How to get URL link on X (Twitter) App

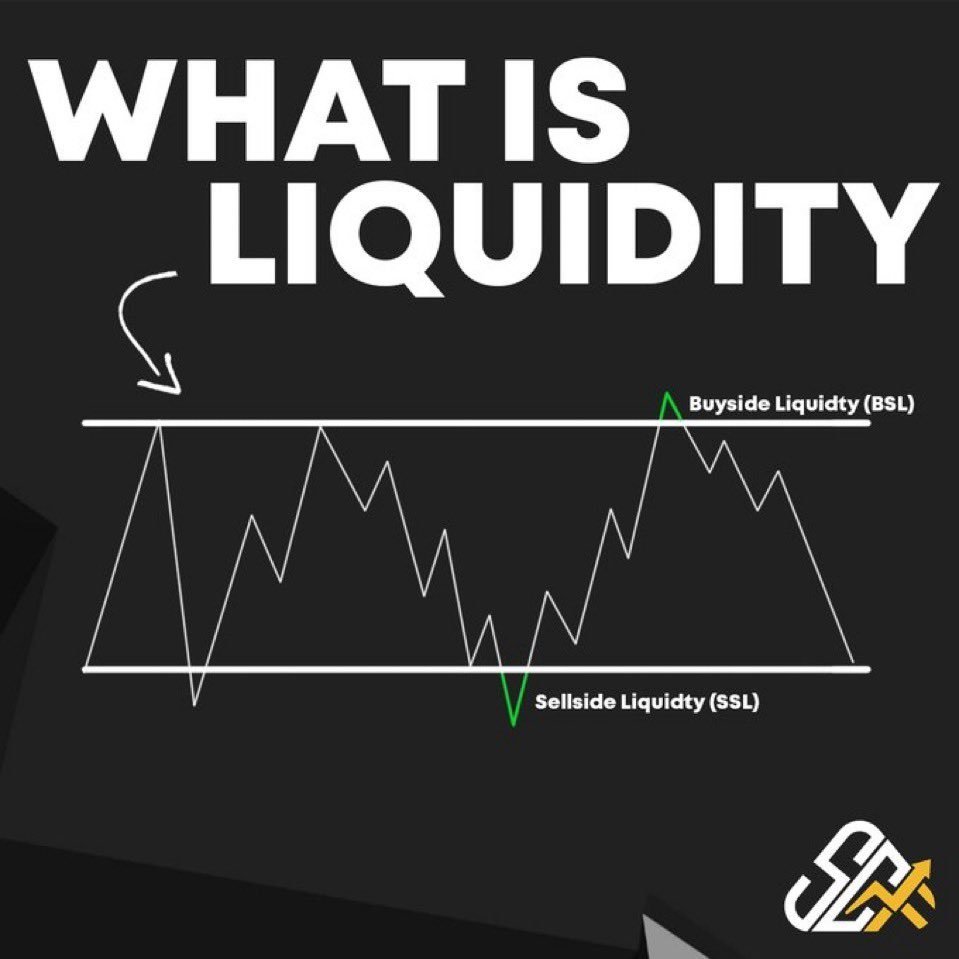

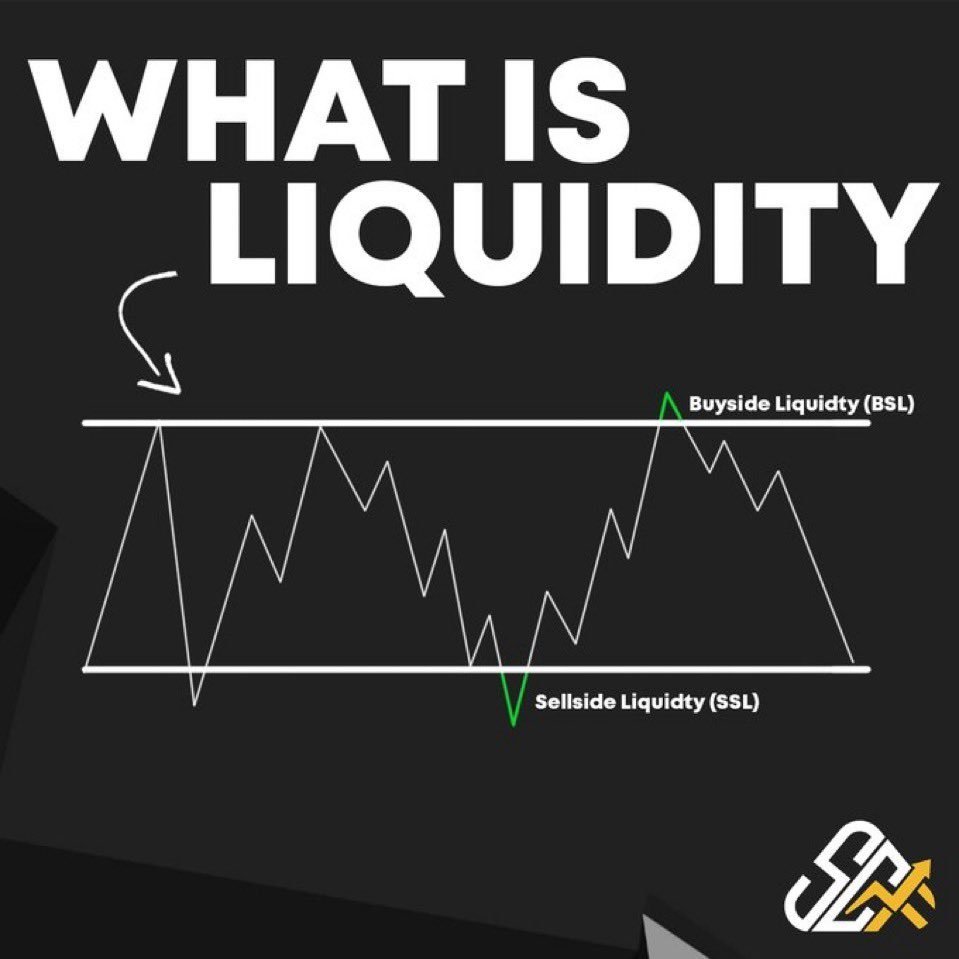

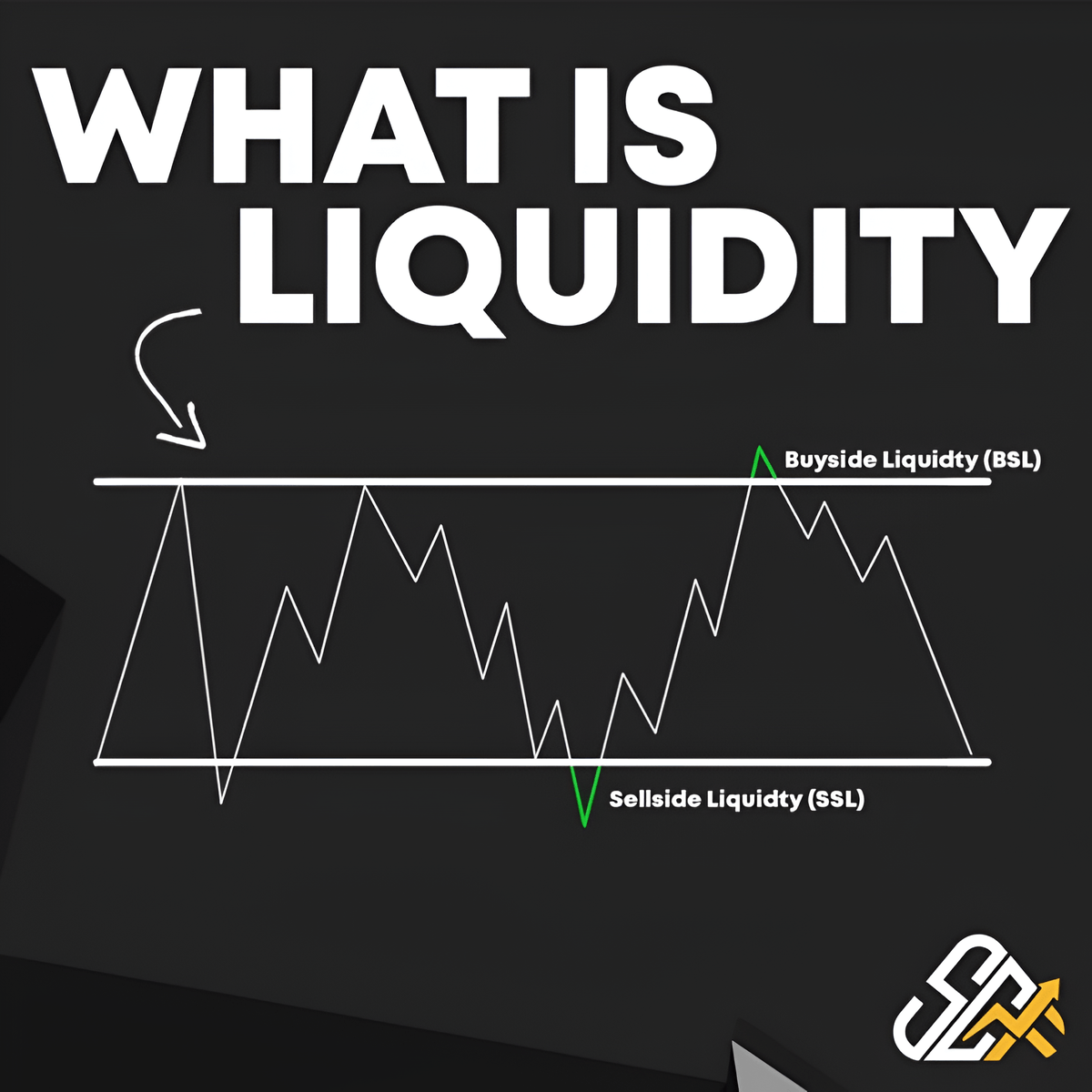

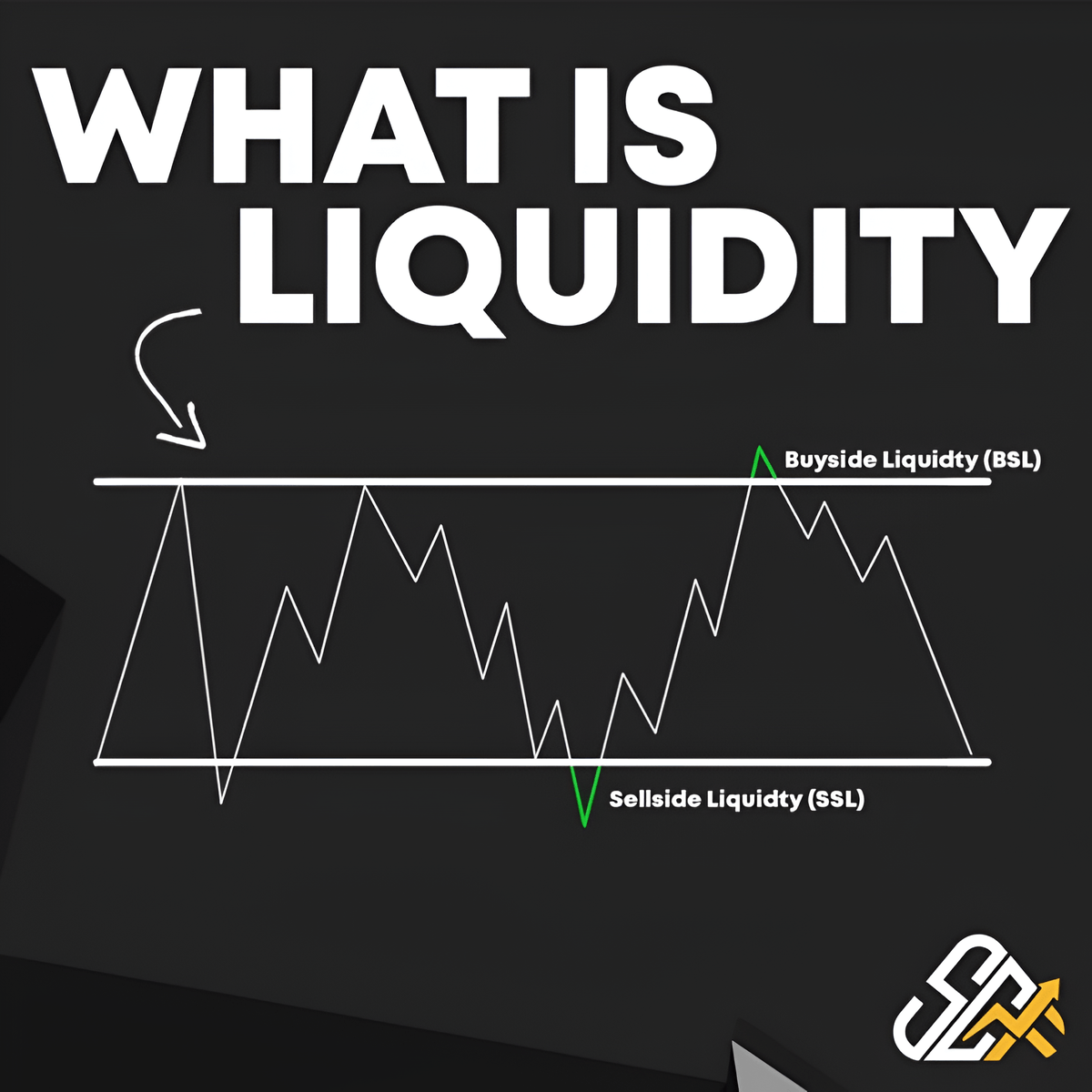

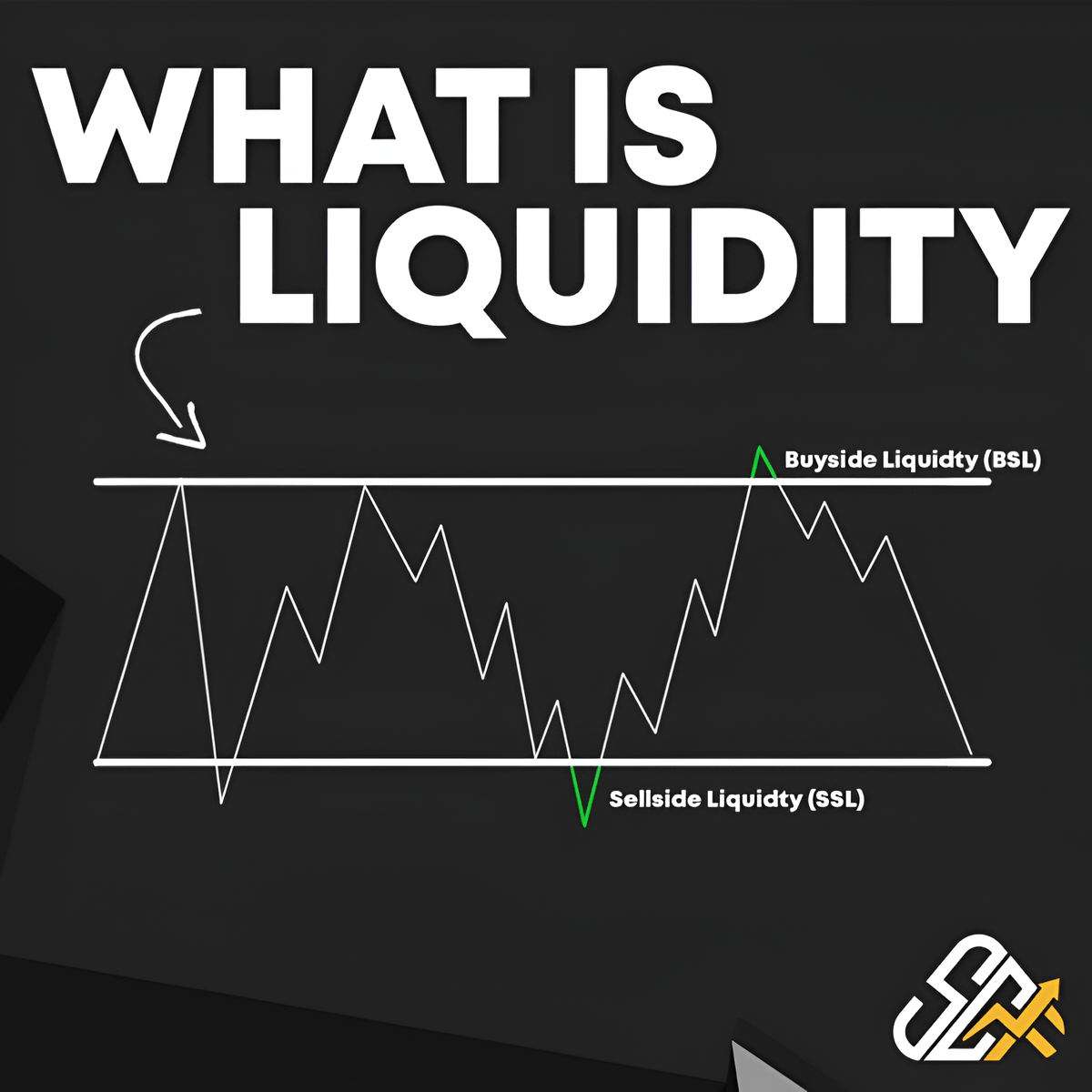

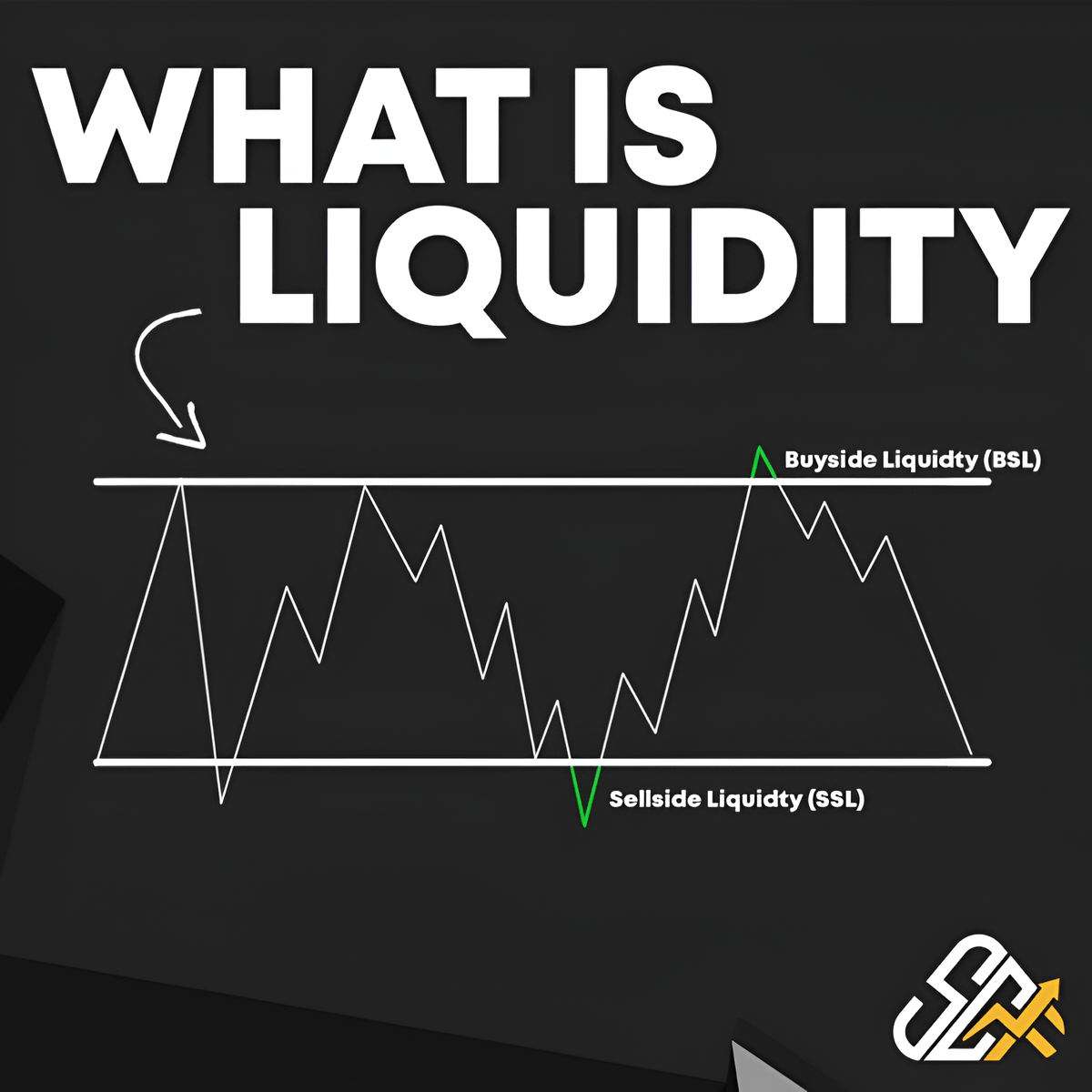

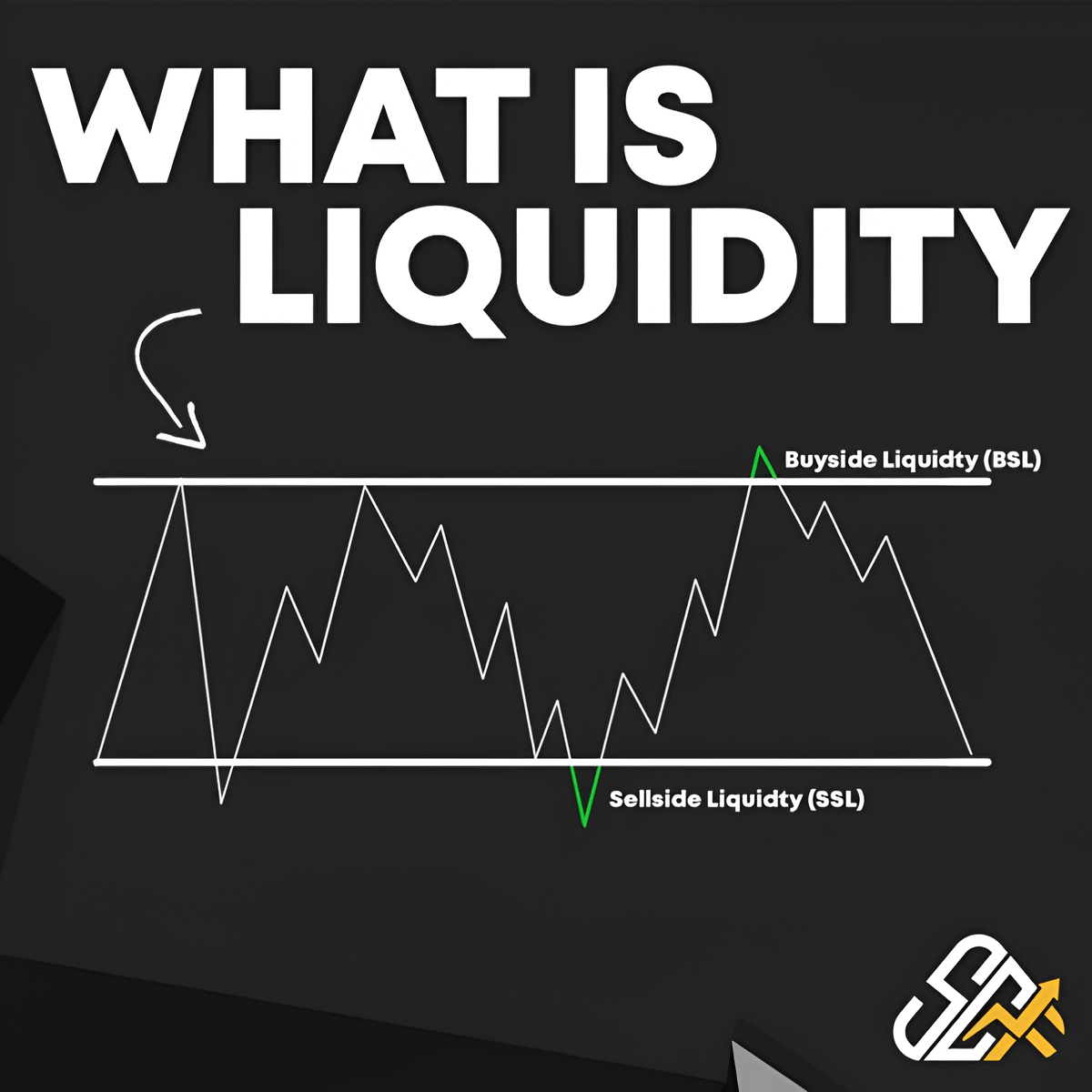

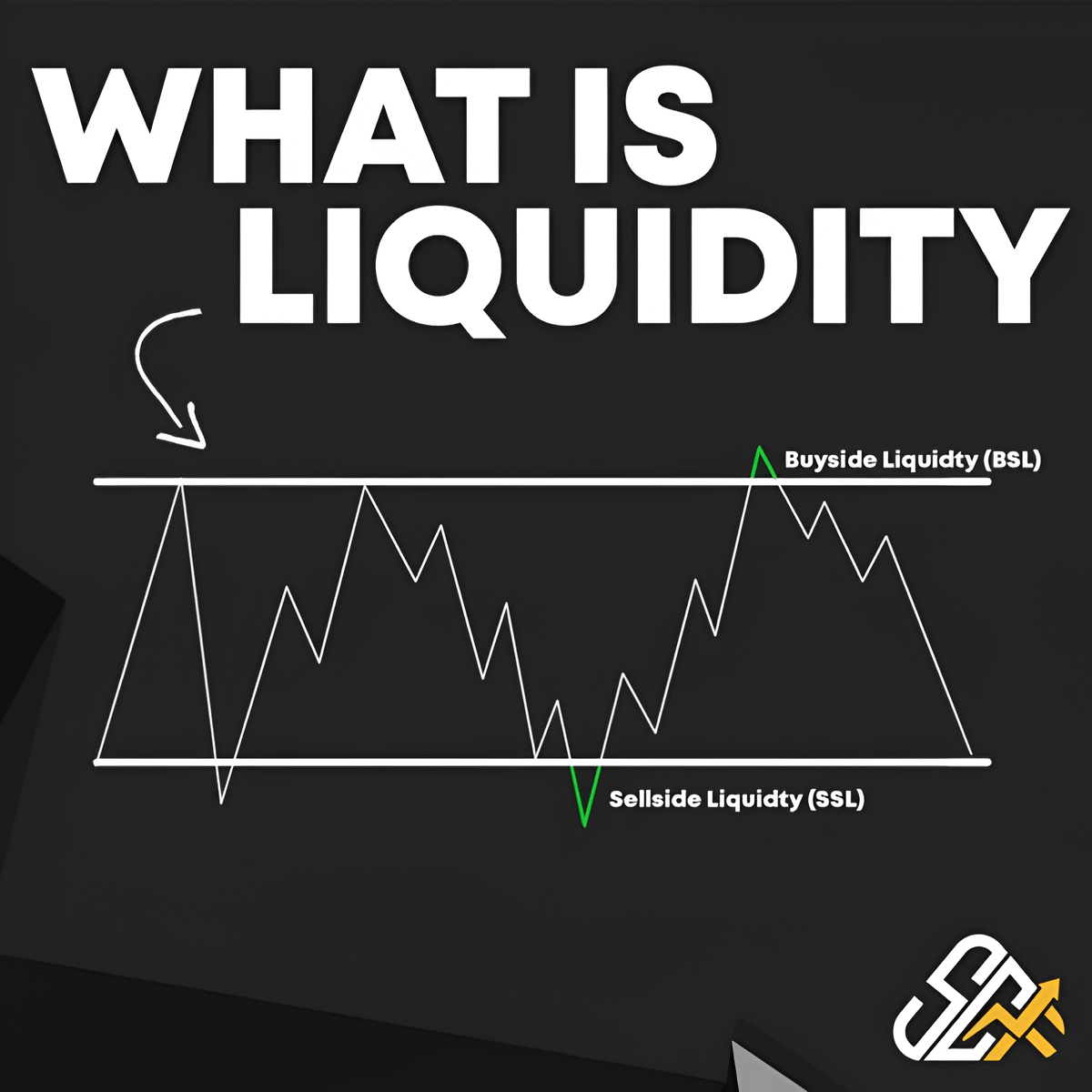

1. Where is the Liquidity?

1. Where is the Liquidity?

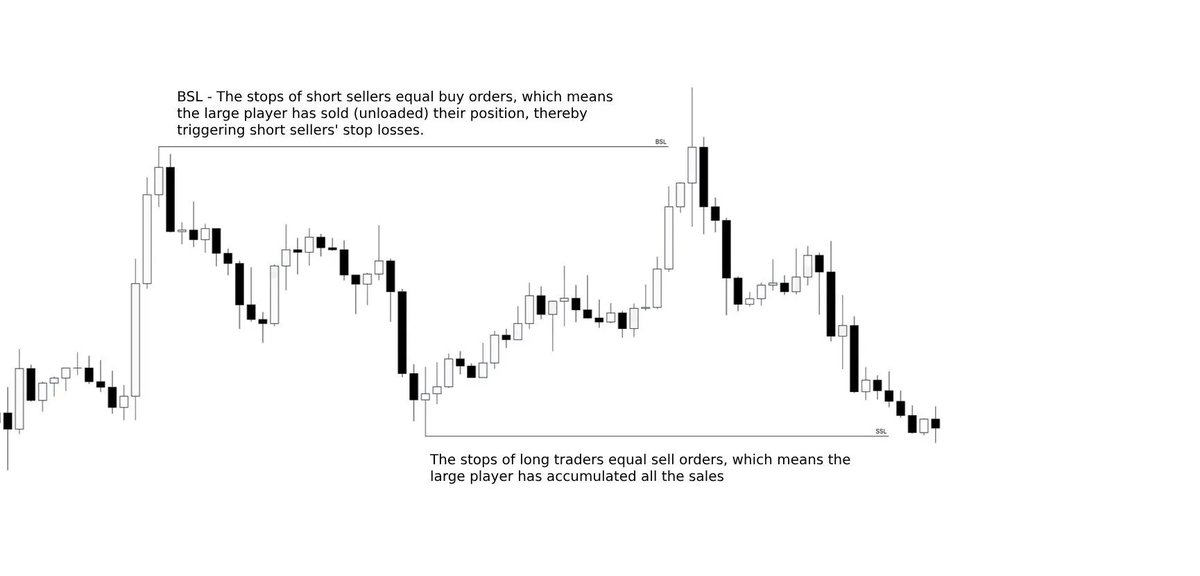

1. RSI

1. RSI

1. Support and Resistance

1. Support and Resistance

1. What is Market Structure?

1. What is Market Structure?

1. Where is the Liquidity?

1. Where is the Liquidity?

1. What is Market Structure?

1. What is Market Structure?

1. Volume

1. Volume

1. Order book Heatmap

1. Order book Heatmap

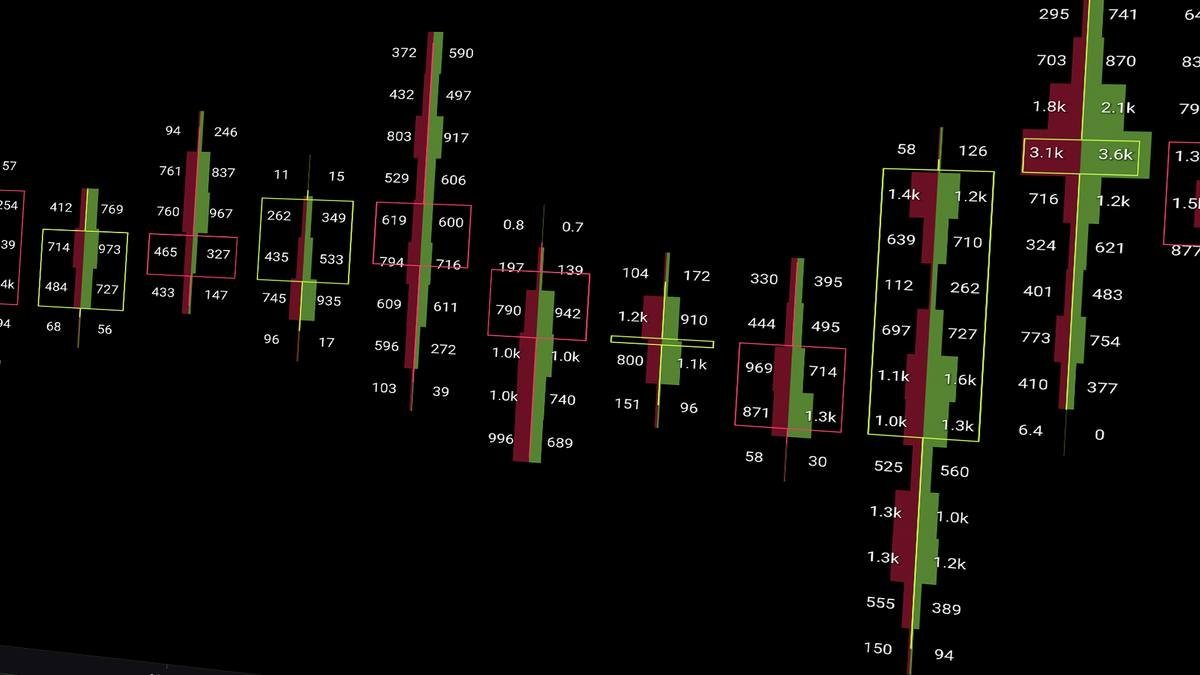

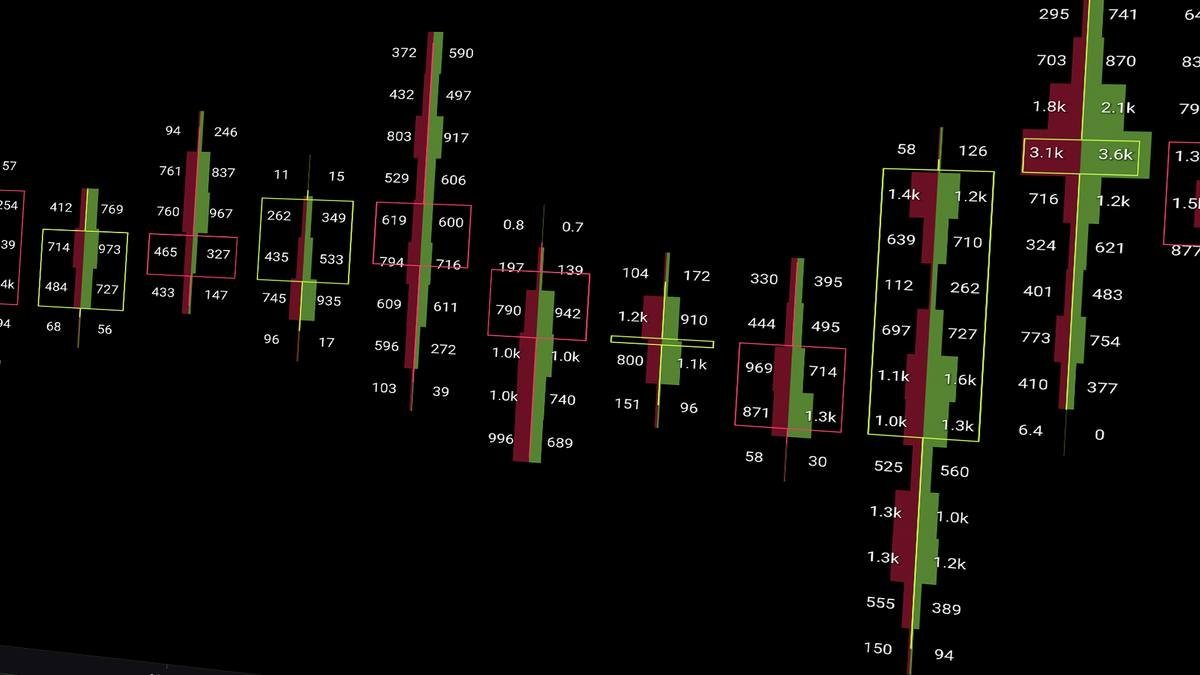

1. Footprint Charts

1. Footprint Charts

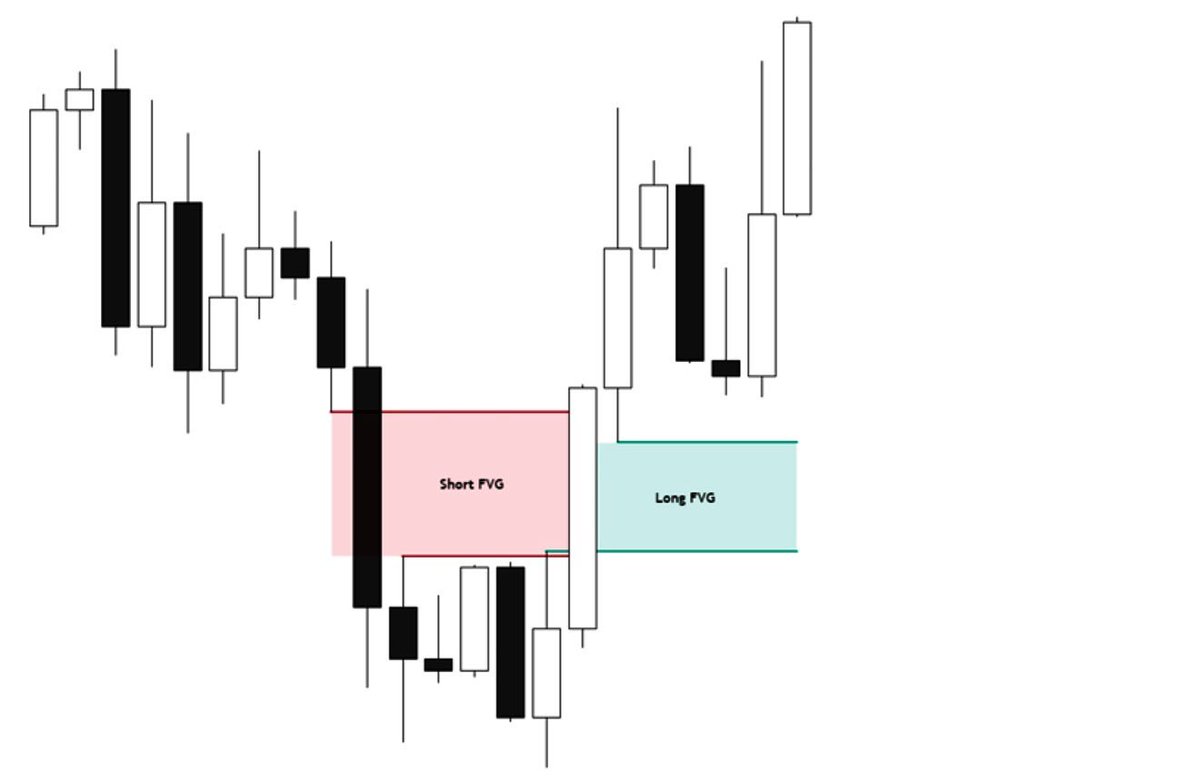

1. FVG

1. FVG

1. Fibonacci Retracement

1. Fibonacci Retracement

1. MACD

1. MACD

1. What is Market Structure?

1. What is Market Structure?

1. Footprint Charts

1. Footprint Charts

1. What is an Order Block?

1. What is an Order Block?

1. Liquidation Heatmap

1. Liquidation Heatmap