After nearly 20 years,🤯🤯

The Tatas are coming with an IPO!

The Tata Technologies IPO opens today.

Is the IPO worth the hype?🤔🤔

A thread🧵on the business of Tata Technologies and if one should apply to the IPO?

Lets go👇

The Tatas are coming with an IPO!

The Tata Technologies IPO opens today.

Is the IPO worth the hype?🤔🤔

A thread🧵on the business of Tata Technologies and if one should apply to the IPO?

Lets go👇

What does Tata Technologies do?

Tata Technologies is a prominent global provider of engineering services, providing turnkey solutions, digital solutions, and product development to OEMs

It is a pure-play manufacturing focused Engineering Research & Development (“ER&D”) company

Tata Technologies is a prominent global provider of engineering services, providing turnkey solutions, digital solutions, and product development to OEMs

It is a pure-play manufacturing focused Engineering Research & Development (“ER&D”) company

Engineering Research & Development (“ER&D)

ER&D services encompass design, development, testing, and maintenance activities for creating devices, platforms, or software ready for production and sale

It is a fast-growing industry

ER&D services encompass design, development, testing, and maintenance activities for creating devices, platforms, or software ready for production and sale

It is a fast-growing industry

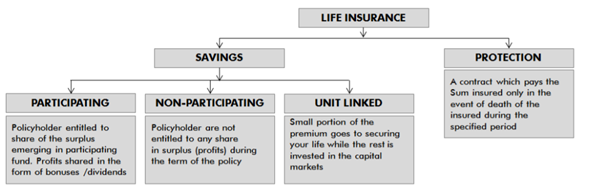

The company operates in 2 segments

1. Services Segment (ER&D)

2. Technology Segment

ER&D dominates the revenue

1. Services Segment (ER&D)

2. Technology Segment

ER&D dominates the revenue

Services Segment (ER&D):-

Tata Tech’s core competency is Full Vehicle Development, the company offers solutions for outsourced vehicle development from concept to reality helping Auto companies to launch competitive vehicles faster with optimized

cost

Tata Tech’s core competency is Full Vehicle Development, the company offers solutions for outsourced vehicle development from concept to reality helping Auto companies to launch competitive vehicles faster with optimized

cost

The company offers services to greenfield customers who are looking for EV development like

startups, and for brownfield customers like traditional OEM:

It offers services like cost optimisation, teardown benchmarking, Internal Combustion Engine (ICE) to Electric (EV) conversions

startups, and for brownfield customers like traditional OEM:

It offers services like cost optimisation, teardown benchmarking, Internal Combustion Engine (ICE) to Electric (EV) conversions

Technology Segment

Tata Tech resells 3rd party software for Product Lifecycle Management, CAD, Simulation, Virtual Collaboration,

Manufacturing Monitoring/Quality Inspection

Tata Tech resells 3rd party software for Product Lifecycle Management, CAD, Simulation, Virtual Collaboration,

Manufacturing Monitoring/Quality Inspection

Highly Diversified Revenue:-

The company's revenue data reflects a strategic balance in its global operations, with a well-distributed presence

across both emerging and developed markets

The company's revenue data reflects a strategic balance in its global operations, with a well-distributed presence

across both emerging and developed markets

Strong Client base:-

The company has worked with clients across the global automotive landscape from North America to China. The client list includes names like Tata Motors, Jaguar-Land Rover, Polestar, Vinfast (Vietnam), Mclaren, Honda, Ford.

The company has worked with clients across the global automotive landscape from North America to China. The client list includes names like Tata Motors, Jaguar-Land Rover, Polestar, Vinfast (Vietnam), Mclaren, Honda, Ford.

Objects of the IPO:-

Tata Technologies is raising a total of Rs 3,042.51 crore via its initial stake sale, which entirely consists of an offer-for-sale (OFS).

The company is not raising funds via fresh issue and will not receive any proceeds from the IPO.

Tata Technologies is raising a total of Rs 3,042.51 crore via its initial stake sale, which entirely consists of an offer-for-sale (OFS).

The company is not raising funds via fresh issue and will not receive any proceeds from the IPO.

Valuation:-

Tata Technologies will trade at a P/E multiple of 30x

The growth prospects and the promoter quality is strong.

However, the stock is not cheap.

This entire space trades at an expensive multiple.

Tata Technologies will trade at a P/E multiple of 30x

The growth prospects and the promoter quality is strong.

However, the stock is not cheap.

This entire space trades at an expensive multiple.

Conclusion:-

Tata Technologies is a world-class company backed by a strong promoter

It operates in the Er&D space which is a growing space.

However, the valuation is not cheap per se

Given the mass hype across the markets very little chance of allotment as well

Tata Technologies is a world-class company backed by a strong promoter

It operates in the Er&D space which is a growing space.

However, the valuation is not cheap per se

Given the mass hype across the markets very little chance of allotment as well

Keep following me -@AdityaD_Shah as I write daily to make you aware around:

📈Personal Finance

📈Investing

📈Stock Analysis

Go to my profile and hit the bell icon🔔to always stay updated

📈Personal Finance

📈Investing

📈Stock Analysis

Go to my profile and hit the bell icon🔔to always stay updated

Disclaimer:-

This is my own study

Not an investment recommendation

Please consult your own financial advisor before making any investment decisions

This is my own study

Not an investment recommendation

Please consult your own financial advisor before making any investment decisions

• • •

Missing some Tweet in this thread? You can try to

force a refresh