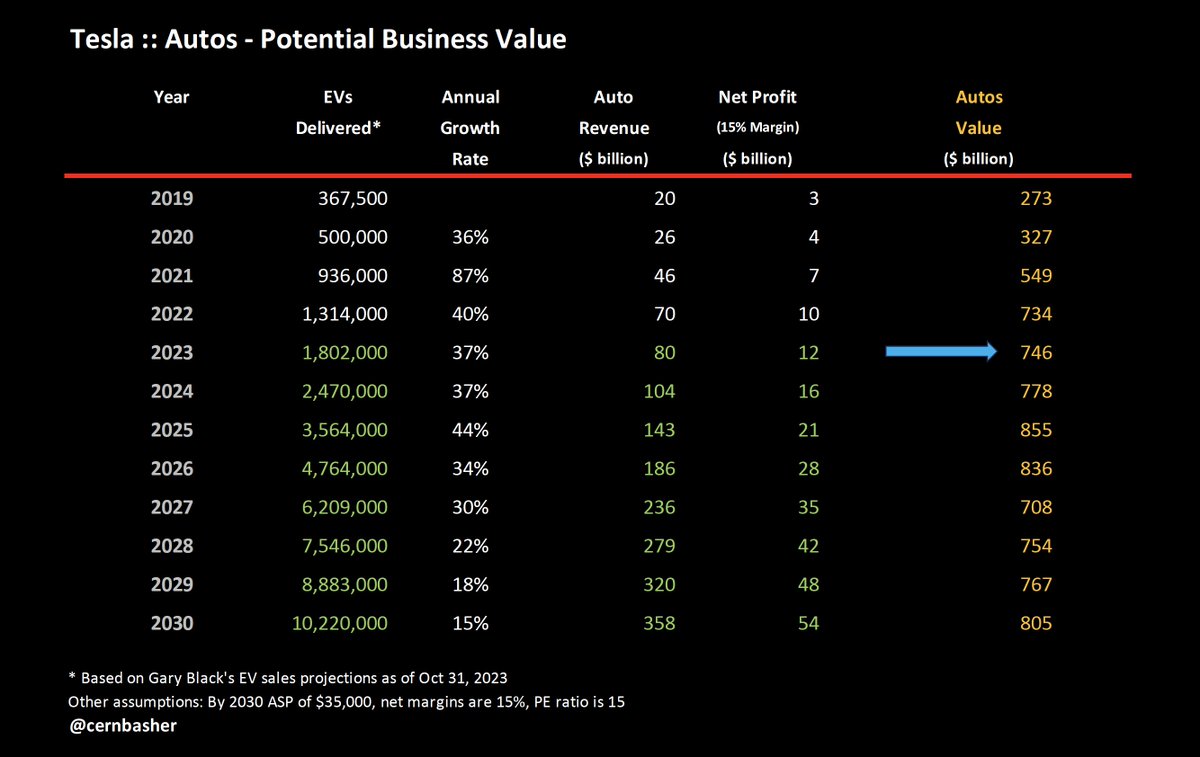

Currently, Tesla derives most of its revenues from selling EVs, as the company will deliver about 1.8 million cars this year and produce about $80 billion in automotive revenue. Tesla's Energy business is growing rapidly and may, one day, rival the auto business in size.

In spite of the rapid growth in Auto and Energy, Tesla will earn most of its revenue from AI-powered robots – primarily from both autonomous vehicles and humanoid robots.

Tesla – a dozen technology startups

On October 21, 2020 Elon Musk said that: “Tesla should really be thought of as roughly a dozen technology startups, many of which have little to no correlation with traditional automotive companies.”

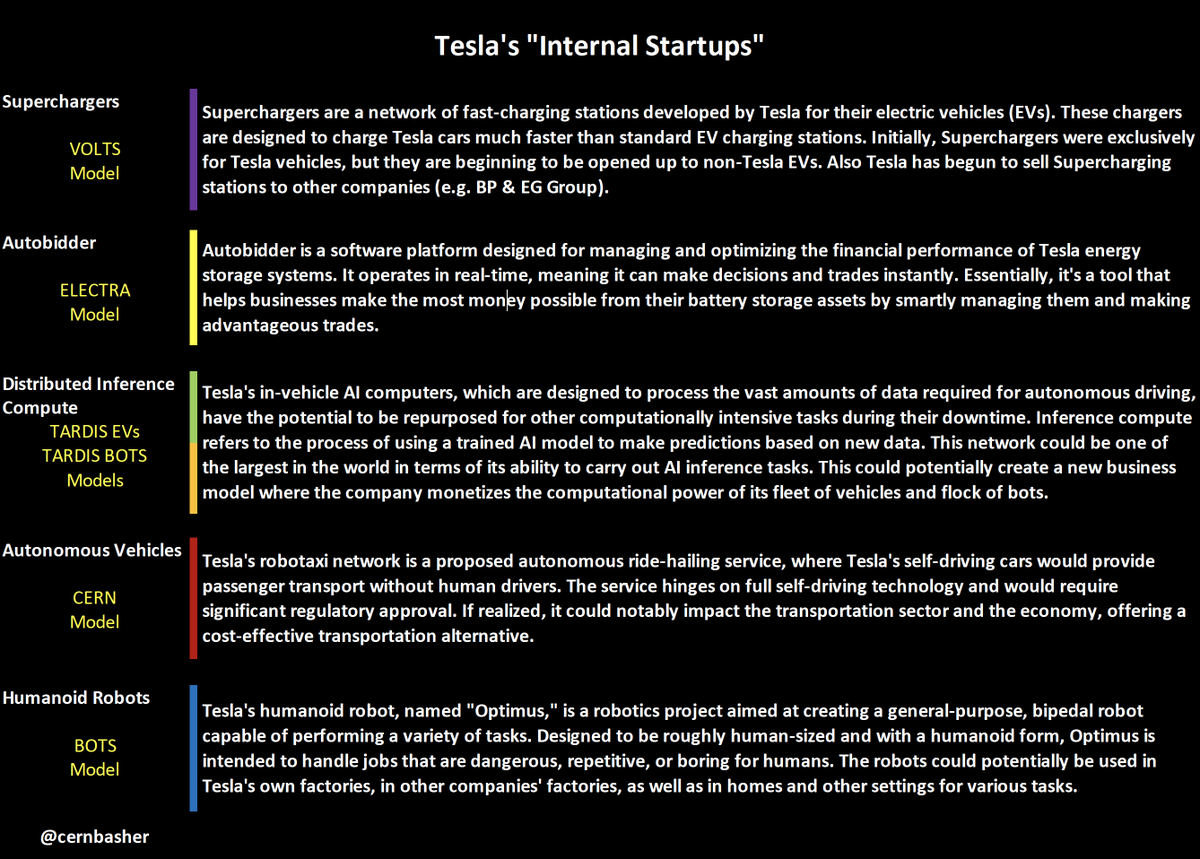

Let’s take a look at five of Tesla’s Internal Startups…

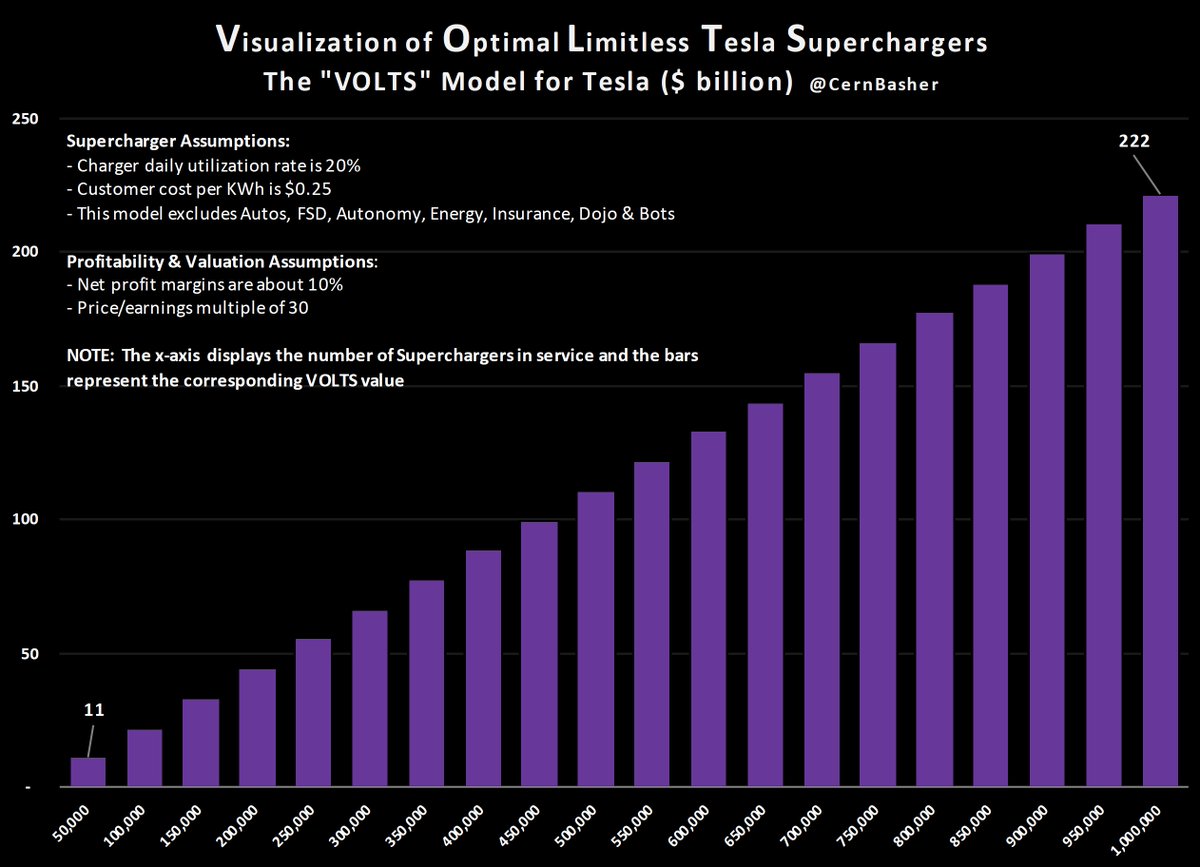

1) Superchargers

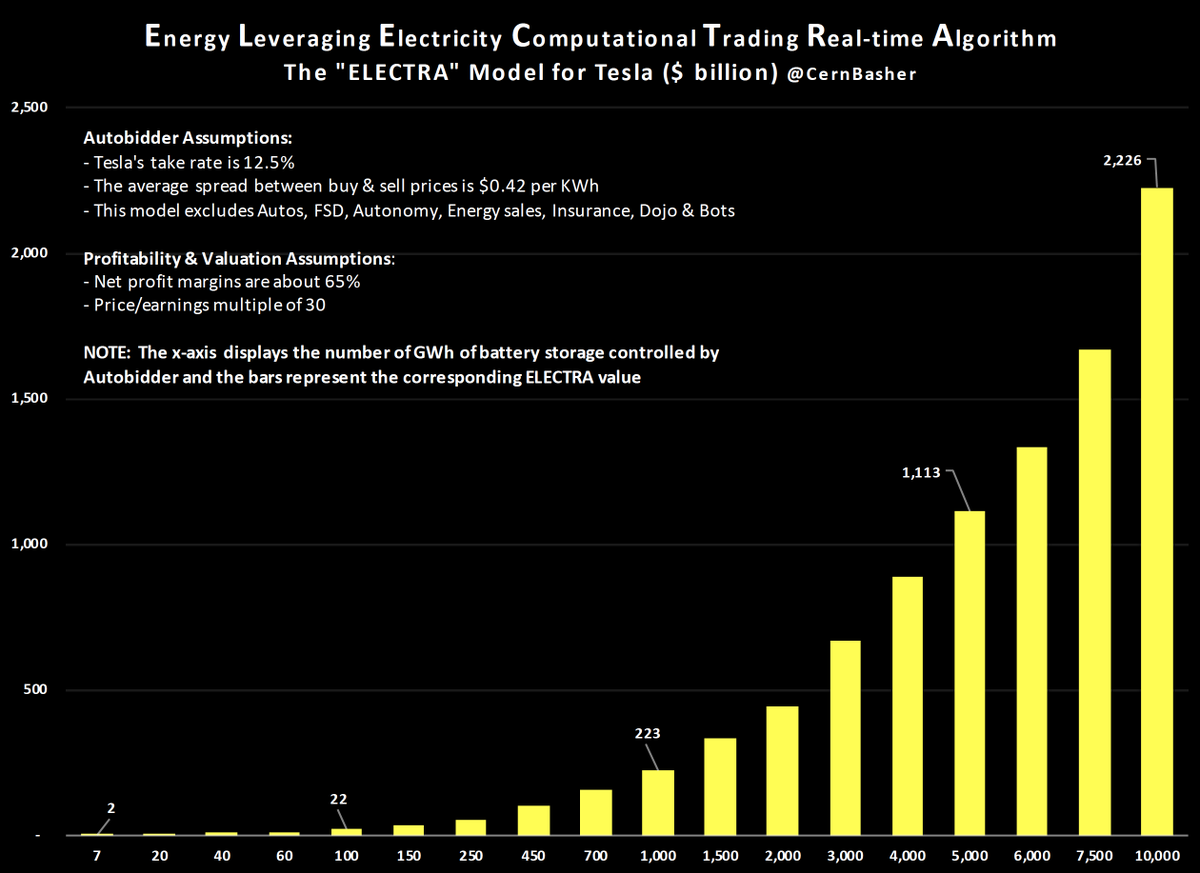

2) Autobidder

3) Distributed Inference Compute

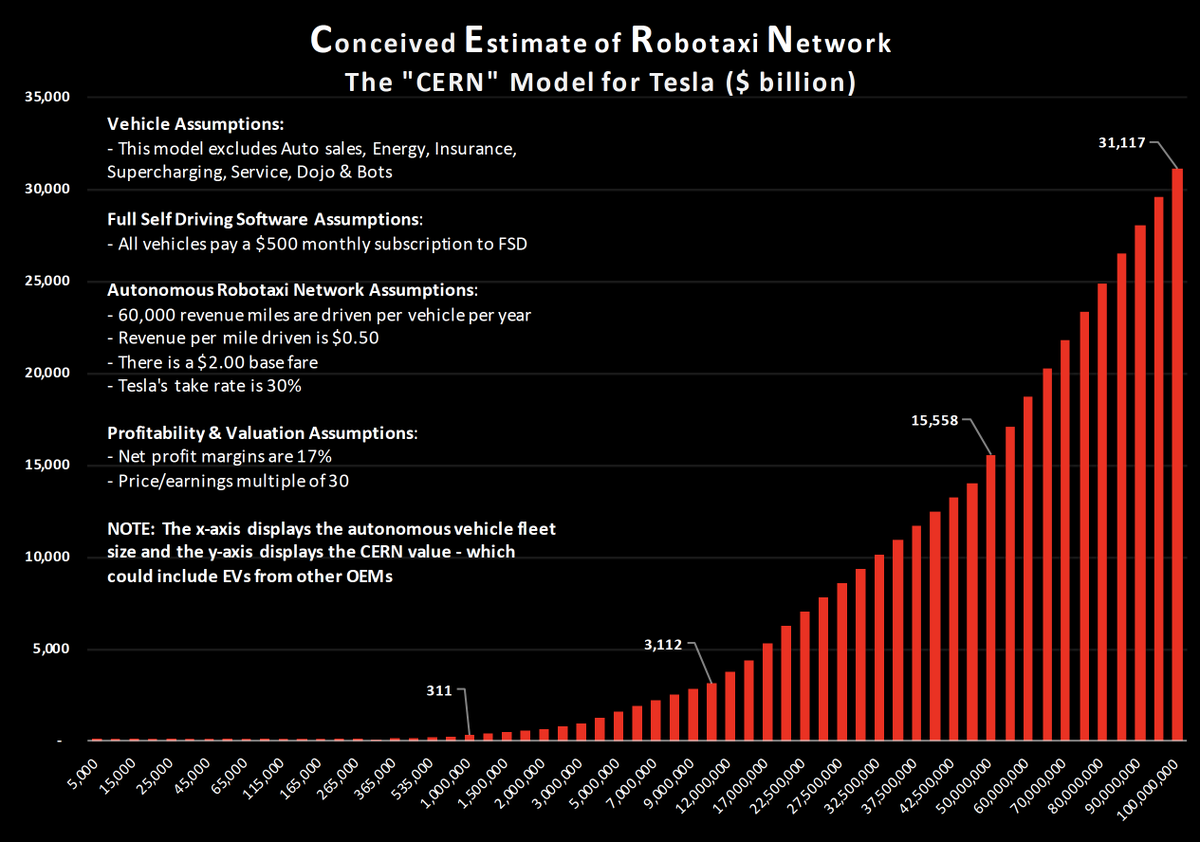

4) Autonomous Vehicles

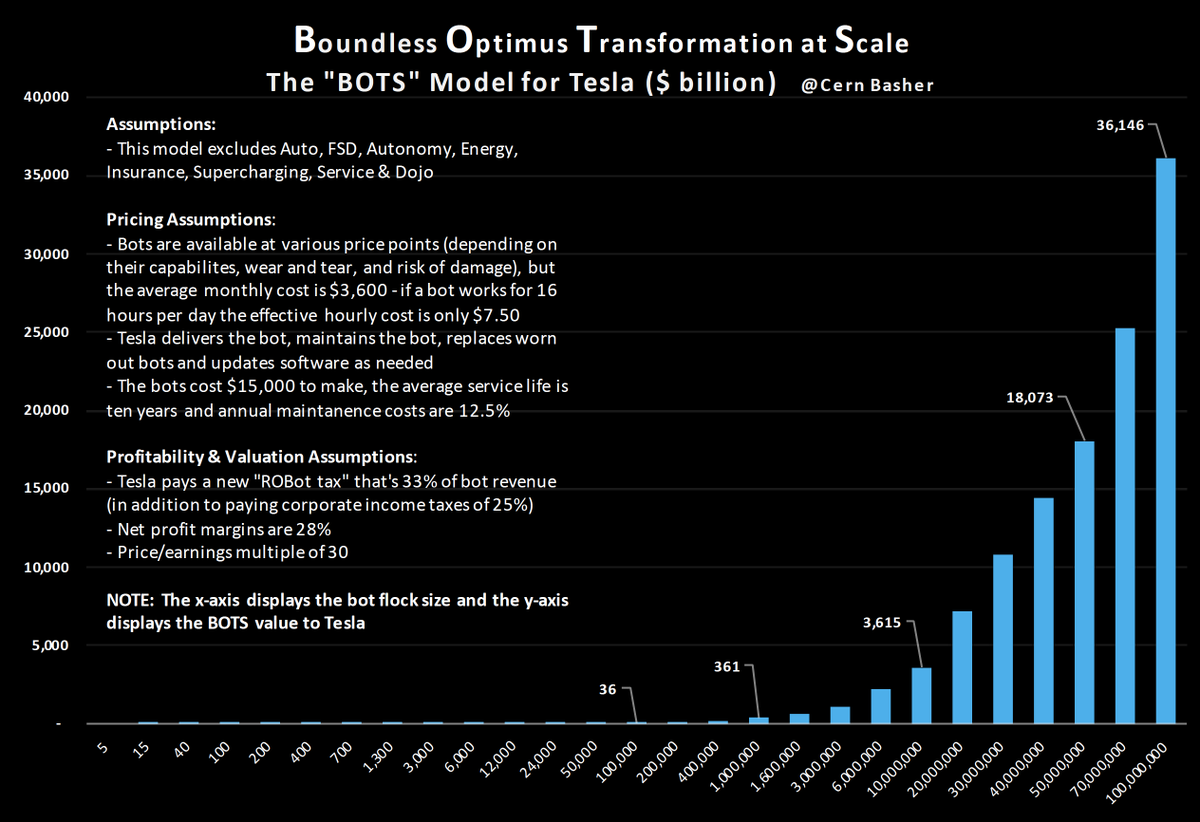

5) Humanoid Robots

I have built business models for each of these internal startups, and it's clear that two of these five - the robots with wheels and feet - are going to transform Tesla from an Auto Company to an AI-Powered Robot Company.

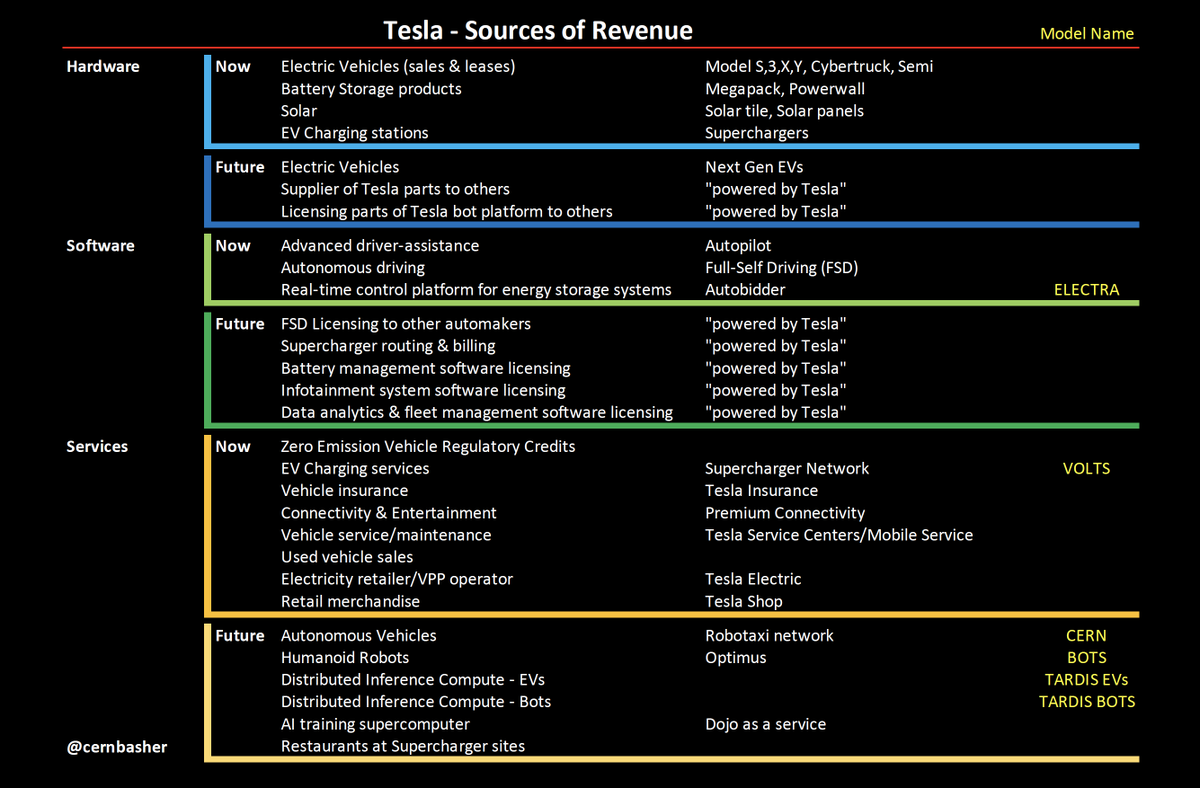

Note: there are more than five promising Internal Startups within Tesla. Recently I discussed Tesla's various sources of current and future revenue streams - see:

An updated table from that post is below:

