1/7

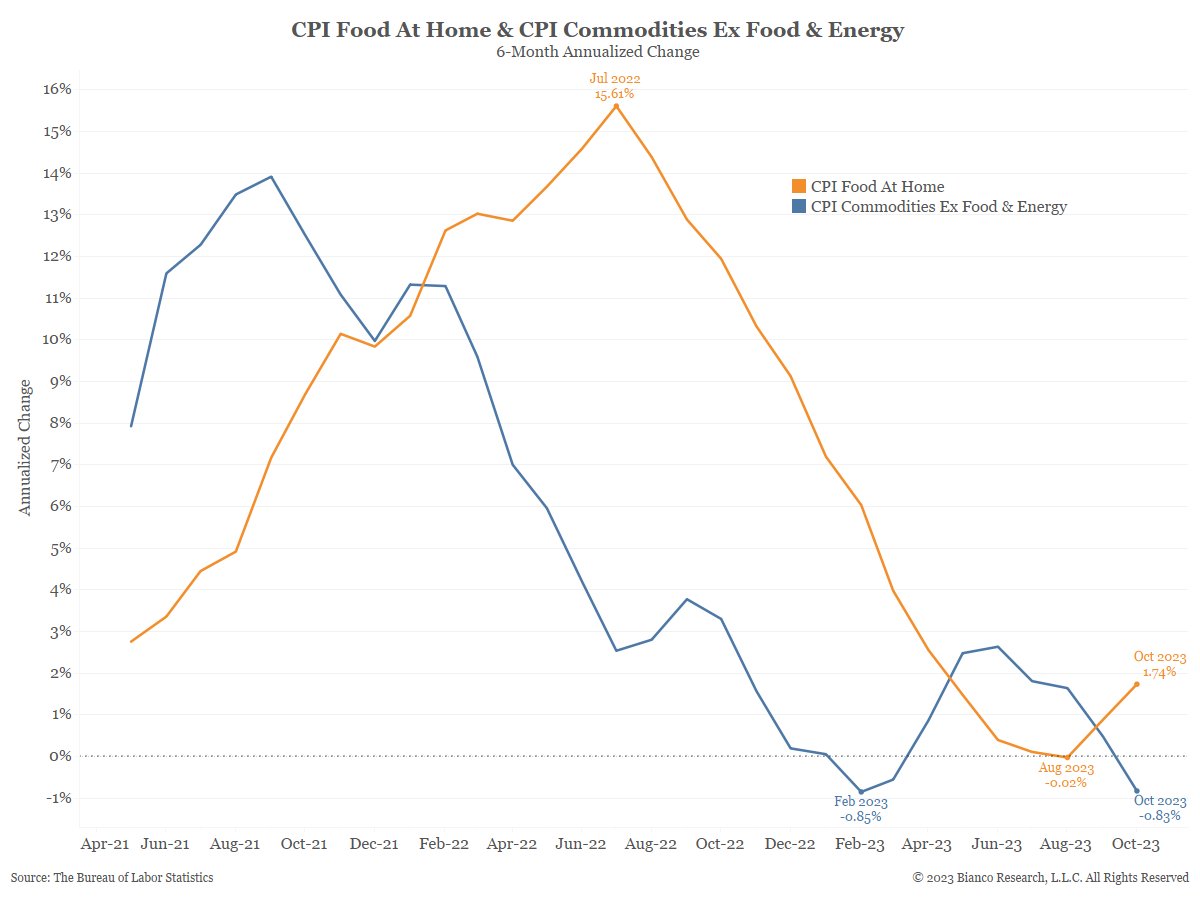

Disagree with this.

Interest rates are having a big impact on rates.

🧵

Disagree with this.

Interest rates are having a big impact on rates.

🧵

https://twitter.com/GunjanJS/status/1727426090287956298

2/7

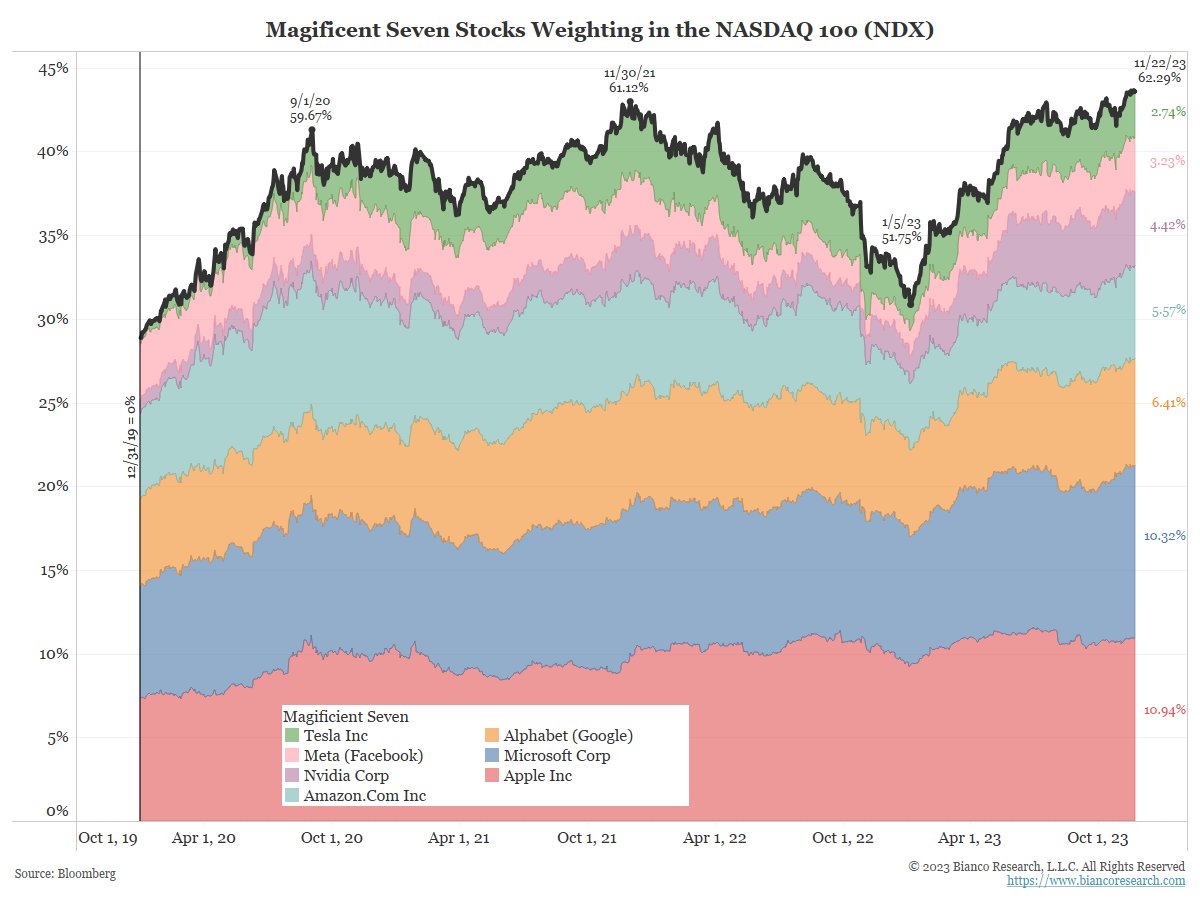

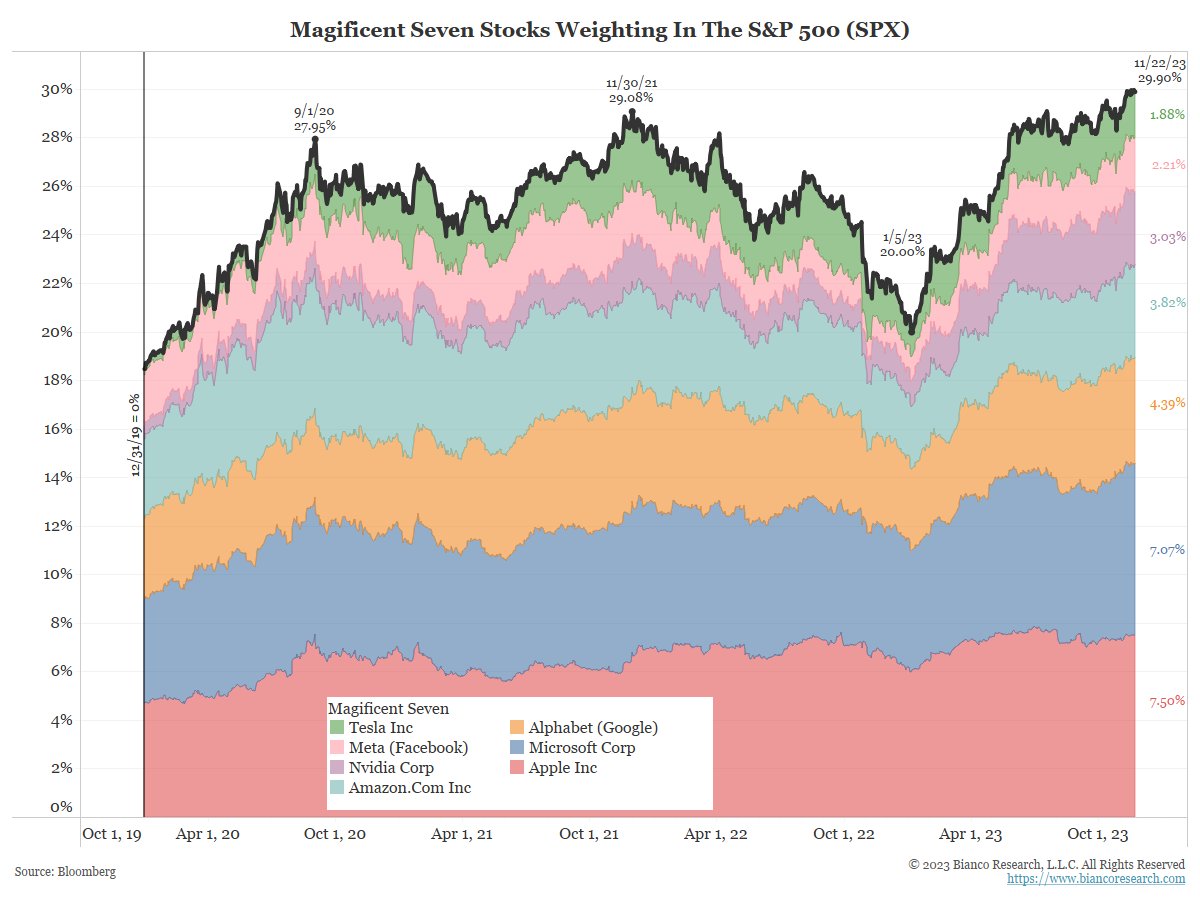

The Magnificent Seven stocks are 30% of the S&P 500.

A record concentration.

Market Cap

Magnificent Seven = $11.9 trillion

"Other 493" = $27.8 trillion

S&P 500 = $$39.7 trillion

The Magnificent Seven stocks are 30% of the S&P 500.

A record concentration.

Market Cap

Magnificent Seven = $11.9 trillion

"Other 493" = $27.8 trillion

S&P 500 = $$39.7 trillion

3/7

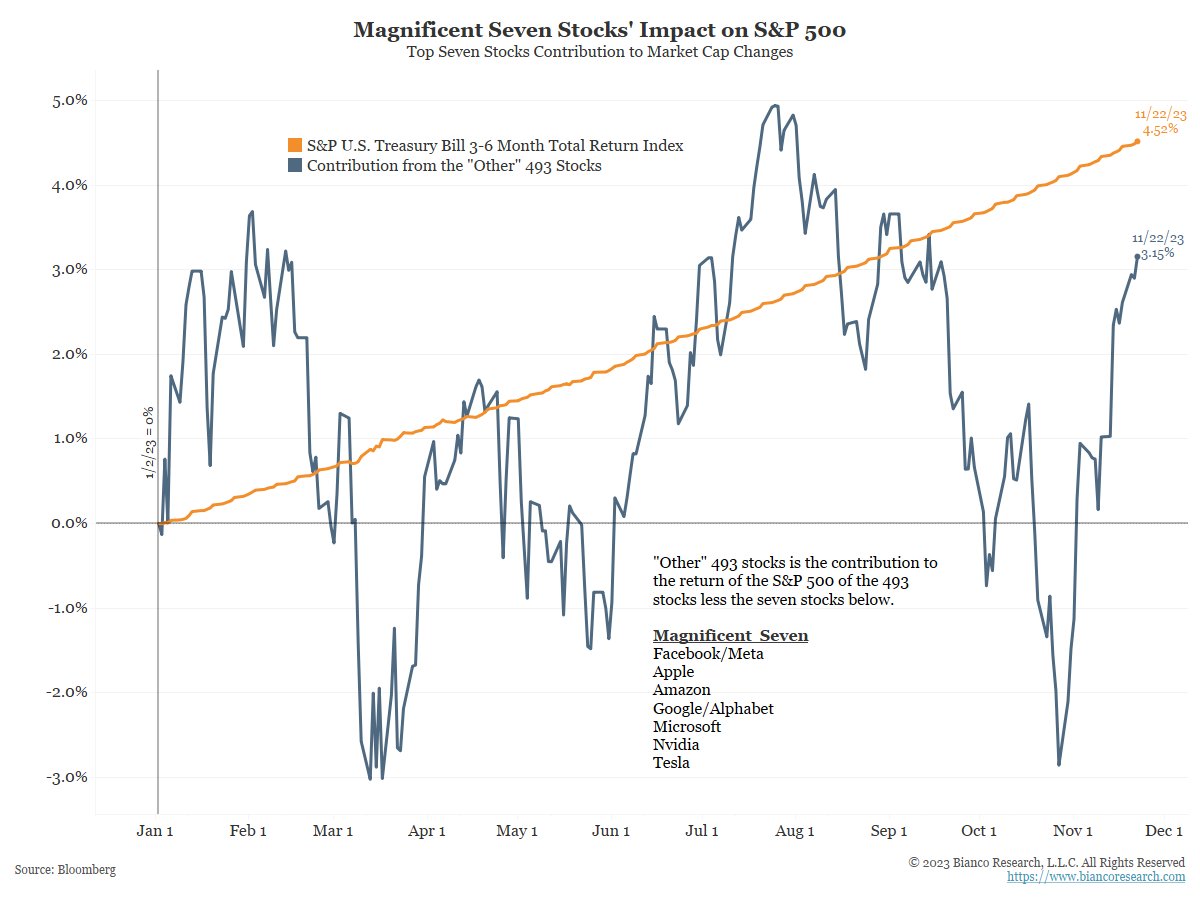

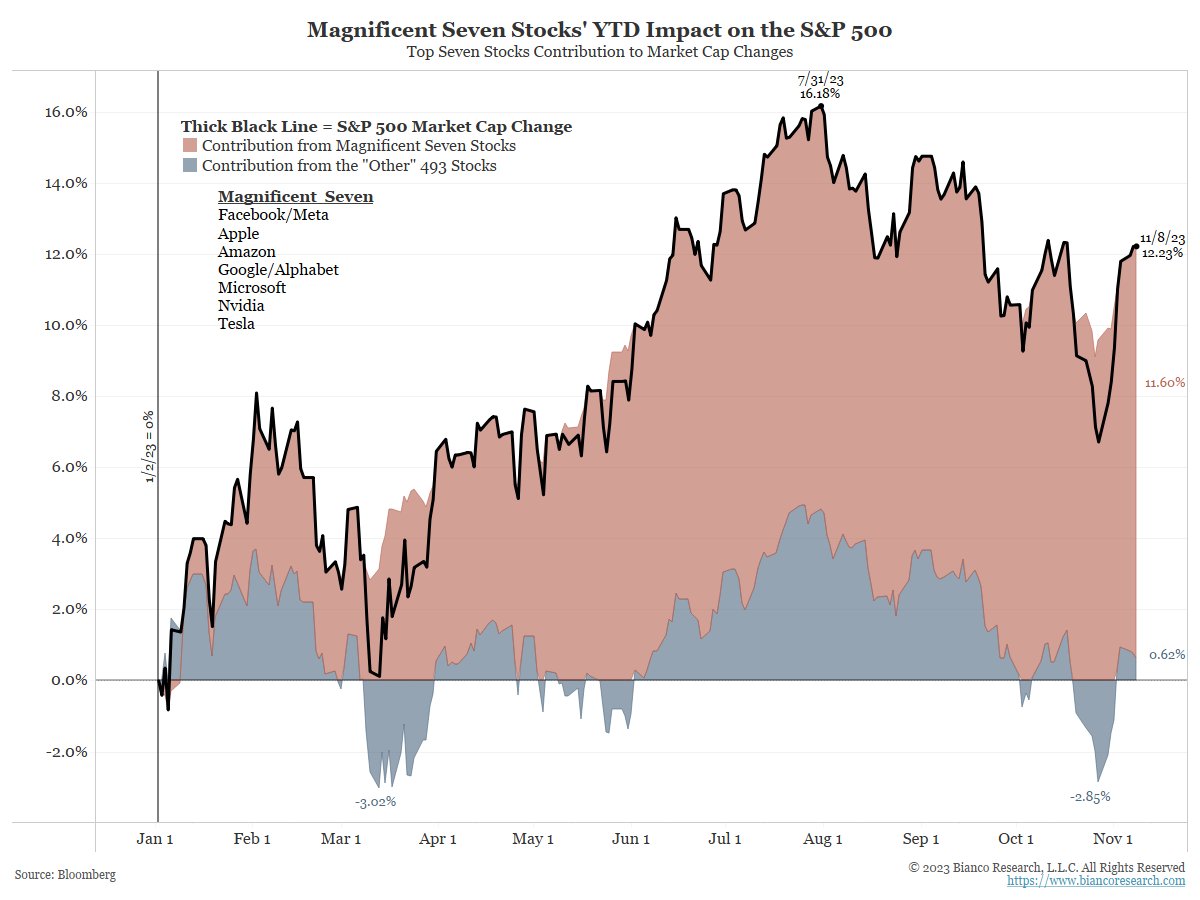

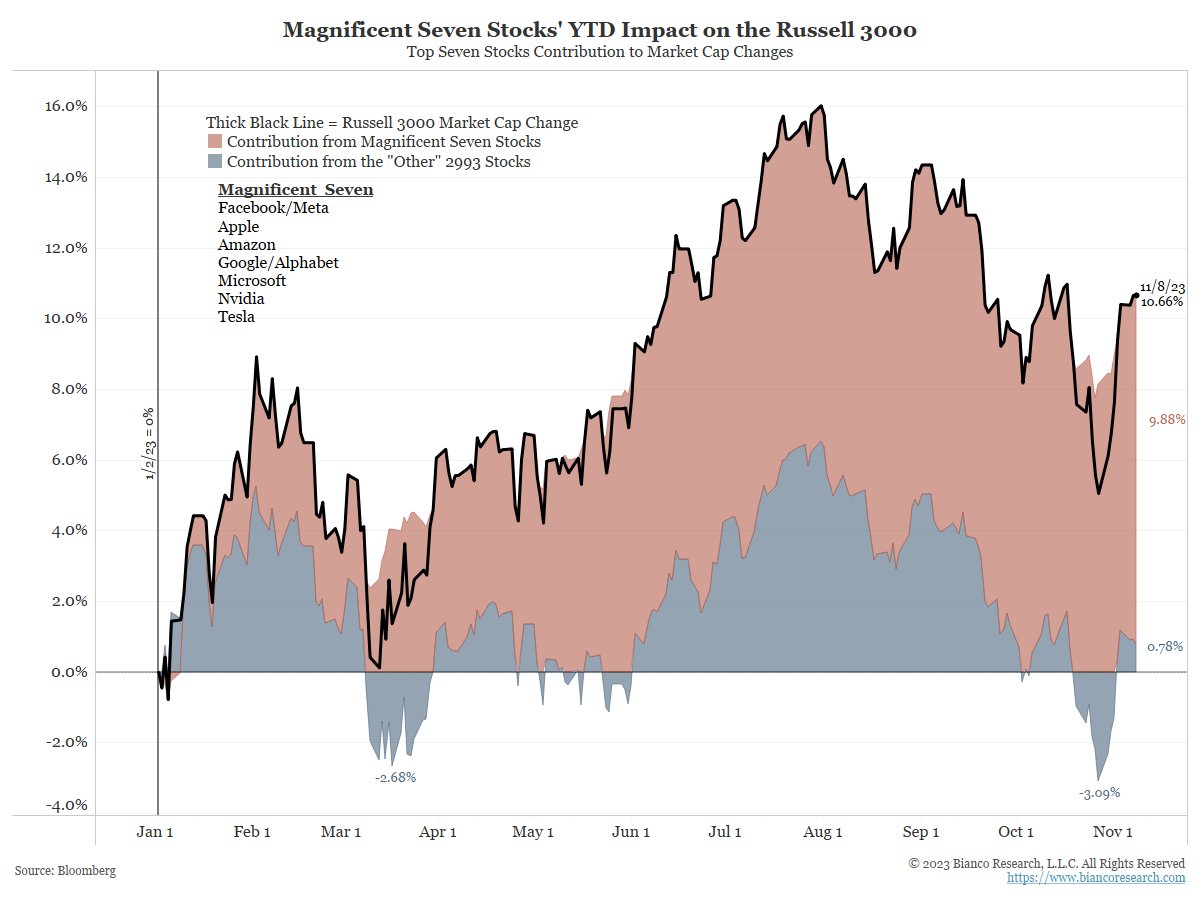

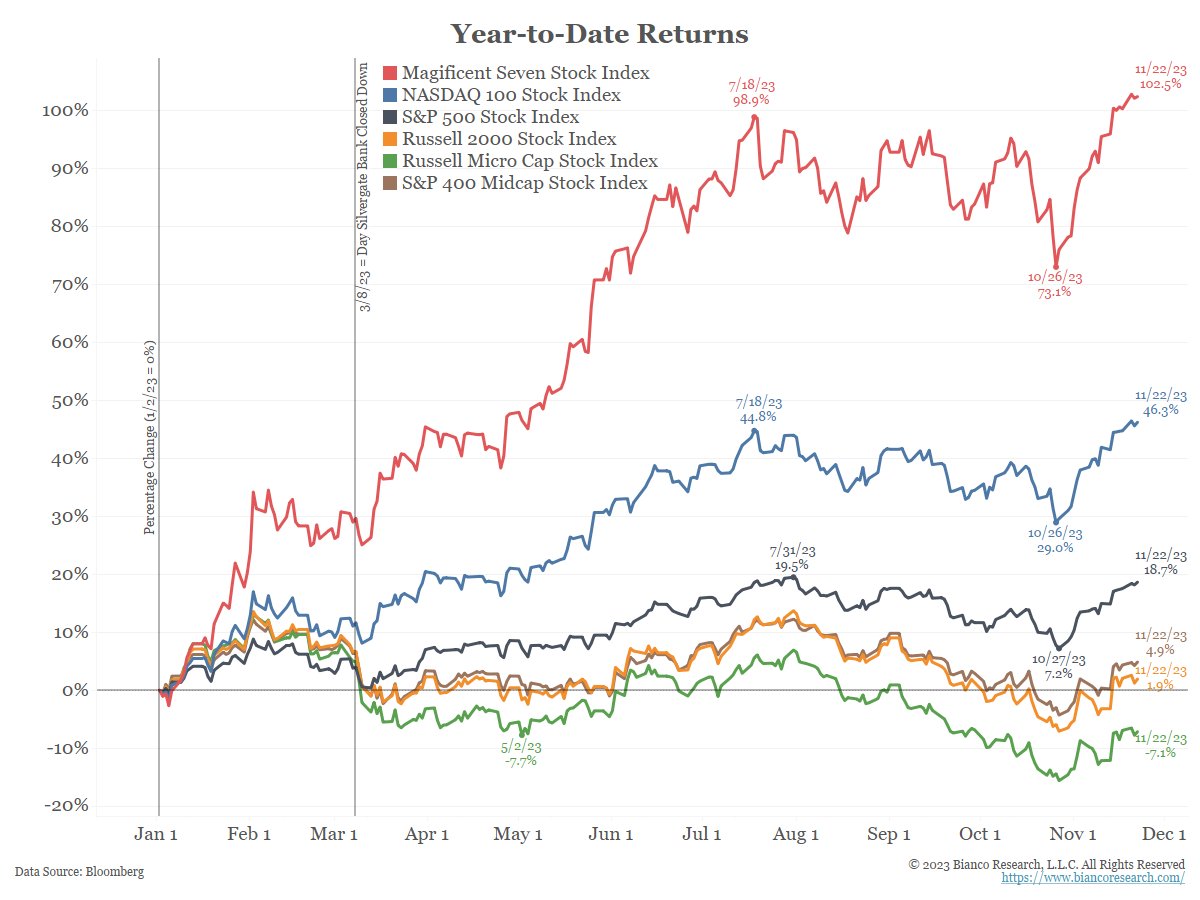

Below, the S&P 500 year-to-date returns are split between the "Mag 7" and the "other 493." We see arguably the most concentrated rally in history.

Over 12% of the S&P 500's gain has come from seven stocks. ~3% from the "other 493."

Below, the S&P 500 year-to-date returns are split between the "Mag 7" and the "other 493." We see arguably the most concentrated rally in history.

Over 12% of the S&P 500's gain has come from seven stocks. ~3% from the "other 493."

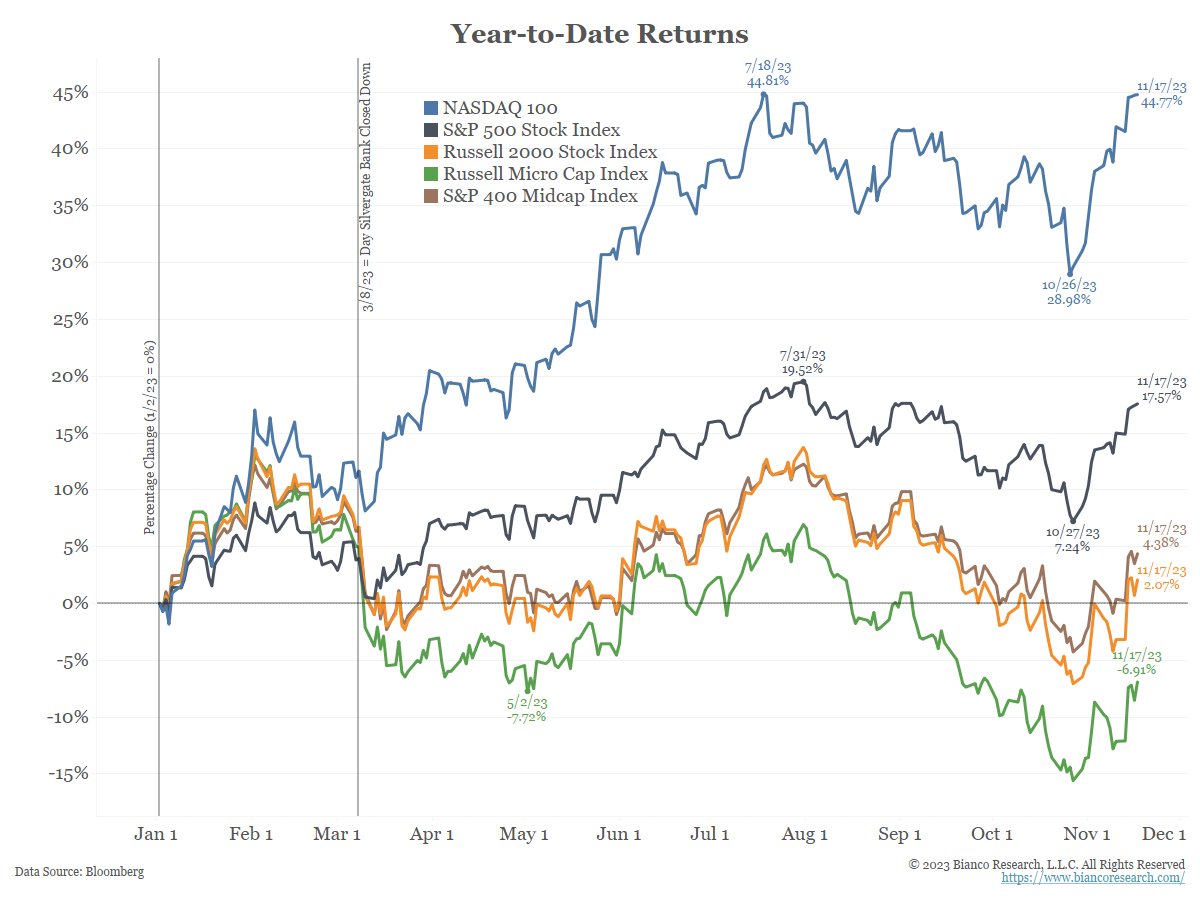

5/7

Why are the "other 493" struggling?

Their flows (orange) peaked when the Fed started hiking ... and money started pouring into money market funds (blue).

Why are the "other 493" struggling?

Their flows (orange) peaked when the Fed started hiking ... and money started pouring into money market funds (blue).

6/7

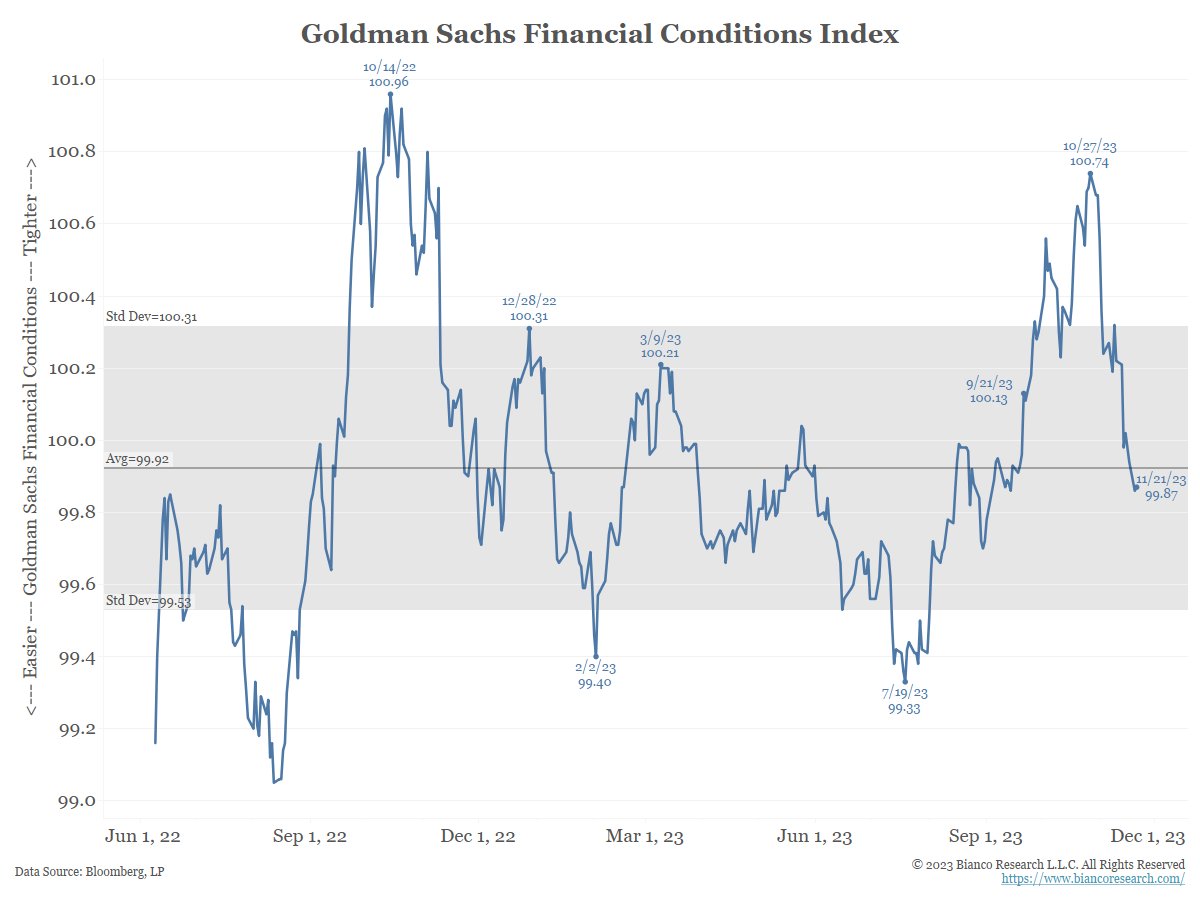

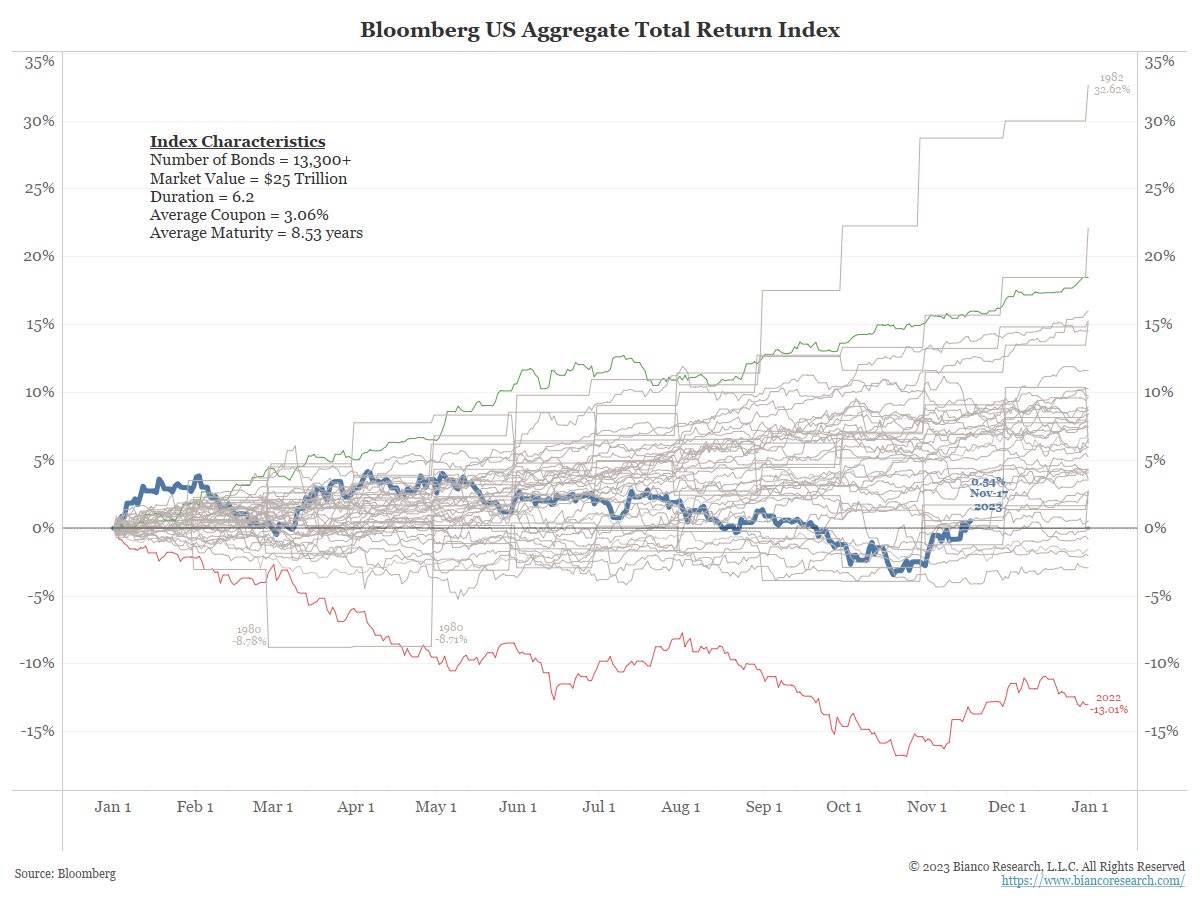

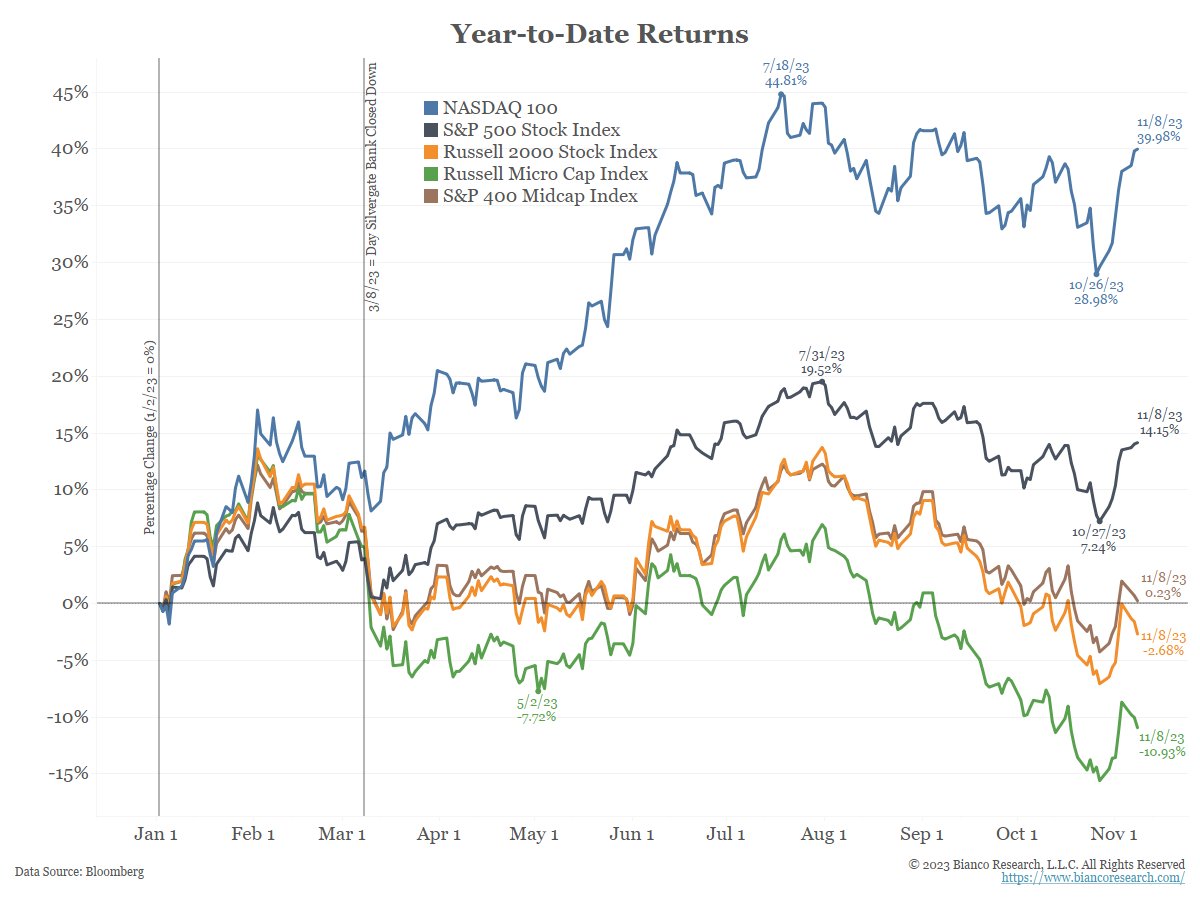

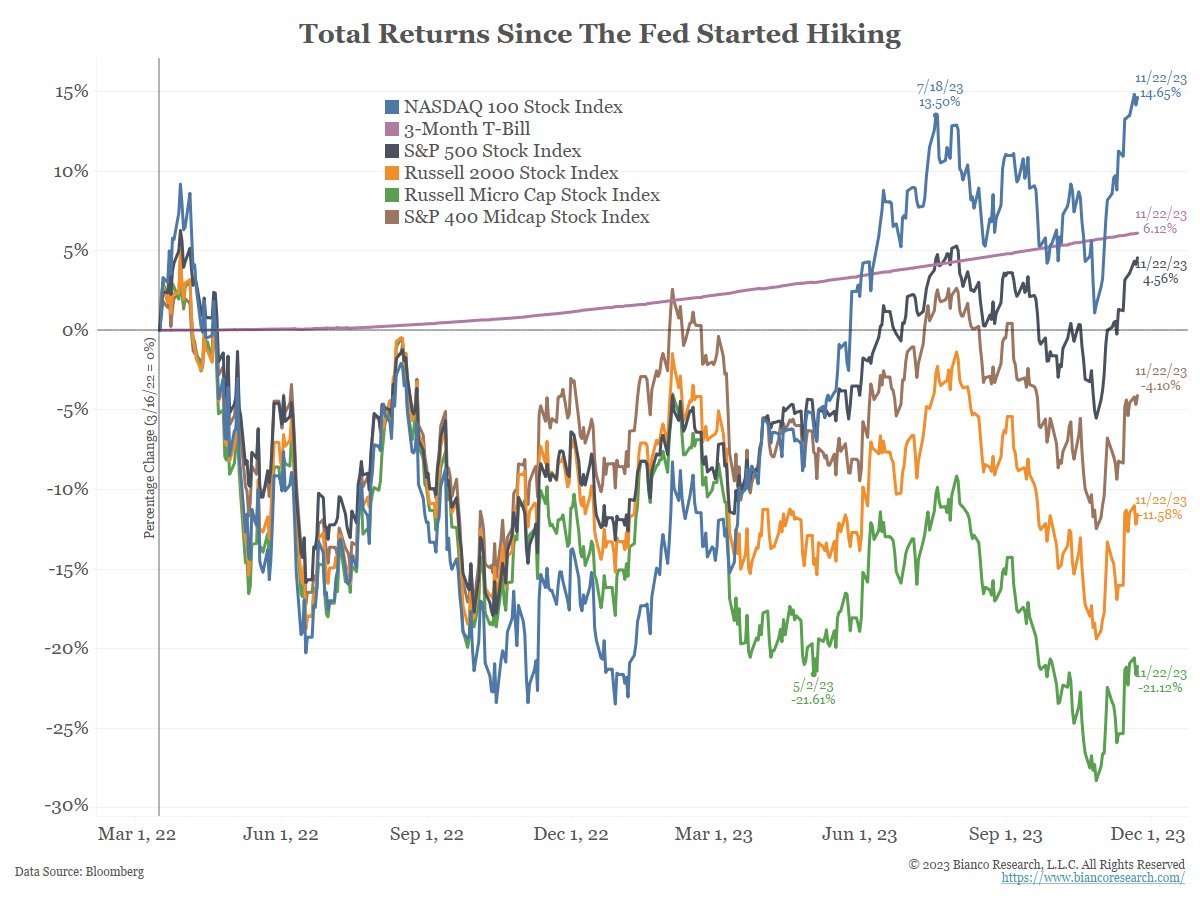

Has the shift into money market funds, or cash (purple), been a mistake?

Not really.

Cash has beaten everything but the index most concentrated in Mag 7 stocks (the NDX/QQQ).

5% money market yields mean "There is an Alternative" to ETFs, and it largely has been working!

Has the shift into money market funds, or cash (purple), been a mistake?

Not really.

Cash has beaten everything but the index most concentrated in Mag 7 stocks (the NDX/QQQ).

5% money market yields mean "There is an Alternative" to ETFs, and it largely has been working!

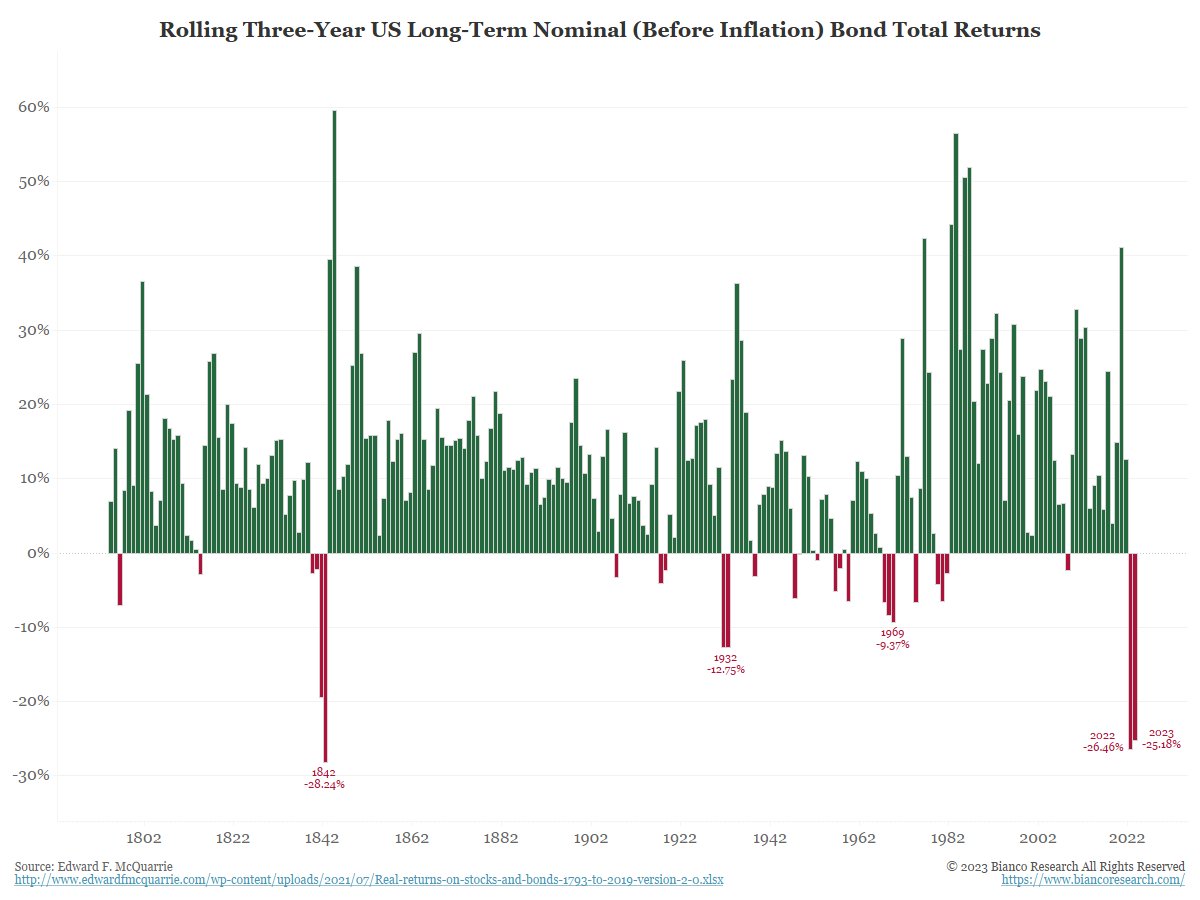

7/7

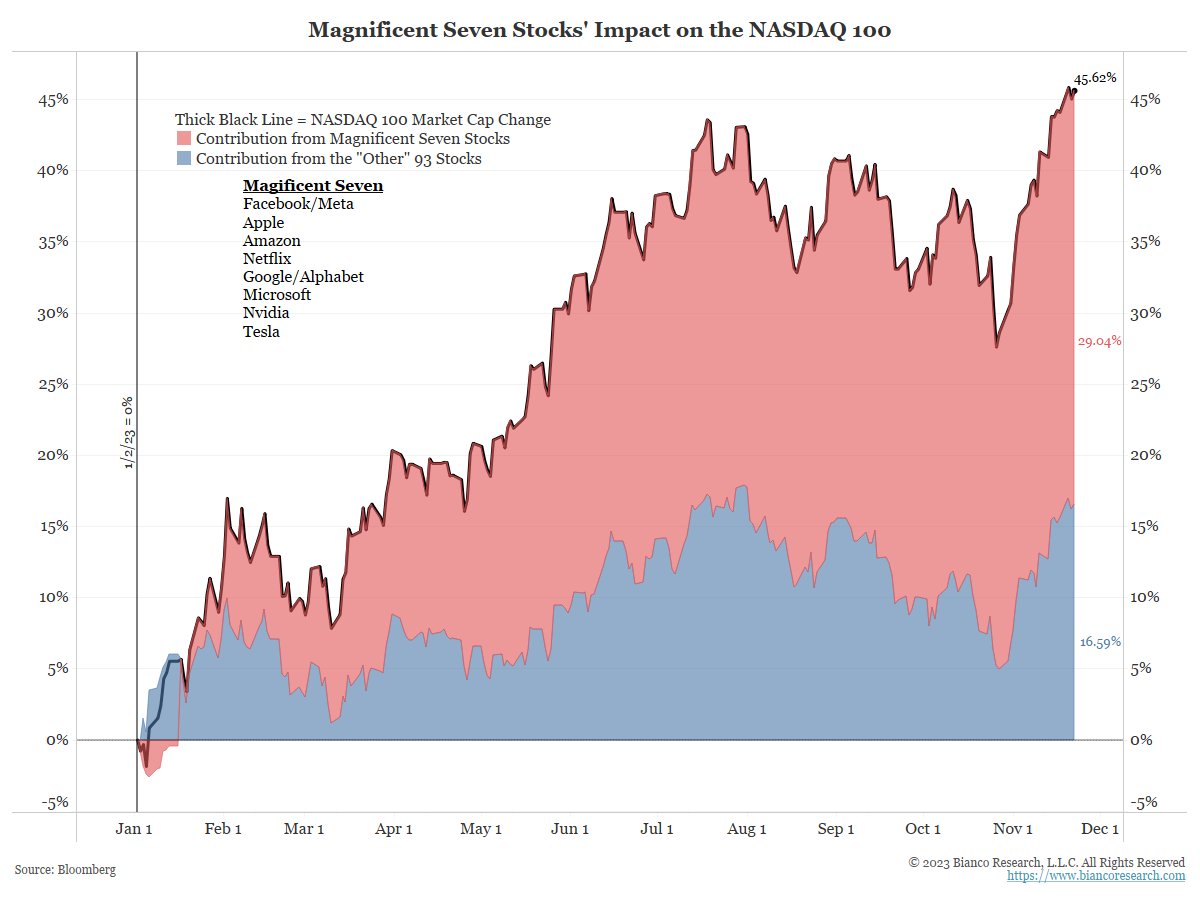

I've been arguing that the era of buying the stock indexes via ETF funds has ended. Stock picking has returned.

2023's theme has been about picking AI stocks.

The rest of the market cannot collectively beat cash, struggling from the alternative of 5% money market funds.

I've been arguing that the era of buying the stock indexes via ETF funds has ended. Stock picking has returned.

2023's theme has been about picking AI stocks.

The rest of the market cannot collectively beat cash, struggling from the alternative of 5% money market funds.

Bonus 3

Mag 7 up over 100% YTD

Micro-cap stocks (the bottom half of the Russell 2000) are DOWN 7%.

The era of buying ETF stocks is morphing back into a stock-picking era!

Mag 7 up over 100% YTD

Micro-cap stocks (the bottom half of the Russell 2000) are DOWN 7%.

The era of buying ETF stocks is morphing back into a stock-picking era!

big impact on stocks.

Please X, fix the edit button!

Please X, fix the edit button!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter