Co-Founder & Chief Investment Officer at Brilliant Advice

My posts here are not financial advice

4 subscribers

How to get URL link on X (Twitter) App

Solution #1: Cut Spending and Balance the Budget

Solution #1: Cut Spending and Balance the Budget

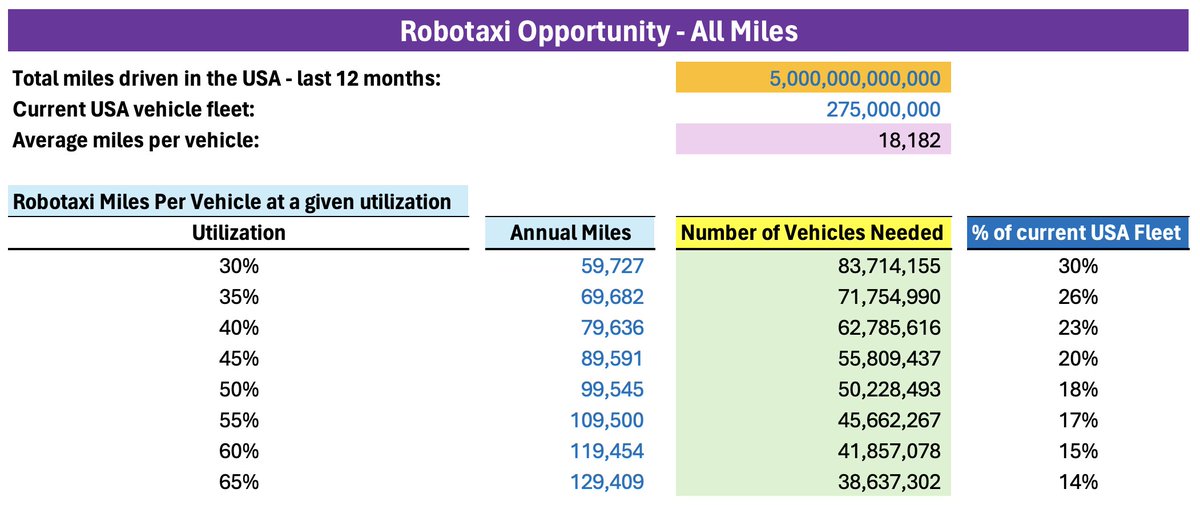

Many people seem to think that Robotaxis can only make money during the daytime and just for a few peak hours, but this real life case study using non-peak hours proves otherwise.

Many people seem to think that Robotaxis can only make money during the daytime and just for a few peak hours, but this real life case study using non-peak hours proves otherwise.https://x.com/CernBasher/status/1924071727757250735

https://x.com/CernBasher/status/1877860811579777346

First, let's take a look at Nvidia - which is the first example of an "AI compounder."

First, let's take a look at Nvidia - which is the first example of an "AI compounder."

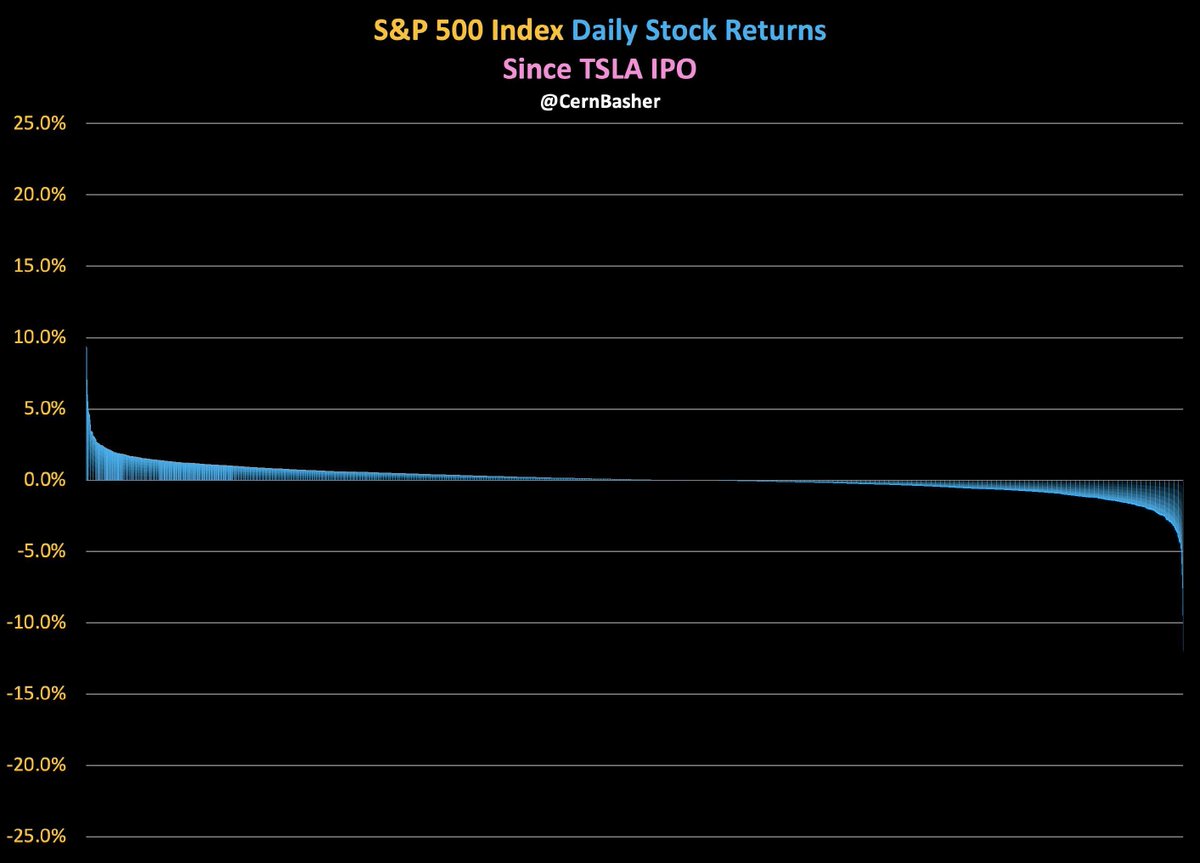

A multi-part post on Tesla's stock performance since the Jun 29, 2010 IPO...

A multi-part post on Tesla's stock performance since the Jun 29, 2010 IPO...https://x.com/CernBasher/status/1830339120461140163

Let's compare Tesla's stock to Nvidia's over the same time period.

Let's compare Tesla's stock to Nvidia's over the same time period.

Lower long-term growth means that short term earnings matter more...

Lower long-term growth means that short term earnings matter more...

Now, let's look at what could happen when transportation becomes so cheap that people decide to travel more miles - when price goes down, demand always goes up.

Now, let's look at what could happen when transportation becomes so cheap that people decide to travel more miles - when price goes down, demand always goes up.

1) A deflation machine

1) A deflation machinehttps://twitter.com/CernBasher/status/1734945442511687768

And how might this look for Tesla?

And how might this look for Tesla?

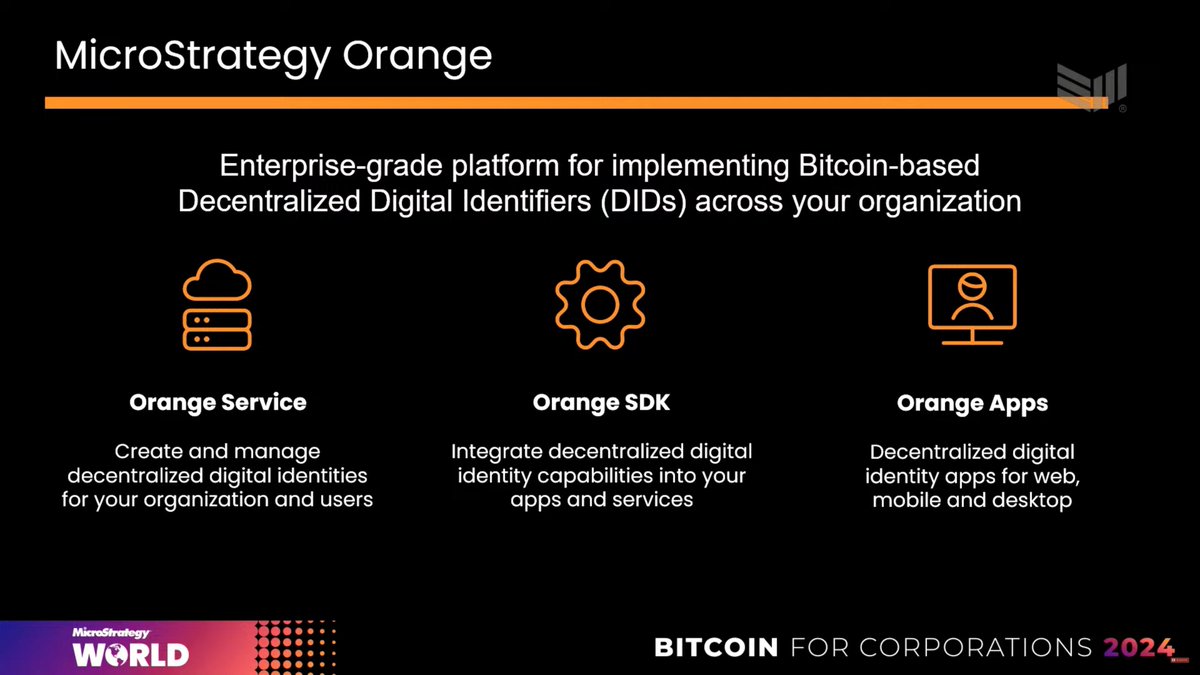

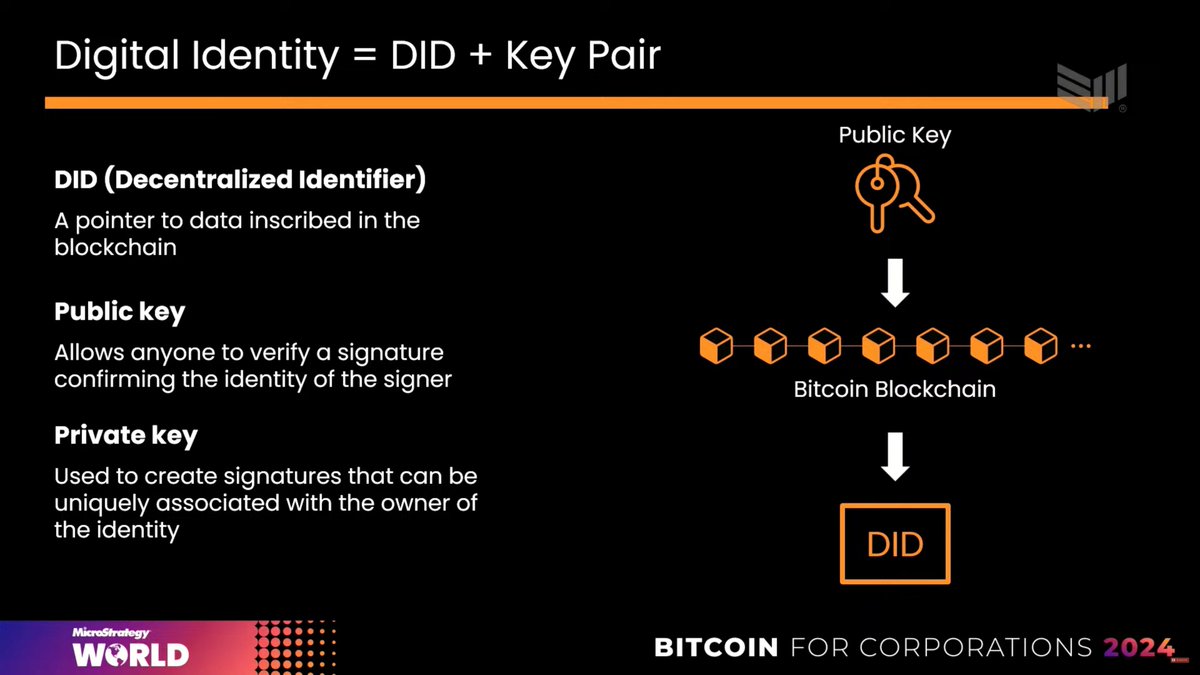

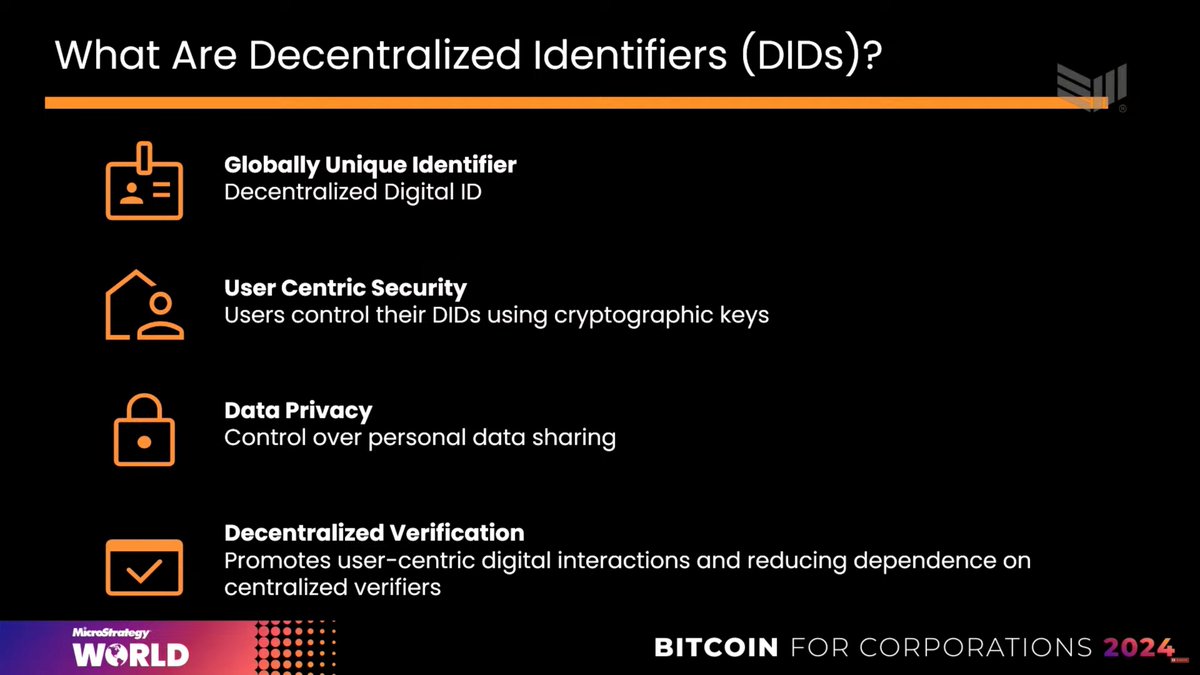

Michael Saylor explains Orange...

Michael Saylor explains Orange...

1) Robotaxi Implications - First, Second & Third Order

1) Robotaxi Implications - First, Second & Third Orderhttps://twitter.com/CernBasher/status/1777709906461675595

Here are the charts/calculations for the vehicles where FSD has already been purchased. This results in a larger jump in value.

Here are the charts/calculations for the vehicles where FSD has already been purchased. This results in a larger jump in value.

FUMES without Autonomy – a steady decline:

FUMES without Autonomy – a steady decline:

Figure @Figure_robot

Figure @Figure_robot

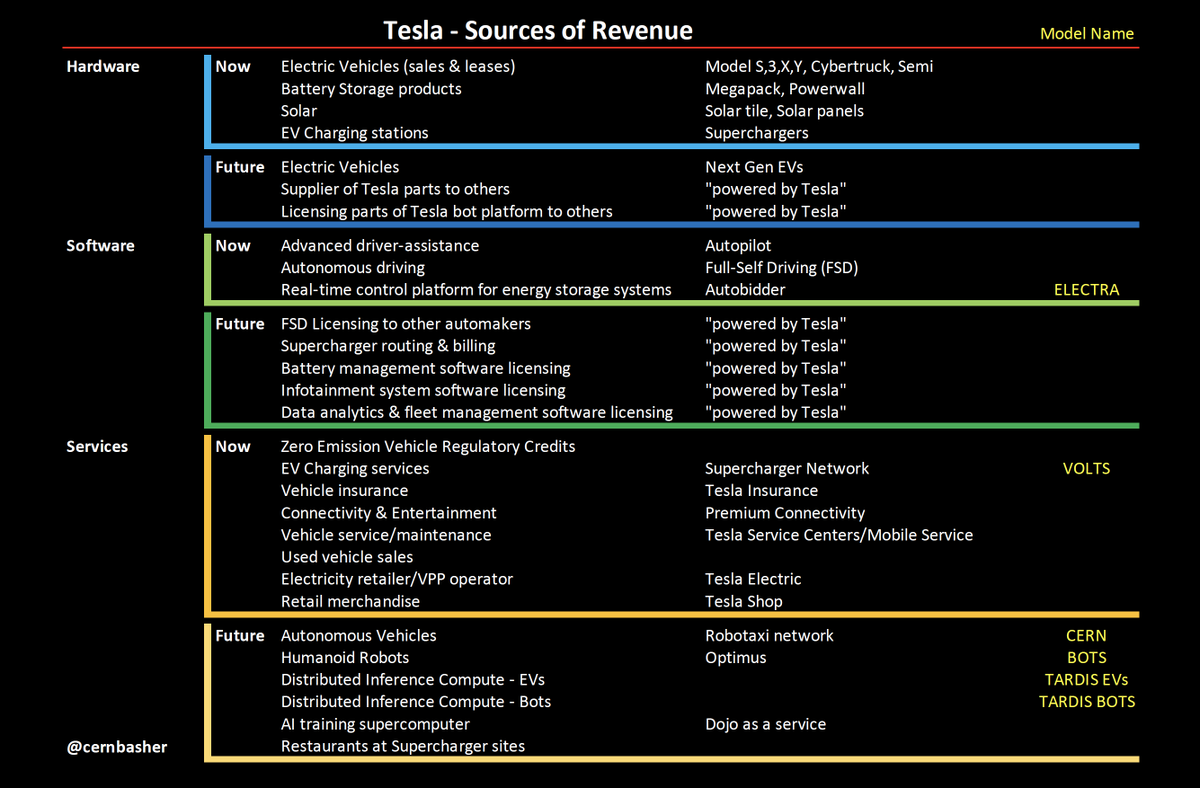

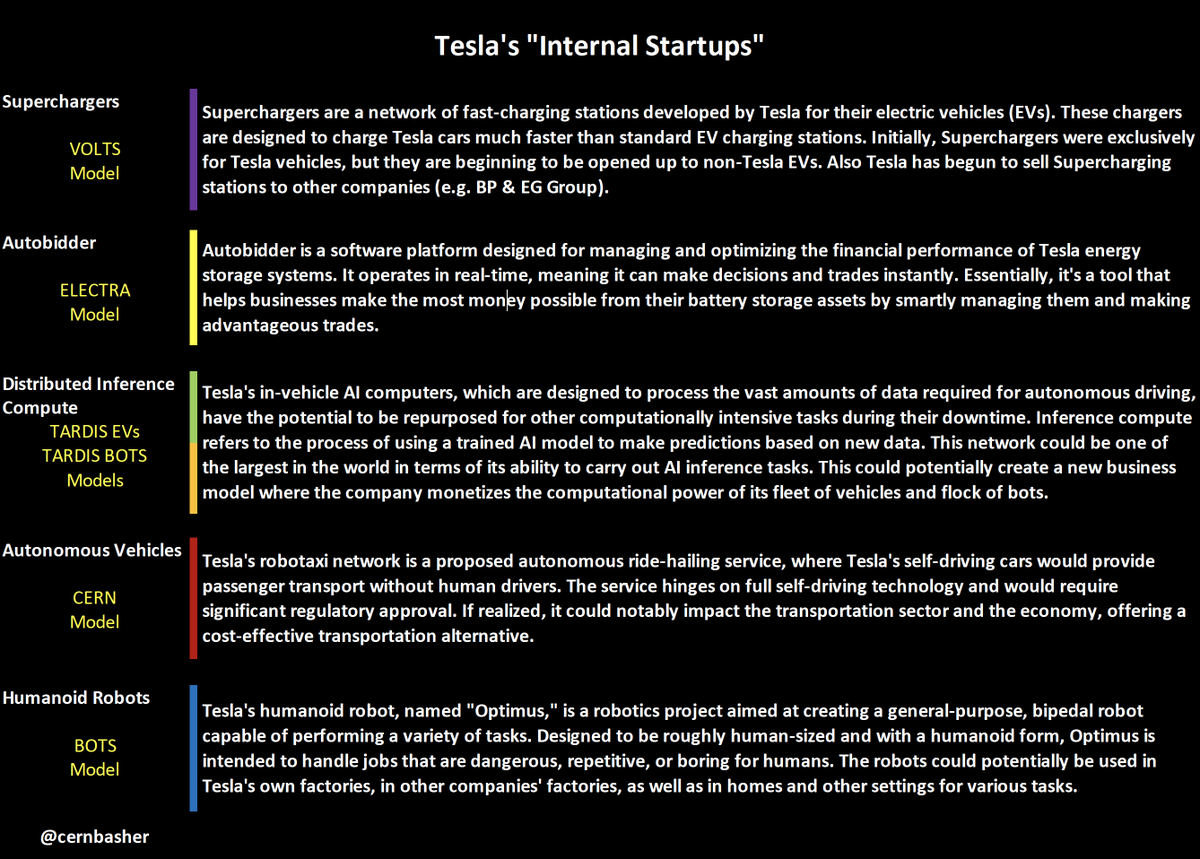

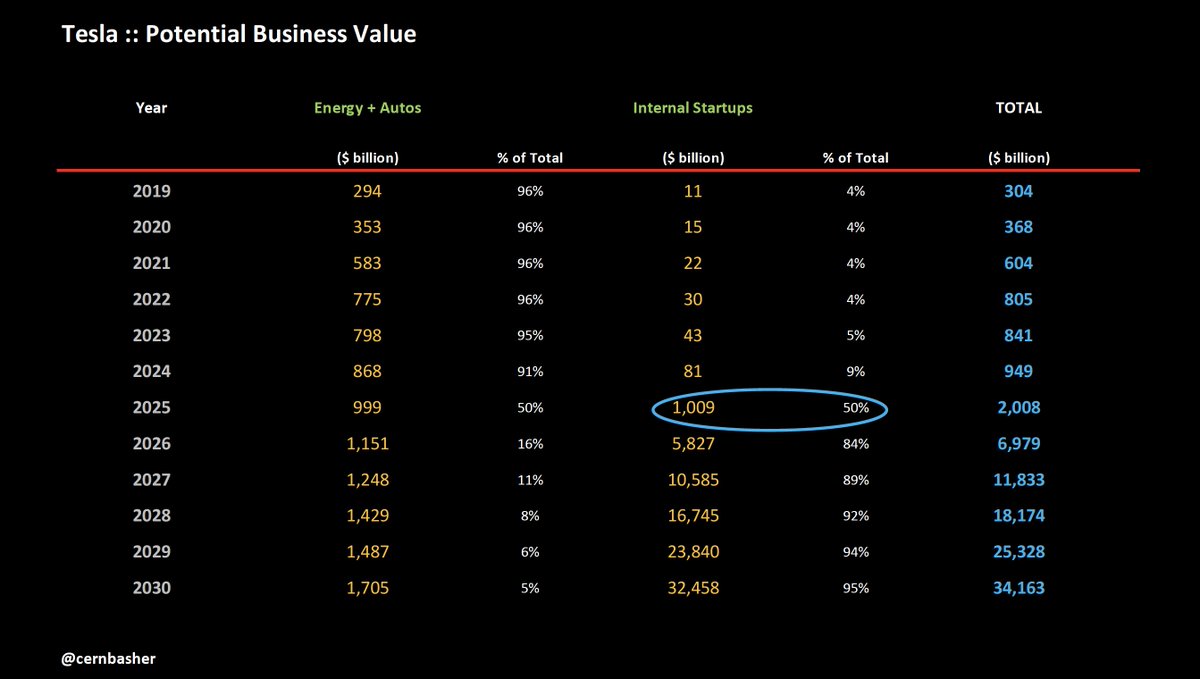

Three of the five Internal Startups - Supercharging, Autobidder and Distributed Inference Computing for both EVs and Bots could account for almost $1 trillion in market value by 2030.

Three of the five Internal Startups - Supercharging, Autobidder and Distributed Inference Computing for both EVs and Bots could account for almost $1 trillion in market value by 2030.

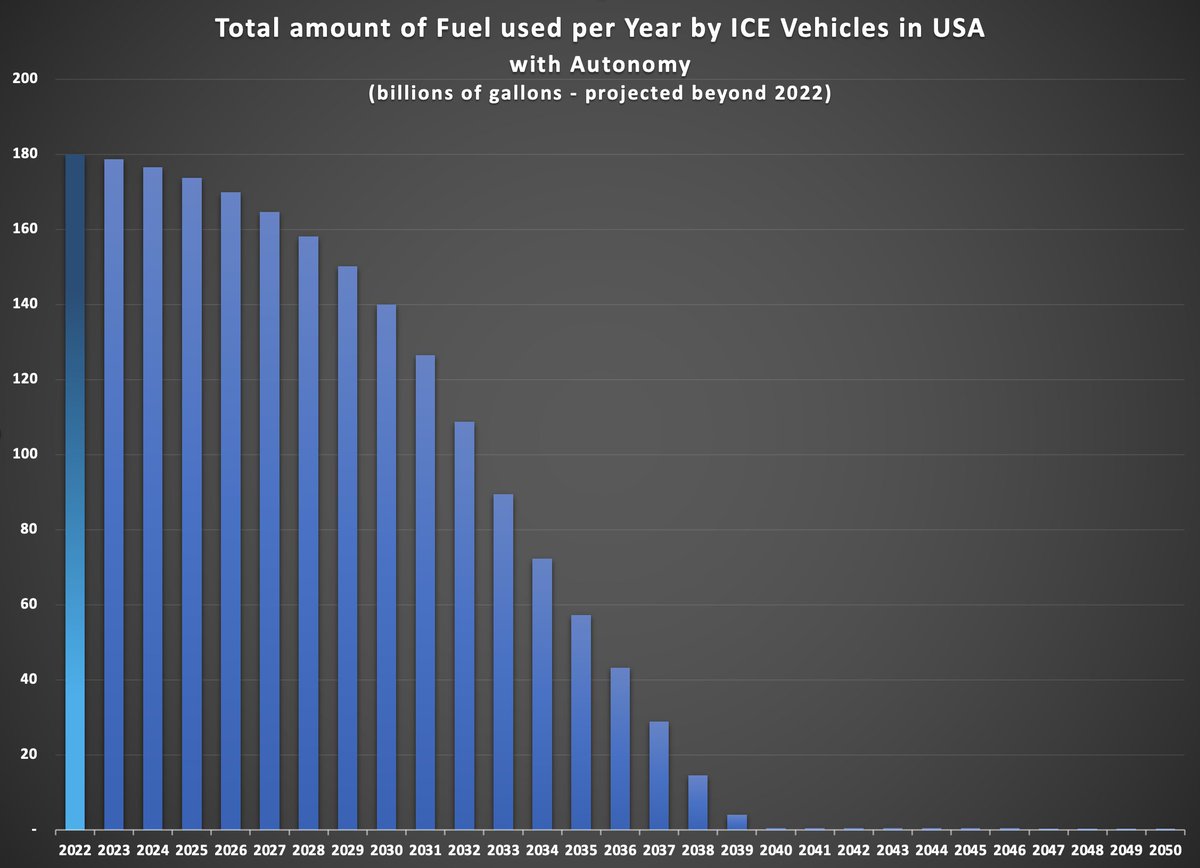

2/ FUMES with Autonomy – a rapid decline:

2/ FUMES with Autonomy – a rapid decline: