CBK hiked its policy rate by 2.0 percentage points to 12.5%:

· The rate is at its highest point since September 2012

· It’s the highest hike since the Nov 2011 5.5 percentage points raise

· The decision was predicated mainly on the US$/Kes

Why go hard on US$/Kes pressures? A 🧵

· The rate is at its highest point since September 2012

· It’s the highest hike since the Nov 2011 5.5 percentage points raise

· The decision was predicated mainly on the US$/Kes

Why go hard on US$/Kes pressures? A 🧵

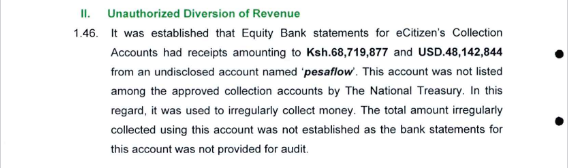

Between 2020 & May 2023, CBK haemorrhaged US$2.8 billion in propping the Kes to artificial strength. Of this amount, US$1.3 billion was in 2020, another US$650.0M in 2021 & US$850.0M in the period to May 2023. By the time global shocks were rising, there was no fire power left

Dr Thugge says the US$/Kes exchange rate has now depreciated more than was necessary to re-establish a stable but competitive exchange rate. In short, the Kes is currently at a rate weaker than its fair value per the CBK's analysis.

FX pass through in inflation has been significant. The Governor says 3.0 percentage points out the 6.8% inflation reported in Nov 2023 was a factor of the exchange rate depreciation & this meant the Shilling's slide was further complicating CBK's price stability mandate

Beyond inflation, the runaway depreciation of the Kes was also adversely impacting the fiscal agenda. 2023/24 began with the fiscal deficit projected at 4.4%, by the tabling of Supplementary Budget I, this had been revised to 5.5%. Thugge says Supp Budget II will target 4.7%

CBK says the 200.0 bps hike pushing the policy rate to 12.5% is aimed at dealing "decisively" with the depreciation & all its pass through effects. Treasury says depreciation of the Kes in the year ended June '23 occasioned a Kes 883.5 billion increase in the stock of debt.

Dr Thugge says CBK isn't too worried about what the 200.0bps hike would mean for the banking sector from loan book quality perspective, says stress tests show resilience. He isn't too worried either about the impact the rate hike will have on growth momentum.

Benefits>Costs

Benefits>Costs

In responding to my question 2 things emerge:

· Dr Thugge believe CBK is still behind the curve in its tightening cycle (hinting at more hikes down the road)

· Despite slowdown in inflation, the headline figure remains stubbornly close to the upper range

· Dr Thugge believe CBK is still behind the curve in its tightening cycle (hinting at more hikes down the road)

· Despite slowdown in inflation, the headline figure remains stubbornly close to the upper range

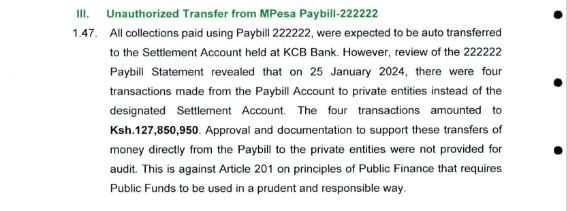

Kenya is set to receive US$300.0M within the 2nd week of December as an instalment for a US$500.0M facility expected from the Trade & Development Bank.

It's this US$300.0M that is earmarked for the early redemption for the US$2.0 billion set for December.

Ends!

It's this US$300.0M that is earmarked for the early redemption for the US$2.0 billion set for December.

Ends!

• • •

Missing some Tweet in this thread? You can try to

force a refresh