📯🇦🇪UAE's Mubadala Energy has announced the discovery of a large gas reserve in the🇮🇩Indonesia South Andaman field.

International companies are pivotal to boost domestic production and exports, even to🇪🇺EU countries.

Gas is also key for🇮🇩Indonesia energy transition.

🧵

International companies are pivotal to boost domestic production and exports, even to🇪🇺EU countries.

Gas is also key for🇮🇩Indonesia energy transition.

🧵

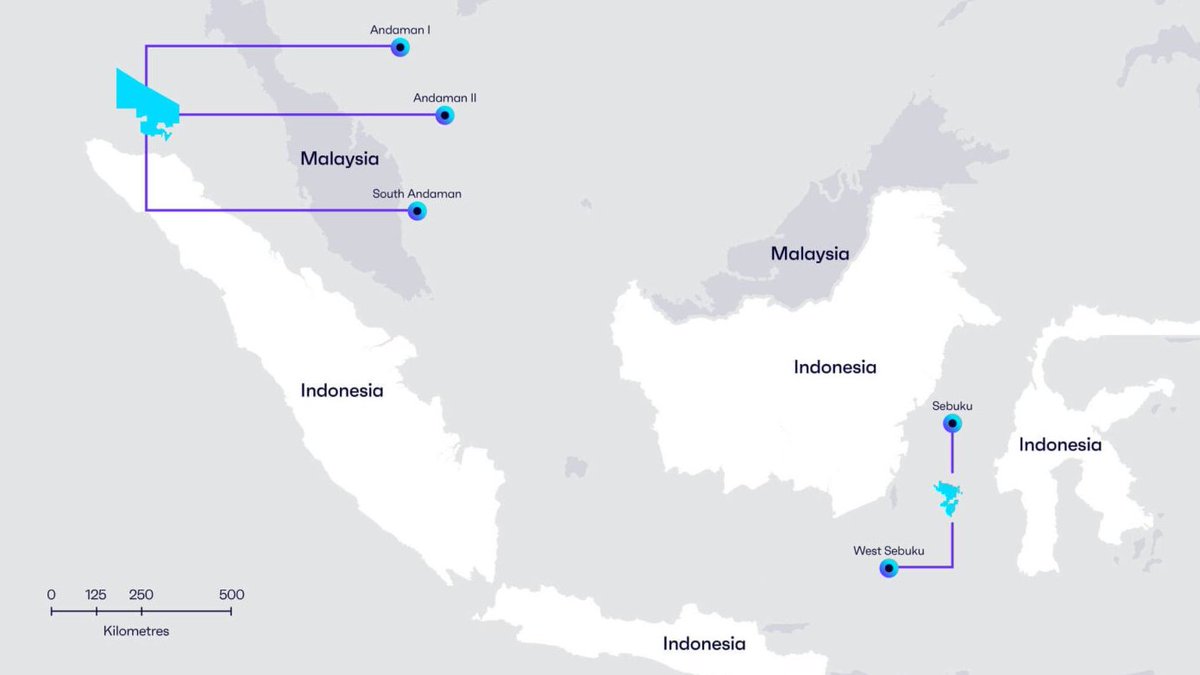

The one in the South Andaman field represents the world's second-largest deep water discovery this year. The field could contain close to 90 bcm of gas and it represents the first deep water operation for Mubadala, which is exploring 4 large areas in🇮🇩Indonesia since 2004

According to Mubadala's chief executive Mansoor Mohamed Al Hamed "This is not only a significant development for Mubadala Energy but a huge milestone for Indonesia’s and Southeast Asia’s energy security."

The discovery cements the company's global operations away from the Gulf

The discovery cements the company's global operations away from the Gulf

in Southeast Asia, where Mubadala has exploration fields in

🇹🇭Thailand

🇲🇾Malaysia

🇻🇳Vietnam

🇮🇩Indonesia

but also in

🇪🇬Egypt - Zohr gas field

🇷🇺Russia - Western Siberia oil fields in a JV with Gazpromneft-Vostok

🇹🇭Thailand

🇲🇾Malaysia

🇻🇳Vietnam

🇮🇩Indonesia

but also in

🇪🇬Egypt - Zohr gas field

🇷🇺Russia - Western Siberia oil fields in a JV with Gazpromneft-Vostok

Mubadala Energy is a state-owned enterprise fully controlled by a sole shareholder, the government of Abu Dhabi.

The company has not signed the Oil and Gas Decarbonization Charter at the recent COP28 in🇦🇪Dubai, with 50 companies pledging to slash methane emissions by 2030

The company has not signed the Oil and Gas Decarbonization Charter at the recent COP28 in🇦🇪Dubai, with 50 companies pledging to slash methane emissions by 2030

In October🇮🇹Italy's Eni announced the discovery of a large ultra-deep gas reserve in the Kutei Basin, among the largest for🇮🇩Indonesia in the past two decades, second only to Japan Inpex's Abadi field which will feed the 9.5 mtpa Abadi LNG terminal.

A project which FID has been

A project which FID has been

delayed several times.

In an effort to reduce imports and meet the country’s increasing energy demand, 🇮🇩Indonesia aims to boost its oil and gas production to respectively 1 million barrels of oil per day and 12 billion standard cubic feet per day by 2030.

In an effort to reduce imports and meet the country’s increasing energy demand, 🇮🇩Indonesia aims to boost its oil and gas production to respectively 1 million barrels of oil per day and 12 billion standard cubic feet per day by 2030.

Moreover,🇮🇩Indonesia plans to use gas as a transitional fuel to support the national energy system pivot away from coal. Jakarta is a major coal consumer and has a large fleet of coal power plants. Gas, together with a massive ramp-up of renewables, should

washingtonpost.com/politics/2022/…

washingtonpost.com/politics/2022/…

ensure energy security to a country willing to play a stronger role in the global gas market.

Within this frame🇮🇩Indonesia has strengthen relations with🇯🇵Japan and🇰🇷South Korea, but has also looked to the🇪🇺EU.

Within this frame🇮🇩Indonesia has strengthen relations with🇯🇵Japan and🇰🇷South Korea, but has also looked to the🇪🇺EU.

As an example, in late October🇮🇹Eni signed a 0.8 bcm LNG sales and purchase agreement with Merakes LNG Sellers, starting from January 2024 and lasting for 3 years.

In this regard, the escalation of the🇮🇱Israel-Hamas war and the stop of transit through the Red Sea does not help.

In this regard, the escalation of the🇮🇱Israel-Hamas war and the stop of transit through the Red Sea does not help.

• • •

Missing some Tweet in this thread? You can try to

force a refresh