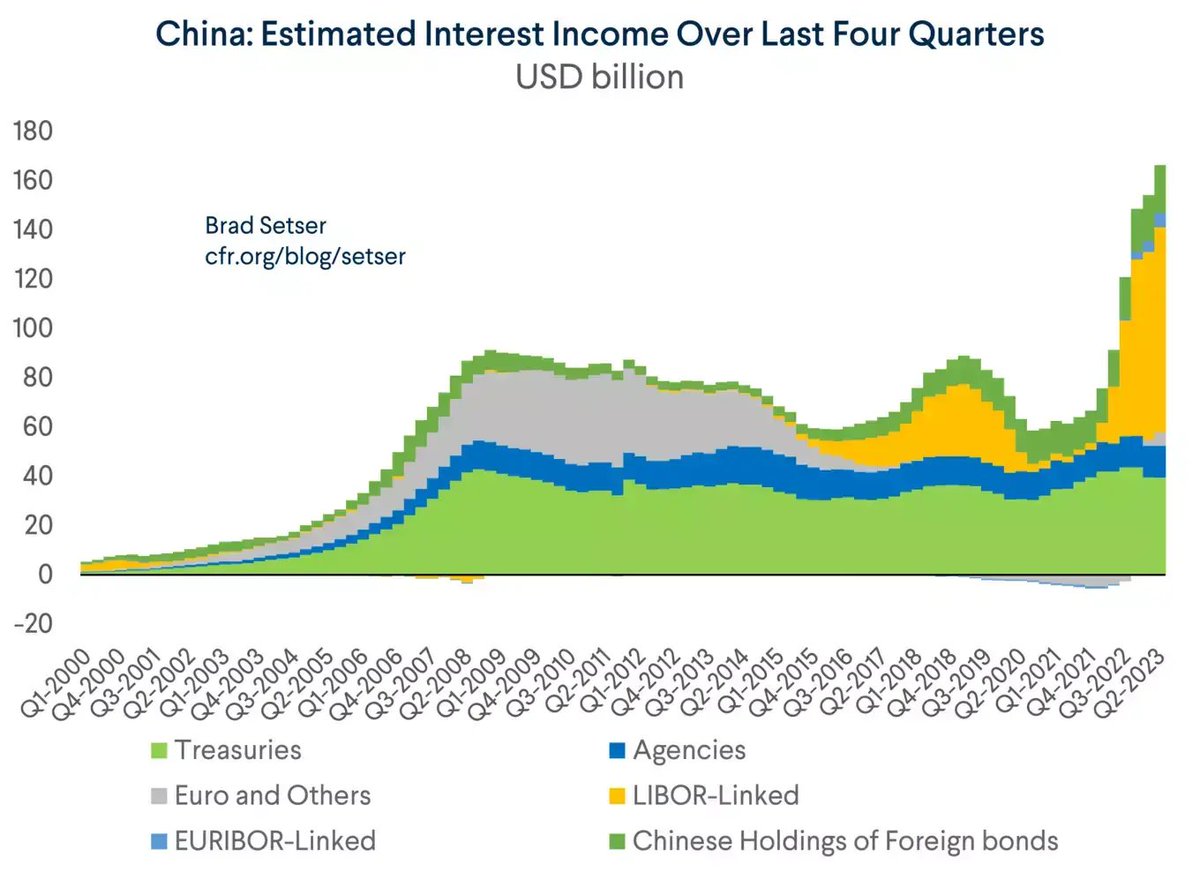

China has a ton of reserves -- including a growing share of high yielding US agencies. And China's state banks have lent a ton to the world, generally in dollars and at a floating rate. China's investment income could be soaring ...

1/

1/

I constructed a model of China's income balance in the balance of payments. China doesn't provide a breakdown of either interest or dividend payments, so I applied an assumed rate of return to the disclosed stocks.

2/

2/

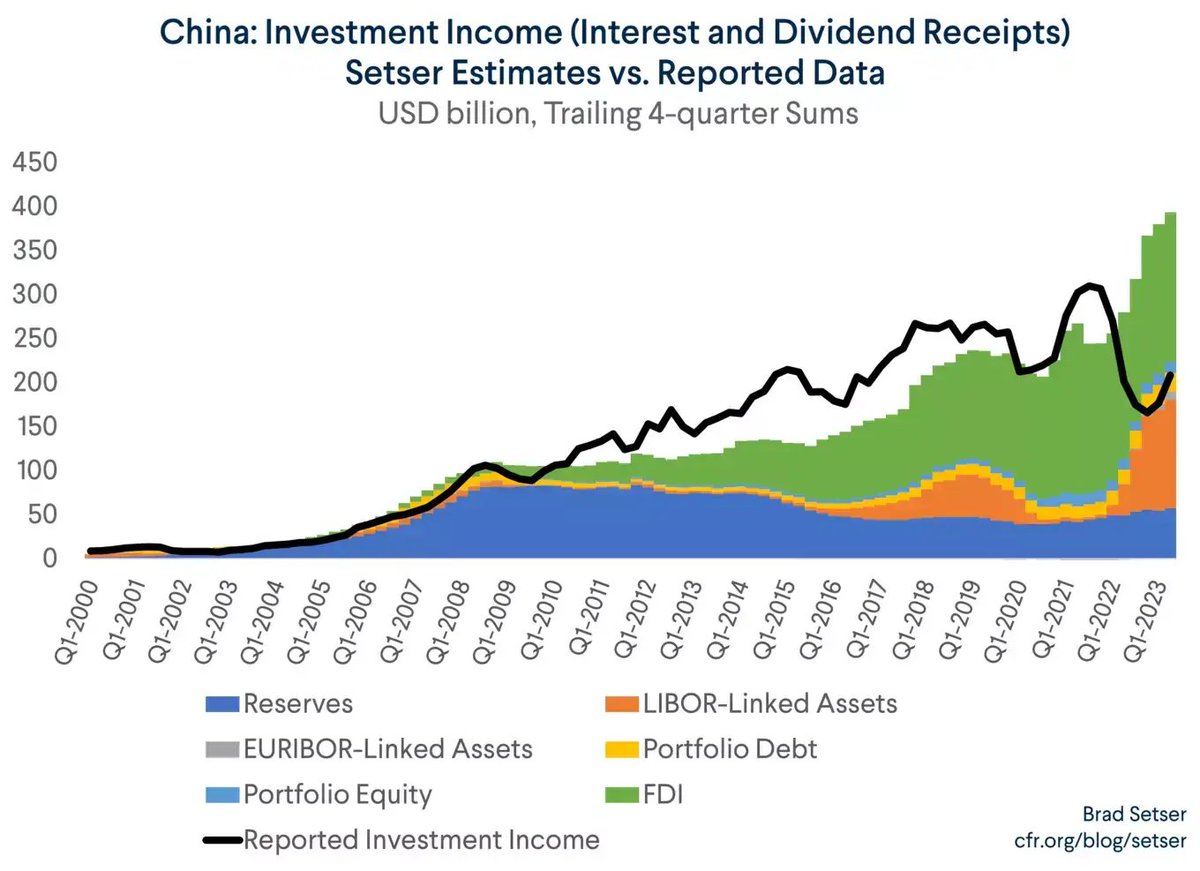

I was able to get a good fit with the disclosed data on outbound payments (with an assumed return of 8% on FDI in China).

But the fit on China's assets broke down recently ...

3/

But the fit on China's assets broke down recently ...

3/

Global rates are a lot higher today than 2018, but China's income receipts are lower -- which doesn't really make sense. Matt Klein noticed the same gap as well

4/

theovershoot.co/p/the-threat-f…

4/

theovershoot.co/p/the-threat-f…

reported investment income is now about $200 billion below model estimates -- and the discrepancy has been increasing --

5/

5/

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter