Trading is hard but some "gurus" on this app make it even harder by trying to sell their "secrets" and scam you

I've been there, and it's frustrating.

So I created a completely FREE guide on everything you need to succeed in trading in 2024.

The Fundamentals Series 🧵

I've been there, and it's frustrating.

So I created a completely FREE guide on everything you need to succeed in trading in 2024.

The Fundamentals Series 🧵

The Fundamentals of Liquidity

This is the foundations of the markets. This is how the market operates. If someone wants to buy, there needs to be someone that sells.

Identify how this works on the charts and you'll have a solid foundation to start.

This is the foundations of the markets. This is how the market operates. If someone wants to buy, there needs to be someone that sells.

Identify how this works on the charts and you'll have a solid foundation to start.

https://twitter.com/1502512803693080581/status/1688082652455194624

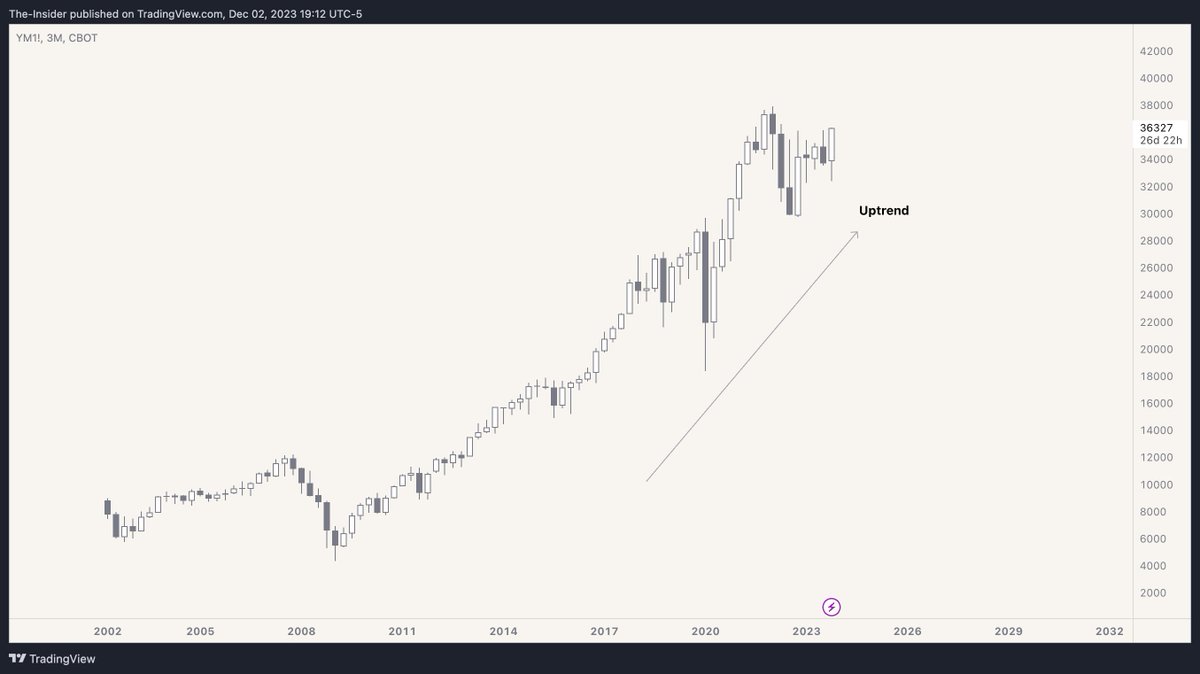

Market Structure

Determine if the market wants to go higher or lower.

The most underrated aspect in trading. It's simple but essential to understanding price

Determine if the market wants to go higher or lower.

The most underrated aspect in trading. It's simple but essential to understanding price

https://twitter.com/1502512803693080581/status/1690619308953538560

PD Array Matrix - Part 1

Identifying liquidity and structure is useless if you don't know where price will react from

Knowing where price will react from will show you when to enter & exit the markets

Identifying liquidity and structure is useless if you don't know where price will react from

Knowing where price will react from will show you when to enter & exit the markets

https://twitter.com/1502512803693080581/status/1700751779330220487

The Daily Bias

Now we put everything we have learnt to determine where price will head to next.

This can be used on all markets, including crypto, forex, futures, indices and stocks.

Now we put everything we have learnt to determine where price will head to next.

This can be used on all markets, including crypto, forex, futures, indices and stocks.

https://twitter.com/1502512803693080581/status/1731252246468235557

Time & Price

Now that you know where price will head to, you need to know WHEN to trade.

Time is as important as price. Master this and you won't be a slave to the markets.

Now that you know where price will head to, you need to know WHEN to trade.

Time is as important as price. Master this and you won't be a slave to the markets.

https://twitter.com/1502512803693080581/status/1733831247556706468

My Model

This is something most people will charge you for, but I won't.

Here is an exact model you can replicate to find success using ICTs methods and concepts.

This is something most people will charge you for, but I won't.

Here is an exact model you can replicate to find success using ICTs methods and concepts.

https://twitter.com/1502512803693080581/status/1738971294329176323

Risk Management

You have your model, you have your edge but you need to know how much to risk.

- Risk too much and you will blow your account

- Risk too little and you barely make enough to pass by

So this is a complete guide on my personal risk management strategies

You have your model, you have your edge but you need to know how much to risk.

- Risk too much and you will blow your account

- Risk too little and you barely make enough to pass by

So this is a complete guide on my personal risk management strategies

https://twitter.com/1502512803693080581/status/1741151291512909983

And that's a wrap! This is literally all you need to get started in 2024

But of course there's more to learn, and for that I've created a FREE Discord group where you can learn more.

Here's the invite link, enjoy!

discord.gg/CNAvHjw5q2

But of course there's more to learn, and for that I've created a FREE Discord group where you can learn more.

Here's the invite link, enjoy!

discord.gg/CNAvHjw5q2

• • •

Missing some Tweet in this thread? You can try to

force a refresh