How to get URL link on X (Twitter) App

First off, there are two types of market profiles we can use.

First off, there are two types of market profiles we can use.

There are only 2 main types of Liquidity in the market.

There are only 2 main types of Liquidity in the market.

First off, there are 2 types of liquidity you must know.

First off, there are 2 types of liquidity you must know.

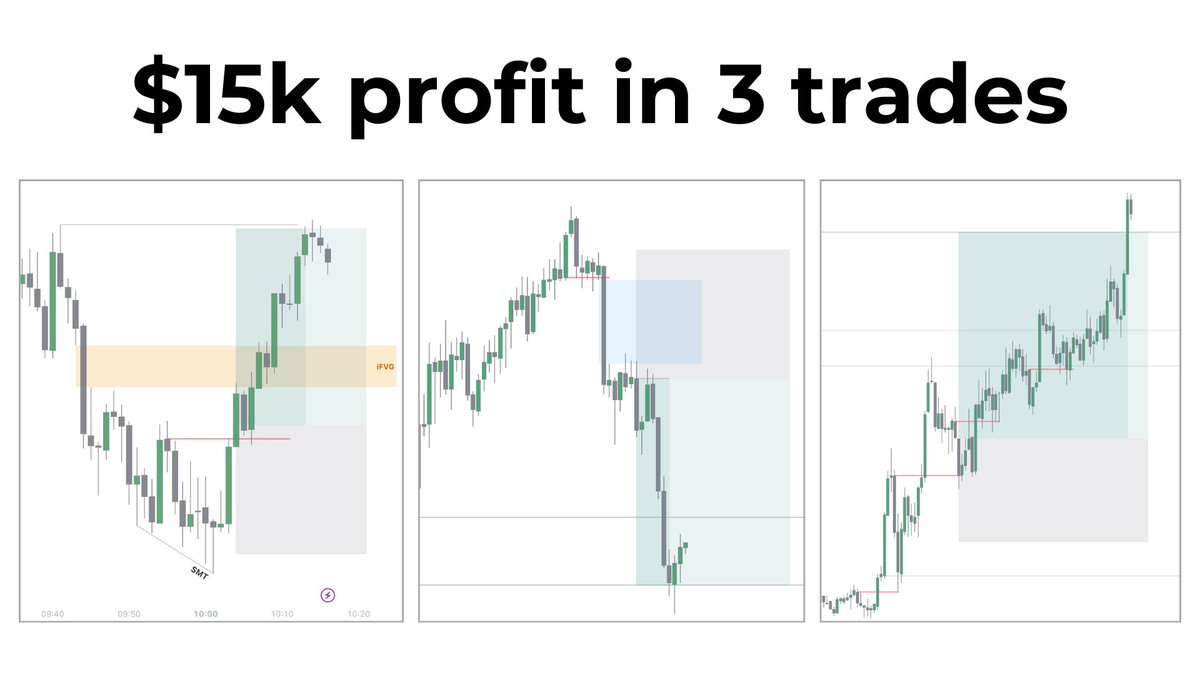

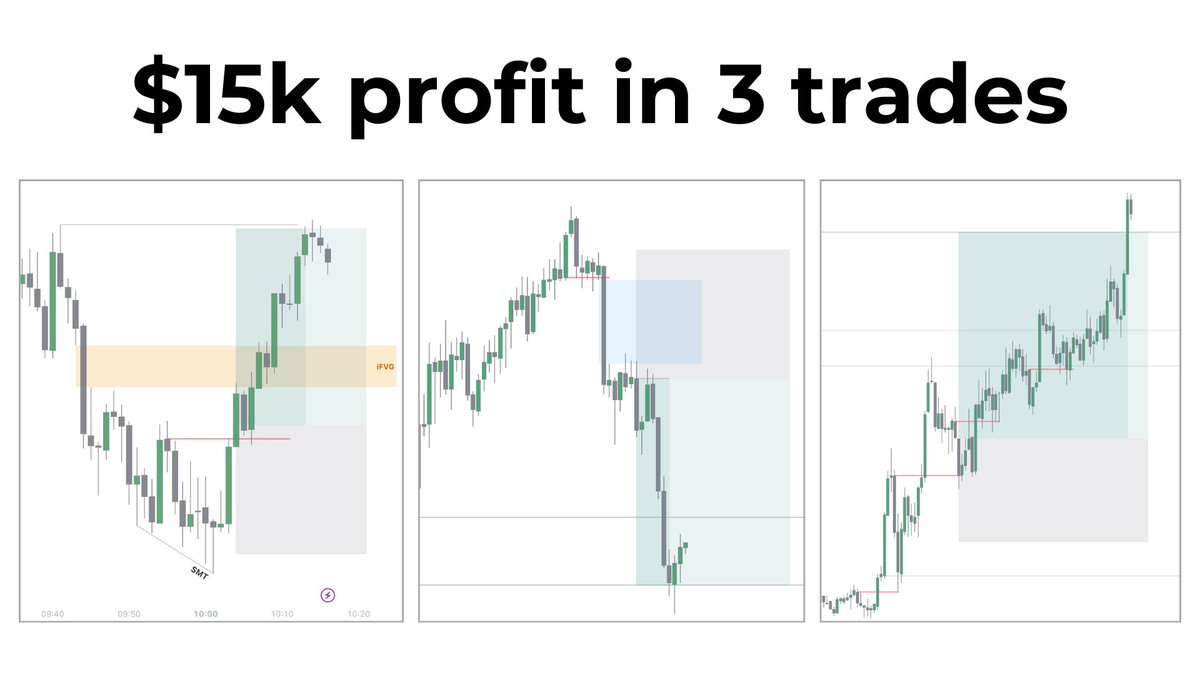

Trade #1

Trade #1

Here's what we'll be covering today:

Here's what we'll be covering today:

Start from the Weekly chart.

Start from the Weekly chart.

The Fundamentals of Liquidity

The Fundamentals of Liquidityhttps://twitter.com/1502512803693080581/status/1688082652455194624

First of all, you need to understand that each trader is different. Some would go more aggressive and some are more conservative.

First of all, you need to understand that each trader is different. Some would go more aggressive and some are more conservative.

First of all, I’d recommend all of you guys to read through The Fundamentals series before reading this thread.

First of all, I’d recommend all of you guys to read through The Fundamentals series before reading this thread.

First of all, if you haven’t read Part 1 of this series, go read it first before coming back here.

First of all, if you haven’t read Part 1 of this series, go read it first before coming back here. https://twitter.com/1502512803693080581/status/1733831247556706468

First of all, there are 3 aspects of time we must look at

First of all, there are 3 aspects of time we must look at

Before trying to determine the Daily Bias, you must first start out on the 3-Month chart

Before trying to determine the Daily Bias, you must first start out on the 3-Month chart

Before we start, if you haven’t read Part 2 of this series, do read it first before coming back here

Before we start, if you haven’t read Part 2 of this series, do read it first before coming back herehttps://twitter.com/TritonTrades/status/1702931165261246610

First of all, if you haven’t read Part 1 of this series, do read that first before coming back here.

First of all, if you haven’t read Part 1 of this series, do read that first before coming back here. https://twitter.com/TritonTrades/status/1700751779330220487

Today, we’ll be looking at the most common and easiest PD Array to learn. The “Fair Value Gap” (FVG)

Today, we’ll be looking at the most common and easiest PD Array to learn. The “Fair Value Gap” (FVG)

First up, if you haven’t read Part 2 of this series, do read it first before coming back here.

First up, if you haven’t read Part 2 of this series, do read it first before coming back here. https://twitter.com/TritonTrades/status/1692461243758457224

First up if you haven’t read the Part 1 of this series, I’d strongly suggest you go read that first before coming back to this.

First up if you haven’t read the Part 1 of this series, I’d strongly suggest you go read that first before coming back to this. https://twitter.com/TritonTrades/status/1690619308953538560

Let's start with the most basic foundation of market structure.

Let's start with the most basic foundation of market structure.

Before you learn how to identify liquidity, you must first learn what is liquidity? Liquidity is created with traders placing and executing orders in the markets. There are four types of Orders in the markets.

Before you learn how to identify liquidity, you must first learn what is liquidity? Liquidity is created with traders placing and executing orders in the markets. There are four types of Orders in the markets.