New report: another potentially criminal breach of the law by Douglas Barrowman - they failed to declare his ownership of their Belgravia house.

Quick thread:

Quick thread:

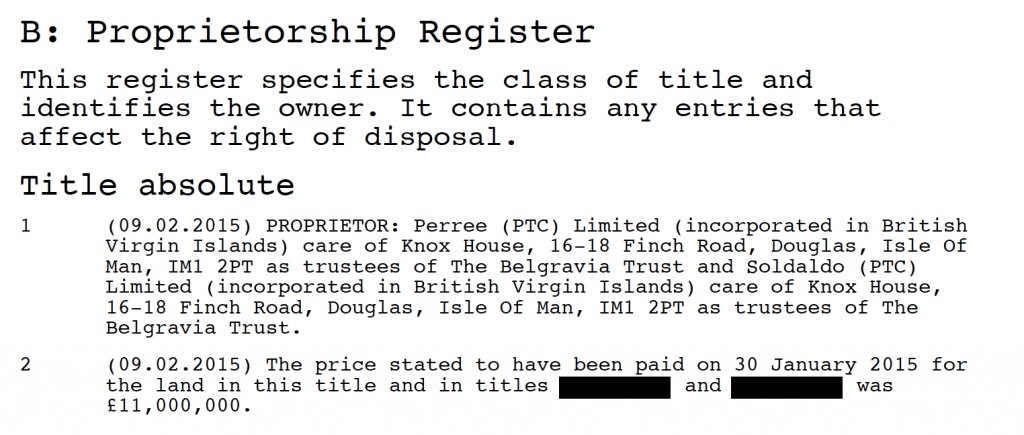

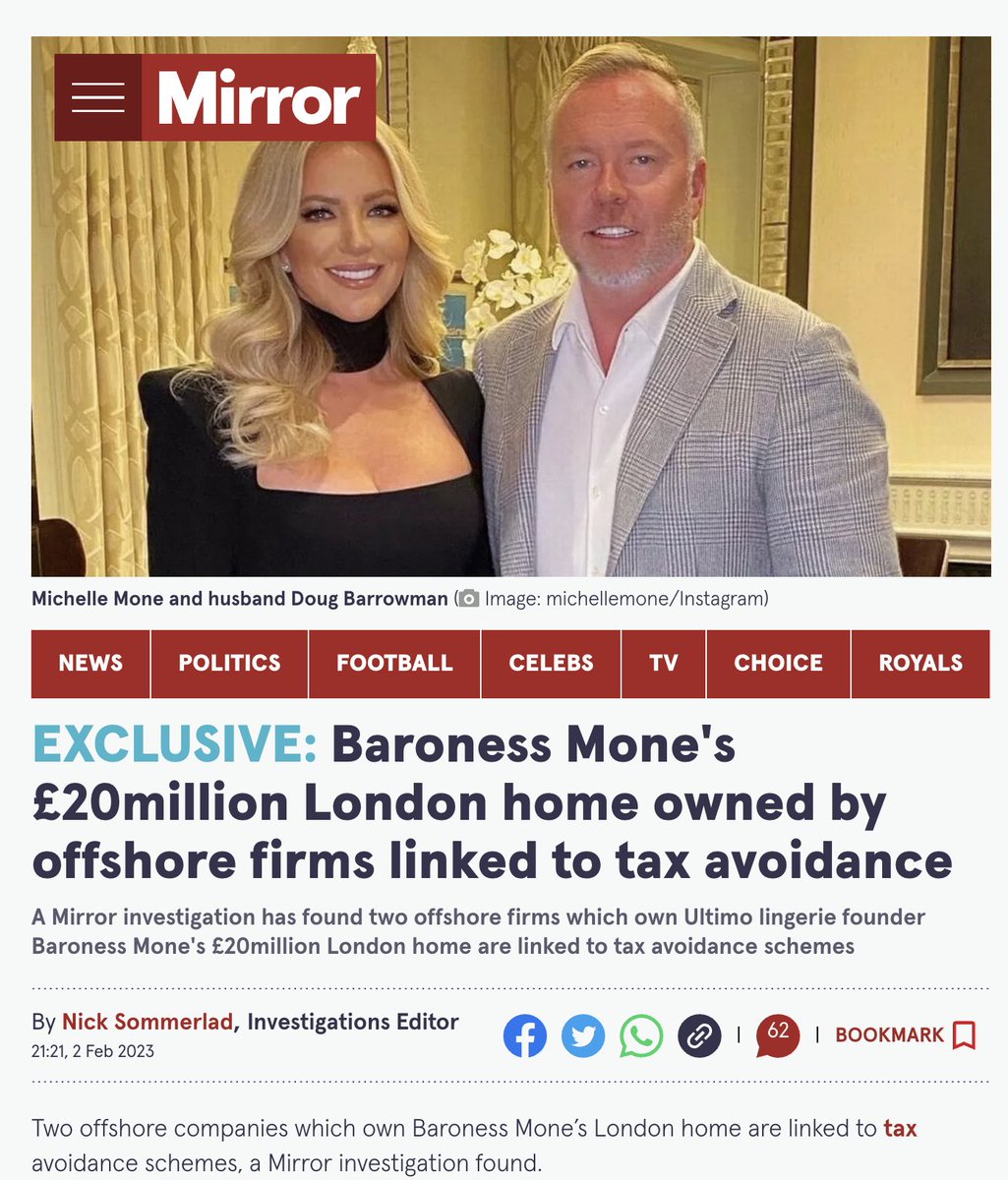

Last year, the Daily Mirror reported that Douglas Barrowman and Michelle Mone own (and sometimes live in) a house in Belgravia which is owned by a British Virgin Islands company called Perree (PTC) Limited.

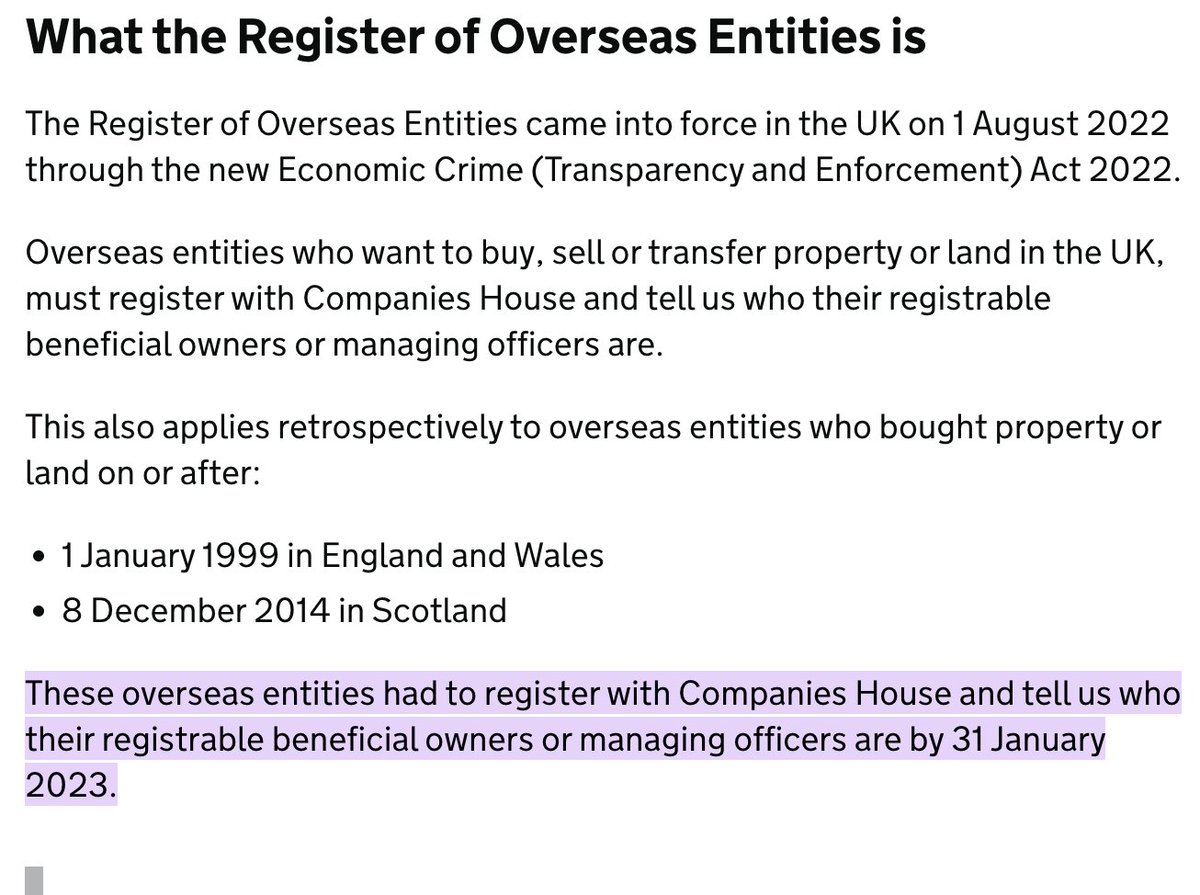

The UK was perhaps the first country in the world requiring foreign companies owning real estate to register their beneficial ownership. The deadline for registration was 31 January 2023.

Naturally Barrowman/Mone didn't do this.

Naturally Barrowman/Mone didn't do this.

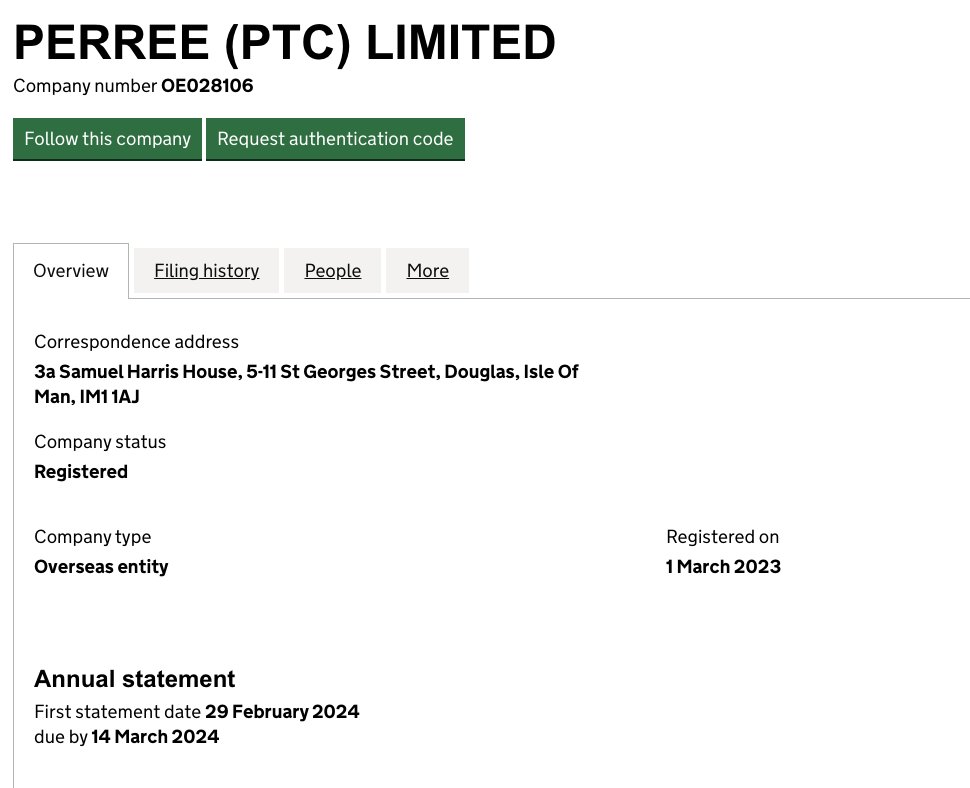

The rules have some "teeth" - a foreign company that fails to register can't buy or sell the real estate. Hence, perhaps because Mone/Barrowman are now selling the house, they registered Perree (PTC) Limited with Companies House on 1 March 2023:

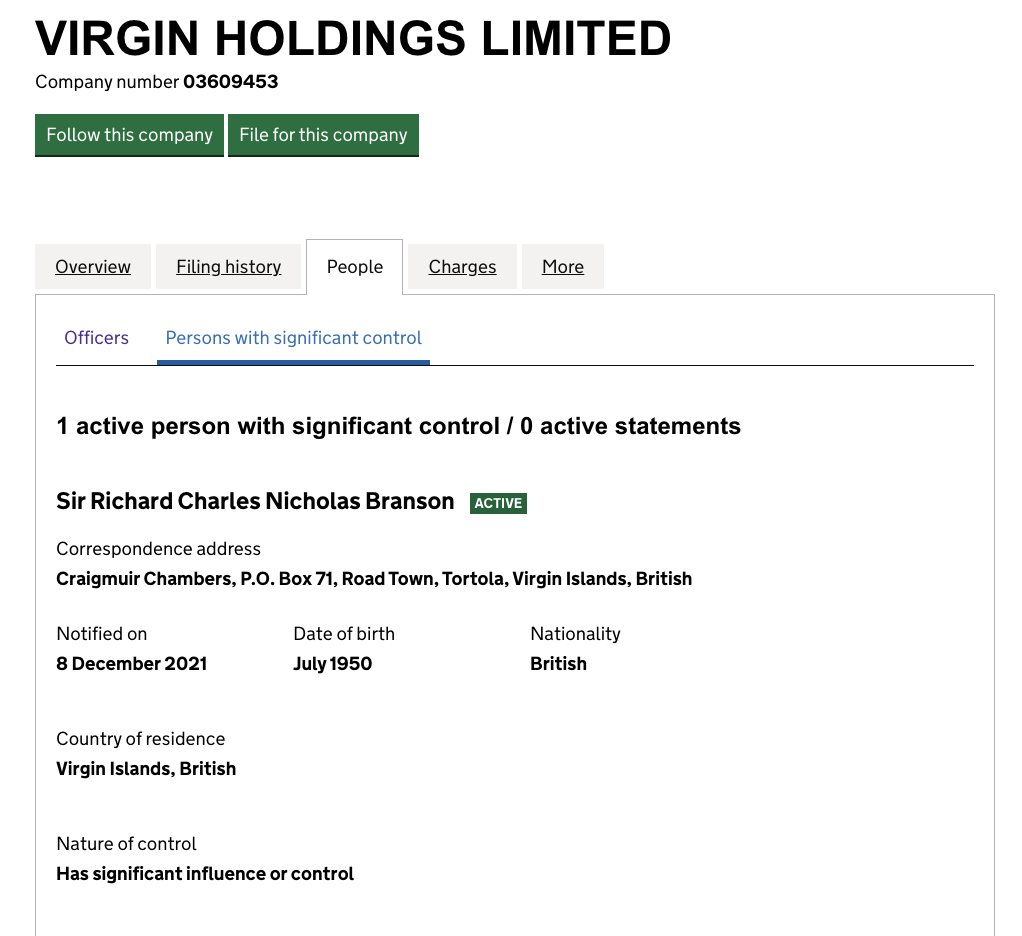

The main purpose of the rules is requiring foreign companies to identify their beneficial owner. Here's the entry for Perree (PTC) Limited:

We don't know who holds the shares in Perree (PTC) Limited, or who the directors are. Here are what we do know about the company:

- It owns a house used personally by Michelle Mone and Douglas Barrowman

- It owns a house used personally by Michelle Mone and Douglas Barrowman

- It gives as its service address the headquarters of Barrowman's Knox Group in the Isle of Man

- It lists as its "managing officers" Anthony Edward Page and Claire Voirrey Coole.

