In this THREAD I will explain LIQUIDITY:

1. What is Liquidity?

2. Sell-side Liquidity

3. Buy-side Liquidity

4. Internal & External Liquidity

🧵(1/6)

1. What is Liquidity?

2. Sell-side Liquidity

3. Buy-side Liquidity

4. Internal & External Liquidity

🧵(1/6)

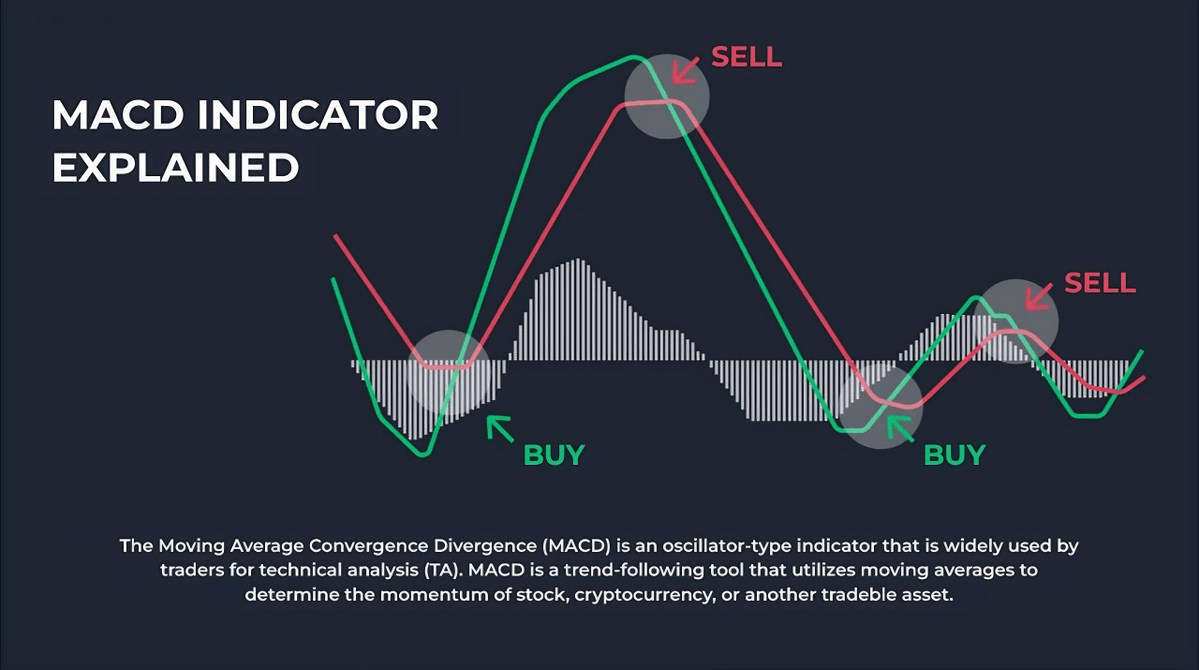

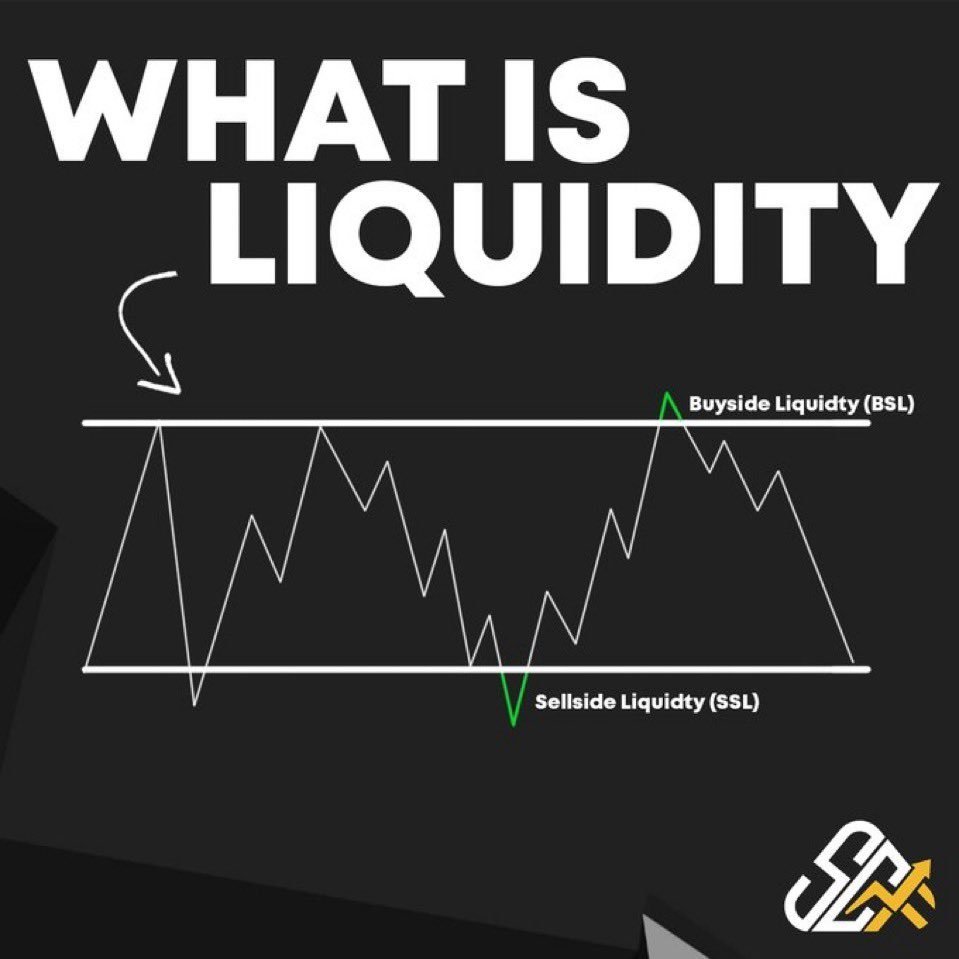

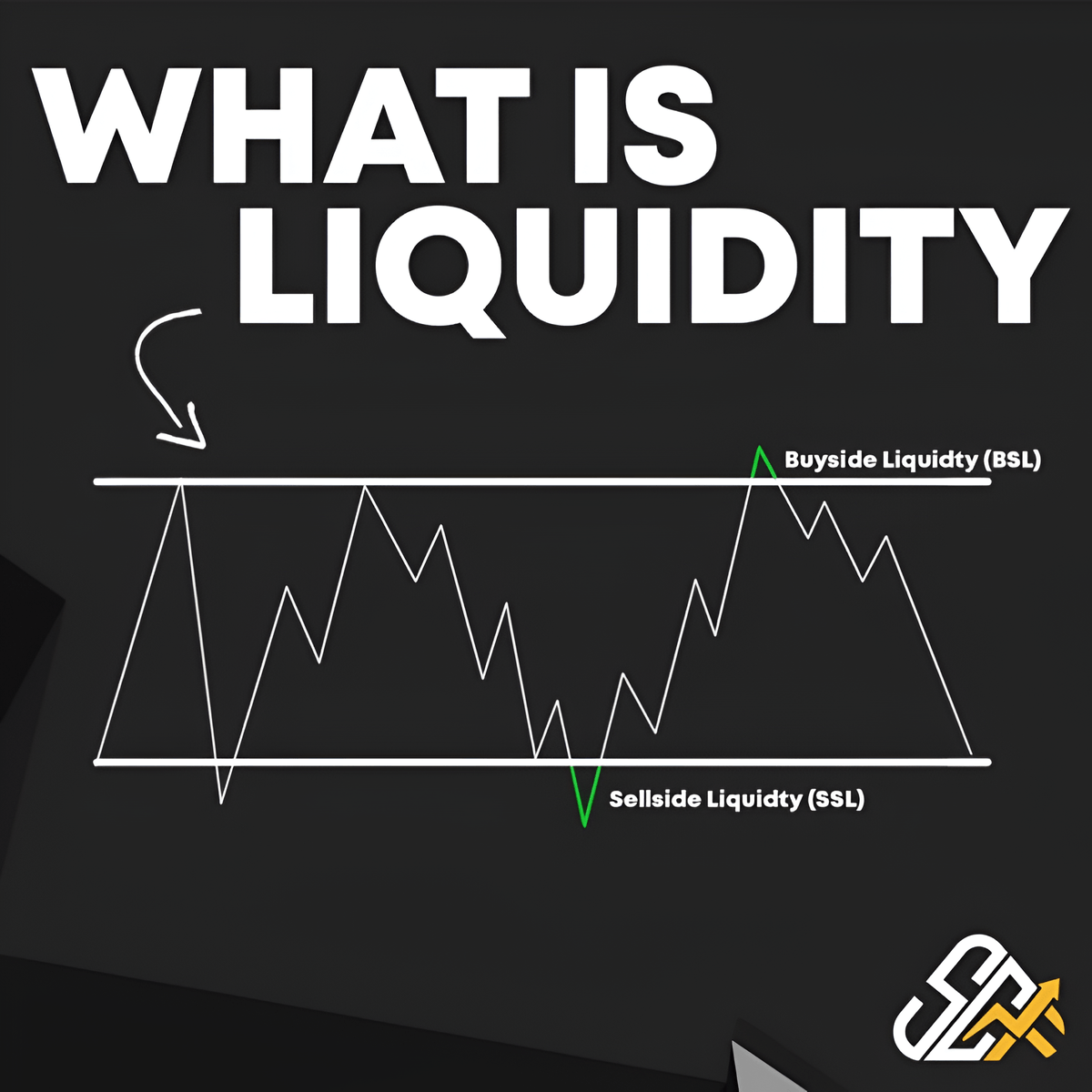

1. What is Liquidity?

- Liquidity is basically sum of all orders at a specific price

- Liquidity is present at every high and low. Since, is where traders place buy, sell and stop orders

- Liquidity is used by smart money to fill gaps on the market

- Liquidity is basically sum of all orders at a specific price

- Liquidity is present at every high and low. Since, is where traders place buy, sell and stop orders

- Liquidity is used by smart money to fill gaps on the market

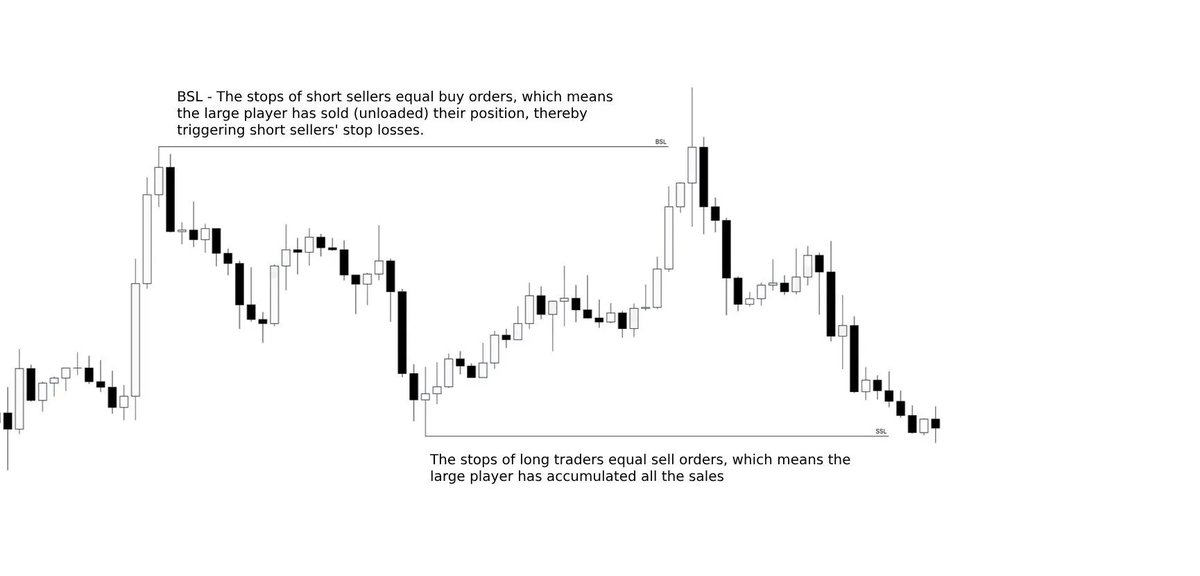

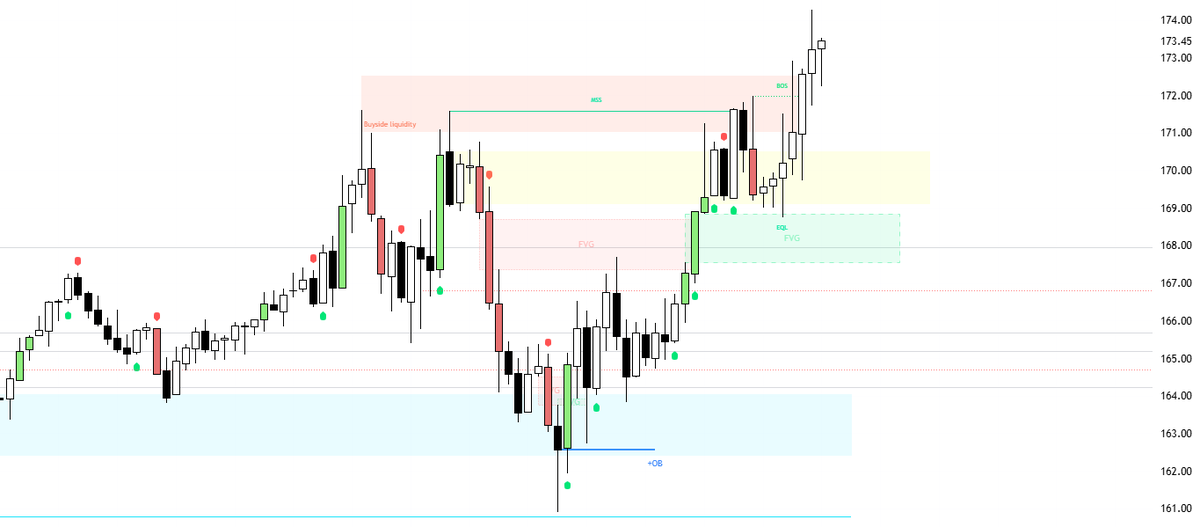

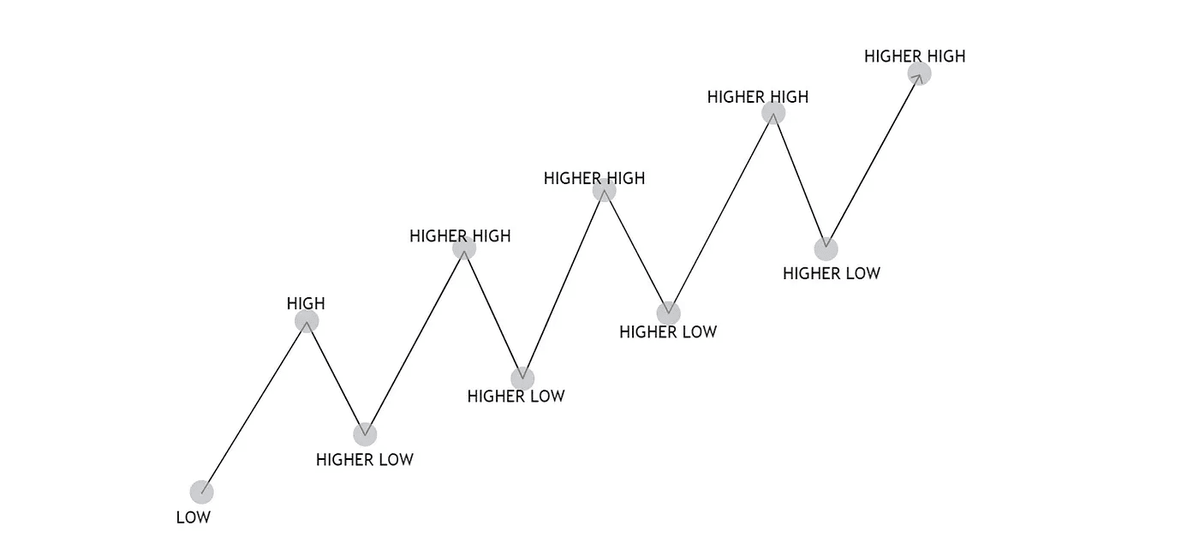

2. Buy-side Liquidity:

- Liquidity generated when SL are taken out.

Areas where Buy-side liquidity rests:

• PWH, PDH, Equal Highs, Above HTF resistance…

- Liquidity generated when SL are taken out.

Areas where Buy-side liquidity rests:

• PWH, PDH, Equal Highs, Above HTF resistance…

3. Sell-side Liquidity:

- Is the liquidity generated when buy-stops are triggered below support.

Areas where Buy-side liquidity rests:

• PWL, PDL, Equal lows, Below HTF Support…

- Is the liquidity generated when buy-stops are triggered below support.

Areas where Buy-side liquidity rests:

• PWL, PDL, Equal lows, Below HTF Support…

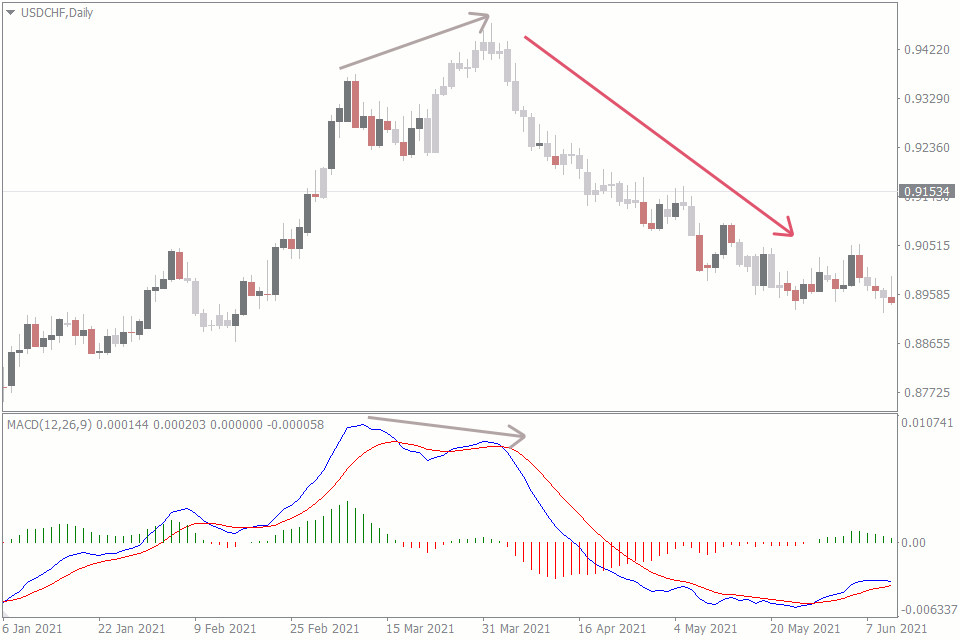

4. Internal & External Liquidity:

- Internal Liquidity: Is the liquidity inside the define range

- External Liquidity: Buy-side liquidity above the range high and sell-liquidity below the range low.

- Market moves essentially between Internal and External Liquidity.

- Internal Liquidity: Is the liquidity inside the define range

- External Liquidity: Buy-side liquidity above the range high and sell-liquidity below the range low.

- Market moves essentially between Internal and External Liquidity.

I hope this THREAD has helped you to understand the extense concept of LIQUIDITY.

It's a needed knowledge you must have.

This has been the SECOND THREAD I made about Liquidity.

RT and FAV to spread this THREAD is appreciated

It's a needed knowledge you must have.

This has been the SECOND THREAD I made about Liquidity.

RT and FAV to spread this THREAD is appreciated

• • •

Missing some Tweet in this thread? You can try to

force a refresh