United States v. Robert Hunter Biden

(Felony Tax Case out of CA)

9 Counts

storage.courtlistener.com/recap/gov.usco…

(Felony Tax Case out of CA)

9 Counts

storage.courtlistener.com/recap/gov.usco…

Special Counsel Weiss has brought nine new charges against Hunter Biden.

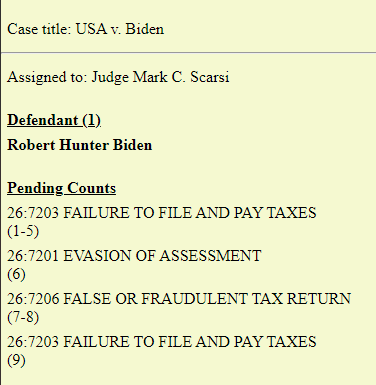

26:7203 FAILURE TO FILE AND PAY TAXES (1-5)

26:7201 EVASION OF ASSESSMENT (6)

26:7206 FALSE OR FRAUDULENT TAX RETURN (7-8)

26:7203 FAILURE TO FILE AND PAY TAXES (9)

law.cornell.edu/uscode/text/26…

law.cornell.edu/uscode/text/26…

law.cornell.edu/uscode/text/26…

26:7203 FAILURE TO FILE AND PAY TAXES (1-5)

26:7201 EVASION OF ASSESSMENT (6)

26:7206 FALSE OR FRAUDULENT TAX RETURN (7-8)

26:7203 FAILURE TO FILE AND PAY TAXES (9)

law.cornell.edu/uscode/text/26…

law.cornell.edu/uscode/text/26…

law.cornell.edu/uscode/text/26…

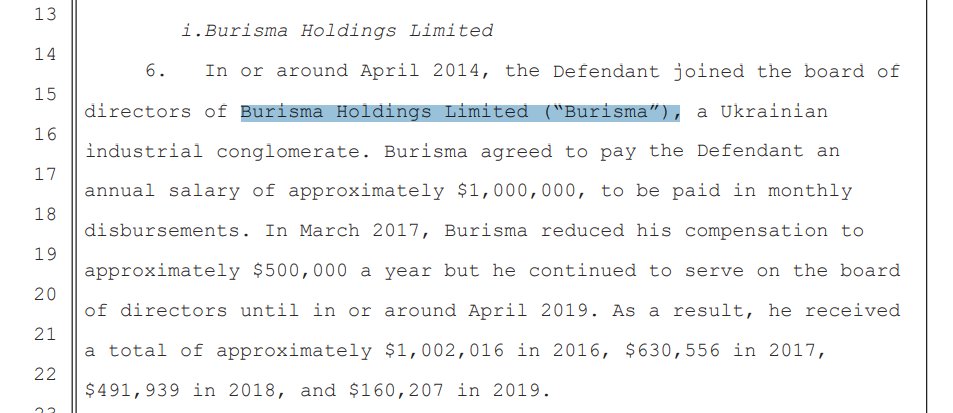

"Defendant served on the board of a Ukrainian industrial conglomerate"

"and a Chinese private equity fund."

"millions of dollars of compensation to him and/or his domestic corporations, Owasco, PC and Owasco, LLC."

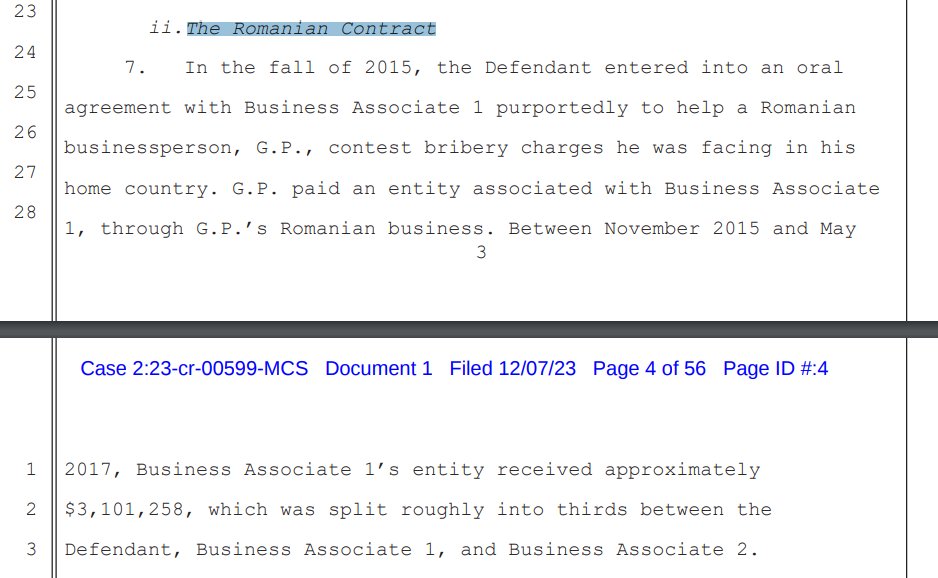

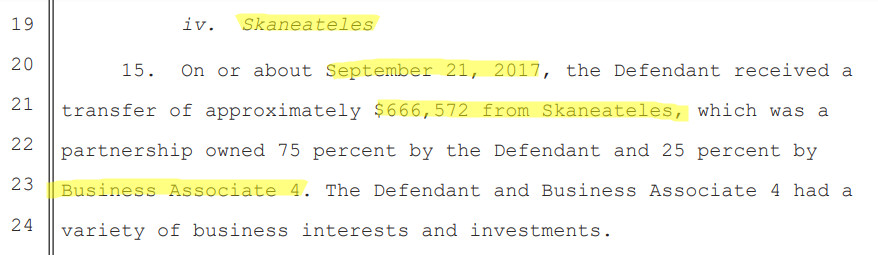

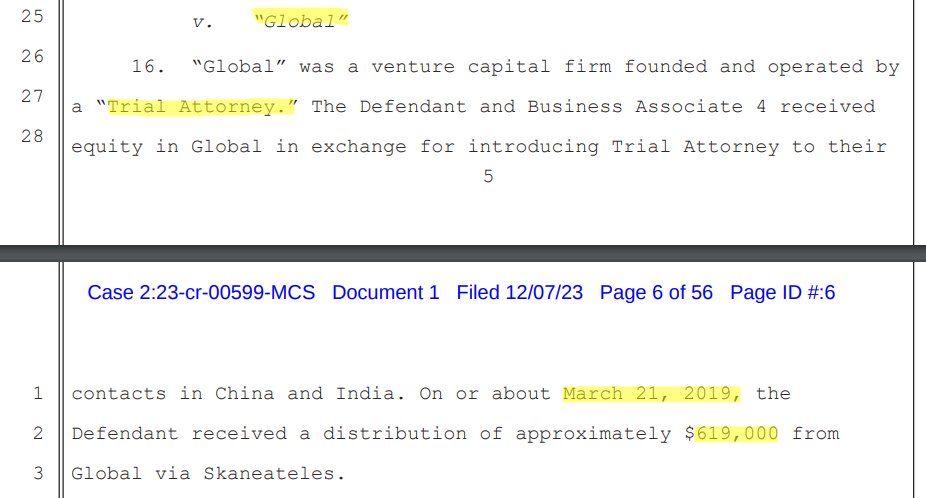

The episodic roll out of information on Hunter Biden and his businesses has made these names very familiar to Americans who pay attention to the news and even a few normies who do not.

"and a Chinese private equity fund."

"millions of dollars of compensation to him and/or his domestic corporations, Owasco, PC and Owasco, LLC."

The episodic roll out of information on Hunter Biden and his businesses has made these names very familiar to Americans who pay attention to the news and even a few normies who do not.

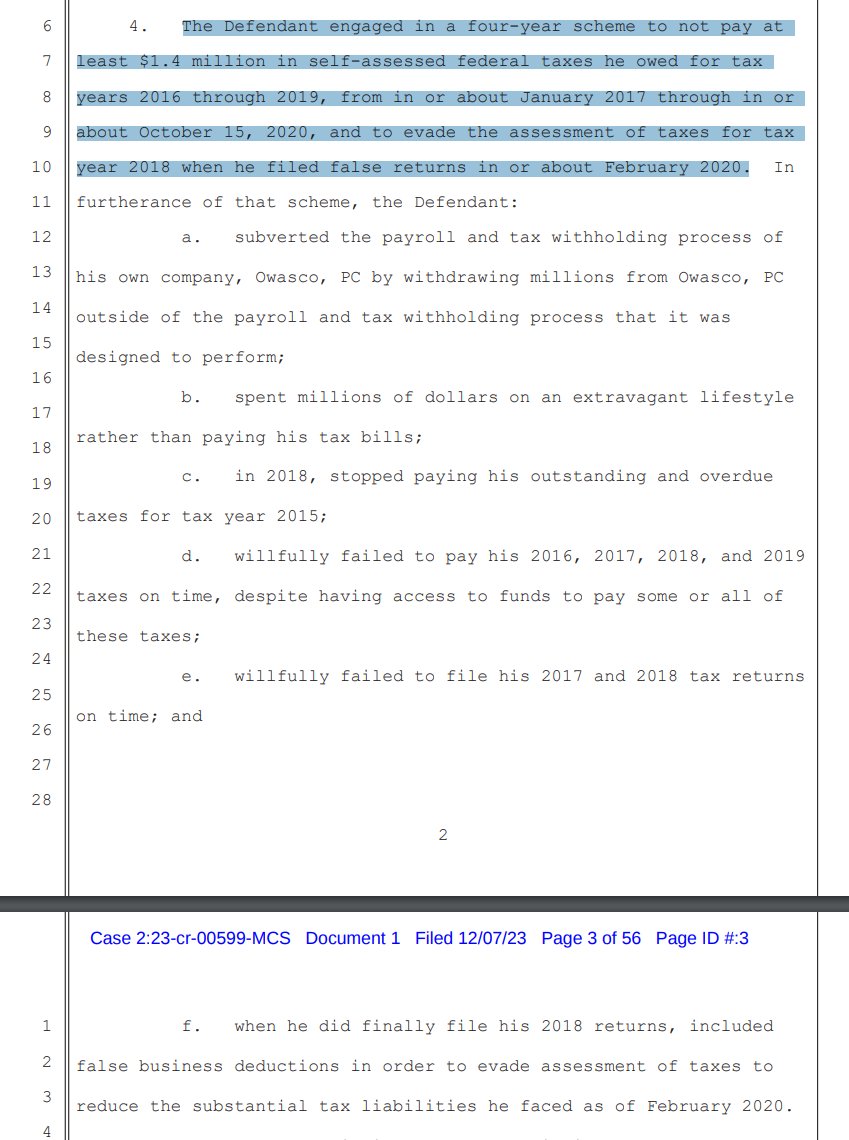

"The Defendant engaged in a four-year scheme to not pay at least $1.4 million in self-assessed federal taxes he owed for tax years 2016 through 2019, from in or about January 2017 through in or about October 15, 2020, and to evade the assessment of taxes for tax year 2018 when he filed false returns in or about February 2020."

"Between 2016 and October 15, 2020, the Defendant individually received more than $7 million in total gross income. This included in excess of $1.5 million in 2016, $2.3 million in 2017, $2.1 million in 2018, $1 million in 2019 and approximately $188,000 from January through October 15, 2020. In addition, from January through October 15, 2020, the Defendant received approximately $1.2 million in financial support to fund his extravagant lifestyle."

CEFC China Energy Co Ltd. (CEFC)

The Chairman = Ye Jianming

Business Associate 1 = Rob Walker

Business Associate 2 = Tony Bobulisnki (?)

Business Associate 3 = James Gilliar (?)

SinoHawk

Hudson West III

Individuals associated with CEFC = Gongwen "Kevin" Dong

The Chairman = Ye Jianming

Business Associate 1 = Rob Walker

Business Associate 2 = Tony Bobulisnki (?)

Business Associate 3 = James Gilliar (?)

SinoHawk

Hudson West III

Individuals associated with CEFC = Gongwen "Kevin" Dong

Owasco, PC

Hudson West III

"HWIII was funded with an initial $5,000,000 capital contribution from an entity that was not owned or controlled by the Defendant."

Hunter is named the "manager" and set to "receive “compensation” of $100,000 per month and a onetime retainer fee of $500,000. Owasco, PC paid no capital contribution for its ownership share of HWIII."

"August 8, 2017, HWIII transferred approximately $400,000 to Owasco, PC."

"Owasco, PC received monthly transfers of approximately $165,000... totaling approximately $1.445 million."

"[Hunter] transferred approximately $555,000 of these funds from Owasco, PC’s Wells Fargo Account to Business Associate 3."

"In 2018, HWIII made another 15 transfers to Owasco, PC, totaling approximately $2.1 million, and the Defendant transferred approximately $843,999 of these funds to Business Associate 3."

Gongwen "Kevin" Dong

Hudson West III

"HWIII was funded with an initial $5,000,000 capital contribution from an entity that was not owned or controlled by the Defendant."

Hunter is named the "manager" and set to "receive “compensation” of $100,000 per month and a onetime retainer fee of $500,000. Owasco, PC paid no capital contribution for its ownership share of HWIII."

"August 8, 2017, HWIII transferred approximately $400,000 to Owasco, PC."

"Owasco, PC received monthly transfers of approximately $165,000... totaling approximately $1.445 million."

"[Hunter] transferred approximately $555,000 of these funds from Owasco, PC’s Wells Fargo Account to Business Associate 3."

"In 2018, HWIII made another 15 transfers to Owasco, PC, totaling approximately $2.1 million, and the Defendant transferred approximately $843,999 of these funds to Business Associate 3."

Gongwen "Kevin" Dong

Personal Friend = Kevin Morris aka "Sugar Brother"

"In total, the Defendant had Personal Friend pay over $1.2 million to third parties for the Defendant’s benefit from January through October 15, 2020." dailymail.co.uk/news/article-1…

"In total, the Defendant had Personal Friend pay over $1.2 million to third parties for the Defendant’s benefit from January through October 15, 2020." dailymail.co.uk/news/article-1…

Beautiful Things

"From January through October 15, 2020, the Defendant received approximately $140,625 paid into his wife’s bank account related to the book."

"From January through October 15, 2020, the Defendant received approximately $140,625 paid into his wife’s bank account related to the book."

"The Defendant had a legal obligation to file and pay taxes."

"Owasco, PC of which the Defendant was the 100 percent owner, was a C Corporation that had to file a U.S. Corporate Income Tax Return, on Form 1120, and pay taxes on its income. 26. The Defendant had a legal obligation to pay taxes on all his income, including income earned in Ukraine from his service on Burisma’s Board, fees generated by deal-making with the Chinese private equity fund, as well as income derived from his work as a lawyer and other sources."

TAXATION IS THEFT!!! GRRRRRRR!

"Owasco, PC of which the Defendant was the 100 percent owner, was a C Corporation that had to file a U.S. Corporate Income Tax Return, on Form 1120, and pay taxes on its income. 26. The Defendant had a legal obligation to pay taxes on all his income, including income earned in Ukraine from his service on Burisma’s Board, fees generated by deal-making with the Chinese private equity fund, as well as income derived from his work as a lawyer and other sources."

TAXATION IS THEFT!!! GRRRRRRR!

"The Defendant knew he had to file and pay taxes."

D.C. Accountant = Bill Morgan (?)

bidenreport.com/#p=211

D.C. Accountant = Bill Morgan (?)

bidenreport.com/#p=211

"Irrespective of the Owasco, PC structure and his standalone “tax account,” the Defendant knew he had to file individual and corporate income tax returns and pay tax on the income that he earned in 2016, 2017, 2018, and 2019. He had done so for tax years 2014 and 2015, the two years preceding his scheme to not pay taxes."

Weiss goes on to list all the times Hunter paid his taxes in a timely manner, demonstrating that Hunter knew what his tax obligations were and how to meet them, but made purposeful, knowing efforts to dodge them in various instances.

Highlighted sentence confirms the DC Accountant in the indictment is Bill Morgan.

Highlighted sentence confirms the DC Accountant in the indictment is Bill Morgan.

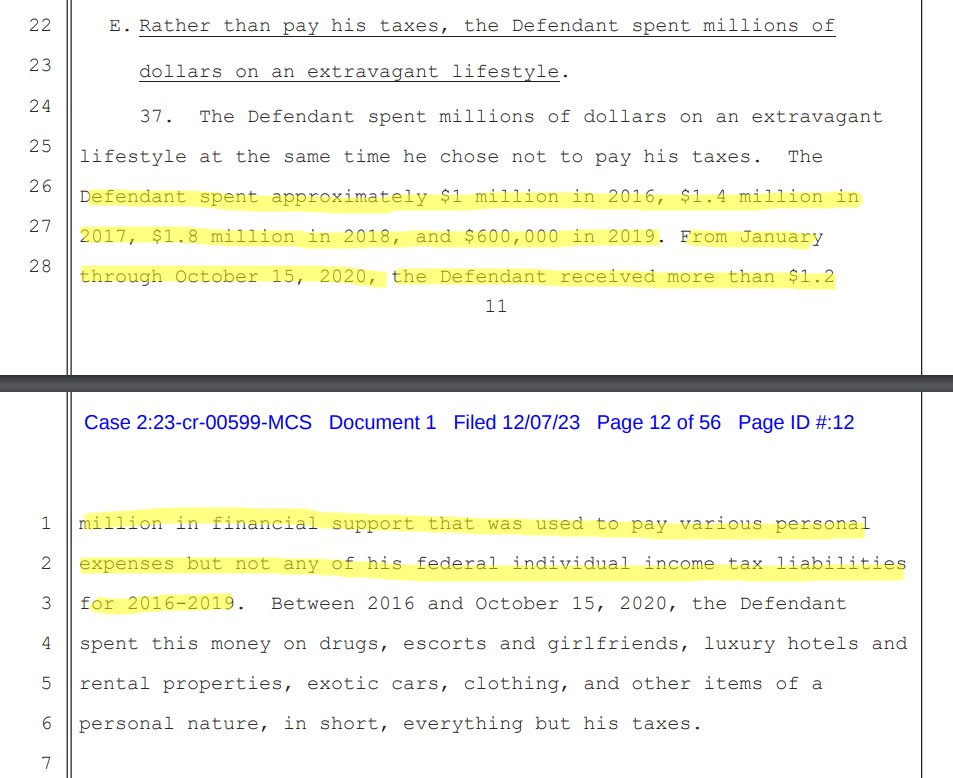

"The Defendant spent approximately $1 million in 2016, $1.4 million in 2017, $1.8 million in 2018, and $600,000 in 2019. From January through October 15, 2020, the Defendant received more than $1.2million in financial support that was used to pay various personal expenses but not any of his federal individual income tax liabilities for 2016-2019."

Instead.... Hunter spent the money on "drugs, escorts and girlfriends, luxury hotels and rental properties, exotic cars, clothing, and other items of a personal nature, in short, everything but his taxes."

Instead.... Hunter spent the money on "drugs, escorts and girlfriends, luxury hotels and rental properties, exotic cars, clothing, and other items of a personal nature, in short, everything but his taxes."

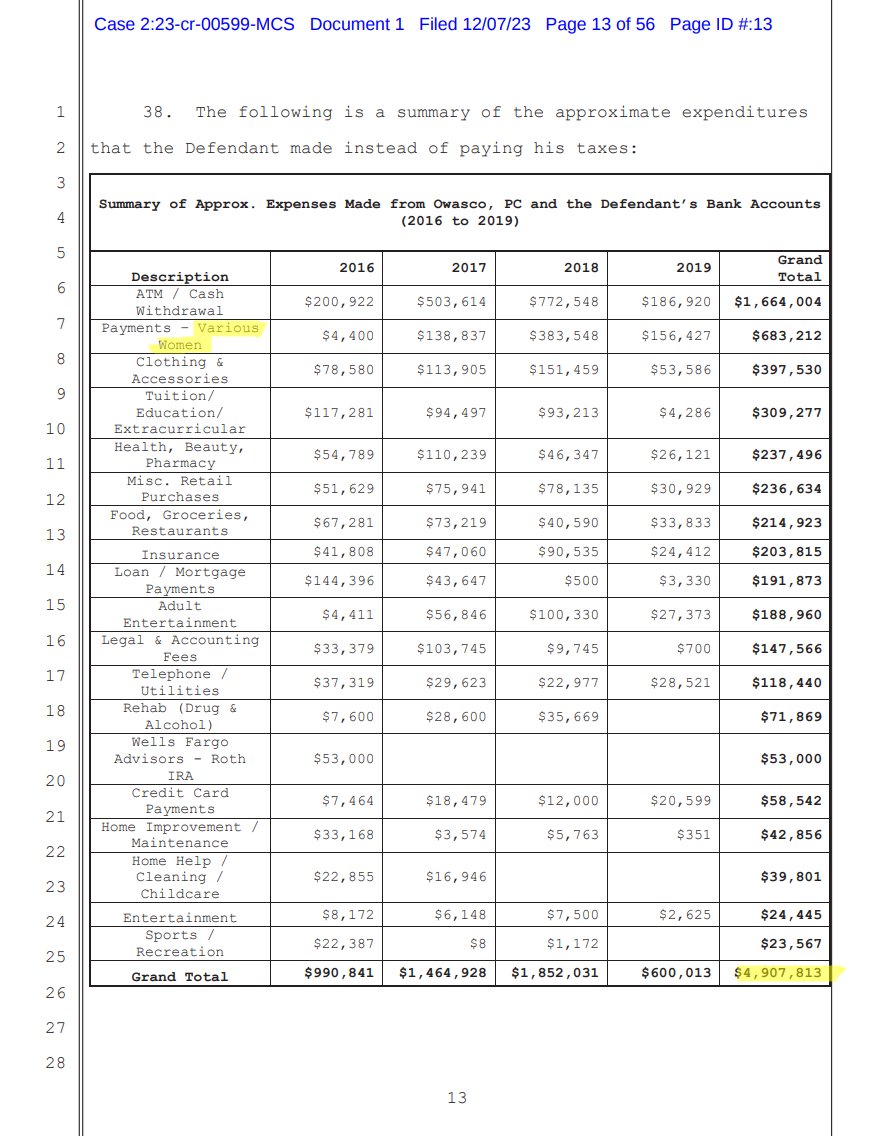

Summary of Approx. Expenses Made from Owasco, PC and the Defendant’s Bank Accounts 2016-2019.

"Various Women" cost Hunter approximately $683,212.

Damn.

"Various Women" cost Hunter approximately $683,212.

Damn.

Hunter was hit with two civil suits in 2019 and 2020... from the two women in his life that he WAS NOT paying, Person 1 and his ex-wife, hahaha!

Person 1 = Lunden Alexis Roberts

Ex-Wife = Kathleen Buhle

"As part of the lawsuits, he had to produce financial records, including his tax returns. These lawsuits forced the Defendant to file his outstanding tax returns for 2017 and 2018."

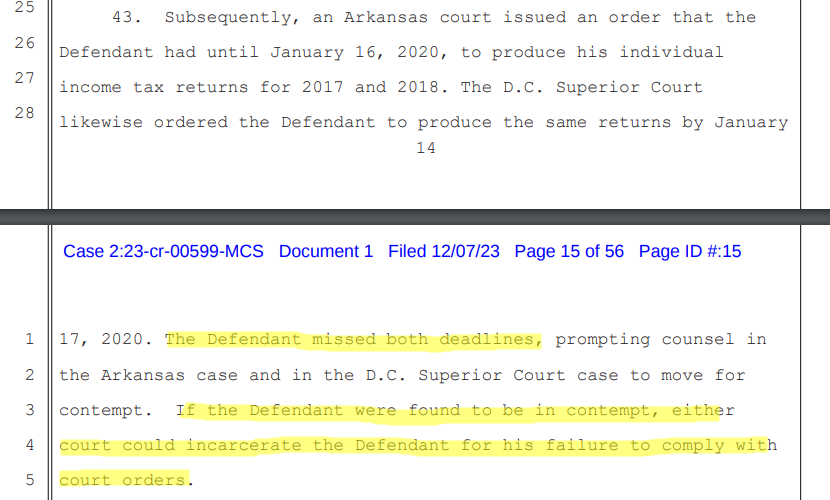

Both courts ordered Hunter to produce his tax returns for 2017 and 2018.

Hunter missed the deadlines to comply and was facing contempt charges and possibly incarceration.

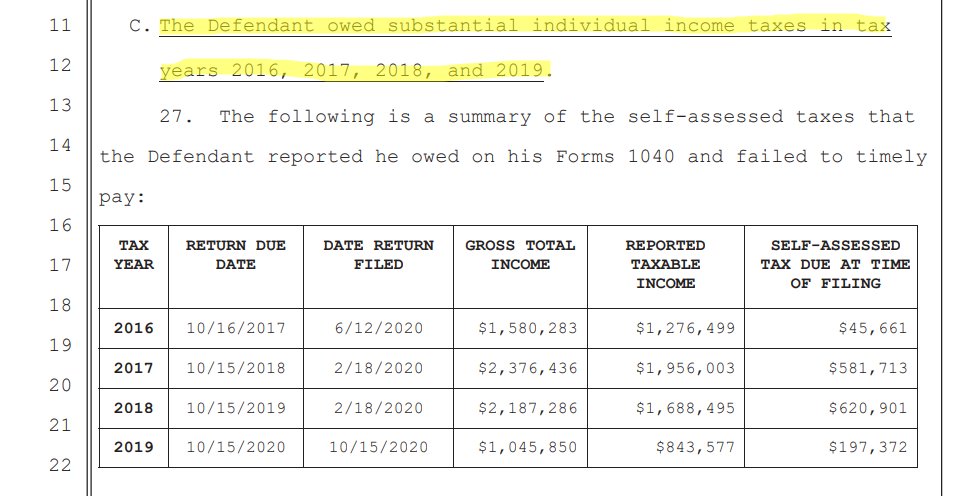

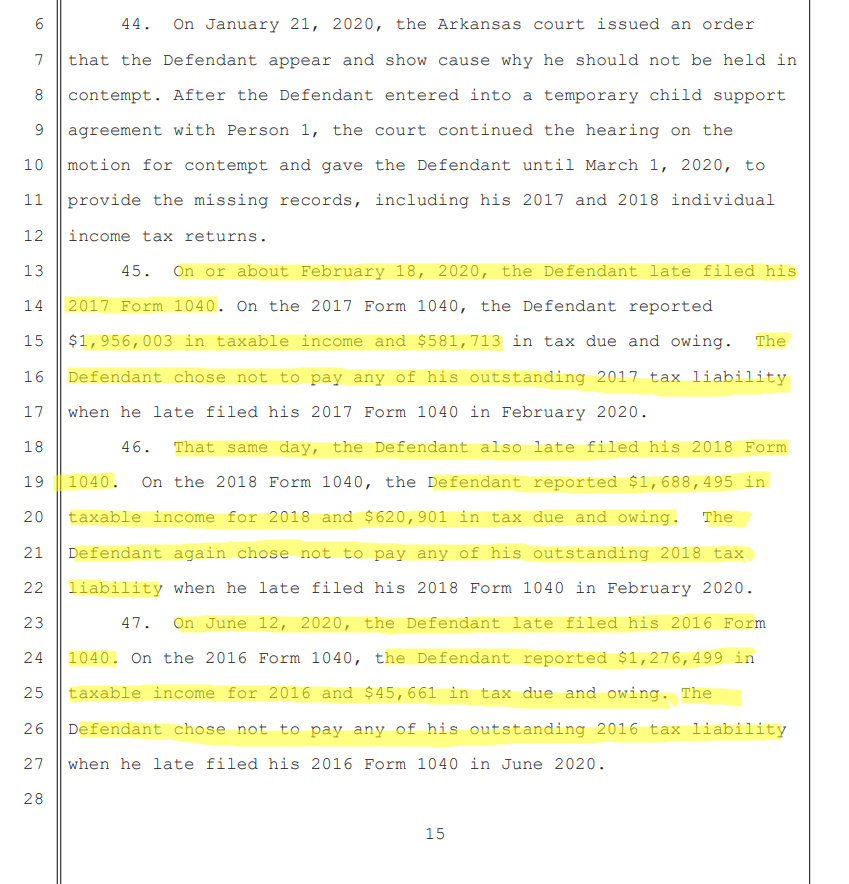

"February 18, 2020, the Defendant late filed his 2017 Form 1040... $1,956,003 in taxable income and $581,713 in tax due and owing. The Defendant chose not to pay any of his outstanding 2017 tax liability"

"That same day, the Defendant also late filed his 2018 Form 1040... $1,688,495 in taxable income for 2018 and $620,901 in tax due and owing. The Defendant again chose not to pay any of his outstanding 2018 tax liability"

"June 12, 2020, the Defendant late filed his 2016 Form 1040... $1,276,499 in taxable income for 2016 and $45,661 in tax due and owing. The Defendant chose not to pay any of his outstanding 2016 tax liability"

Person 1 = Lunden Alexis Roberts

Ex-Wife = Kathleen Buhle

"As part of the lawsuits, he had to produce financial records, including his tax returns. These lawsuits forced the Defendant to file his outstanding tax returns for 2017 and 2018."

Both courts ordered Hunter to produce his tax returns for 2017 and 2018.

Hunter missed the deadlines to comply and was facing contempt charges and possibly incarceration.

"February 18, 2020, the Defendant late filed his 2017 Form 1040... $1,956,003 in taxable income and $581,713 in tax due and owing. The Defendant chose not to pay any of his outstanding 2017 tax liability"

"That same day, the Defendant also late filed his 2018 Form 1040... $1,688,495 in taxable income for 2018 and $620,901 in tax due and owing. The Defendant again chose not to pay any of his outstanding 2018 tax liability"

"June 12, 2020, the Defendant late filed his 2016 Form 1040... $1,276,499 in taxable income for 2016 and $45,661 in tax due and owing. The Defendant chose not to pay any of his outstanding 2016 tax liability"

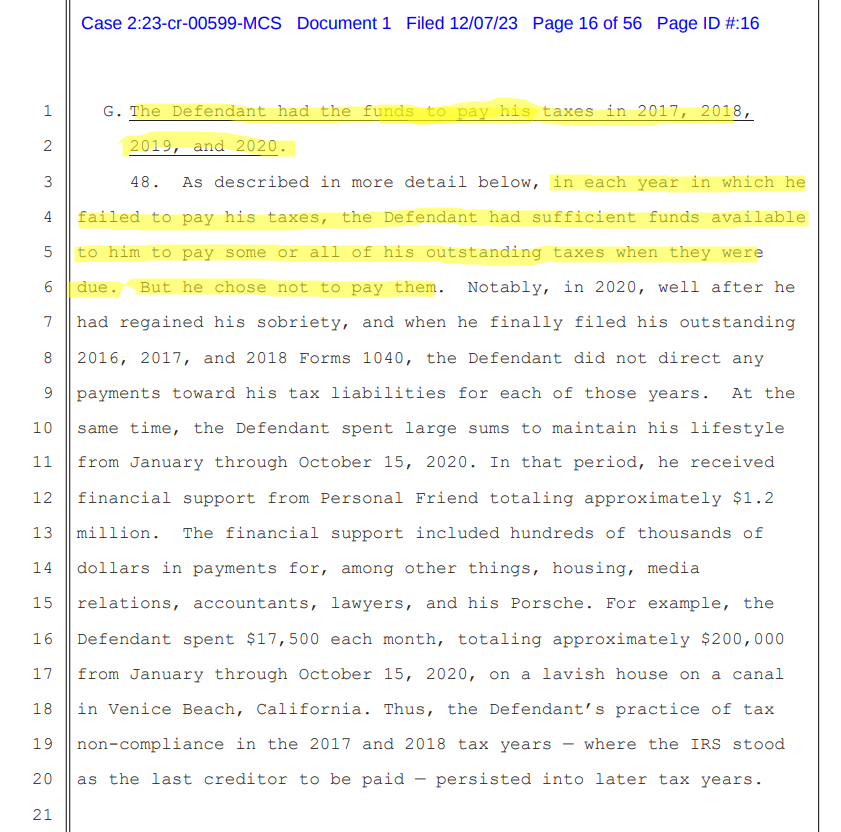

"...in each year in which he failed to pay his taxes, the Defendant had sufficient funds available to him to pay some or all of his outstanding taxes when they were due. But he chose not to pay them."

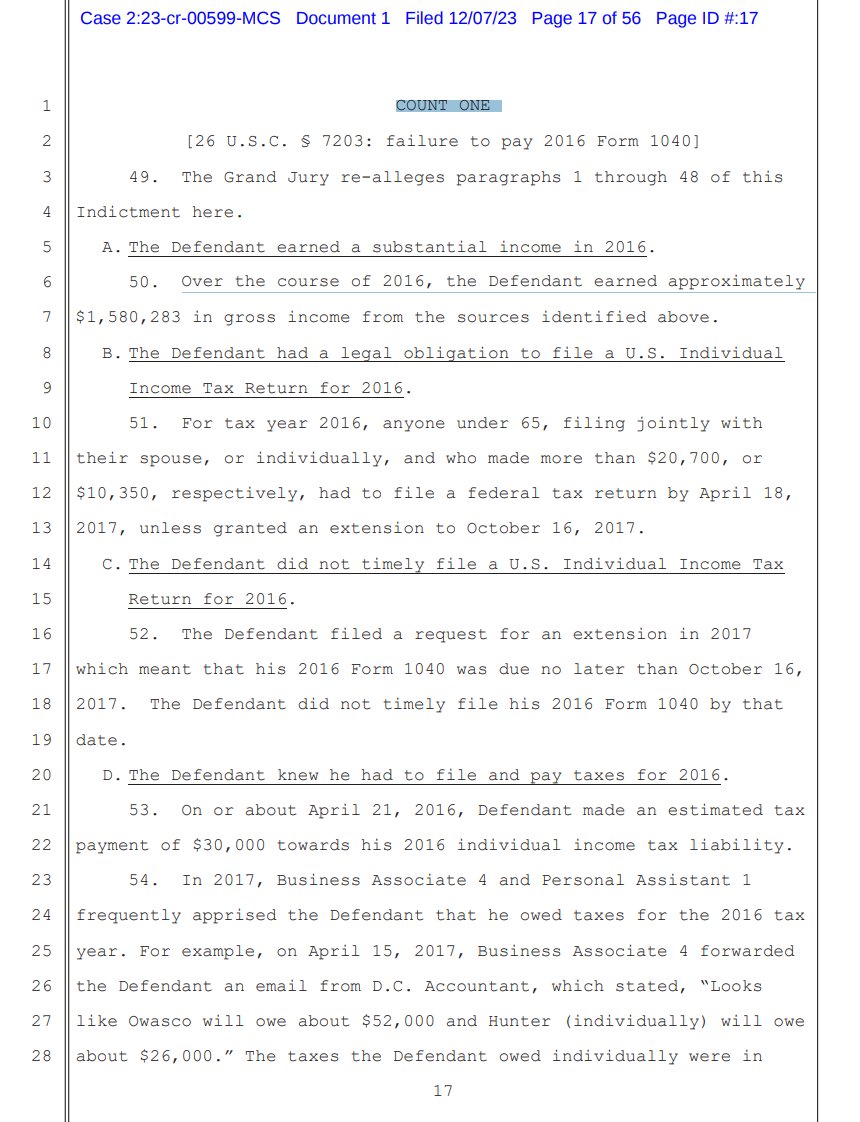

Count One

26 U.S.C. § 7203: failure to pay 2016 Form 1040

"Over the course of 2016, the Defendant earned approximately $1,580,283 in gross income from the sources identified above."

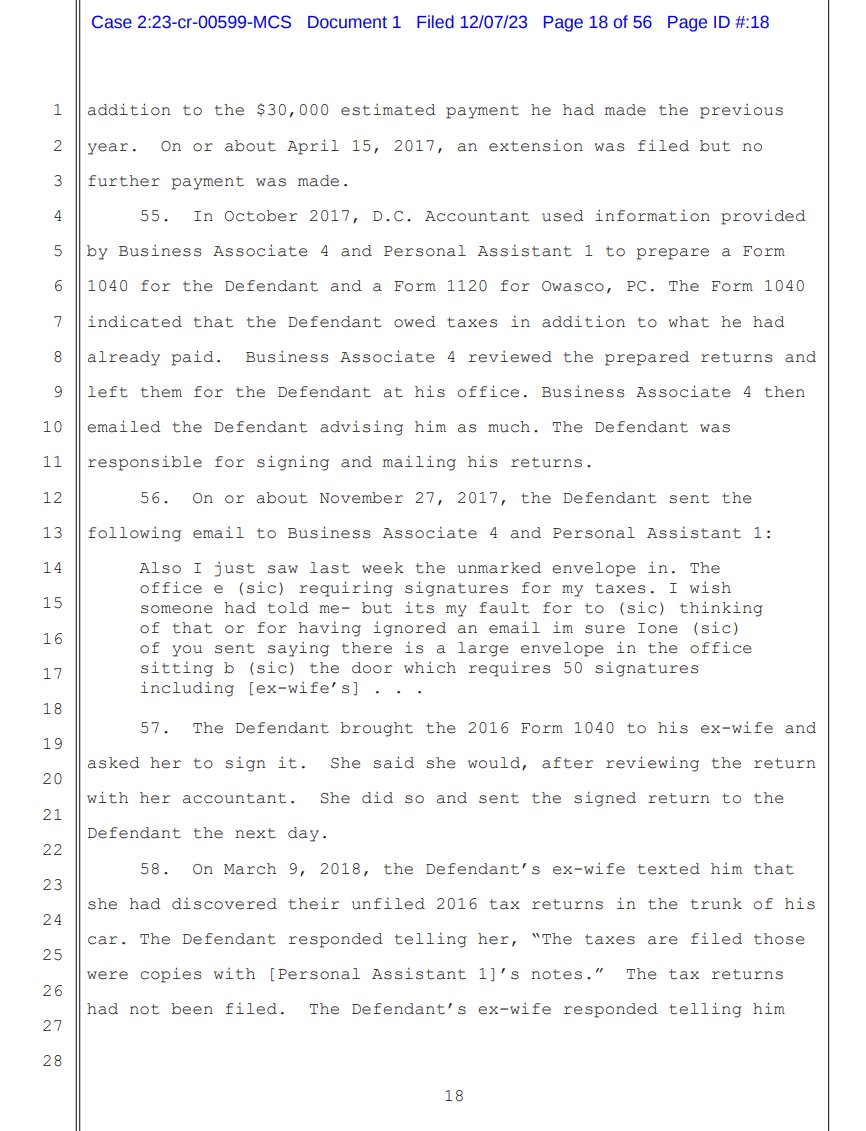

"During the calendar year 2016, the Defendant ROBERT HUNTER BIDEN had and received taxable income of $1,276,499, on which taxable income there was owing to the United States of America an income tax of $45,661...

Well knowing all of the foregoing, he did willfully fail, on June 12, 2020, in the Central District of California and elsewhere, to pay the income tax due..."

26 U.S.C. § 7203: failure to pay 2016 Form 1040

"Over the course of 2016, the Defendant earned approximately $1,580,283 in gross income from the sources identified above."

"During the calendar year 2016, the Defendant ROBERT HUNTER BIDEN had and received taxable income of $1,276,499, on which taxable income there was owing to the United States of America an income tax of $45,661...

Well knowing all of the foregoing, he did willfully fail, on June 12, 2020, in the Central District of California and elsewhere, to pay the income tax due..."

Count Two

26 U.S.C. § 7203: failure to pay 2017 Form 1040

"Over the course of 2017, the Defendant earned approximately $2,376,436 in gross income from the sources identified above."

"During the calendar year 2017, the Defendant ROBERT HUNTER BIDEN had and received taxable income of $1,956,003, on which taxable income there was owing to the United States of America an income tax of $581,713...

Well knowing all of the foregoing, he did willfully fail on April 17, 2018, and on February 18, 2020, in the Central District of California and elsewhere, to pay the income tax due."

26 U.S.C. § 7203: failure to pay 2017 Form 1040

"Over the course of 2017, the Defendant earned approximately $2,376,436 in gross income from the sources identified above."

"During the calendar year 2017, the Defendant ROBERT HUNTER BIDEN had and received taxable income of $1,956,003, on which taxable income there was owing to the United States of America an income tax of $581,713...

Well knowing all of the foregoing, he did willfully fail on April 17, 2018, and on February 18, 2020, in the Central District of California and elsewhere, to pay the income tax due."

Count Three

26 U.S.C. § 7203: failure to file 2017 Form 1040

"During the calendar year 2017, the Defendant ROBERT HUNTER BIDEN had received gross income in excess of $2.3 million...

Knowing and believing all of the foregoing, he did willfully fail, on or about October 15, 2018, in the Central District of California and elsewhere, to make an income tax return."

26 U.S.C. § 7203: failure to file 2017 Form 1040

"During the calendar year 2017, the Defendant ROBERT HUNTER BIDEN had received gross income in excess of $2.3 million...

Knowing and believing all of the foregoing, he did willfully fail, on or about October 15, 2018, in the Central District of California and elsewhere, to make an income tax return."

Count Four

26 U.S.C. § 7203: failure to pay 2018 Form 1040

"Over the course of 2018, the Defendant earned approximately $2,187,286 in gross income from the sources identified above...

...the Defendant ROBERT HUNTER BIDEN, had and received taxable income in excess of $1.6 million, on which taxable income there was owing to the United States of America an income tax of $620,901...

Well knowing all of the foregoing, he did willfully fail on April 15, 2019, and on February 18, 2020, in the Central District of California and elsewhere, to pay the income tax due.

26 U.S.C. § 7203: failure to pay 2018 Form 1040

"Over the course of 2018, the Defendant earned approximately $2,187,286 in gross income from the sources identified above...

...the Defendant ROBERT HUNTER BIDEN, had and received taxable income in excess of $1.6 million, on which taxable income there was owing to the United States of America an income tax of $620,901...

Well knowing all of the foregoing, he did willfully fail on April 15, 2019, and on February 18, 2020, in the Central District of California and elsewhere, to pay the income tax due.

Count Five

26 U.S.C. § 7203: failure to file 2018 Form 1040

"During the calendar year 2018, the Defendant ROBERT HUNTER BIDEN, had and received gross income in excess of $2.1 million...

Knowing and believing all of the foregoing, he did willfully fail, on or about October 15, 2019, in the Central District of California and elsewhere, to make an income tax return."

26 U.S.C. § 7203: failure to file 2018 Form 1040

"During the calendar year 2018, the Defendant ROBERT HUNTER BIDEN, had and received gross income in excess of $2.1 million...

Knowing and believing all of the foregoing, he did willfully fail, on or about October 15, 2019, in the Central District of California and elsewhere, to make an income tax return."

Count Six

26 U.S.C. § 7201: evasion of assessment for 2018 Form 1040

Special Counsel Weiss uses passages from Hunter's own memoir, Beautiful Things, to inform this charge and piece together Hunter's various "activities" in 2018.

"The Defendant claimed extensive business travel in 2018 when he had none."

"At the same time the Defendant was making those representations to the CA Accountants, the Defendant was working on his memoir, which was not published until after he filed his 2018 returns and which he did not share with them. Unbeknownst to the CA Accountants, in his memoir, the Defendant described 2018 as being dominated by crack cocaine use “twenty-four hours a day, smoking every fifteen minutes, seven days a week.”"

"Rather than conducting business, and generating business expenses, the Defendant wrote in his memoir that after he arrived in California in April 2018, for the next “four or five months,” he surrounded himself with and paid for an entourage of:

. . . thieves, junkies, petty dealers, over-the-hill strippers, con artists, and assorted hangers-on, who then invited their friends and associates and most recent hookups. They latched on to me and didn’t let go, all with my approval. I never slept. There was no clock. Day bled into night and night into day.

And the Defendant specifically described his stays in various luxury hotels in California and private rentals, and expenses related to them..."

26 U.S.C. § 7201: evasion of assessment for 2018 Form 1040

Special Counsel Weiss uses passages from Hunter's own memoir, Beautiful Things, to inform this charge and piece together Hunter's various "activities" in 2018.

"The Defendant claimed extensive business travel in 2018 when he had none."

"At the same time the Defendant was making those representations to the CA Accountants, the Defendant was working on his memoir, which was not published until after he filed his 2018 returns and which he did not share with them. Unbeknownst to the CA Accountants, in his memoir, the Defendant described 2018 as being dominated by crack cocaine use “twenty-four hours a day, smoking every fifteen minutes, seven days a week.”"

"Rather than conducting business, and generating business expenses, the Defendant wrote in his memoir that after he arrived in California in April 2018, for the next “four or five months,” he surrounded himself with and paid for an entourage of:

. . . thieves, junkies, petty dealers, over-the-hill strippers, con artists, and assorted hangers-on, who then invited their friends and associates and most recent hookups. They latched on to me and didn’t let go, all with my approval. I never slept. There was no clock. Day bled into night and night into day.

And the Defendant specifically described his stays in various luxury hotels in California and private rentals, and expenses related to them..."

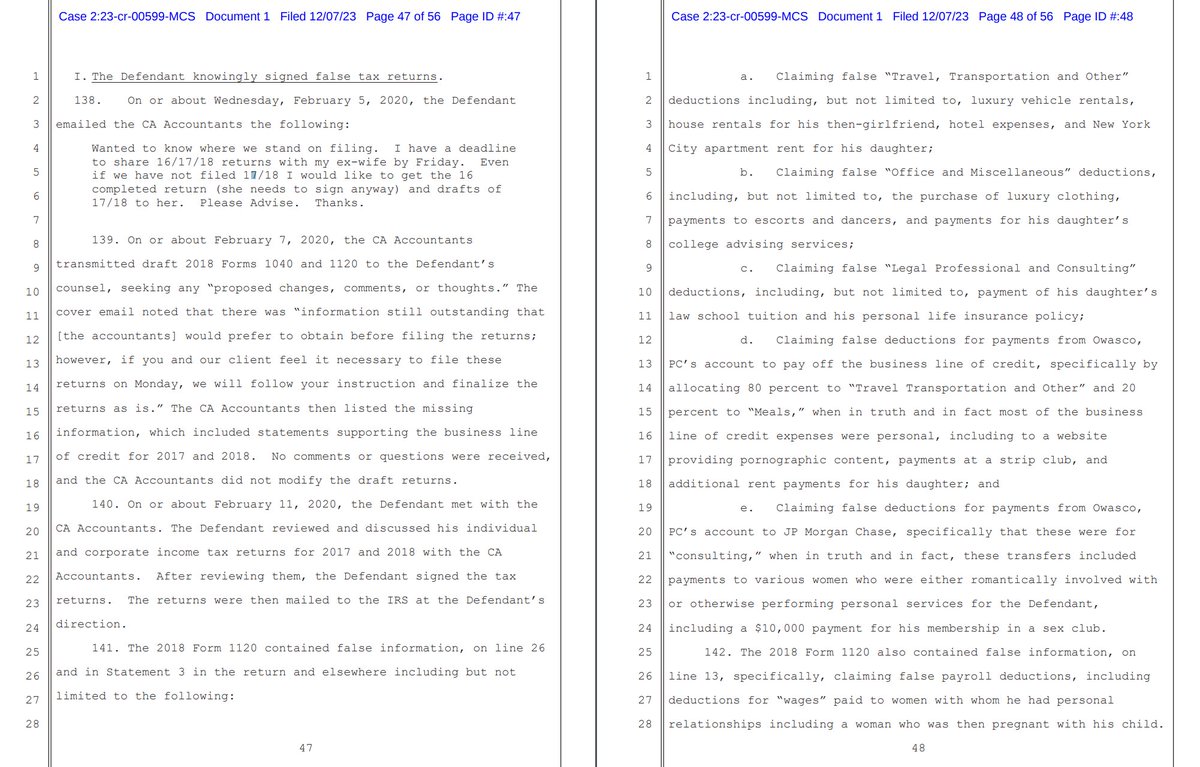

"The Defendant failed to identify all personal expenses paid using corporate funds."

"The Defendant falsely claimed that money paid to women with whom he had personal relationships was wages, reducing his tax burden."

"The Defendant falsely identified personal expenses as business deductions paid out of his individual accounts."

"The Defendant wired money to JP Morgan Chase to pay personal expenses and falsely represented to the CA Accountants that these wire transfers were business expenses."

"The Defendant used the business line of credit to pay personal expenses and falsely represented to the CA Accountants that it was for business expenses."

"The Defendant knowingly signed false tax returns."

"The Defendant falsely claimed that money paid to women with whom he had personal relationships was wages, reducing his tax burden."

"The Defendant falsely identified personal expenses as business deductions paid out of his individual accounts."

"The Defendant wired money to JP Morgan Chase to pay personal expenses and falsely represented to the CA Accountants that these wire transfers were business expenses."

"The Defendant used the business line of credit to pay personal expenses and falsely represented to the CA Accountants that it was for business expenses."

"The Defendant knowingly signed false tax returns."

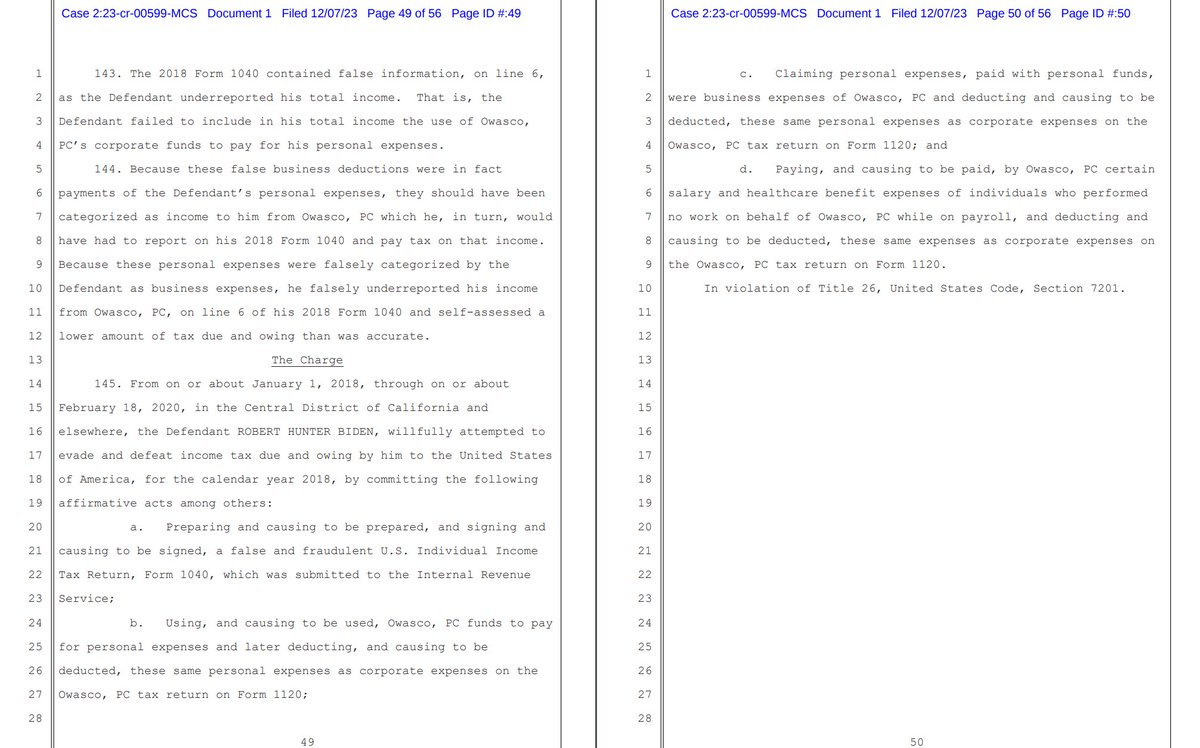

"From on or about January 1, 2018, through on or about February 18, 2020, in the Central District of California and elsewhere, the Defendant ROBERT HUNTER BIDEN, willfully attempted to evade and defeat income tax due and owing by him to the United States of America, for the calendar year 2018"

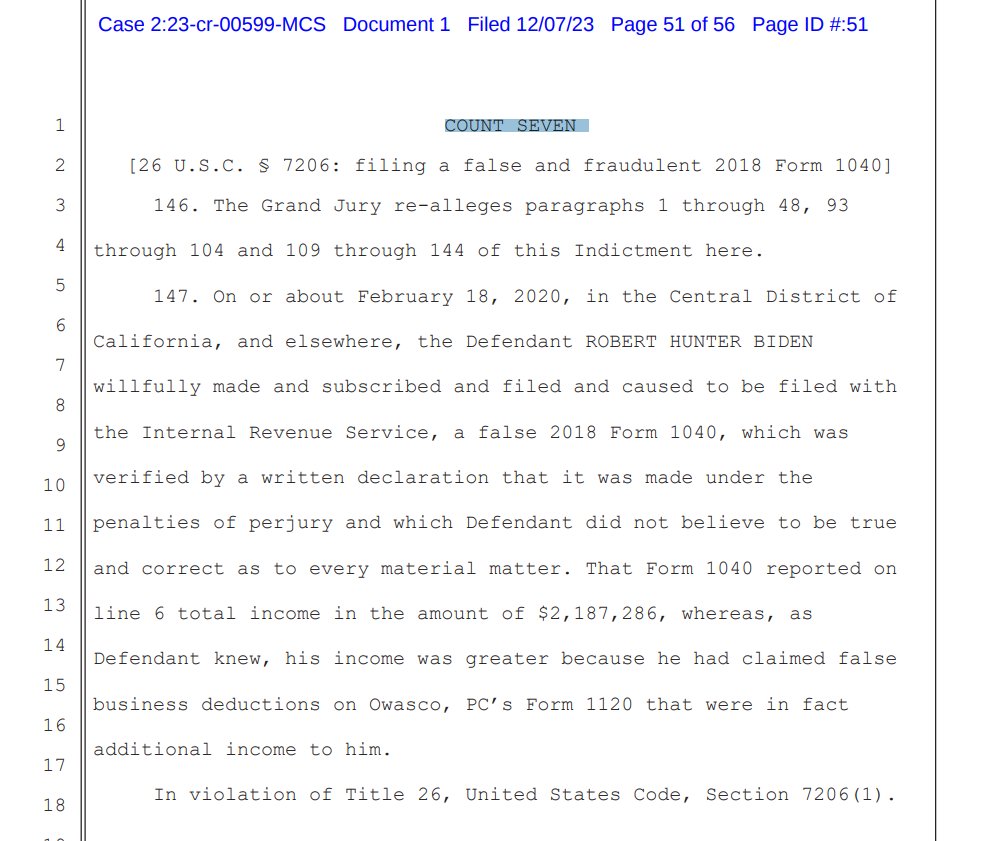

Count Seven

26 U.S.C. § 7206: filing a false and fraudulent 2018 Form 1040

"On or about February 18, 2020, in the Central District of California, and elsewhere, the Defendant ROBERT HUNTER BIDEN willfully made and subscribed and filed and caused to be filed with the Internal Revenue Service, a false 2018 Form 1040"

26 U.S.C. § 7206: filing a false and fraudulent 2018 Form 1040

"On or about February 18, 2020, in the Central District of California, and elsewhere, the Defendant ROBERT HUNTER BIDEN willfully made and subscribed and filed and caused to be filed with the Internal Revenue Service, a false 2018 Form 1040"

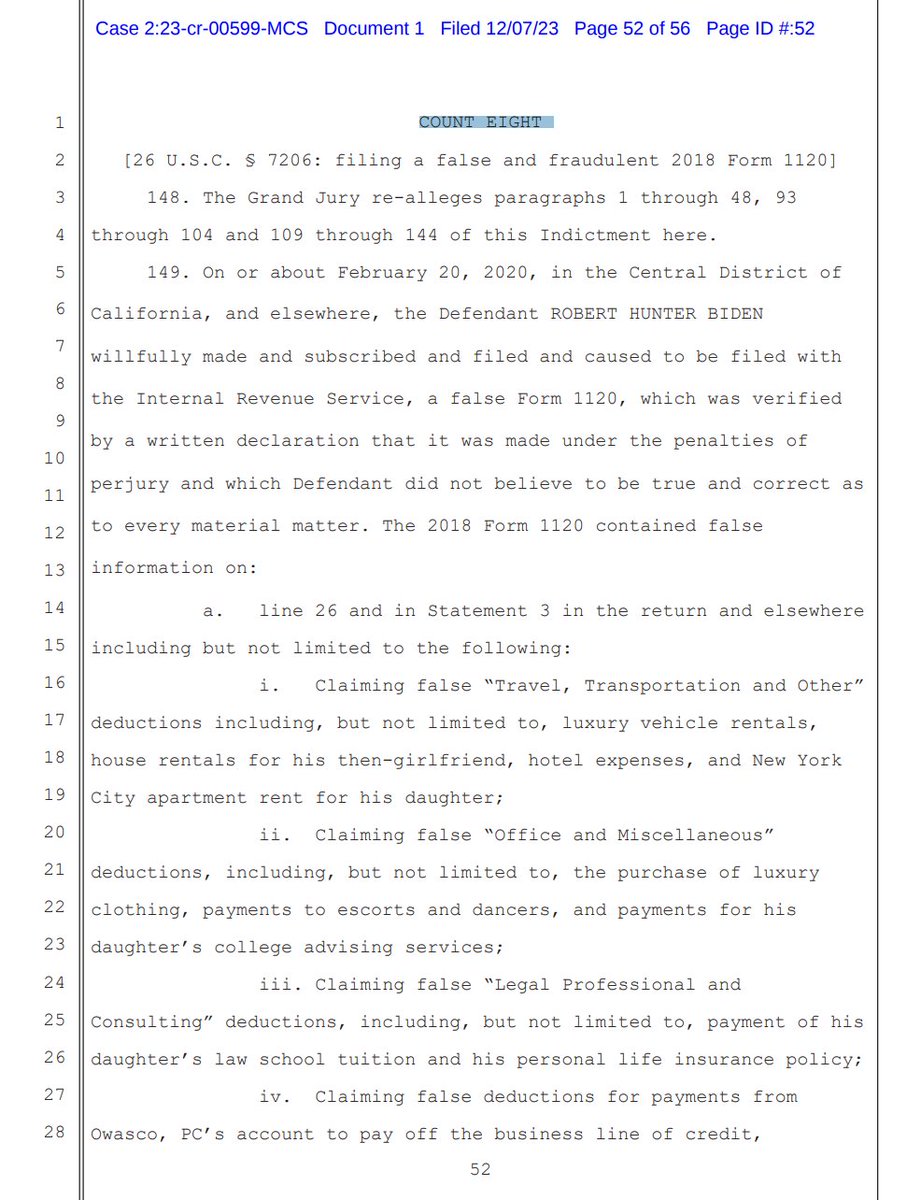

Count Eight

26 U.S.C. § 7206: filing a false and fraudulent 2018 Form 1120

"On or about February 20, 2020, in the Central District of California, and elsewhere, the Defendant ROBERT HUNTER BIDEN willfully made and subscribed and filed and caused to be filed with the Internal Revenue Service, a false Form 1120"

26 U.S.C. § 7206: filing a false and fraudulent 2018 Form 1120

"On or about February 20, 2020, in the Central District of California, and elsewhere, the Defendant ROBERT HUNTER BIDEN willfully made and subscribed and filed and caused to be filed with the Internal Revenue Service, a false Form 1120"

Count Nine

26 U.S.C. § 7203: failure to pay 2019 Form 1040

"Over the course of 2019, the Defendant earned approximately $1,045,850 in gross income from the sources identified above."

"During the calendar year 2019, the Defendant ROBERT HUNTER BIDEN, had and received taxable income of $843,577, on which taxable income there was owing to the United States of America an income tax of $197,372...

Well knowing all of the foregoing, he did willfully fail on July 15, 2020, in the Central District of California and elsewhere, to pay the income tax due."

26 U.S.C. § 7203: failure to pay 2019 Form 1040

"Over the course of 2019, the Defendant earned approximately $1,045,850 in gross income from the sources identified above."

"During the calendar year 2019, the Defendant ROBERT HUNTER BIDEN, had and received taxable income of $843,577, on which taxable income there was owing to the United States of America an income tax of $197,372...

Well knowing all of the foregoing, he did willfully fail on July 15, 2020, in the Central District of California and elsewhere, to pay the income tax due."

Deep Throat: No, heh, but it's touching. Forget the myths the media's created about the White House. The truth is, these are not very bright guys, and things got out of hand.

Bob Woodward: Hunt's come in from the cold. Supposedly he's got a lawyer with $25,000 in a brown paper bag.

Deep Throat: Follow the money.

Bob Woodward: What do you mean? Where?

Deep Throat: Oh, I can't tell you that.

Bob Woodward: But you could tell me that.

Deep Throat: No, I have to do this my way. You tell me what you know, and I'll confirm. I'll keep you in the right direction if I can, but that's all. Just... follow the money.

Bob Woodward: Hunt's come in from the cold. Supposedly he's got a lawyer with $25,000 in a brown paper bag.

Deep Throat: Follow the money.

Bob Woodward: What do you mean? Where?

Deep Throat: Oh, I can't tell you that.

Bob Woodward: But you could tell me that.

Deep Throat: No, I have to do this my way. You tell me what you know, and I'll confirm. I'll keep you in the right direction if I can, but that's all. Just... follow the money.

• • •

Missing some Tweet in this thread? You can try to

force a refresh