Private Equity, a lament 🧵

In which you will learn how a nearly invisible [to normies] group of financial wreckers has been exploiting the American economy for decades. It’s long and maybe tedious, but it’s an important way the wealthy in US have been extracting an ever greater share of the nation’s bounty.

I know I sound like a lefty here, and I have even surprised myself, given how hard right I am, to come to this conclusion.

Also, please forgive some of my ai generated illustrations. I had to do a lot of them and it was more time consuming than writing the copy, not to mention I’m not great at it. My experience with effort posting is that images are very important to keep people’s attention.

In which you will learn how a nearly invisible [to normies] group of financial wreckers has been exploiting the American economy for decades. It’s long and maybe tedious, but it’s an important way the wealthy in US have been extracting an ever greater share of the nation’s bounty.

I know I sound like a lefty here, and I have even surprised myself, given how hard right I am, to come to this conclusion.

Also, please forgive some of my ai generated illustrations. I had to do a lot of them and it was more time consuming than writing the copy, not to mention I’m not great at it. My experience with effort posting is that images are very important to keep people’s attention.

Over the past couple of years, investment management companies like Black Rock, State Street, and Vanguard have been excoriated on twitter for pushing ESG, buying up private houses, and in general ruining America for regular people.

I have been gently pushing back on this focus. The main problem with them (call them hedge funds, asset managers, whatever) is the concentration of power in the hands of finks like Larry Fink. The underlying business model is not horrible (buy and manage assets on behalf of investors). They also benefit ordinary people because they try to make money for pensions, 401K’s, and other savings of ordinary people. Another reason I can’t get very excited about them is because:

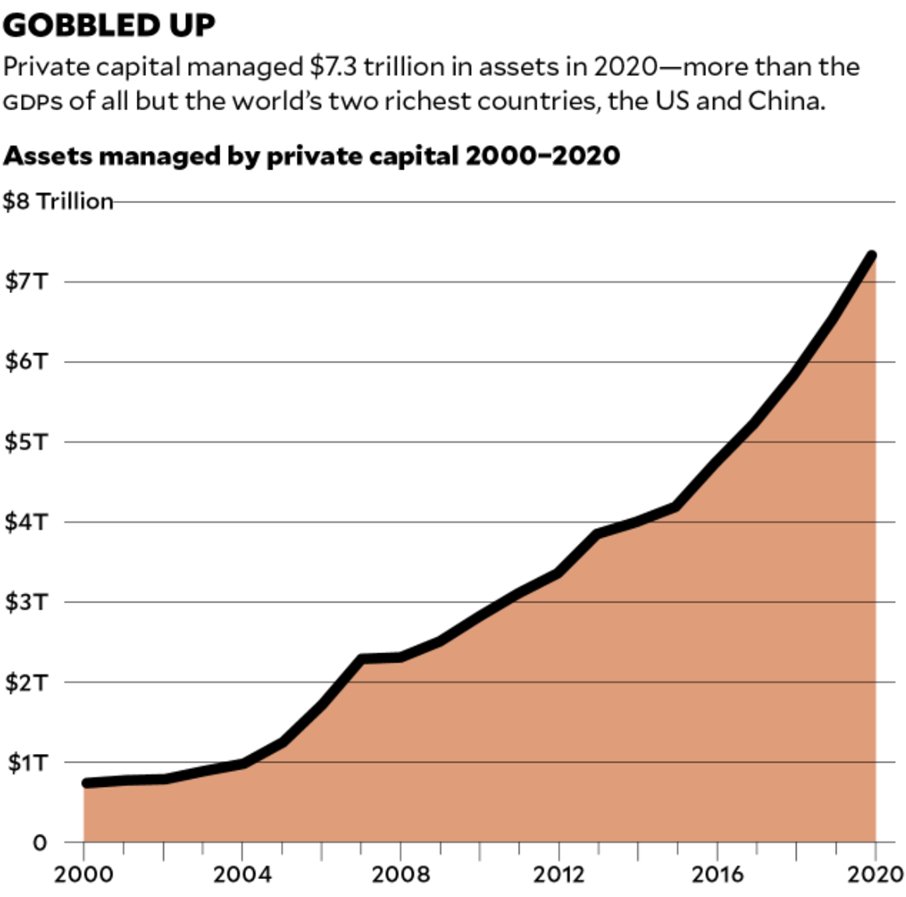

I’d wager not many of them (note Blackstone not the same as BlackRock!). But these behemoths and others like them now control trillions of dollars in assets, and they've been growing rapidly for decades.

They’re called private equity (PE). The purpose of this thread is to persuade you that private equity’s business model is cursed and should be illegal. The best estimates I could find indicate that right now over 6% of US GDP is now controlled by PE firms.*

*Take #’s in this thread as approximate – one of the many issues with private equity is that so much about it is opaque (Private – it’s literally in the name). eg the numbers in this graph probably include venture capital and other assets not subject to the traditional PE model.

They’re called private equity (PE). The purpose of this thread is to persuade you that private equity’s business model is cursed and should be illegal. The best estimates I could find indicate that right now over 6% of US GDP is now controlled by PE firms.*

*Take #’s in this thread as approximate – one of the many issues with private equity is that so much about it is opaque (Private – it’s literally in the name). eg the numbers in this graph probably include venture capital and other assets not subject to the traditional PE model.

What is “private equity”? In a broad sense, it’s capital not held in a publicly traded company. It includes privately-held companies, startups, real estate, private loans, etc. But for the purpose of this thread, I’m talking about a very specific business model that has come to be synonymous with the term “private equity”.

Aside: the backlash against PE has begun and many of these companies are rebranding as “alternative asset managers”. Don’t be fooled – they are doing the same things.

Watch this to a) see how PE firms view themselves and to b) to marvel at the cringe

Watch this to a) see how PE firms view themselves and to b) to marvel at the cringe

https://twitter.com/i/status/1735333244063694870

The PE business model:

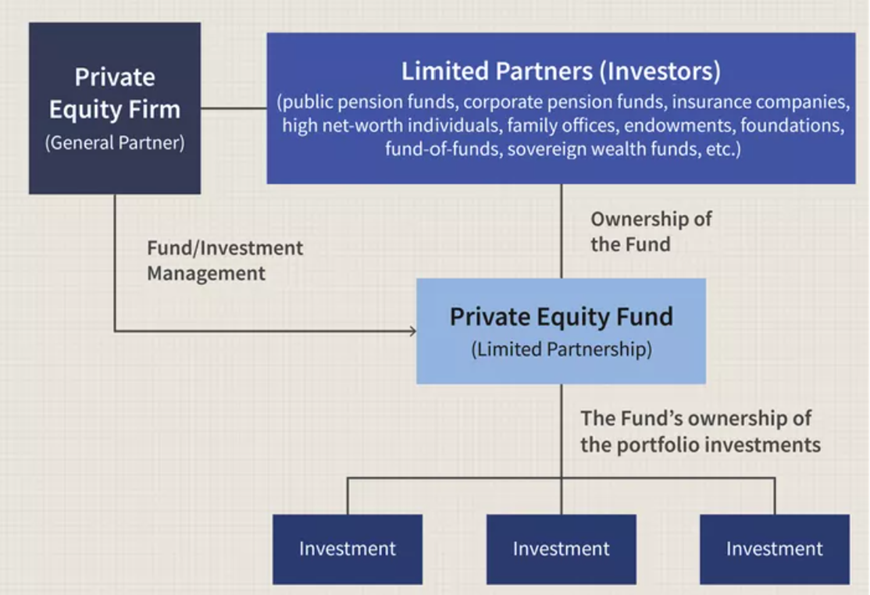

1) The PE firm injects a little bit of capital, solicits additional capital from other deep pockets*, forms a separate company (the “fund”) and has that company borrow a whole bunch more money (typically 50-80% of the entire fund value). But be not deceived: though a separate legal entity, the fund is entirely a puppet of the PE firm.

* Note that unless you are rich it’s been literally illegal to invest in these funds. Until very recently.

1) The PE firm injects a little bit of capital, solicits additional capital from other deep pockets*, forms a separate company (the “fund”) and has that company borrow a whole bunch more money (typically 50-80% of the entire fund value). But be not deceived: though a separate legal entity, the fund is entirely a puppet of the PE firm.

* Note that unless you are rich it’s been literally illegal to invest in these funds. Until very recently.

2) Now the fund goes forth and buys. It might buy one big company, or a bunch of smaller ones. If buying multiple companies, there will typically be a theme, or story to tell investors, relating to supposed synergies among the companies. Eg “green energy tax credit farming” or “Canadian healthcare informatics”. Or it might be a consolidation play – often called a “rollup”. Eg “we are buying up every 25+ headcount HVAC company we can find.”

The PE firm usually gets a transaction fee from the fund on every deal it completes (like 1% of value).

The PE firm usually gets a transaction fee from the fund on every deal it completes (like 1% of value).

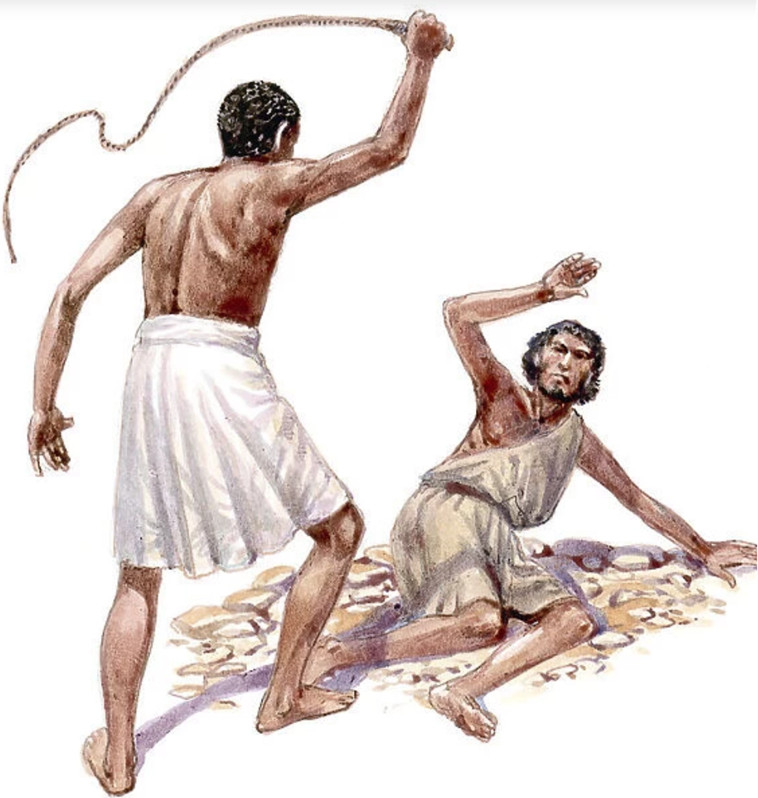

3) Put all the fund portfolio companies on a financial rack and torture them into surrendering every bit of cash they possible can. Yeah, inflammatory language, but this is how I see it. I’ll expand on what this looks like a bit further down.

4) Profit! This comes in a few different ways. The PE firms operate on the notorious “2 & 20” rule. They get 2% of the fund’s value every year as a management fee. The 20% is a “performance incentive fee” and is levied against any earnings of portfolio and gains from any sales of the companies. They also can extract cash via “dividend recapitalization” which is a special kind of evil, covered below.

5) The endgame – sell it. After 2-5 years of hard squeezing, the PE firm typically looks to flip the fund (called an exit). Often the potential customers in these deals are other PE firms. There are other ways to restructure the fund’s capital and buyout investors and bring in new ones, but I don’t want to get into the weeds.

This business model has been around for a long time. If you are very old, like me, you may remember the intense controversy around “Leveraged Buyouts” or LBO’s, in the 1980’s. That culminated in KKR’s purchase of RJR Nabisco in 1989. When I first became aware of PE shenanigans a couple of years ago, KKR was the only large PE firm I recognized. In spite of all the caterwauling, nothing was done.

So what’s wrong with all this? Pretty much everything. Let’s start with the legal structure. The debts incurred and the legal liabilities are all owned by the fund, and PE companies employ the best legal minds in the country to keep this firewall intact, even though the funds are entirely their creatures. The boards and management of these funds are hand-picked, incentivized, and take orders from the PE firms. In spite of this, when their funds screw up egregiously and hurt people (often in shocking ways), the PE firms shelter behind these liability shields. Same with bankruptcy.

