Professional equity operator. Archival work documenting precision wealth transfer via the NYSE NASDAQ and leading equities.

5 subscribers

How to get URL link on X (Twitter) App

I should have waited for this program to commence but this a buying algorithm based on the news that 46's EV infrastructure bill is passing.

I should have waited for this program to commence but this a buying algorithm based on the news that 46's EV infrastructure bill is passing.

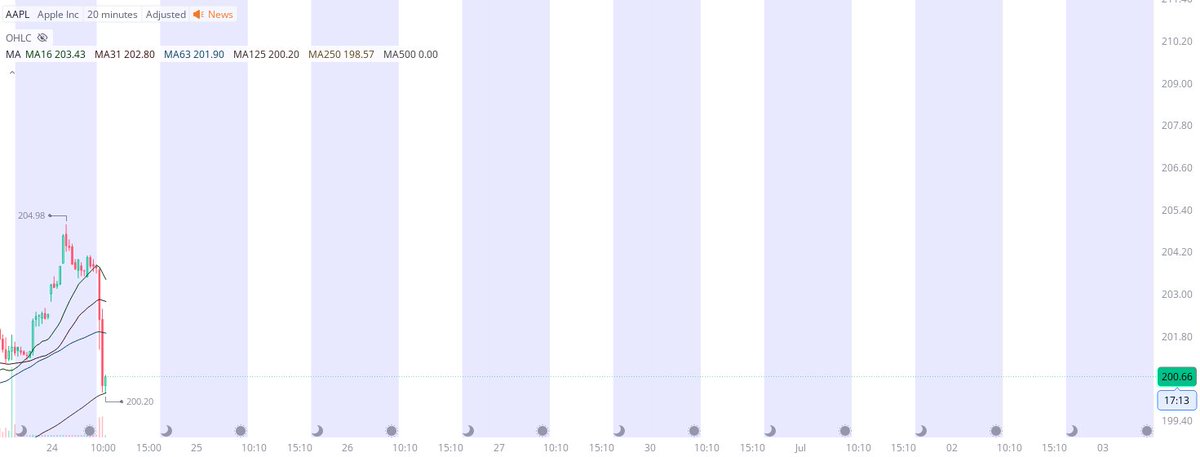

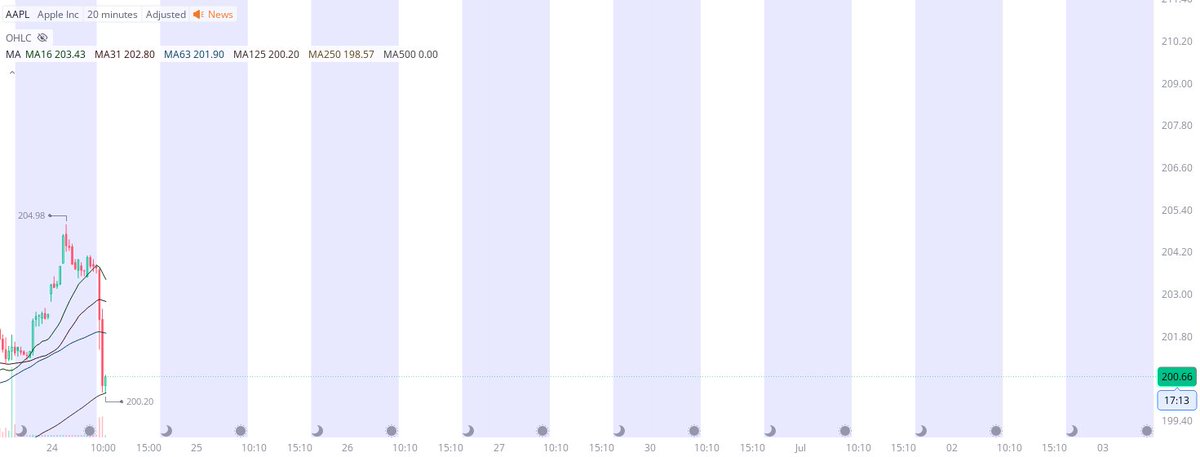

$AAPL

$AAPL

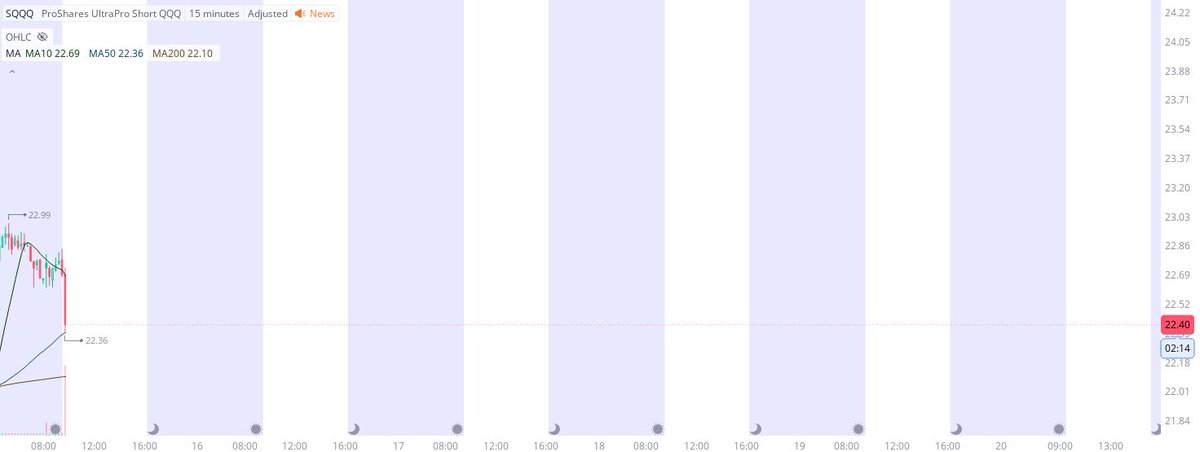

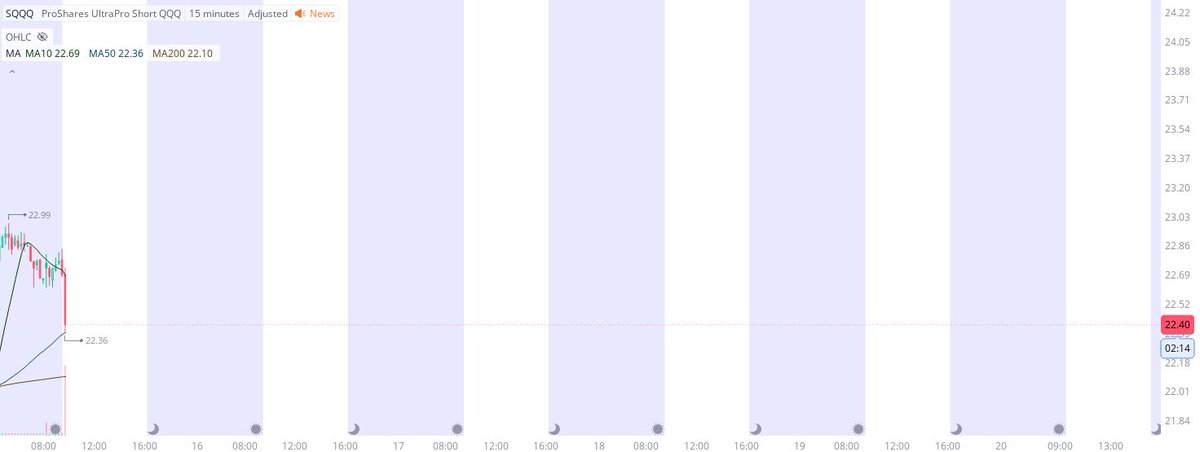

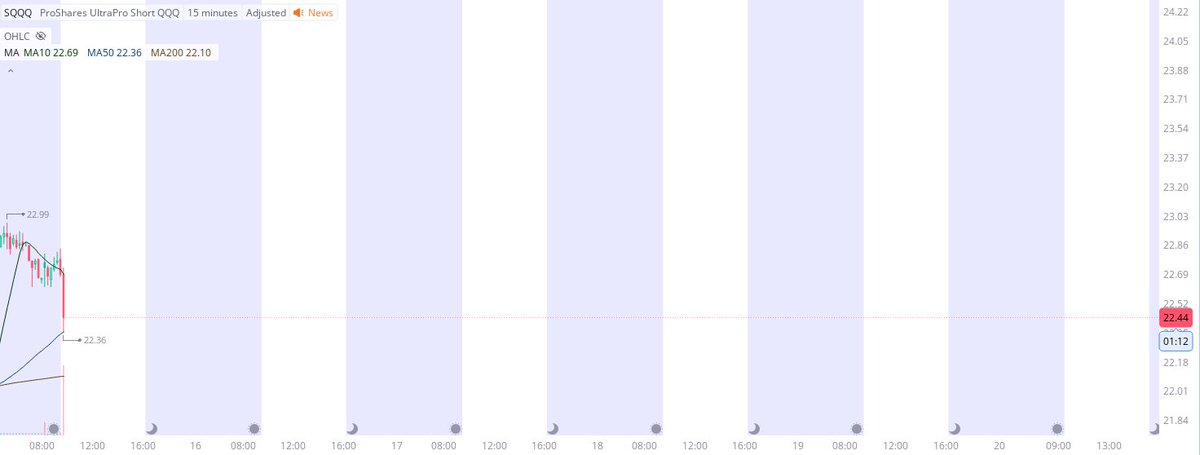

$SQQQ at 22.36 .

$SQQQ at 22.36 .

$SCO at 18.21 is only operating because of real time arbitrageurs operating the SCO on the Xi outfit. Leading trading divisions and leading trading systems have identified the hard stop order at precisely [MA448 18.20] to coordinate a bet short here, live and in real time.

$SCO at 18.21 is only operating because of real time arbitrageurs operating the SCO on the Xi outfit. Leading trading divisions and leading trading systems have identified the hard stop order at precisely [MA448 18.20] to coordinate a bet short here, live and in real time.

I purchased the ERX Direxion Daily Energy Bull 2X ETF because of the fact that XLE is operating on a blowout buying protocol at precisely 81.46. So as a conditional co-operation I've purchased the bullish 2x energy stock ERX.

I purchased the ERX Direxion Daily Energy Bull 2X ETF because of the fact that XLE is operating on a blowout buying protocol at precisely 81.46. So as a conditional co-operation I've purchased the bullish 2x energy stock ERX.

This is the XLE, The Energy Select Sector SPDR ETF operating on the 404 SMA Outfit.

This is the XLE, The Energy Select Sector SPDR ETF operating on the 404 SMA Outfit.

So that's:

So that's:

This is all operating while the S&P 500's System is negative, so keep that context in mind. The parameter limitations above are strict and this is all information shared live and in real time.

This is all operating while the S&P 500's System is negative, so keep that context in mind. The parameter limitations above are strict and this is all information shared live and in real time.

The reason I bought the NASDAQ QQQ here with 503.92 as risk is because earlier equities traded down using the [1H] programs on the [Xi Outfit].

The reason I bought the NASDAQ QQQ here with 503.92 as risk is because earlier equities traded down using the [1H] programs on the [Xi Outfit].

https://twitter.com/rauItrades/status/1798082384459599887

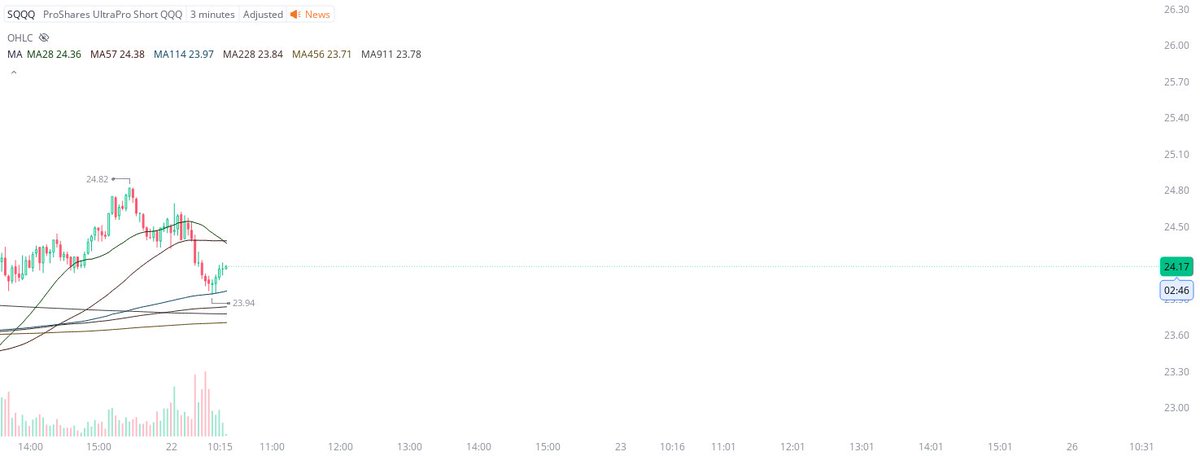

The SQQQ low was 7.73 . That's my risk.

The SQQQ low was 7.73 . That's my risk.

This is my third and final shot call at shorting semiconductors.

This is my third and final shot call at shorting semiconductors.

It's the only reason the US equity market stalled at lows from getting shorted all day.

It's the only reason the US equity market stalled at lows from getting shorted all day.

Unfortunately they complicate shorting equities like that because only JPM Blackrock and Citadel want to make their mark and profit so I will see this one through.

Unfortunately they complicate shorting equities like that because only JPM Blackrock and Citadel want to make their mark and profit so I will see this one through.

And the shorter term timeframe that was operated was this very specific 2m SPXU protocol at 26.04 .

And the shorter term timeframe that was operated was this very specific 2m SPXU protocol at 26.04 .