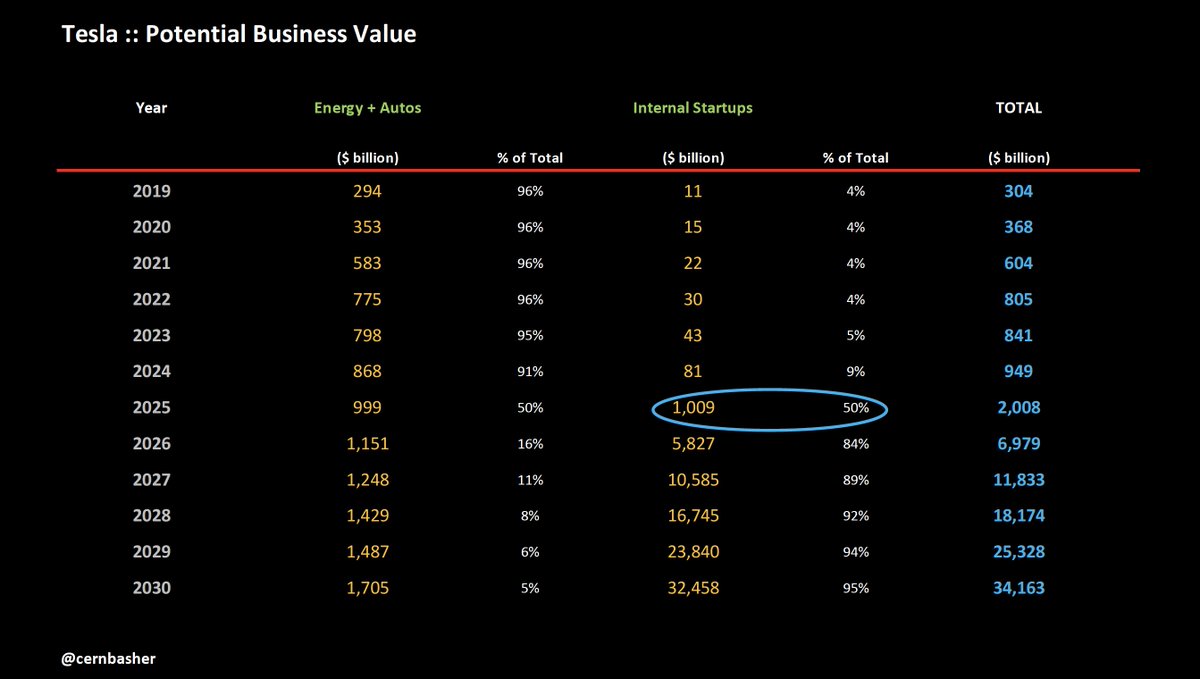

Collectively, the five Internal Startups could quickly create $1 trillion in value for Tesla by 2025, surpassing the value of Tesla's Auto and Energy businesses combined.

Today, the five Internal Startups account for about 5% of Tesla's market value. By 2030 they could account for 95% of the company's market value.

$tsla

The answer depends on whether you’re looking at today versus the future. Or whether you rent ("trade") or own ("buy and hold") the stock.

Currently, Tesla derives most of its revenues from selling EVs, as the company will deliver about 1.8 million cars this year and produce about $80 billion in automotive revenue. Tesla's Energy business is growing rapidly and may, one day, rival the auto business in size.

In spite of the rapid growth in Auto and Energy, Tesla will earn most of its revenue from AI-powered robots – primarily from both autonomous vehicles and humanoid robots.

Tesla – a dozen technology startups

On October 21, 2020 Elon Musk said that: “Tesla should really be thought of as roughly a dozen technology startups, many of which have little to no correlation with traditional automotive companies.”

Let’s take a look at five of Tesla’s Internal Startups…

1) Superchargers

2) Autobidder

3) Distributed Inference Compute

4) Autonomous Vehicles

5) Humanoid Robots

I have built business models for each of these internal startups, and it's clear that two of these five - the robots with wheels and feet - are going to transform Tesla from an Auto Company to an AI-Powered Robot Company.

Note: there are more than five promising Internal Startups within Tesla. Recently I discussed Tesla's various sources of current and future revenue streams - see:

An updated table from that post is below:

Collectively, the five Internal Startups could quickly create $1 trillion in value for Tesla by 2025, surpassing the value of Tesla's Auto and Energy businesses combined.

Today, the five Internal Startups account for about 5% of Tesla's market value. By 2030 they could account for 95% of the company's market value.

$tsla

Three of the five Internal Startups - Supercharging, Autobidder and Distributed Inference Computing for both EVs and Bots could account for almost $1 trillion in market value by 2030.

But they are dwarfed by the potential value created by Humanoid Robots and Autonomous Vehicles/Robotaxi Network.

The numbers get a bit nutty... but the financial assumptions aren't.

Not financial advice - do your own research!

Not financial advice - do your own research!

Using @garyblack00 projections for auto deliveries out to 2030, the auto business could be worth about $800 billion (assuming 15% net profit margins and using a P/E ratio of 15 in 2030).

@garyblack00 By 2030 the Energy part of the business could be worth about $900 billion (assuming net profit margins are 15% and using a P/E ratio of 20).

By 2030 the Energy business could be worth as much as the Auto business (assuming 10 million deliveries in 2030).

If Tesla can achieve their 20 million delivery target, then the Auto business would still be worth more.

If Tesla can achieve their 20 million delivery target, then the Auto business would still be worth more.

Distributed Inference Computing for EVs & Bots: also difficult to model, but shows some promise if massively scaled. Most of the opportunity here is with EVs - as they have more compute and more downtime. But the Bots can make up for those short comings if scaled into the hundreds of millions / billions.

Putting it all together: If either humanoid bots or autonomous vehicles become reality, it's a game changer for Tesla (provided they can execute on their plans).

If both are realized, the world changes beyond comprehension - with cheap energy, cheap transportation and unlimited labor.

If both are realized, the world changes beyond comprehension - with cheap energy, cheap transportation and unlimited labor.

It's 2030 - can you spot the car company?

Again, not financial advice - please do your own research.

/end

Again, not financial advice - please do your own research.

/end

It's 2030 - can you spot the car company?

Again, not financial advice - please do your own research.

/end

Again, not financial advice - please do your own research.

/end

• • •

Missing some Tweet in this thread? You can try to

force a refresh