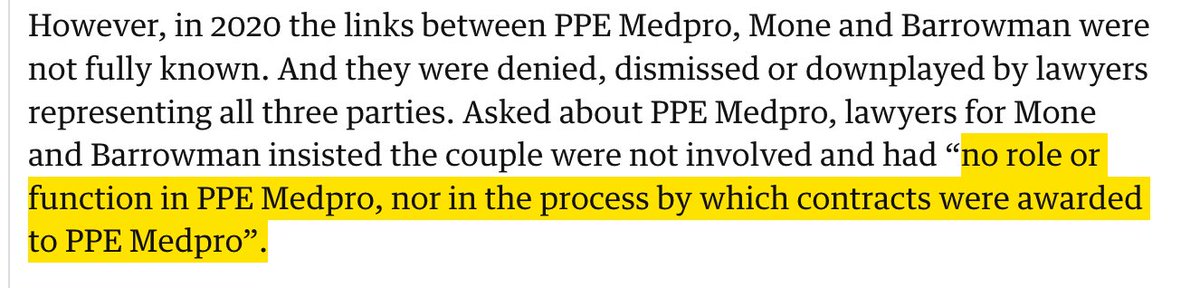

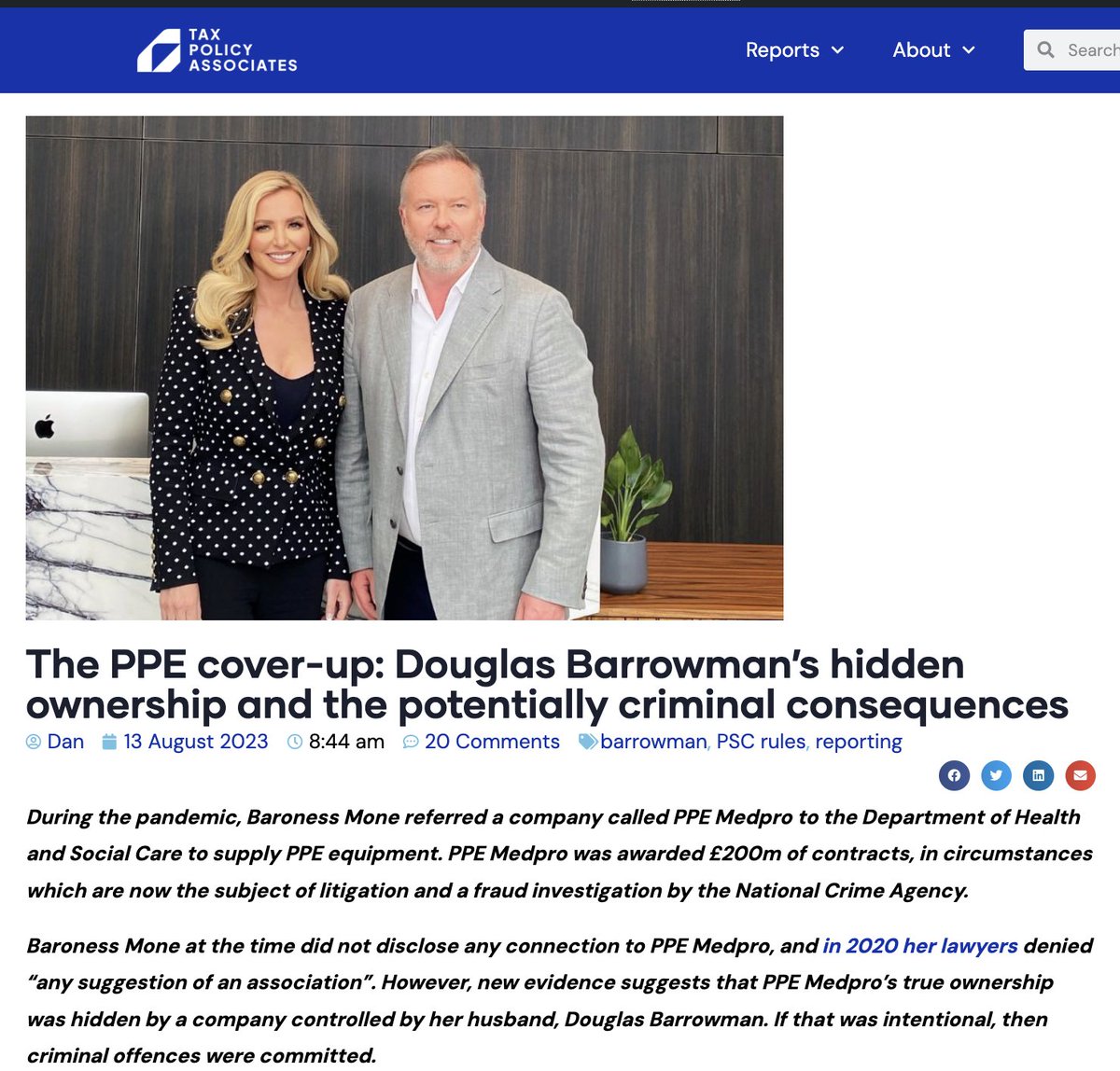

The "truth" this statement misses: Barrowman lied about his connection to PPE Medpro. The company and its directors probably committed a criminal offence in not disclosing that Barrowman controlled it. Barrowman plausibly committed an offence himself.

https://twitter.com/MichelleMone/status/1741746468329840866

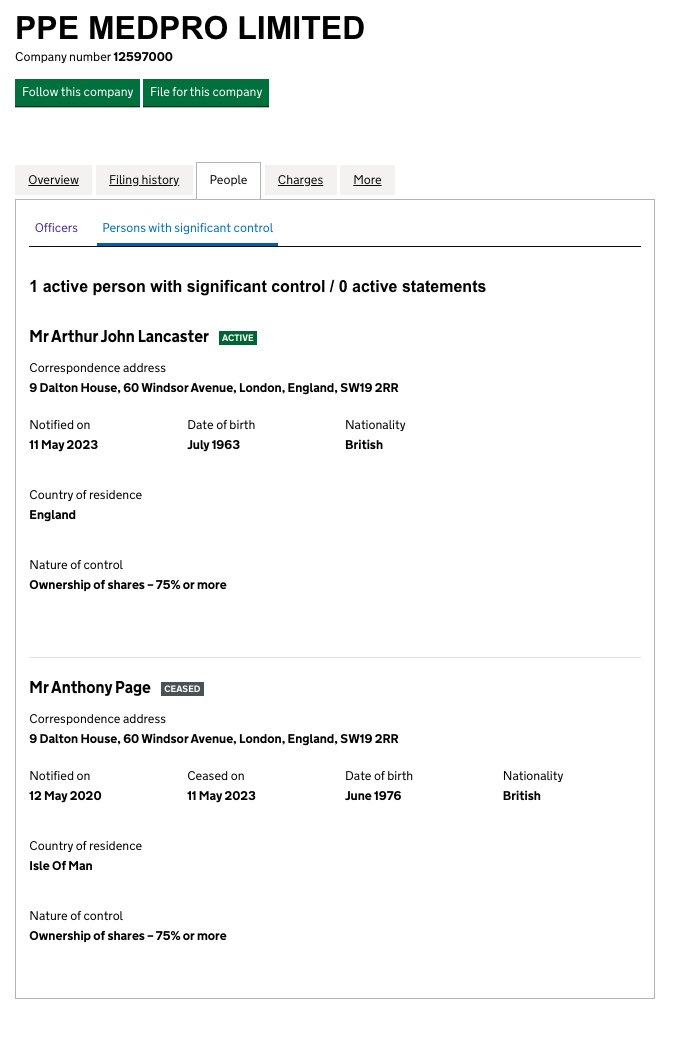

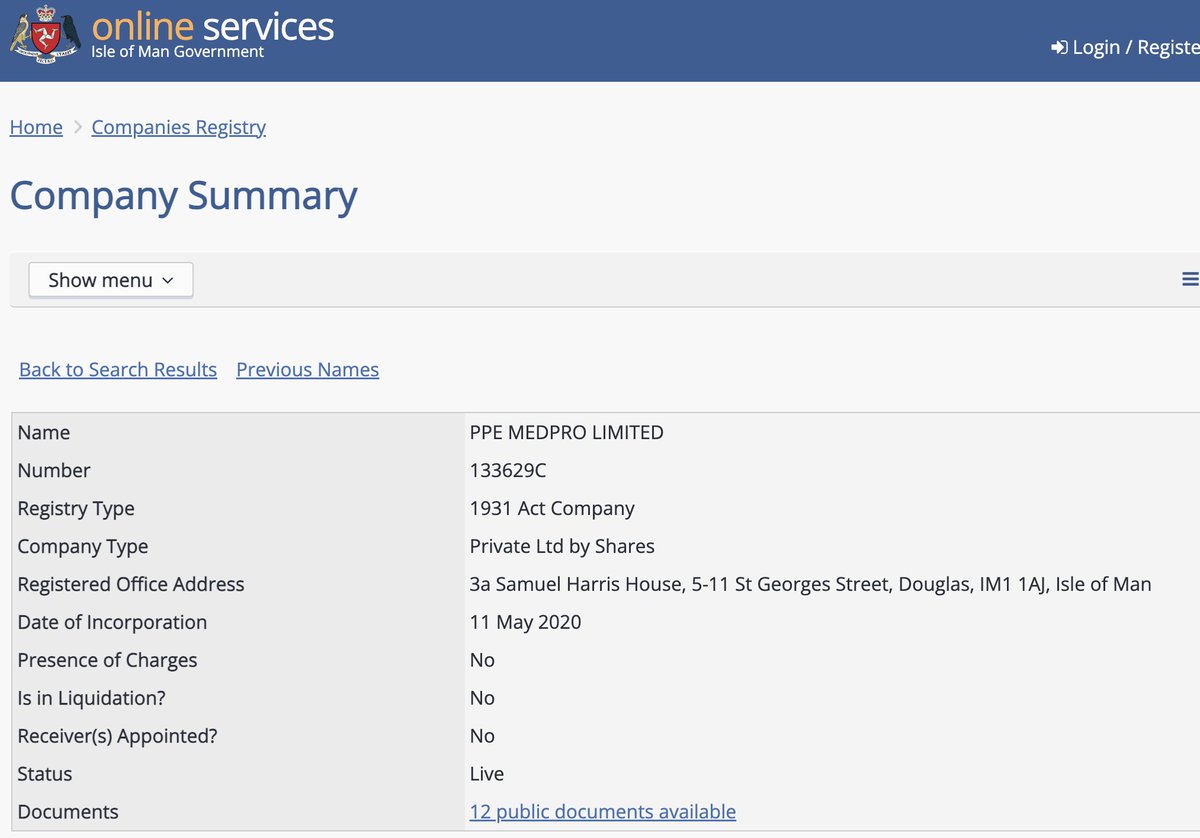

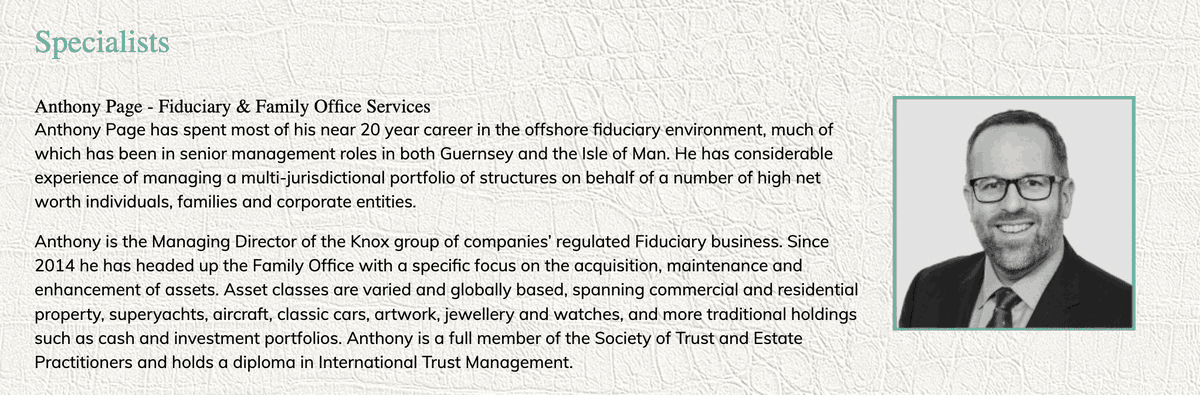

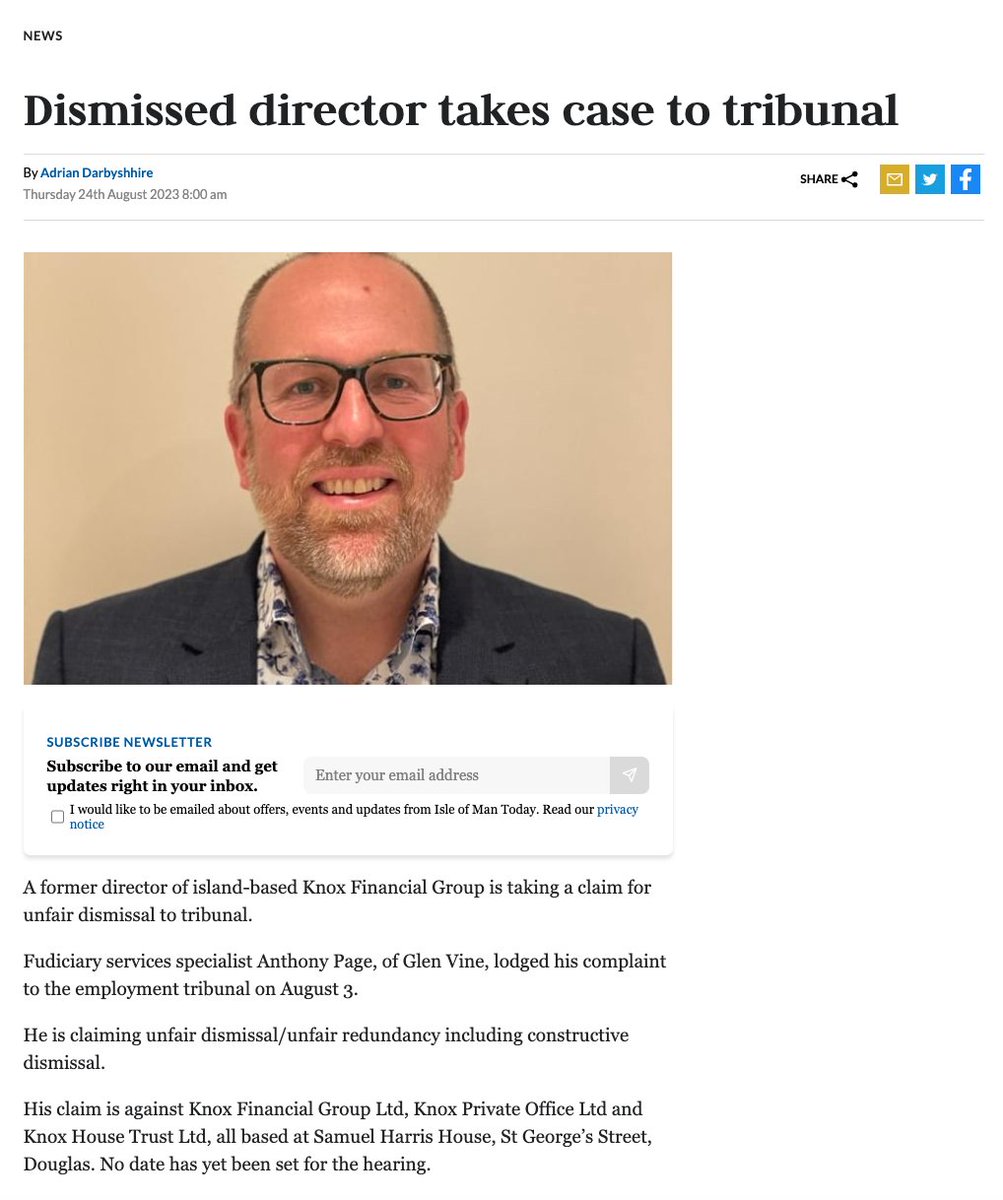

Anthony Page was initially listed as a "person with significant control" of PPE Medpro. He was an employee of Barrowman's until he was sacked...

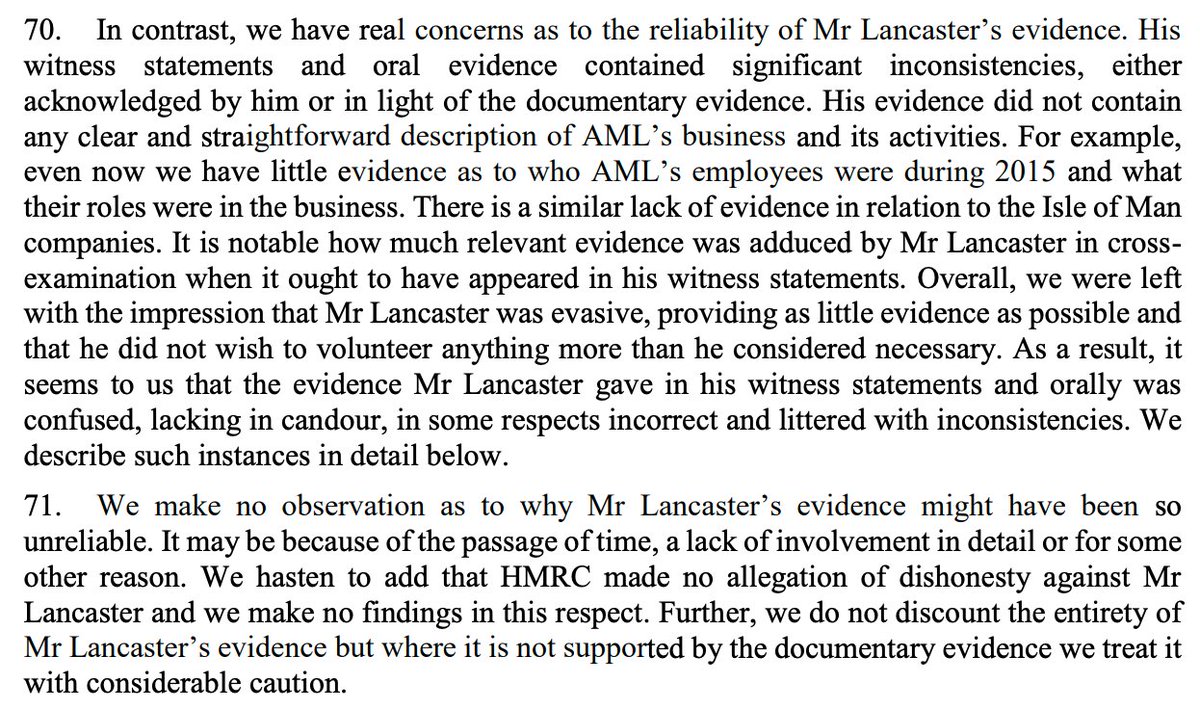

Whereupon he was replaced with Arthur Lancaster, another Barrowman employee. Lancaster, is an accountant who is closely connected to Douglas Barrowman, and was recently described by a tax tribunal as “seriously misleading”, “evasive” and “lacking in candor”.

So it's fairly obvious that Page and Lancaster didn't really control PPE Medpro - they were mere placemen. Barrowman should have been listed as the "person with significant control". The failure to do so was likely a criminal offence.

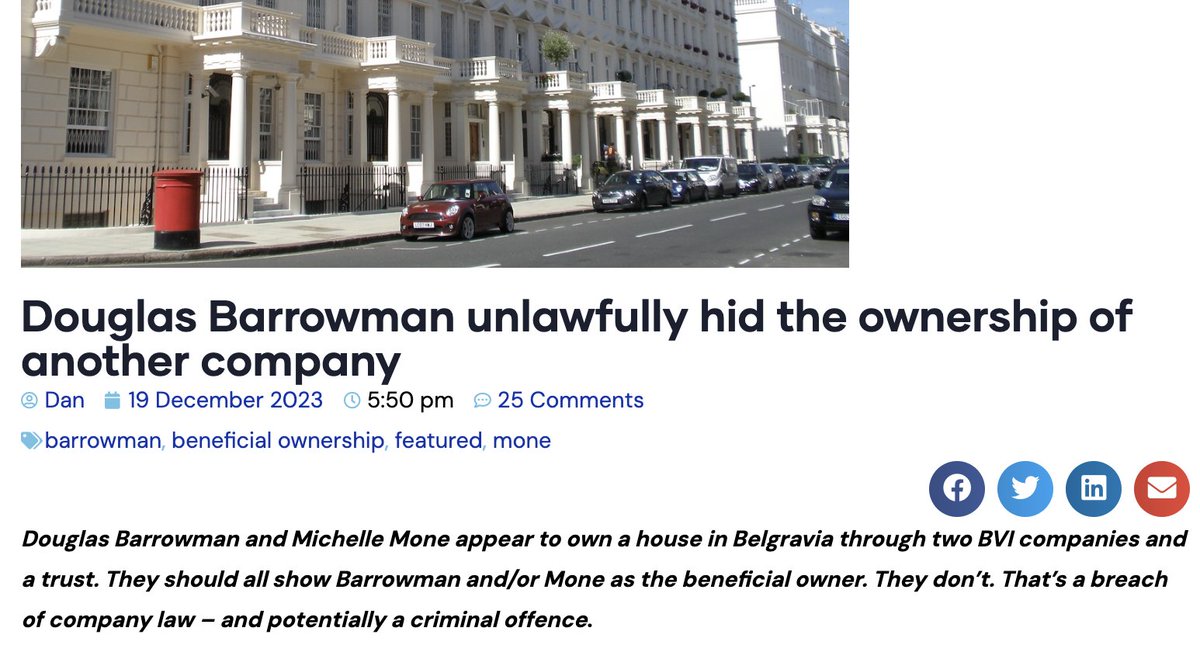

And it's not a one-off. There was a similar failure to disclose who holds Barrowman's Belgravia house: taxpolicy.org.uk/2023/12/19/oop…

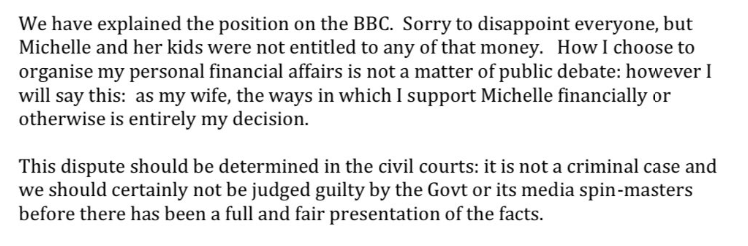

Barrowman says how he organises his affairs isn't a matter of public debate. It is when he breaks the law.

