The U.S. public equity market is operated by every megalodon wealth firm, bank, family office, hedge fund etc. and these are the proprietary simple moving average operations used to vehiculate wealth in and out of the Nasdaq S&P500 Dow VIX and every equity on the NYSE NASDAQ AMS.

10/50/200 - S&P

20/100/250 -NAS

30/60/90 -DJI

33/66/99

11/44/88

22/55/77

19/37/73/143/279/548 - Waring's Problem

16/32/64/128/256/512

27/53/105/210/420/840

23/46/91/183/365/730

18/36/72/144/288/576

25/51/101/202/404/808

20/100/250 -NAS

30/60/90 -DJI

33/66/99

11/44/88

22/55/77

19/37/73/143/279/548 - Waring's Problem

16/32/64/128/256/512

27/53/105/210/420/840

23/46/91/183/365/730

18/36/72/144/288/576

25/51/101/202/404/808

Elite firms have astute precision detection systems that use the preceding Simple Moving Average combinations on multiple timeframes to collectively execute bids, asks, and maximize on every singular point and penny move higher and lower on liquid trading vehicles.

Documented publicly for the first time ever is the empirical evidence of global wealth managers using these parameters with 100% abject precision. The goal of this project: to publicly document & inquire @SECGov for a PUBLIC INJUNCTION & address institutional gamified markets.

Threaded live and in real time are precision wealth transfer operations that I've learned over the years navigating this industry and developing decryption to intellectual knowledge involved in Trading.

Quite the plethora is simply computer science developed to create exclusion.

Quite the plethora is simply computer science developed to create exclusion.

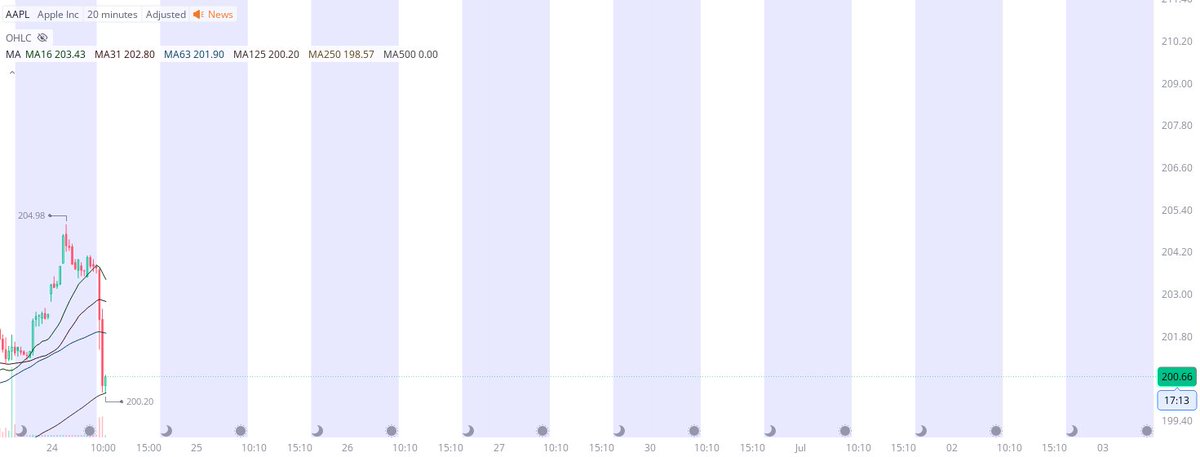

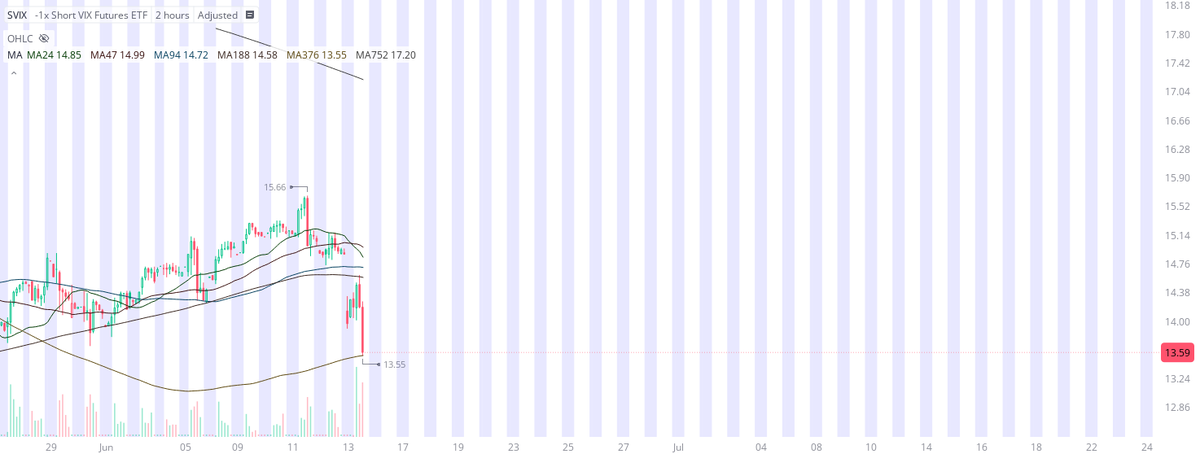

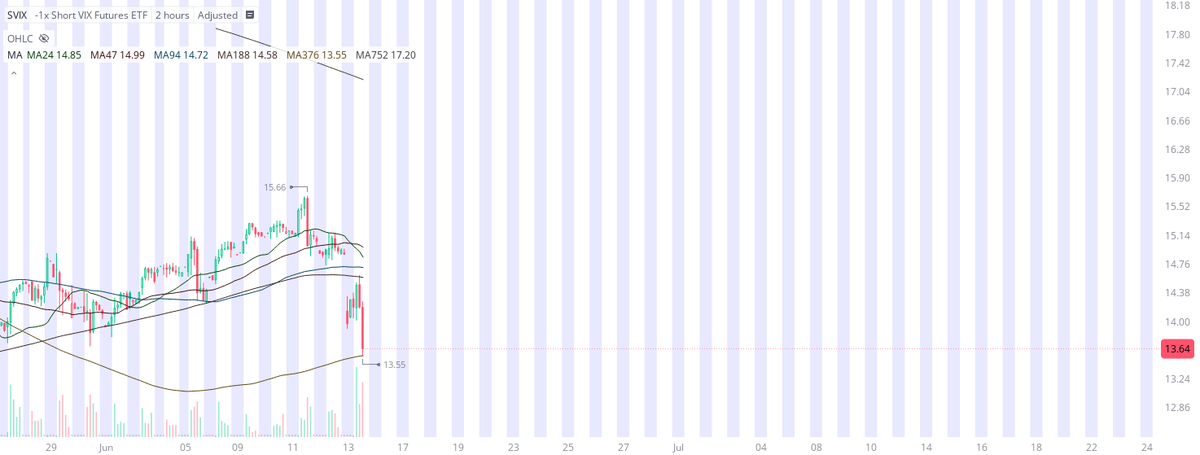

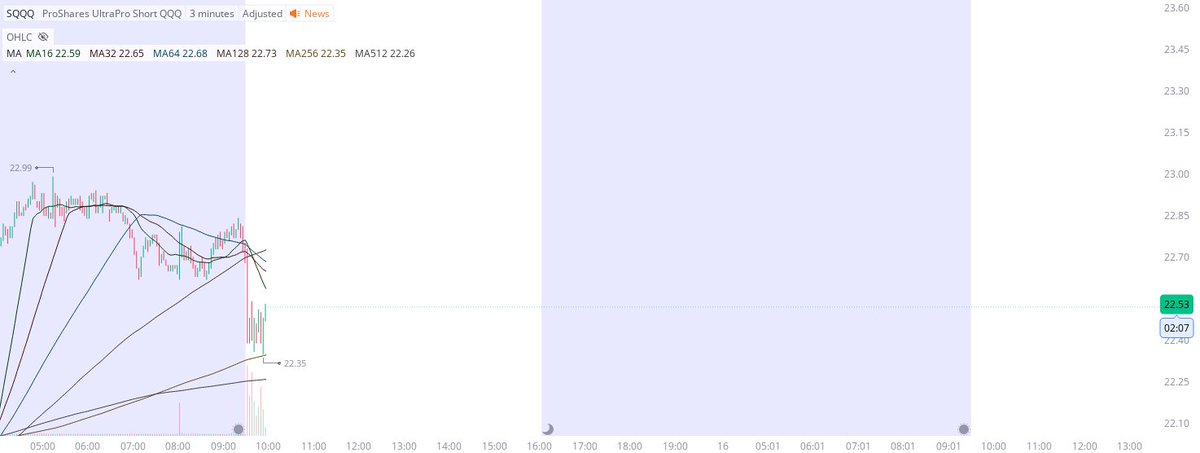

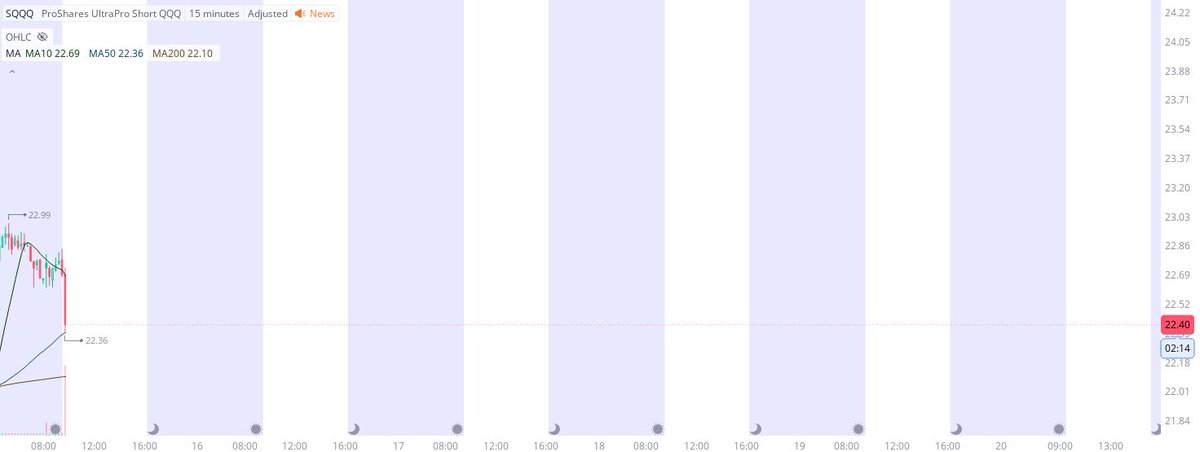

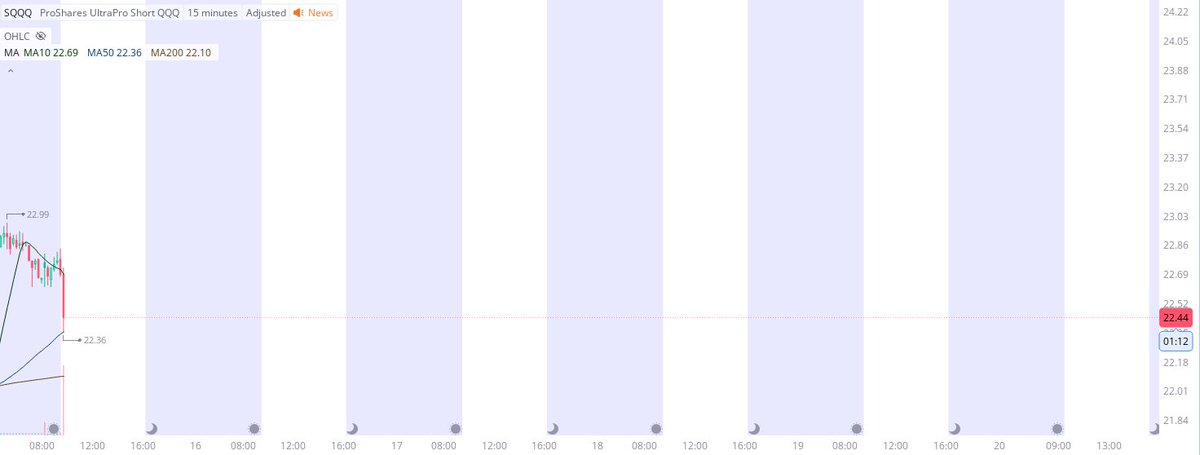

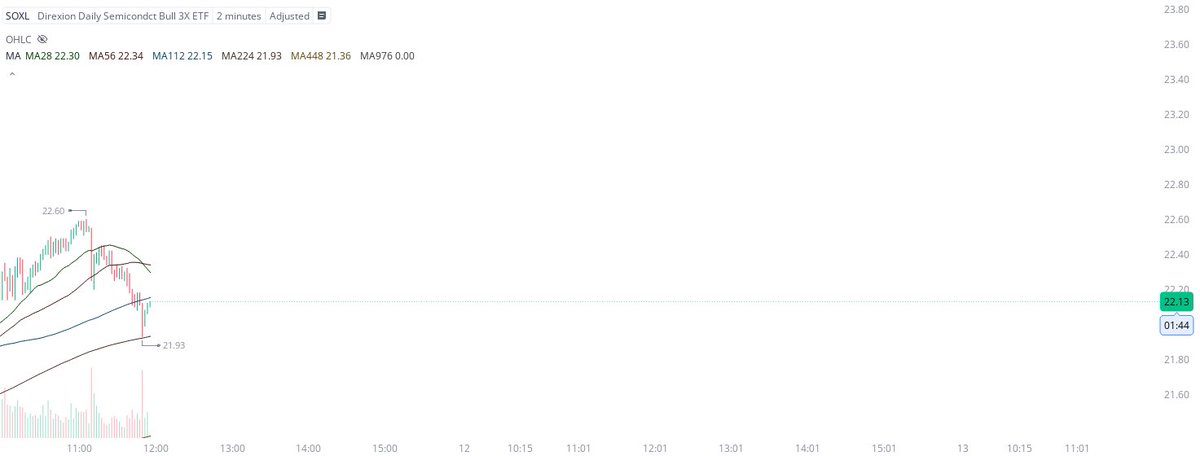

For the past year this page has, in real time, documented live price action of massive, economy altering, selections of the Nasdaq's vehicles TQQQ SQQQ as well as the S&P 500s SPY, VIX UVXY and when possible individual equities i.e. TSLA and AAPL.

The only utility that the following information has is the democratization of institutional knowledge, such as how the largest financial entities create selections on the "outfits" for other firms to elect liquidity on for bets, & understanding how financiers transfer capital.

What this thread & public burgeoning page is going to share is the practice of high-frequency dependent operations, organized visibility of algorithmic enactment, as well as the macro-role that plays into wealth stimulated from 401K/Roth IRA/borrowed capital etc. .

First and foremost, the machinations of the U.S. financial project are meant to be complicated. The facade of finance is the reality that the Elite, Public who work to live & contribute to an IRA/Pension/401K/Tax etc., and International Subjects rely on this sophisticated system.

There is an urging reality that this is a joint endeavor that institutionalists from all leading industries work pervasively to maximize from. No surprise to anyone, as many Fraud charges & Fines are of the U.S. legacy. The collaboration rewards American participants long-term.

I am sharing the following information, threaded in a one piece post on X/Twitter for the Public to have all of the facts and details in a systematically collected and organized matter. I have omitted to ever delete this page and all of the evidence based real time work ...

mainly in the regard of the whistleblower case of FTC vs. X and Project Eraser. I also do believe that X (F.K.A Twitter) does maintain a responsibility to uphold Free Speech and has served as an excellent platform to document this all due to the utility of the advanced search fx.

Now for the critical part.

Detailed below are the procedures and selection process that is determined by particularly complex parameters to selections that are quite simple to visualize & document & record in real time. The proof here is what has garnered the public's reception.

Detailed below are the procedures and selection process that is determined by particularly complex parameters to selections that are quite simple to visualize & document & record in real time. The proof here is what has garnered the public's reception.

Access & the utility of this knowledge, that I discovered independently, is what has cemented my role on Sand Hill Road, Menlo Park CA where I have developed not only the skills, but have managed to develop relationships in intelligence/trust & safety/litigation. This is my gift.

I can only detail a high level outline of this work. Public equities are a product of a multidisciplinary combination of data science, software engineering integrating Data Acquisition from real time & historical market data, broker API integration, & real time selections.

Each of the "SMA Outfits" will be detailed explicitly & for clarity of each operation one can use the chronological advance search function to view historical/real time documents by searching "from:rauitrades" + parameter (i.e. MA250, MA279, MA512, MA548, MA404 MA808 MA999 etc.).

(10/50/200)

The first and unequivocally utilized SMA outfit is the 10/50/200 SMA combination that those in the Industry call "The System". This specific combination of simple moving averages are majorly reflected in the S&P 500's SPX 30 minutes chart.

The first and unequivocally utilized SMA outfit is the 10/50/200 SMA combination that those in the Industry call "The System". This specific combination of simple moving averages are majorly reflected in the S&P 500's SPX 30 minutes chart.

This is a simplification of the parameters that action the S&P 500's midterm buying & selling operations. There is a extremely radical amount of evidence that the real time significance of buying/selling/short operations elected are when the S&P is positive or negative.

A positive S&P regards the SMA10 to trade above the SMA50 while a negative S&P regards the SMA10 to trade below the SMA50.

During times of heightened volatility those parameters are shifted to being simply a candle close and bidding above the SMA50 or liquidation below the SMA50.

During times of heightened volatility those parameters are shifted to being simply a candle close and bidding above the SMA50 or liquidation below the SMA50.

Even this singular baseline SMA function of the 10/50/200 serves without utility if one doesn't have access to the rest of the machinations facilitating price action. That's where the following precision algorithms are executed to gamify what would otherwise be too simple.

The 1st public record & real time distribution of this Simple Moving Average outfit comes from @MasterBJones .

He has mentored me since 2019, creating his own legacy in public equities exposing how Firms manipulate small stocks & utilize the S&P 500s System. My flowers go there!

He has mentored me since 2019, creating his own legacy in public equities exposing how Firms manipulate small stocks & utilize the S&P 500s System. My flowers go there!

(20/100/250)

Second is the NASDAQ's proprietary Simple Moving Average outfit. The second SMA outfit will expose everyone to an escalation of complexity. The vehicle this is selected on is the IXIC, though during times of an overperforming and underperforming NASDAQ alternates ...

Second is the NASDAQ's proprietary Simple Moving Average outfit. The second SMA outfit will expose everyone to an escalation of complexity. The vehicle this is selected on is the IXIC, though during times of an overperforming and underperforming NASDAQ alternates ...

between the 30 minutes chart and the 20 minutes chart, as wealth managers are selecting as homage to the NASDAQ's first proprietary SMA integer, 20. You're going to figure out that plenty built into financial markets rely on American intellectual/arbitrary knowledge/selections.

The NASDAQ creatively operates as the leader of the United State's financial expansion thus, most frequently being what global wealth managers use to vehiculate purchasing/liquidation/short orders. The majority of the documentation on this page is of the TQQQ SQQQ respectively.

(30/60/90/300/600/900)

Third is the Dow Jones Industrials' proprietary simple moving average outfit. Consider the U.S. institutional hour session operating for 6 hours and 30 minutes. Or 390 minutes.

The positive and negative SYSTEM functions are on the 15 minute & 1 hour chart.

Third is the Dow Jones Industrials' proprietary simple moving average outfit. Consider the U.S. institutional hour session operating for 6 hours and 30 minutes. Or 390 minutes.

The positive and negative SYSTEM functions are on the 15 minute & 1 hour chart.

At this point you can see how the creation of this machine and the super computer work necessary to pioneer the global financial markets are quite remarkable. That's one astute observation. The Elite elect to maintain this system as it functions well and creatively.

Shared above now are only three of the SMA outfit combinations and their fulcrum vehicles. That is to say that these SUPER COMPUTERS work by drawing precision Bid/Ask (OHLC Candles) that every firm that matters have detection/automation systems in place to maximize from.

Eventually the nature of the public equity market is the regard of RISK when the reality is that plenty of Firms, especially that of the last 12 years of near 0% interest, are collateral and rely on large entities gamifying the System higher and rewarding most large participants.

Pretty much everyone understands that even when the largest entities fail that there is quite a semblance of dishonesty as other firms benefit of the removal of one skeleton in the closet (i.e. mishandling of assets, failure of thorough audits etc.) . It is always after the fact.

When I learned about the initial 10/50/200 SMA outfit in November of 2019 I saw the precision function of the SMA50 and that's when I realized how extremely calculated each singular point move of the S&P 500, DJI, and NASDAQ are for the global economy. The NASDAQ is the arbiter.

Before I continue. An extremely long story short.. I began to explore the significance of the integer Three in public equities. That led to a month long academic trail taking me from conjectures in quantum mechanics, cryptography, mathematical abstractions & logic etc.

Following the work of Alan Turing and mathematical pedagogy I learned of the work of Edward Waring and David Hilbert. Two incredibly fundamental mathematicians. That's when I came across the Waring's Problem conjecture. This is what opened the portal.

WARING'S PROBLEM A profoundly historic natural number theory conjecture. In layman terms it explores proof that every number can be broken down into a certain type of smaller number. More importantly, if every number can be expressed using a limited set of patterns.

That is where you get the integers 19/37/73/143/279 and 548 that, for the sake of simplicity apparently are the six integers global wealth operates have elected to use as one of the SMA outfits. Every single firm that matters knows of this behemoth operation.

The most important role the Waring's Problem solution played was capitular 28th of December NASDAQ Composite Market operation that famously bottomed exactly 19 points above the Weekly Chart (long term operation) SMA279. (19)/37/73/*143*/(279). That gave the world IXIC at 10207.

(33/66/99/333/666/999) During heightened intraday volatility. "Angel Number" SMA outfits are another cog in complicating the selection process. Most important are the Major Averages of each outfit (largest integers), as the bid/ask spread is usually washed on the smaller SMAs.

(22/55/77/222/555/777) Another SMA outfit. This is a volatile program due to the displacement of the 222/777 Simple Moving Averages often making it quite easy to detect. Go figure this program is often applied to the equity AAPL. Go figure? Their December 1980 price was 22.00.

(11/44/88/111/444/888) The last of the Angel Number SMA outfits. Whenever this outfit is operating there are often massive strikes of volatility as the result of the amount of displacement between the 111/444/888 integers.

Documented on this platform, these outfits are often shortened to (11/44) (22/55) (33/66). For the sake of a collected & organised repertoire. When you delve into the reality of finance and even the world of mathematics I leave you with the following:

[Mathematics] is a conceptual system possessing internal necessity that can only be so and by no means otherwise. . David Hilbert 1919. While the real life ramifications of capital is organized and material, it's solely the result of out agreement of what is arbitrary.

(19/37/73/143/279/548) The Waring's Problem SMA outfit. One that can be researched of the real time documentation of these outfits using the X search function (MA143) (MA279) (MA548). This is what binds the academics of Wharton/Stanford/Sloan/Harvard and the structure of capital.

(16/32/64/128/256/512) Binary. A more obvious elected SMA outfit. This one is by far the most complicated in terms of real time operations being executed by firms... likely in the event of being too evident. Irrespective there is plenty of documented use here on this page.

(27/53/105/210/420/840) The most industry altering SMA outfit to come out of 12 years of near 0% interest rates. The selection process highlighting the true gamification and arbitrary nature of vehiculated wealth transfer led none other than by the TSLA vehicle. Need I say more.

There is NOTHING that caught me more off guard than learning that there were algorithms being stimulated off a singular SMA i.e. 210 420 etc.. I believed certainly that intellectualizing wealth was the result of pragmatic mathematics, then I saw this.

Most often operating in the S&P or NASDAQ when TSLA is underperforming/overperforming and before/after earnings reports (ER). What I can say, especially based on proof here, is that the TSLA outfit is complex, & often breaks out into facilitated automated short squeezes.

There is a reason the TSLA vehicle extended itself into creating the wealthiest person/Firms on Earth. There is zero doubt that the collaborative effort of entities operating that vehicle and its SMA application of the major market maximized on it to an extreme.

(23/46/91/183/365/730) (18/36/72/144/288/576) Both are time based integer SMA outfits. Simply put it's binary for digits 365 and 144. 365 days in a year & 144(0) minutes in a singular calendar day. The parameter shifts to 366 leap years. 138(0) Spring Forward. 150(0) Fall Back.

The "Time" based operations are used to elongate the equity markets' trend or allow time to budget for the following transition. Since TIME is a specific tool that the institution uses to maximize on Simple Moving Averages that are time/candle based. Firms operate Time as a tool.

(25/51/101/202/404/808) In computer network communications, HTTP 404, 404 error, page/file not found error message is a hypertext transfer protocol response code, indicating that the browser was able to communicate with a given server, but the server could not find the request.

This SMA outfit created the Blowout October Low & buy algor that enabled the S&P/IXIC System to go positive after insiders bid on October 27th 2022. This page documented that live & in real time. It all commenced after insiders shorted the rise after Oct 6th's Jobs Data report.

Finally. In the great advent capitalism and the institutions ability to explore adaptation and the gamified election of SMA outfits you have those that pay homage to the institution. Those SMA outfits go as follows:

High Ranking Government Official/Head of State SMA outfits. 45 - (29/57/114/227/455/911) 46 - (23/46/92/184/368/736) 56 - (28/56/112/224/448/896) - Speaker of the House Most recently selected was the operation that celebrated the election of Mike Johnson. That is documented also.

My friends in the U.K. may be able to attest to a Monarch operated SMA outfit based on the integers 40 and 41 respectively but the european markets are not of my expertise. The United States Stock Market celebrates the ability to maximize from domestic shifts in the economy.

911 - (28/57/114/228/456/911) Homage to One World Trade. Interestingly this operation was selected on November 9th as well.

Lastly you have EVENT operations. Integers selected "Day Of". The most recent and devastating example is of the current operation in the Middle East.

Lastly you have EVENT operations. Integers selected "Day Of". The most recent and devastating example is of the current operation in the Middle East.

The "EVENT" led operations account for singularities. In this case war. On the 33rd Day of Israel's intervention of Gaza, SMA detection Systems identified a blowout Buy Algo that wealth operators managed to maximize from operating on the integer 33. This page shared that, live.

In the event you missed the consecutive press following that with "Day ## of Israel/Hamas war" many seemed to miss out on the wealth transfer opportunity maximized by the U.S. empire, that at least I documented and called prestinely in real time. That is reality. Devastating.

That there is an outline of these operations. There is NO better resource in the world that exists to this day that details public equity vehicles as thoroughly as this page has now for the past year. Only now, the Public is paying attention. This is my gift to the world.

There is some divinity to how well constructed this behemoth of an industry is and perhaps a sign that there is indeed human excellence.

The intellectualization of this world has created magnificent advances and now the knowledge that operates it can exist publicly.

The intellectualization of this world has created magnificent advances and now the knowledge that operates it can exist publicly.

What is most important about everything shared today is the fact that technology has created platforms like this for the whole world to learn and create from. This is the Public's first real time exposure to the fulcrum of global capitalism what what creates the American Dream.

I end this with highlighting the following.

There is far little utility for this work's exposure outside of the Public.

Please do human good with this information.

Here it is. END 6:39 PST

There is far little utility for this work's exposure outside of the Public.

Please do human good with this information.

Here it is. END 6:39 PST

There are now over forty-three-thousand live documents on this platform exposing supercomputers selections between SPY IXIC DIA, tangential proshares TQQQ SQQQ etc., and Volatility Indices to select a singular timeframe and singular SMA outfit that creating 100% of price action.

The question now is how can one possibly make sense of this information without accessing a supercomputer.

Follow along. The ONLY platform that I can co-opt is Webull's Desktop client.

The selection process is visualized.

Please pay attention.

Follow along. The ONLY platform that I can co-opt is Webull's Desktop client.

The selection process is visualized.

Please pay attention.

Unless one has access to an institutional broker with advanced technical analysis like Lightspeed, the only publicly accessible Desktop platform with consistent data is Webull's Desktop Client. This will NOT work on any mobile client.

Here is how to set up the Webull platform.

Here is how to set up the Webull platform.

This will involve layout customization.

Include a tab for every single SMA outfit.

On the SMA settings apply all SMAs so they are visible and distinct, color coding is typical.

Include a tab for every single SMA outfit.

On the SMA settings apply all SMAs so they are visible and distinct, color coding is typical.

The one caveat is that wealth professionals use all major timeframes, & Webull can only display a 3x3 timeframe grid in a single SMA outfit tab. It's limiting.

Precision detection systems distinguish between the 5s/15s/30s/1m/2m/3m/5m/10m/15m/20m/30m/1h/2h/4h/1d/1w/1m ... etc.

Precision detection systems distinguish between the 5s/15s/30s/1m/2m/3m/5m/10m/15m/20m/30m/1h/2h/4h/1d/1w/1m ... etc.

For the sake of access, since Webull only allows nine timeframes in a singular tab, simply include the following:

5s 15s 30s 1m 2m 3m 5m 30m 1d

That will look something like this.

5s 15s 30s 1m 2m 3m 5m 30m 1d

That will look something like this.

What has made this page stand out the most has been the live real time threaded blowout buying operations that wealth managers give out like candy to smaller firms. Documented for the first time ever, I've gone out of my way to share what every firm uses to wash wealth higher.

After it's all said and done, ONE of the programs used on the SMA outfits operates as following:

Wealth operators at the big firms select the lowest SMA of the outfit as a "selection" and that's where money managers place real time multibillion dollar bets.

Looks like this.

Wealth operators at the big firms select the lowest SMA of the outfit as a "selection" and that's where money managers place real time multibillion dollar bets.

Looks like this.

This is your portal to real time DOCUMENTED fraud operation in the United States institution.

Threaded from the moment of selection.

Threaded from the moment of selection.

https://x.com/rauItrades/status/1732143038653444247?s=20

https://x.com/rauItrades/status/1727350382488436901?s=20

https://x.com/rauItrades/status/1727334601188921727?s=20

https://x.com/rauItrades/status/1722647419383595346?s=20

https://x.com/rauItrades/status/1722358656182767938?s=20

https://x.com/rauItrades/status/1663998256685387776?s=20

Other times the program is on a higher SMA.

You can see it here so clearly.

You can see it here so clearly.

https://x.com/rauItrades/status/1704869290284085405?s=20

https://x.com/rauItrades/status/1710286567292670381?s=20

https://x.com/rauItrades/status/1638601824935772161?s=20

https://x.com/rauItrades/status/1735705820686672119?s=20

https://x.com/rauItrades/status/1615450881746694151?s=20

https://x.com/rauItrades/status/1719776408321527865?s=20

https://x.com/rauItrades/status/1679857048689999873?s=20

https://x.com/rauItrades/status/1725590210254381283?s=20

The list of corruption shared on this page is endless.

A live real time media section of 17,000+ documented organized crime in the financial markets.

For anyone curious about FOMC:

A live real time media section of 17,000+ documented organized crime in the financial markets.

For anyone curious about FOMC:

https://x.com/rauItrades/status/1653794015018631168?s=20

https://x.com/rauItrades/status/1679857554657255426?s=20

https://x.com/rauItrades/status/1681339351551340544?s=20

https://x.com/rauItrades/status/1638601697030475777?s=20

This is my public service. This information is partially useless for the average person to ever have tangible access to. At least now the Public will be able to visualize exactly how they are exploited.

How Firms use these operations to move markets higher and, eventually, lower.

How Firms use these operations to move markets higher and, eventually, lower.

• • •

Missing some Tweet in this thread? You can try to

force a refresh