How to get URL link on X (Twitter) App

Are we still expecting a successor programme with the IMF following the premature termination of the US$3.6 billion arrangement in March this year?

Are we still expecting a successor programme with the IMF following the premature termination of the US$3.6 billion arrangement in March this year?

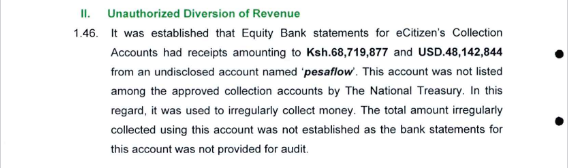

· Equity Bank statements for eCitizen's Collection

· Equity Bank statements for eCitizen's Collection

First off,

First off,

Are you wondering where this Bill is coming from?

Are you wondering where this Bill is coming from? https://x.com/AmbokoJH/status/1761102362779815961

Who are the biggest winners in Supp. Budget III 2024/25?

Who are the biggest winners in Supp. Budget III 2024/25?

The starting point is that this Report was tabled by the Committee Chairman, @KuriaKimaniMP, on Thursday last week just before the CS National Treasury took the floor to pronounce the 2025/26 Budget Highlights.

The starting point is that this Report was tabled by the Committee Chairman, @KuriaKimaniMP, on Thursday last week just before the CS National Treasury took the floor to pronounce the 2025/26 Budget Highlights.

First, there have been adjustment in the numbers at the macros level.

First, there have been adjustment in the numbers at the macros level.

The Bank argues that Kenya bloated public sector wage bill is hinged largely on its allowances system.

The Bank argues that Kenya bloated public sector wage bill is hinged largely on its allowances system.

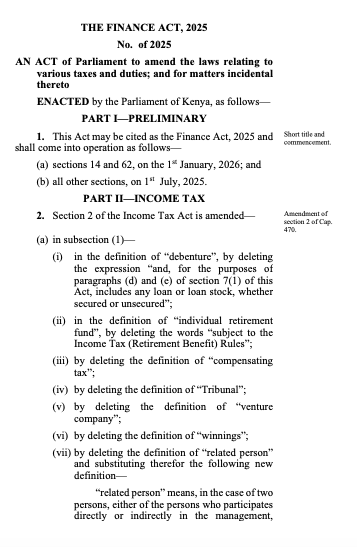

First thing to flag is that GOK has done away with the traditional three tiered effective dates.

First thing to flag is that GOK has done away with the traditional three tiered effective dates.

First,

First,

No. 1: Changes in the 2025/26 headline figures

No. 1: Changes in the 2025/26 headline figures

Our conversation started on the balance sheet with me asking Musau 2 things:

Our conversation started on the balance sheet with me asking Musau 2 things:

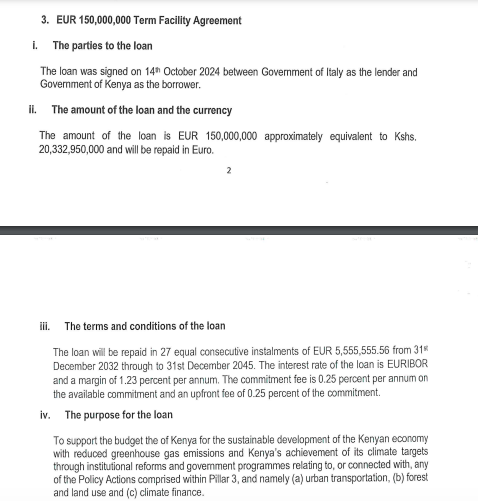

· The largest single loan taken is from the Government of Italy, a €150.0M (Kes 20.33 billion) facility

· The largest single loan taken is from the Government of Italy, a €150.0M (Kes 20.33 billion) facility

About the slash in the benchmark rate & the Cash Reserve Ratio & risks of failure to transmit to the real economy:

About the slash in the benchmark rate & the Cash Reserve Ratio & risks of failure to transmit to the real economy:

Summary:

Summary:

The highlight of my day was RSM East Africa's proposal on amendments to the VAT registration threshold (currently Kes 5.0M).

The highlight of my day was RSM East Africa's proposal on amendments to the VAT registration threshold (currently Kes 5.0M).

Summary:

Summary:

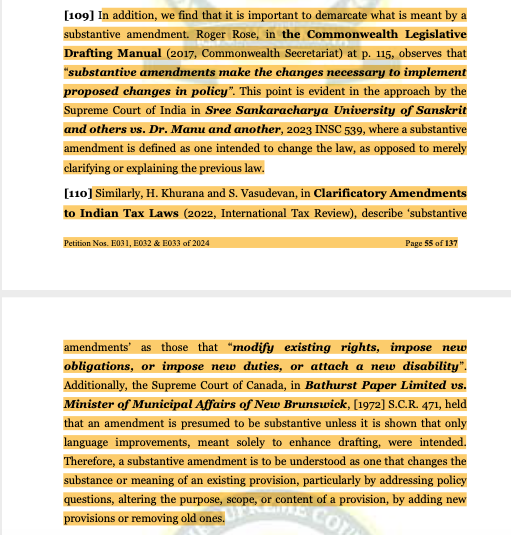

The question of whether an amendment is material or minor/technical was very key in this judgement.

The question of whether an amendment is material or minor/technical was very key in this judgement.