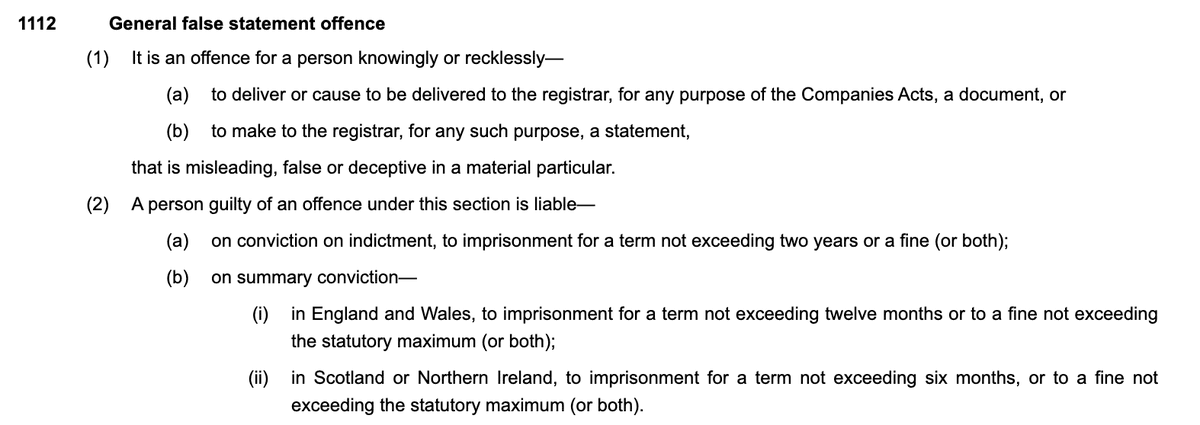

And he says it's not criminal matter. The Companies Act begs to disagree.

And he says it's not criminal matter. The Companies Act begs to disagree.

Some people in this position would run the defence of ignorance: the rules are complicated and they just had no idea.

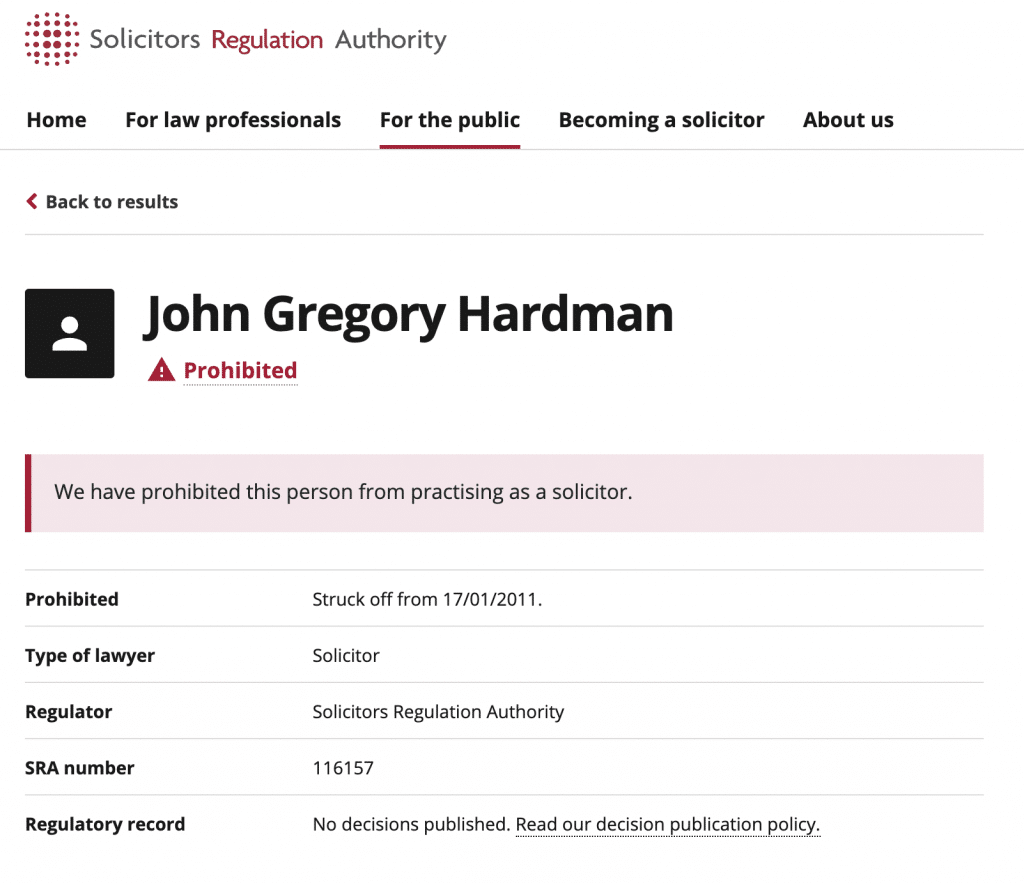

But Barrowman runs a group of companies that provide technical tax and legal services to private offices. Understanding rules like these should be part of their core expertise.

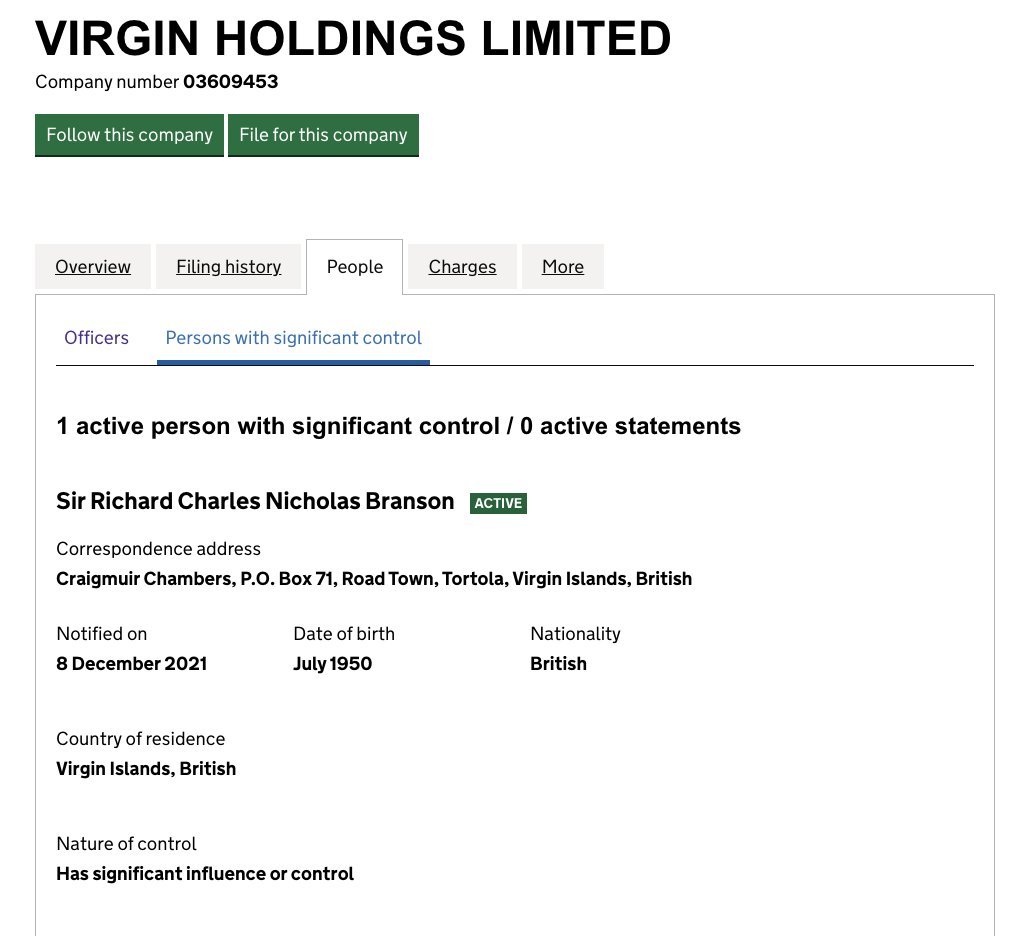

Other people wealthier than Barrowman, and with more complex and more international businesses, have no problem complying with these rules.

Richard Branson has a private office. He’s never been shy about his desire to minimise tax. But, quite properly, Mr Branson is listed as the beneficial owner of his main UK company.

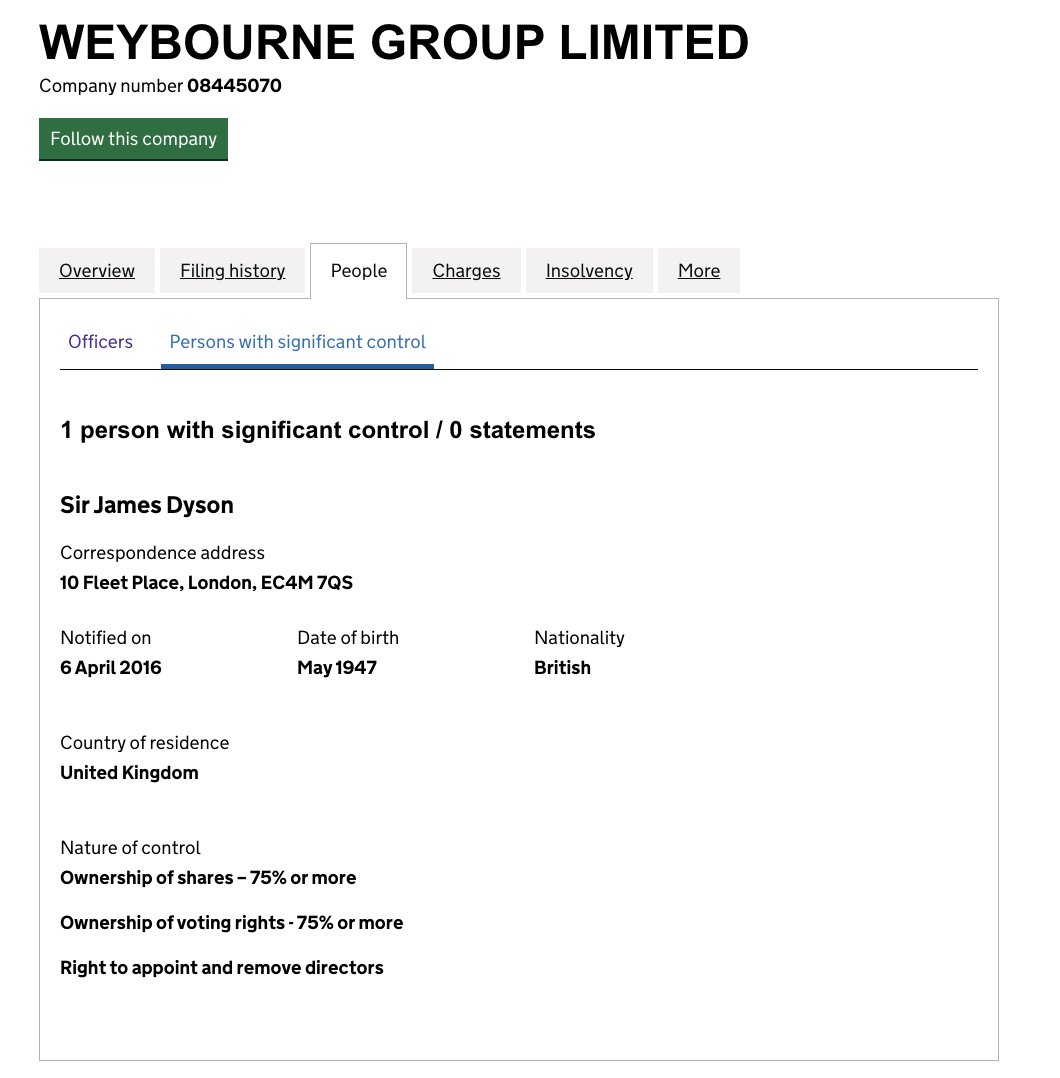

James Dyson has a family office. He’s no longer a director of Weybourne Group Limited, which holds some of his personal UK assets. Yet Weybourne, quite properly, lists Dyson as the person with significant control.

I know people who've advised Dyson, and the question always asked of them was: what risks are we running? What will the reputational consequences of this be?

Not questions that appear to bother Barrowman.

Not questions that appear to bother Barrowman.

Barrowman is shameless, and so confident that the rules won't be enforced, that even now - when he admits his role - he still hasn't corrected the Companies House entry for PPE Medpro.

Companies House, the CPS and the police have a choice. Prosecute Barrowman and his team for a breach that was both blatant and impactful.

Or get ready for absolutely everyone to ignore these rules. Because rules that are never enforced may as well not exist.

Or get ready for absolutely everyone to ignore these rules. Because rules that are never enforced may as well not exist.

More details here: taxpolicy.org.uk/2023/08/13/ppe…

• • •

Missing some Tweet in this thread? You can try to

force a refresh