Page was the managing director of the Knox Group; he subsequently had some kind of falling-out with Barrowman.

Coole is a director of PPE Medpro and another Barrowman company.

Page was the managing director of the Knox Group; he subsequently had some kind of falling-out with Barrowman.

Coole is a director of PPE Medpro and another Barrowman company.

So it seems likely, from the known facts, that Barrowman exercises "significant influence or control" over the company. If so, then Barrowman is the beneficial owner.

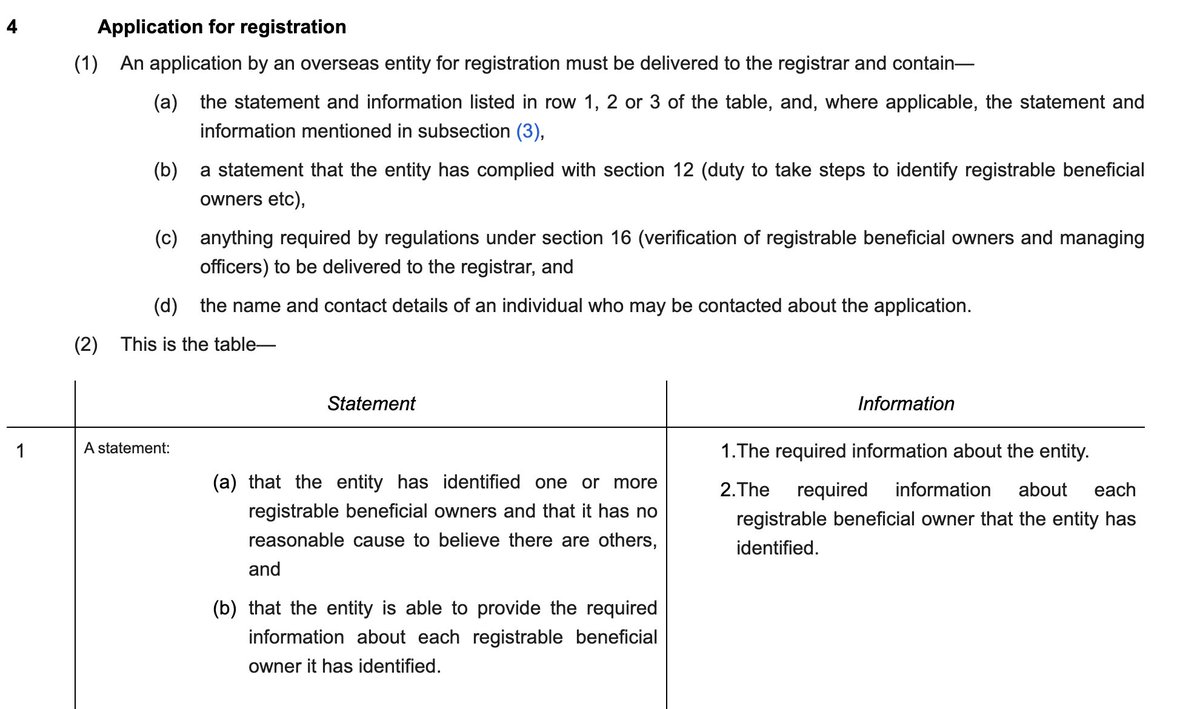

Section 4 of the Economic Crime (Transparency and Enforcement) Act 2022 requires the beneficial ownership information to be included in the application for registration. Plainly that didn't happen.

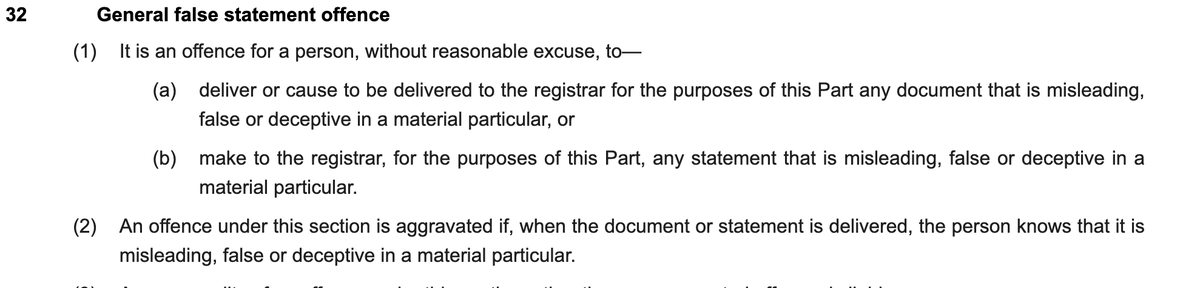

Under section 32, it's an offence for anyone, without reasonable excuse, to deliver (or cause to be delivered) a false or deceptive filing under the Act - on conviction they can be liable for an unlimited fine.

The offence is "aggravated" if a person knows it was false or deceptive - there is then also the possibility of up to two years' imprisonment.

In this case, if Barrowman was the beneficial owner, the registration documents were false/deceptive in not listing him. Surely the directors knew they were false.

That suggests that Page and Coole may have committed the aggravated offence. If Barrowman was aware, he may also be liable.

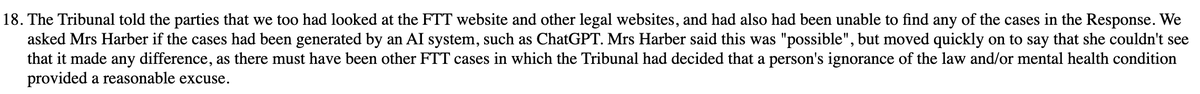

If this was a small widget company then we could be forgiving about a technical breach of the law. People make mistakes, and those unfamiliar with the law can easily misunderstand what it means...

But the Knox Group is in the business of providing corporate and fiduciary services - setting up and managing companies. Knowing how these rules work is literally their job.

Why do Barrowman and his companies ignore the law?

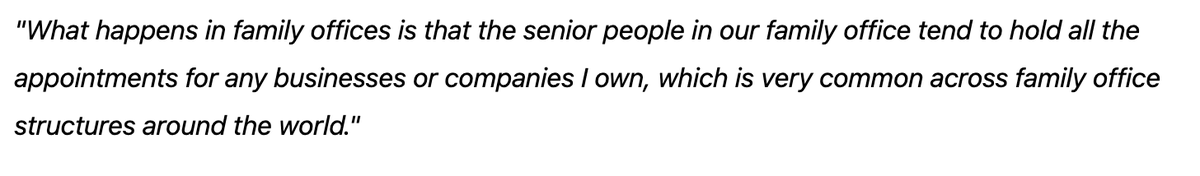

In the BBC interview with Barrowman and Mone, Laura Keunsenneg asked specifically why Barrowman wasn't visible on PPE Medpro's Companies House filings.

Barrowman first suggested this was a complicated technical question. Then he admitted being the ultimate beneficial owner (see starting 41:53)bbc.co.uk/sounds/play/p0…

Unfortunately for Mr Barrowman, there is no exemption from transparency laws for people wanting privacy. And Barrowman's suggestion that most private offices operate this way is false.

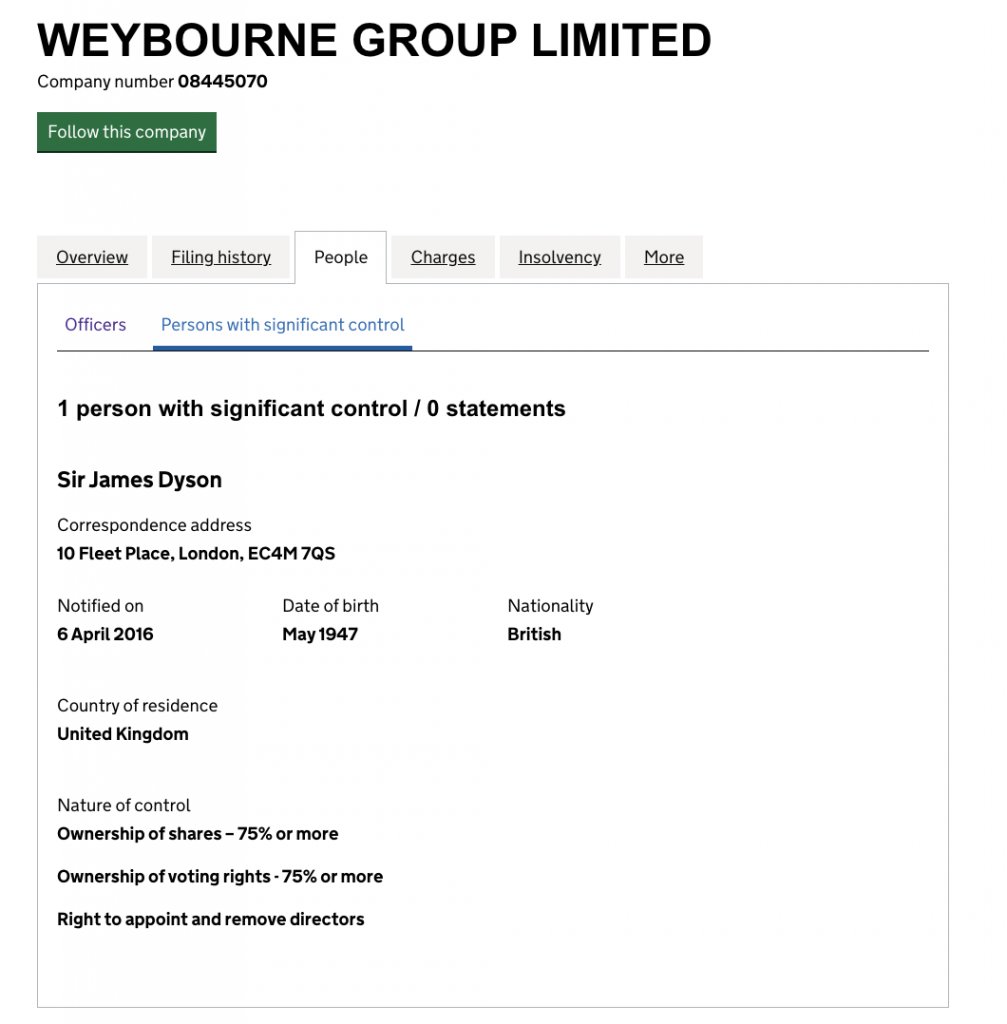

Branson and Dyson have famously complicated corporate structures. Their UK businesses properly declare them as beneficial owners.

The only reason Douglas Barrowman's company filings are different from Messrs Dyson and Branson is that Mr Barrowman chooses to ignore the law. He has form for this.

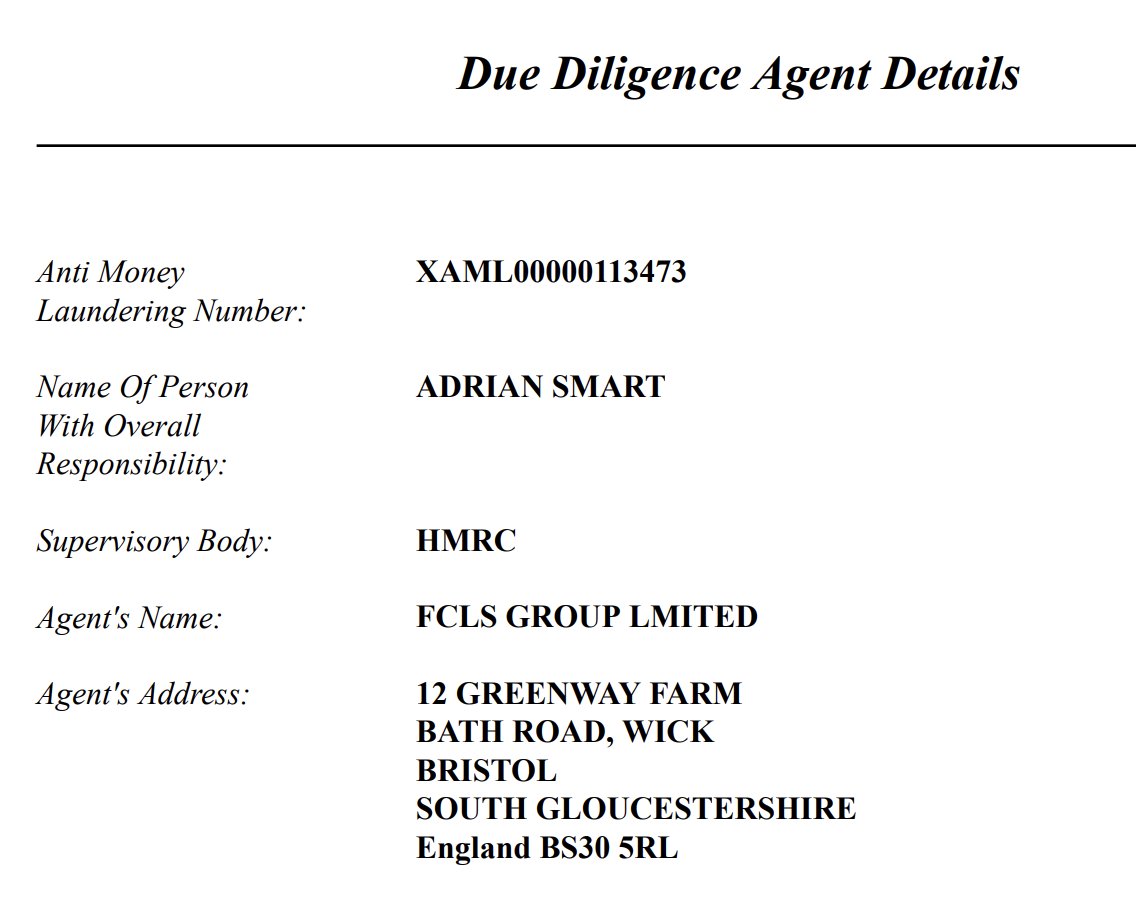

What about the agent?

The Act doesn't just trust companies to file correct beneficial ownership information. Regulations made under the Act require that an agent (regulated under money laundering rules) must verify beneficial ownership.

I've written to the Knox Group and FCLS seeking comment, and will update this article with anything I receive.

The question is whether Mr Barrowman and his team will face any criminal sanctions for what appears to be their widespread practice of treating inconvenient laws as optional.

Our report is here, with full links to sources: taxpolicy.org.uk/2023/12/19/oop…

You can subscribe for updates here, so you can get our updates free from the hell-site: taxpolicy.org.uk/subscribe/

We don't accept donations, but Bridge The Gap does.

It's a wonderful charity that provides excellent and free tax advice to people in need. If you can afford it, please consider donating: bridge-the-gap.org.uk

It's a wonderful charity that provides excellent and free tax advice to people in need. If you can afford it, please consider donating: bridge-the-gap.org.uk

OMG it gets worse. Perree (PTC) Limited and another company, Soldaldo (PTC) Limited, are said to hold the property as trustees for the Belgravia Trust.

Who does the Belgravia Trust list as its beneficial owners? Its own trustees. Total lawlessness.

Who does the Belgravia Trust list as its beneficial owners? Its own trustees. Total lawlessness.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter