Systematic Withdrawal Plan (SWP) as a Pension Tool.

More realistic nos.

At 23 yr, I

SIP in Mutual Funds: Rs 2,500

Annual Increment: 15%

Duration: 25 yr

Conservative CAGR: 12%

Corpus at the age 48yr: 1.7 Cr

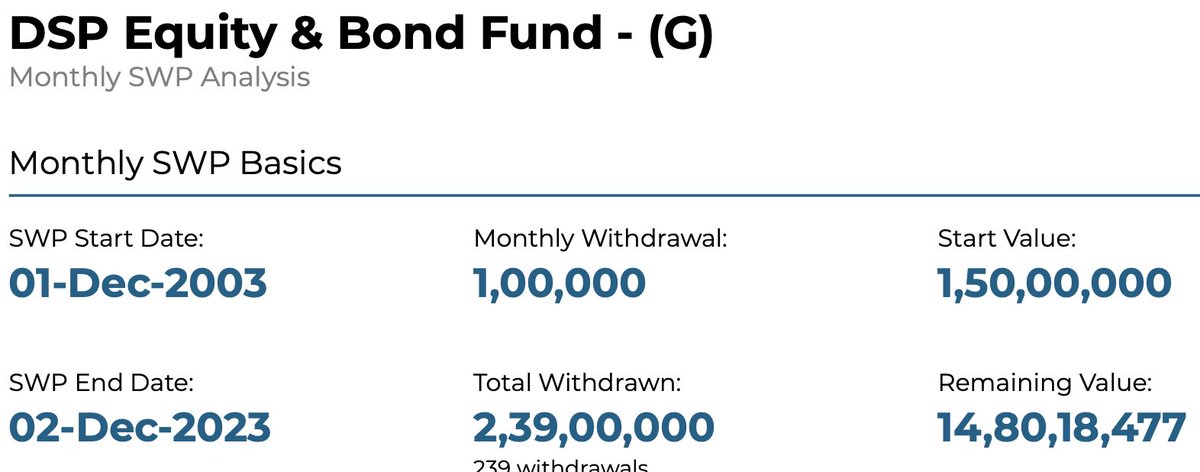

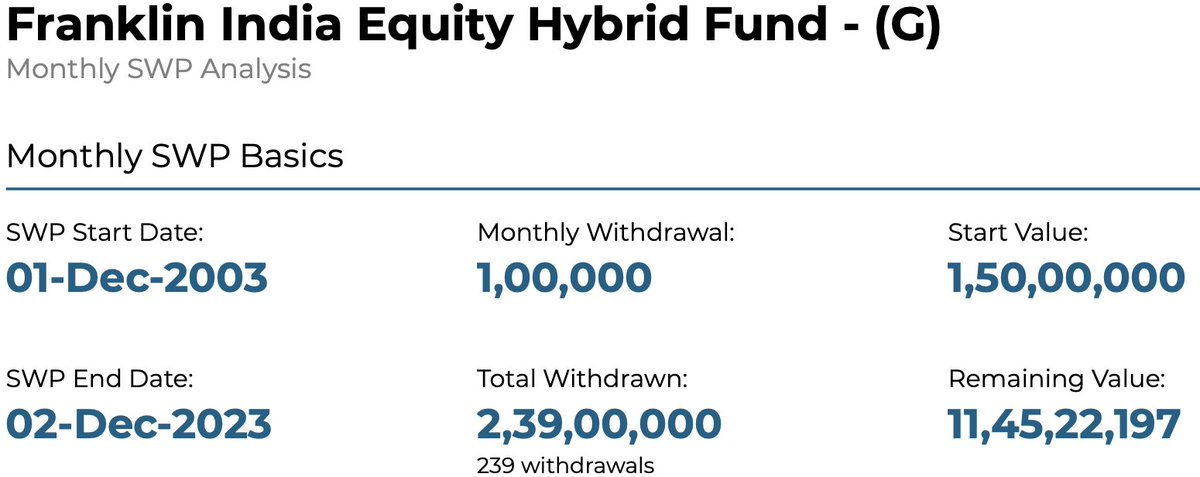

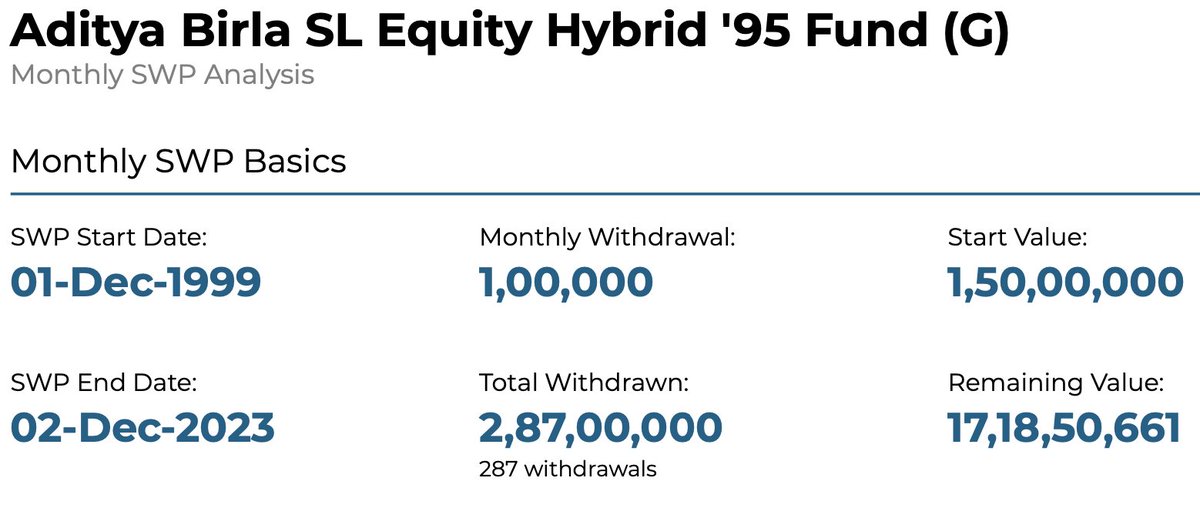

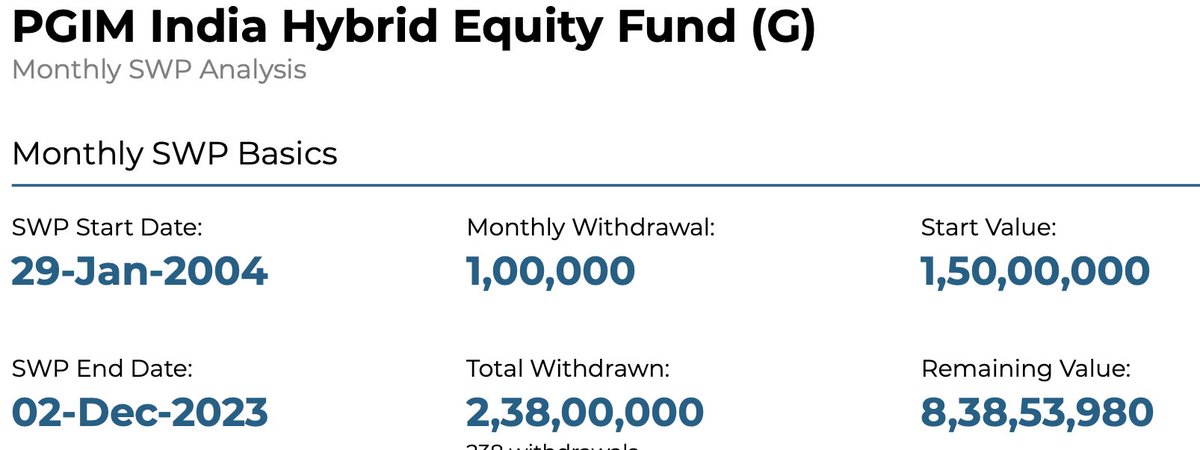

Lets see if I do 1.5 Cr SWP in below BAF

(20L - Taxes)

🧵⤵️

More realistic nos.

At 23 yr, I

SIP in Mutual Funds: Rs 2,500

Annual Increment: 15%

Duration: 25 yr

Conservative CAGR: 12%

Corpus at the age 48yr: 1.7 Cr

Lets see if I do 1.5 Cr SWP in below BAF

(20L - Taxes)

🧵⤵️

Monthly withdrawal is 8% of the corpus. Slightly on higher side.

For those who are concerned about inflation, every 2-3 yrs you can increase withdrawal. Just that reminder will be reduced.

Fund1: HDFC Balanced Advantage Fund

Withdrawal/ Month: 1 Lakh

Duration: 20 yr

For those who are concerned about inflation, every 2-3 yrs you can increase withdrawal. Just that reminder will be reduced.

Fund1: HDFC Balanced Advantage Fund

Withdrawal/ Month: 1 Lakh

Duration: 20 yr

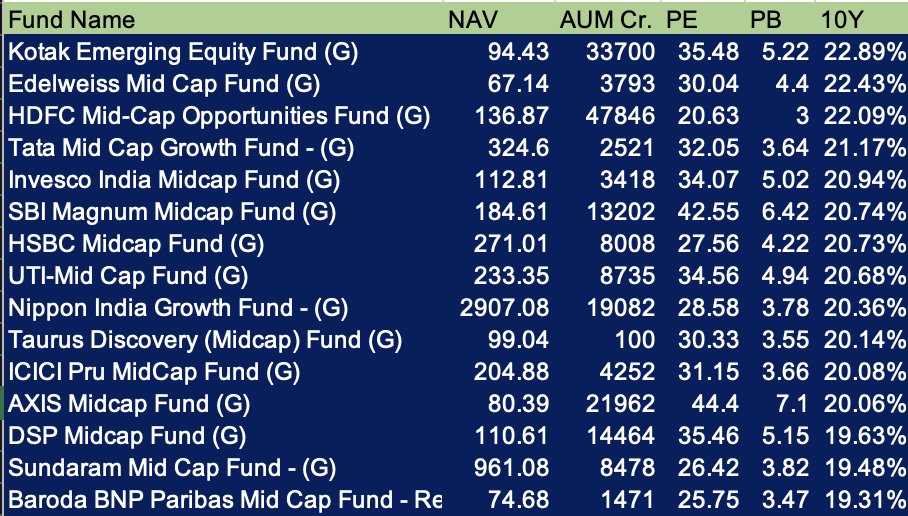

Fund8: What if we would have opted SWP in Nippon India Mird-cap kind of fund? Highly not suggested.

Just for curiousity in 20 yrs how much reminder value it creates with 1 lakh/ month withdrawal on 1.5 Cr Lumpsum.

Its 48.39 Crore.

Just for curiousity in 20 yrs how much reminder value it creates with 1 lakh/ month withdrawal on 1.5 Cr Lumpsum.

Its 48.39 Crore.

Please note this is just a concept we can have it as a pension tool.

Dont try this concept to clear your holiday loan, house EMI or Vehicle EMIs & Personal Loan.

For Inflation Lovers: Reiterating to increase withdrawal every 2-3 yrs. Reminder value reduced.

Best Wises

~END~

Dont try this concept to clear your holiday loan, house EMI or Vehicle EMIs & Personal Loan.

For Inflation Lovers: Reiterating to increase withdrawal every 2-3 yrs. Reminder value reduced.

Best Wises

~END~

• • •

Missing some Tweet in this thread? You can try to

force a refresh