I read different things and share the interesting ones |

DMs open.

3 subscribers

How to get URL link on X (Twitter) App

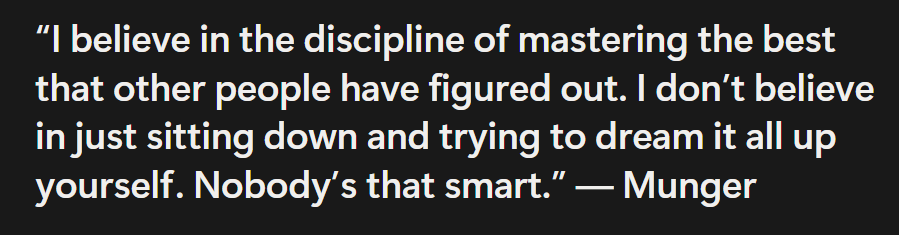

We are taught 'original thinking' is good and even feel shame when we 'copy others.'

We are taught 'original thinking' is good and even feel shame when we 'copy others.'

There are two big narratives in this book:

There are two big narratives in this book:

Everyone has a negative view of the investing field.

Everyone has a negative view of the investing field.

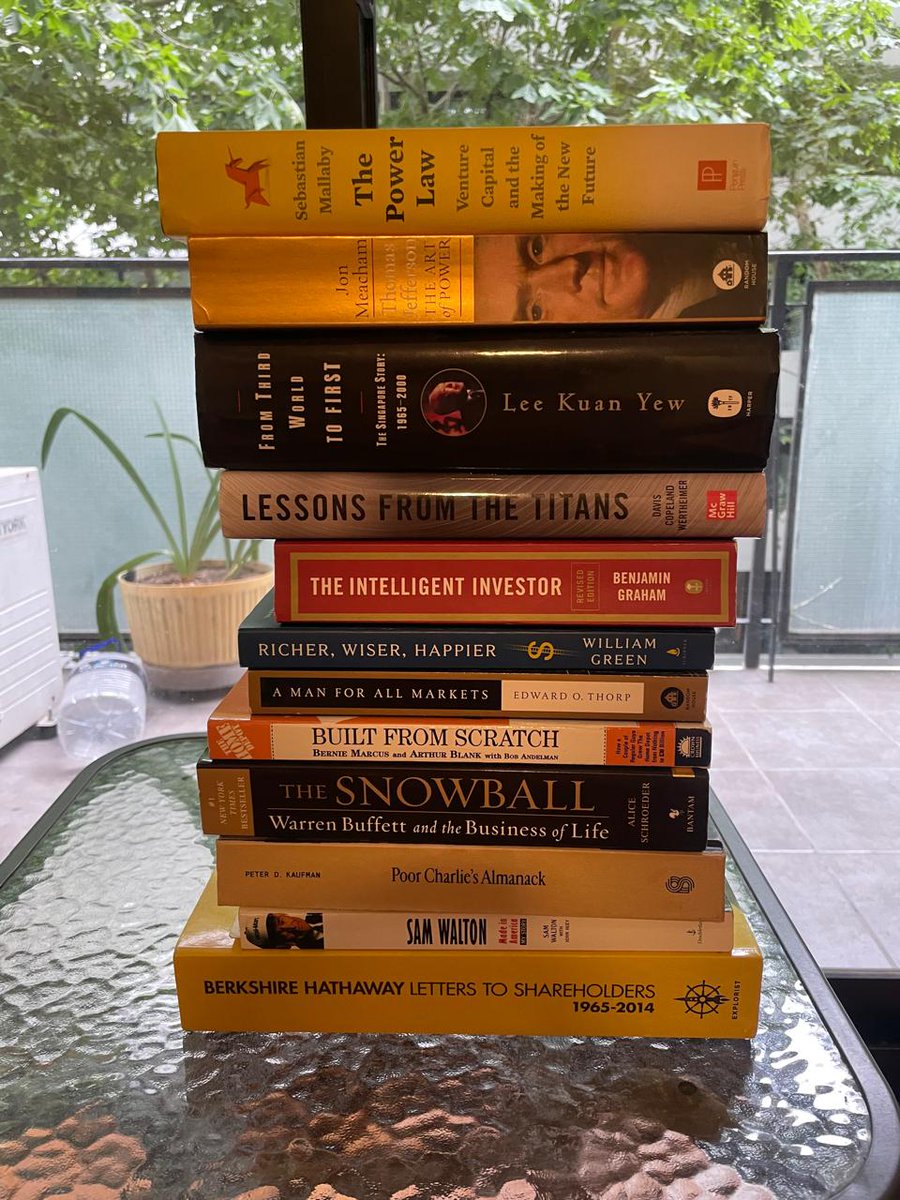

Lee Kuan Yew's genius was in systematically picking the correct system to fix huge societal issues.

Lee Kuan Yew's genius was in systematically picking the correct system to fix huge societal issues.

There is no miracle people.

There is no miracle people.

Adam Smith was the father of modern Economics.

Adam Smith was the father of modern Economics.

The Selfish Gene came to improve upon Darwinism, but at a huge cost.

The Selfish Gene came to improve upon Darwinism, but at a huge cost.

There's a simple way up in most societal hierarchies:

There's a simple way up in most societal hierarchies:

Truly gifted, high-integrity, people are rare.

Truly gifted, high-integrity, people are rare.

Lee Kuan Yew's genius was in systematically picking the correct system to fix huge societal issues.

Lee Kuan Yew's genius was in systematically picking the correct system to fix huge societal issues.

While reading and thinking, there were moments when I felt I was having actual fun.

While reading and thinking, there were moments when I felt I was having actual fun.

The first time this idea hit me from an unexpected place was in physics.

The first time this idea hit me from an unexpected place was in physics.

This is a dangerous approach to acquiring wisdom.

This is a dangerous approach to acquiring wisdom.

Lee Kuan Yew's genius was in systematically picking the correct system for fixing huge societal issues.

Lee Kuan Yew's genius was in systematically picking the correct system for fixing huge societal issues.

Jared Diamond went to New Guinea in the 70s to study birds.

Jared Diamond went to New Guinea in the 70s to study birds.

After religion started losing the spot as the main explanatory agent, science hopped on a peculiar path.

After religion started losing the spot as the main explanatory agent, science hopped on a peculiar path.

The first test most sources fail is in admitting the limitations of accounting.

The first test most sources fail is in admitting the limitations of accounting.