Second – what they do to companies. It’s a relentless focus on EBITDA (just think “profits”). PE firms often tout themselves as savvy “operators.” It sounds like they are business experts who are good at managing people, processes, and products. What it really means is they are good at cutting staff, increasing hours, cheapening products & services, and raising prices. This is the “value creation” they are forever boasting about.

This is bad enough when the company is selling widgets, but imagine what happens when a PE fund gets hold of a nursing home or hospital.

This is bad enough when the company is selling widgets, but imagine what happens when a PE fund gets hold of a nursing home or hospital.

Those are general criticisms. But the PE playbook has some specific and very egregious moves. The first is real estate sale & leaseback. For companies with expensive real estate assets (think businesses like retail or nursing homes), the fund will force their sale.

The company then has to lease back the facilities they used to own. The proceeds then flow to the investors and PE firms as dividends or debt reduction.

This is just odious asset stripping and is inherently destabilizing. Saddled with high fixed costs and no longer able to access lines of credit collateralized against real estate, this technique has forced many firms into bankruptcy.

The company then has to lease back the facilities they used to own. The proceeds then flow to the investors and PE firms as dividends or debt reduction.

This is just odious asset stripping and is inherently destabilizing. Saddled with high fixed costs and no longer able to access lines of credit collateralized against real estate, this technique has forced many firms into bankruptcy.

I mentioned dividend recapitalization. This involves forcing the companies or the PE fund to take out further loans in order to pay the investors (and the PE firm) a dividend.

Please read that again. It is mind-boggling to me why this is legal. Dividends are supposed to be a way to pass profits to investors. In the absence of the requisite profits, PE just commandeers their portfolio’s credit card.

Please read that again. It is mind-boggling to me why this is legal. Dividends are supposed to be a way to pass profits to investors. In the absence of the requisite profits, PE just commandeers their portfolio’s credit card.

Next up: bankruptcy for profit. PE firms are adept at using the bankruptcy code to their advantage. If a portfolio company has a defined benefit pension (vanishingly rare now in 21st century America), the PE firm can force it into bankruptcy, and hive off the pension obligations to the government or disappear them altogether.

This is a typical move when PE just wants to strip mine the assets. But if there is anything of the carcass left, they can wind up still owning the company after bankruptcy, after having shed liabilities to employees and creditors.

I don’t want to exaggerate how often this happens, but if a PE firm’s spreadsheets indicate the company is worth more dead than alive, they will absolutely do it.

This is a typical move when PE just wants to strip mine the assets. But if there is anything of the carcass left, they can wind up still owning the company after bankruptcy, after having shed liabilities to employees and creditors.

I don’t want to exaggerate how often this happens, but if a PE firm’s spreadsheets indicate the company is worth more dead than alive, they will absolutely do it.

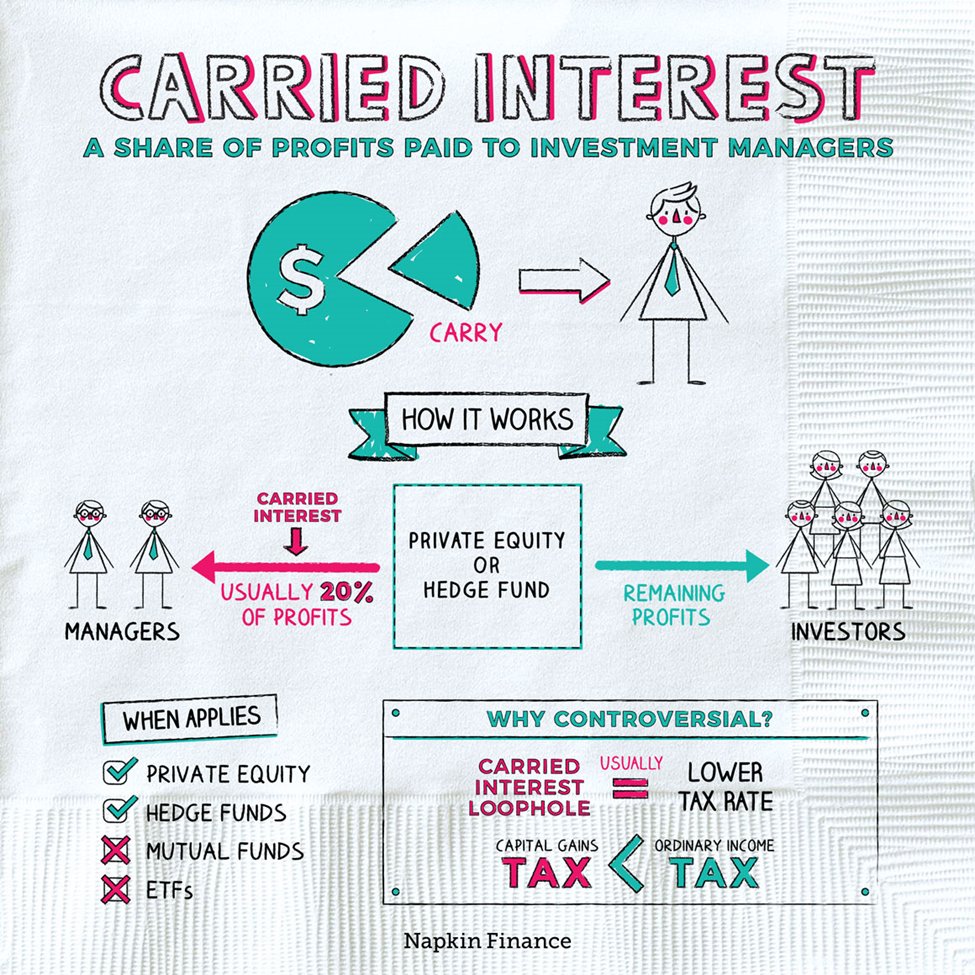

The last specific thing I want to cover is the so-called carried interest tax loophole. This is less about direct destruction PE firms cause than it is about the wages of their sin. The carried interest dodge allows PE firms (among others such as hedge fund managers & VC’s) to treat their 20% performance fee to be taxed at the lower capital gains rate rather than as ordinary income.

I want to remind you of the rationalization for taxing capital gains at a lower rate – it’s to compensate investors for risking capital that theoretically will benefit everyone through expansion of economic activity. I’m not arguing for this rationalization (I’ve been moving “left” on this question for a while) just pointing it out in this context.

Why is this benefit conferred on PE firms? They aren’t risking their own capital. Sure they carry reputational risk and are exposed to opportunity cost, so does every one else. PE firms take every precaution to shield themselves from financial and legal risk. There is absolutely no reason to offer them a lower tax rate.

In the scheme of things, the cost to the US government for this tax loophole is pretty minor (estimates I’ve seen put it at between 1 and 2 billion a year). It’s just another irritating reminder of how the wealthy rig the system to benefit themselves.

I want to remind you of the rationalization for taxing capital gains at a lower rate – it’s to compensate investors for risking capital that theoretically will benefit everyone through expansion of economic activity. I’m not arguing for this rationalization (I’ve been moving “left” on this question for a while) just pointing it out in this context.

Why is this benefit conferred on PE firms? They aren’t risking their own capital. Sure they carry reputational risk and are exposed to opportunity cost, so does every one else. PE firms take every precaution to shield themselves from financial and legal risk. There is absolutely no reason to offer them a lower tax rate.

In the scheme of things, the cost to the US government for this tax loophole is pretty minor (estimates I’ve seen put it at between 1 and 2 billion a year). It’s just another irritating reminder of how the wealthy rig the system to benefit themselves.

The carried interest loophole is a good reason to bring up another evil of private equity – the objectively corrupt way in which it affects our politics and legal system. PE excels at recruiting politicians and senior ex-bureaucrats into its ranks. Coupled with huge political and lobbying outlays, PE is able to influence laws and regulations to shape the marketplace in its favor. In spite of big momentum behind the effort to kill the carried interest loophole in more than one administration (even Trump wanted to get rid of it). Biden wanted to axe it, but owing to last minute objections from Kristen Sinema (why would she care?), it survives.

I want to draw this thread to a close by talking about the future of Private Equity. Recent interest rate hikes have damped down PE M&A activity. Sidebar: fed haters deserve a shoutout about the destructive effects of artificially cheap money, of which this is a prime example.

But private equity has grown so large that they have begun to look at other sources of leverage. Namely themselves. Yes, PE is increasingly sourcing the loans as private credit and getting a cut of those sweet interest payments. But they are not only lending to fund their own deals, they are getting into every sort of loan – like mortgages and consumer credit.

Because this activity has nowhere near the regulation or oversite than banks have, this increases the overall systemic risk in the economy.

But private equity has grown so large that they have begun to look at other sources of leverage. Namely themselves. Yes, PE is increasingly sourcing the loans as private credit and getting a cut of those sweet interest payments. But they are not only lending to fund their own deals, they are getting into every sort of loan – like mortgages and consumer credit.

Because this activity has nowhere near the regulation or oversite than banks have, this increases the overall systemic risk in the economy.

Another big change looming on the horizon is opening up retirement assets as a source of funding for PE.

Remember when I said that you had to be rich to invest in PE funds? Very recent rule changes by various organs of the US government have changed that – 401k’s can now get in.

Now one might argue that if we are going to pick the bones of the US economy, letting the little people have a scrap of gristle makes sense.

No. The PE business model is inherently bad and giving them access to more money will just accelerate the destruction and risk.

I have a counter-proposal: make the whole business model illegal.

Remember when I said that you had to be rich to invest in PE funds? Very recent rule changes by various organs of the US government have changed that – 401k’s can now get in.

Now one might argue that if we are going to pick the bones of the US economy, letting the little people have a scrap of gristle makes sense.

No. The PE business model is inherently bad and giving them access to more money will just accelerate the destruction and risk.

I have a counter-proposal: make the whole business model illegal.

PE is now aggressively moving into insurance. They already control over 10% of all life insurance & annuity policies in the US. They are doing the kinds of things you would expect: investing customer premiums in their own schemes, setting up captive re-insurers in Bermuda, and lobbying state regulators hard for favorable treatment.

I am growing weary as I expect you are. I have two footnotes that I have to include before I’m done. The first is this book, which I teased a few weeks ago.

It’s a good introduction, though I was kind of surprised how little I learned. It’s mostly a recitation of shocking individual PE disaster stories. I would caution that you might get the impression that those incidents are the norm rather than the exception. But the decline in care at PE run nursing homes and hospitals is real and documented.

Also, Ballou is very, very left-wing. I lost count of the number of “women and minorities hit hardest”.

A note to leftists everywhere: if something is bad, the concentration of effects on women and minorities does not make it worse.

There is one anecdote, however, about how one mega-rich PE guy got exploded on his own BLM endorsing petard, and it made me laugh. Of course, Ballou also rejoiced, but in a different way for different reasons.

It’s a good introduction, though I was kind of surprised how little I learned. It’s mostly a recitation of shocking individual PE disaster stories. I would caution that you might get the impression that those incidents are the norm rather than the exception. But the decline in care at PE run nursing homes and hospitals is real and documented.

Also, Ballou is very, very left-wing. I lost count of the number of “women and minorities hit hardest”.

A note to leftists everywhere: if something is bad, the concentration of effects on women and minorities does not make it worse.

There is one anecdote, however, about how one mega-rich PE guy got exploded on his own BLM endorsing petard, and it made me laugh. Of course, Ballou also rejoiced, but in a different way for different reasons.

Final footnote: you may notice that the structure of Elon’s Twitter buyout is uncomfortably close to the PE playbook I outlined above.

1 borrow billions

2 acquire company

3 fire a bunch of people

A thorough-going extirpation of this business model might have prevented the salutary liberation of twitter and similar future triumphs.

I have thought a lot about this, and it’s probably impossible to carve out some exception for our guys and our purposes, and I’m ok with that.

Realistically, nothing along these lines will happen without root-and-branch regime change anyway.

/fin!

1 borrow billions

2 acquire company

3 fire a bunch of people

A thorough-going extirpation of this business model might have prevented the salutary liberation of twitter and similar future triumphs.

I have thought a lot about this, and it’s probably impossible to carve out some exception for our guys and our purposes, and I’m ok with that.

Realistically, nothing along these lines will happen without root-and-branch regime change anyway.

/fin!

• • •

Missing some Tweet in this thread? You can try to

force a refresh