The price of newly constructed homes is falling sharply.

The median price of a new home fell to $409,300 in October, down more than 17% from a peak of $496,800.

This dynamic is not the same in the existing home market...

Let's explore the difference.

1/

The median price of a new home fell to $409,300 in October, down more than 17% from a peak of $496,800.

This dynamic is not the same in the existing home market...

Let's explore the difference.

1/

New construction sales come from homebuilders where the business is to build and sell homes.

Like any business, you can't hold too much inventory. When inventory piles up, you have to move units at discounted prices.

Existing home sales come from regular working people.

2/

Like any business, you can't hold too much inventory. When inventory piles up, you have to move units at discounted prices.

Existing home sales come from regular working people.

2/

The best measure in the housing market is the "months supply" or how many months of inventory there is at the current pace of sales.

This measure takes both supply and demand into account.

3/

This measure takes both supply and demand into account.

3/

A months supply above 6 = too much inventory and negative price pressure coming.

A months supply below 6 = tight inventory and upward price pressure.

The new and existing markets generally tracked each other for many years but the inventory situation diverged after COVID

4/

A months supply below 6 = tight inventory and upward price pressure.

The new and existing markets generally tracked each other for many years but the inventory situation diverged after COVID

4/

The new home market has had a months supply above 6 for almost two years straight.

This means homebuilders have an urgency to move units at discounted prices.

The existing market has been historically tight so prices have remained very sticky.

5/

This means homebuilders have an urgency to move units at discounted prices.

The existing market has been historically tight so prices have remained very sticky.

5/

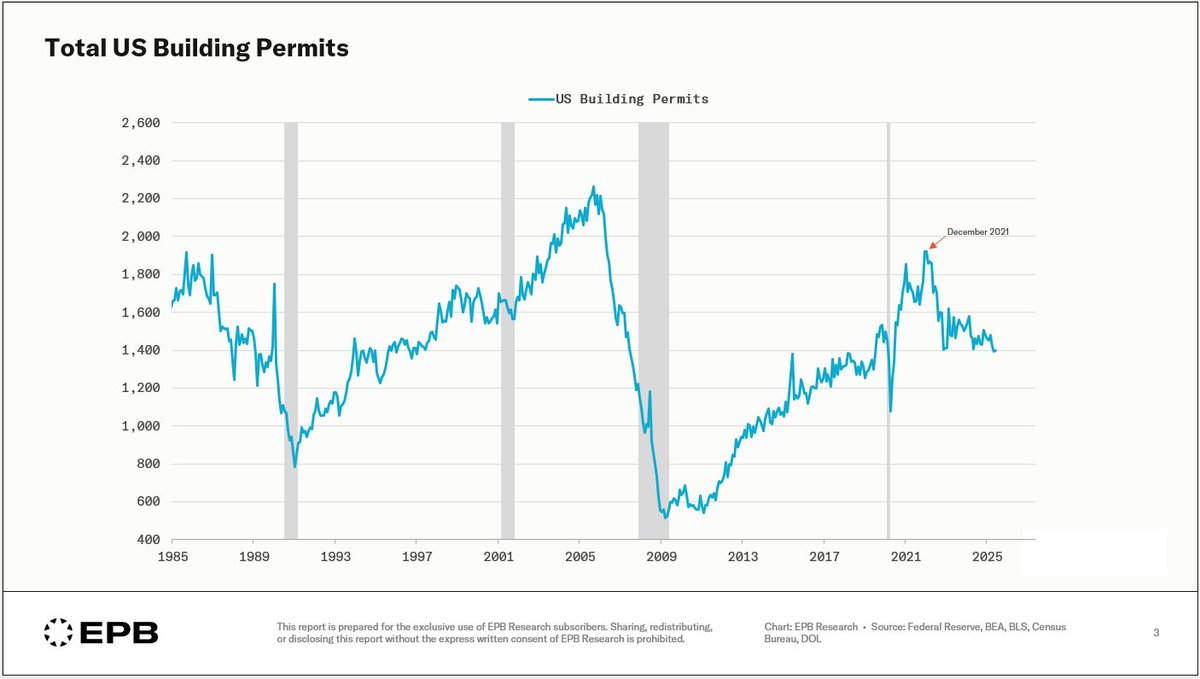

The new home market almost always moves first as builders have a business of building and moving inventory.

The long-term chart of new home months supply shows an extended period above 6 so there should be no surprise there's price pressure.

6/

The long-term chart of new home months supply shows an extended period above 6 so there should be no surprise there's price pressure.

6/

In fact, we started writing there would be negative price pressure for new homes back in late 2022.

7/

7/

Looking at history, we can see the accumulated price pressure by looking at the consecutive months that the months supply was above or below 6.

The months supply of new homes was below 6 for 115 consecutive months from 1996 to 2006.

Insane upward price pressure.

8/

The months supply of new homes was below 6 for 115 consecutive months from 1996 to 2006.

Insane upward price pressure.

8/

There were also two pockets more recently from 2011 to 2014 and from 2015 to 2017 where there was a lot of upward price pressure from very tight homebuilder supply.

9/

9/

On the flip side, we can see periods when there was a persistent oversupply of new construction and that led to a price decline every time.

The months supply of new homes has been above 6 for 21 months and we've seen a 15%-18% correction in new home prices.

10/

The months supply of new homes has been above 6 for 21 months and we've seen a 15%-18% correction in new home prices.

10/

So we're seeing a massive divergence between new home pricing and existing home pricing.

New home price valuations (price to income) have come down sharply from record levels while existing home valuations are still sky-high.

11/

New home price valuations (price to income) have come down sharply from record levels while existing home valuations are still sky-high.

11/

Most people will say "home prices are still high where I live."

This could be true.

Not all areas of the country have a lot of new construction.

Where I live, in the northeast, there is virtually no new construction so all we see is the existing market and high prices.

12/

This could be true.

Not all areas of the country have a lot of new construction.

Where I live, in the northeast, there is virtually no new construction so all we see is the existing market and high prices.

12/

In the areas with a lot of new construction, the price declines have bled into the existing market because there's an alternative.

This shows the price changes for the existing market based on Case-Shiller data.

Upper left = peak prices

Lower right = declining prices

13/

This shows the price changes for the existing market based on Case-Shiller data.

Upper left = peak prices

Lower right = declining prices

13/

There are some regions with political difficulties but Las Vegas, Phoenix, Denver, and Dallas generally have high volumes of new construction and the existing markets have softened in those areas.

14/

14/

All in all, the best predictor of prices is the months supply.

The existing market, on average, is still tight.

But the new market has accumulated a lot of price pressure with months supply above 6 for 21 months.

15/

The existing market, on average, is still tight.

But the new market has accumulated a lot of price pressure with months supply above 6 for 21 months.

15/

The current months supply is 7.8 and trending up so this price pressure for new homes won't subside in the near term.

The existing market will remain very tight until the unemployment rate jumps strongly and forces inventory to market.

16/

The existing market will remain very tight until the unemployment rate jumps strongly and forces inventory to market.

16/

If you're in an area with new construction, it's a buyer's market with home valuations roughly back to the long-run average with good chances you can buy with below-average valuations.

If you only see the existing market, you're still looking at stretched home prices.

17/17

If you only see the existing market, you're still looking at stretched home prices.

17/17

• • •

Missing some Tweet in this thread? You can try to

force a refresh