Henry Singleton founded and ran Teledyne for 31 years.

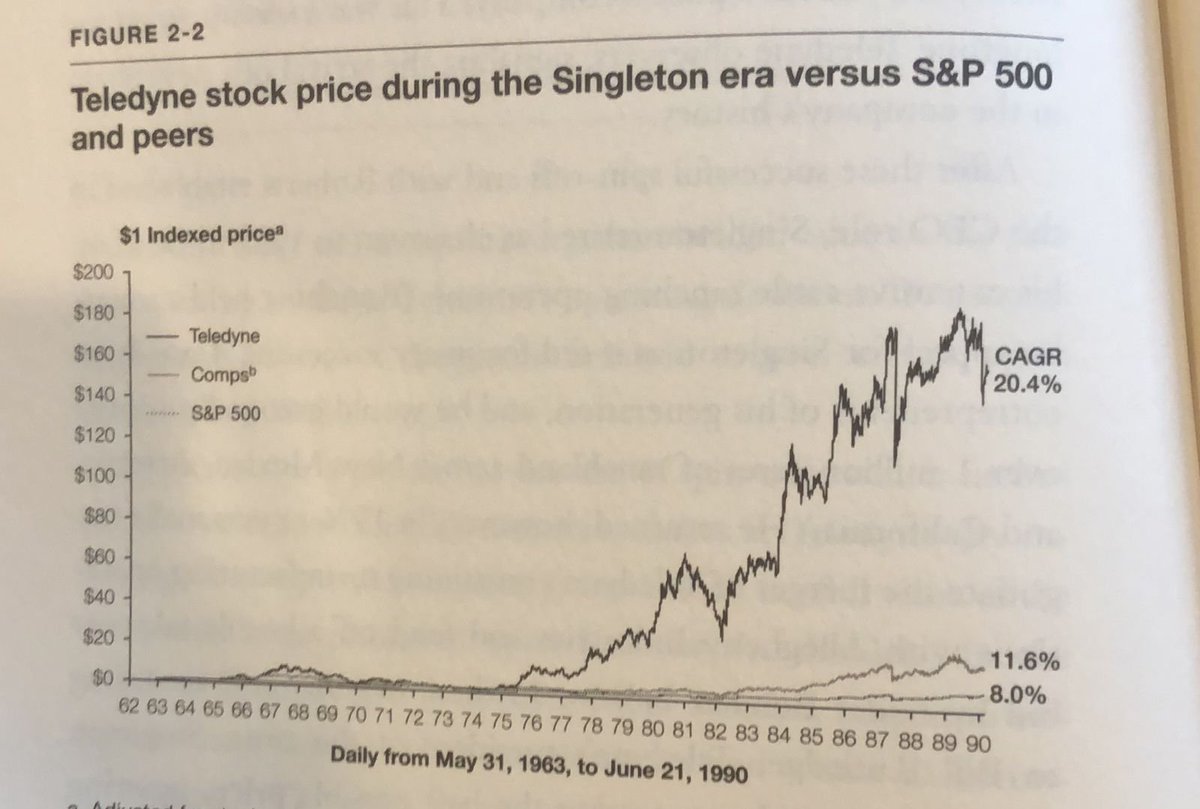

From 1963-1991, the company achieved a 20.4% CAGR. Let's see how he did it:

From 1963-1991, the company achieved a 20.4% CAGR. Let's see how he did it:

During the 1960s, conglomerates were starting to emerge.

However, they were all ran the same way: centralized approach, diversification and promotion of "synergies".

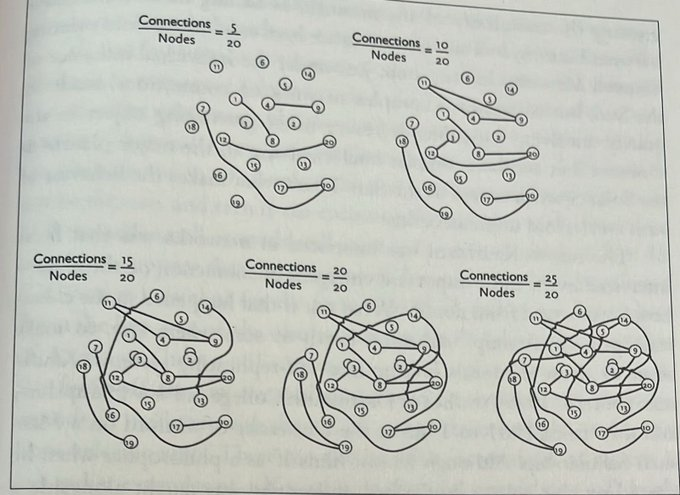

Henry's approach was radically different, taking a completely decentralized route to management.

However, they were all ran the same way: centralized approach, diversification and promotion of "synergies".

Henry's approach was radically different, taking a completely decentralized route to management.

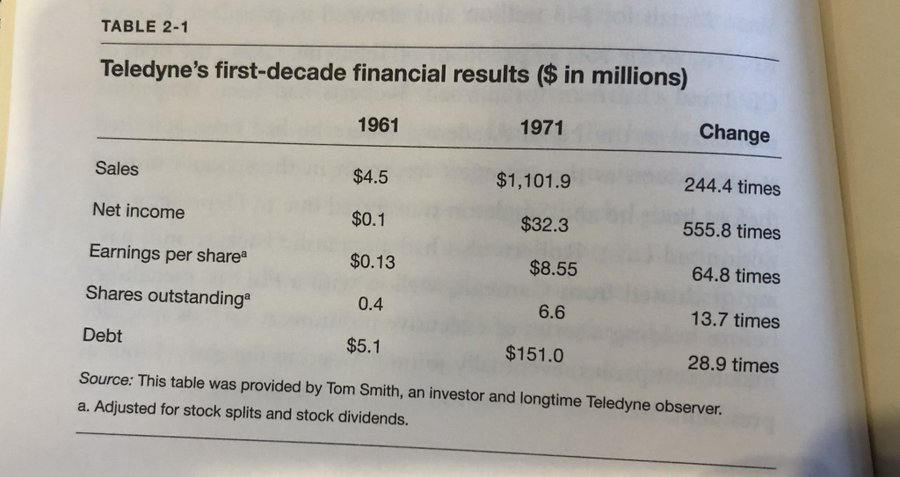

Taking advantage of conglomerate's (and Teledyne's) high multiples and acquisitions' easy environment, he went on an M&A spree.

"Between 1961 and 1969, he purchased 130 companies"

These were done by issuing equity at a PE of 20-50 and paying low multiples.

"Between 1961 and 1969, he purchased 130 companies"

These were done by issuing equity at a PE of 20-50 and paying low multiples.

In 1967, he did the largest acquisition so far, 43M for Vasco Metals.

This way, Henry brought in George Roberts. The latter had been Henry's roommate at the Naval Academy.

Now on, Roberts focused on managing operations and Henry on strategy and capital allocation.

This way, Henry brought in George Roberts. The latter had been Henry's roommate at the Naval Academy.

Now on, Roberts focused on managing operations and Henry on strategy and capital allocation.

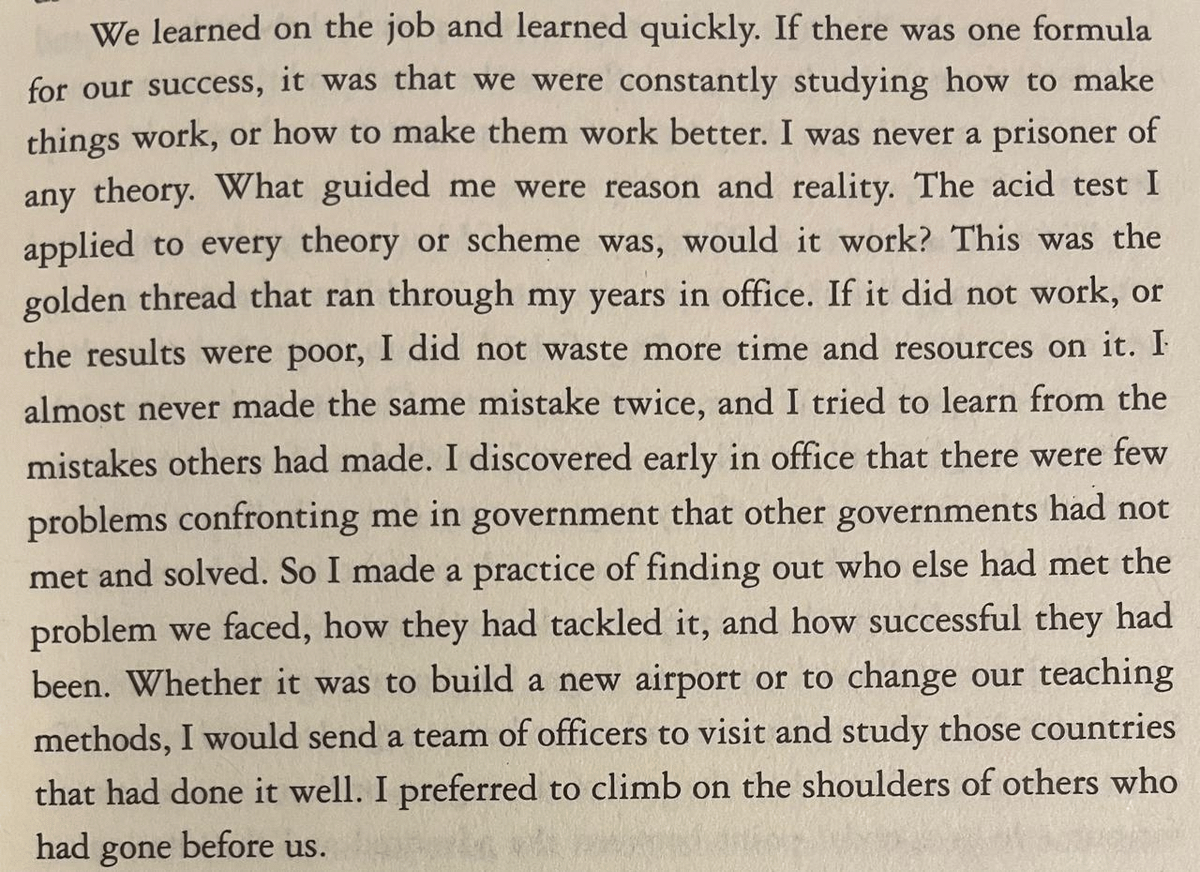

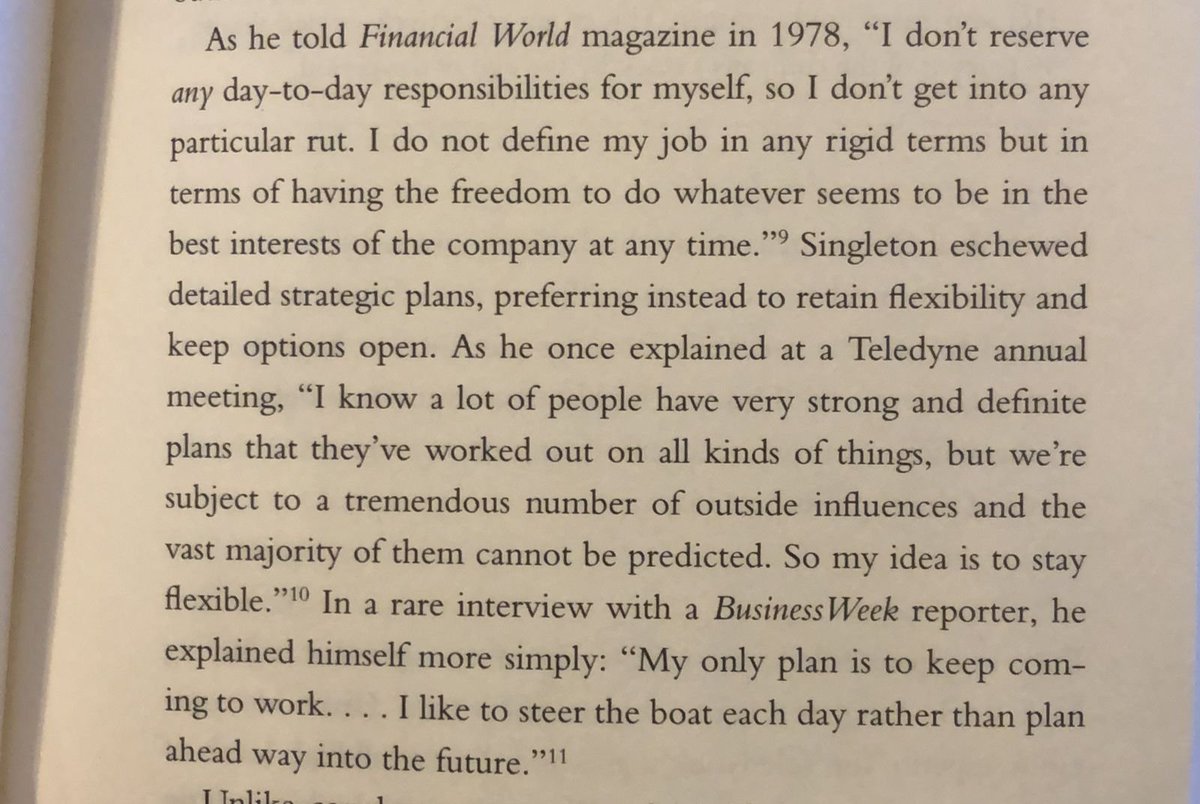

His approach to time allocation was superbly unique.

Unlike peers, Henry did not spend any time communicating with Wall Street analysts nor having press coverage.

His schedule was flexible and Singleton's activities depended on the day-to-day, no planning.

Unlike peers, Henry did not spend any time communicating with Wall Street analysts nor having press coverage.

His schedule was flexible and Singleton's activities depended on the day-to-day, no planning.

One of Teledyne's divisions was doing abnormally bad.

Singleton and Roberts did their proper dd and concluded the business unit had a 'permanent competitive disadvantage' against Japanese producers.

They rapidly discontinued operations.

Singleton and Roberts did their proper dd and concluded the business unit had a 'permanent competitive disadvantage' against Japanese producers.

They rapidly discontinued operations.

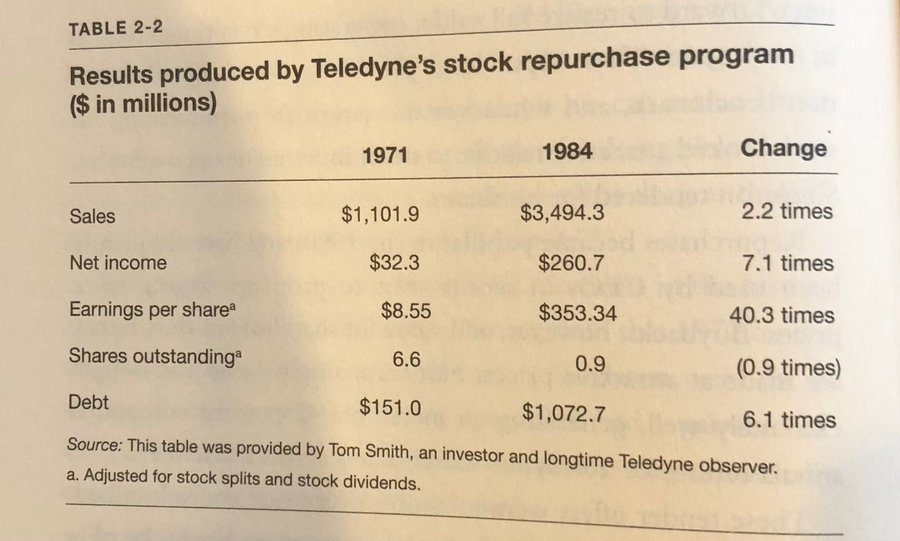

In 1972, valuations reversed. Now acquisitions were pricey and Teledyne's stock traded at low multiples.

He started to aggressively purchase shares back.

"Between 1972 and 1984, he bought back 90% of shares outstanding".

He started to aggressively purchase shares back.

"Between 1972 and 1984, he bought back 90% of shares outstanding".

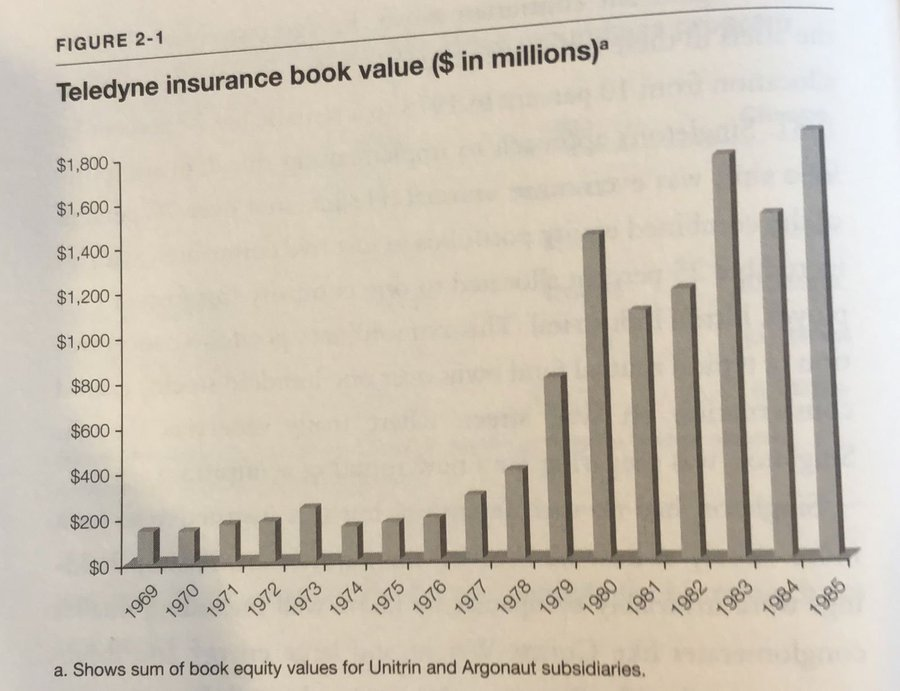

In the mid 70s, he took charge of Teledyne's insurance operations.

Taking advantage of the sever bear market, he reallocated capital from a 10% equity portfolio to a 77% by by 1981.

He only invested in 5 companies.

Taking advantage of the sever bear market, he reallocated capital from a 10% equity portfolio to a 77% by by 1981.

He only invested in 5 companies.

A final phenomenal call (1/2)

In 1980, Henry initiated the largest tender so far, with Teledyne's PE near all time lows.

The tender offer was oversubscribed, and he decided to by all tendered shares, equal to 20% of shares outstanding...

In 1980, Henry initiated the largest tender so far, with Teledyne's PE near all time lows.

The tender offer was oversubscribed, and he decided to by all tendered shares, equal to 20% of shares outstanding...

Given the drop in interest rates, Singleton financed the buybacks with fixed rate debt.

After the buybacks, rates rose sharply, making Teledyne's issued bond prices decline.

He then proceeded to buy all bonds back.

After the buybacks, rates rose sharply, making Teledyne's issued bond prices decline.

He then proceeded to buy all bonds back.

Hope you found the thread interesting and, if you have, sharing is very much appreciated!

https://x.com/Giuliano_Mana/status/1734594066048766171?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh