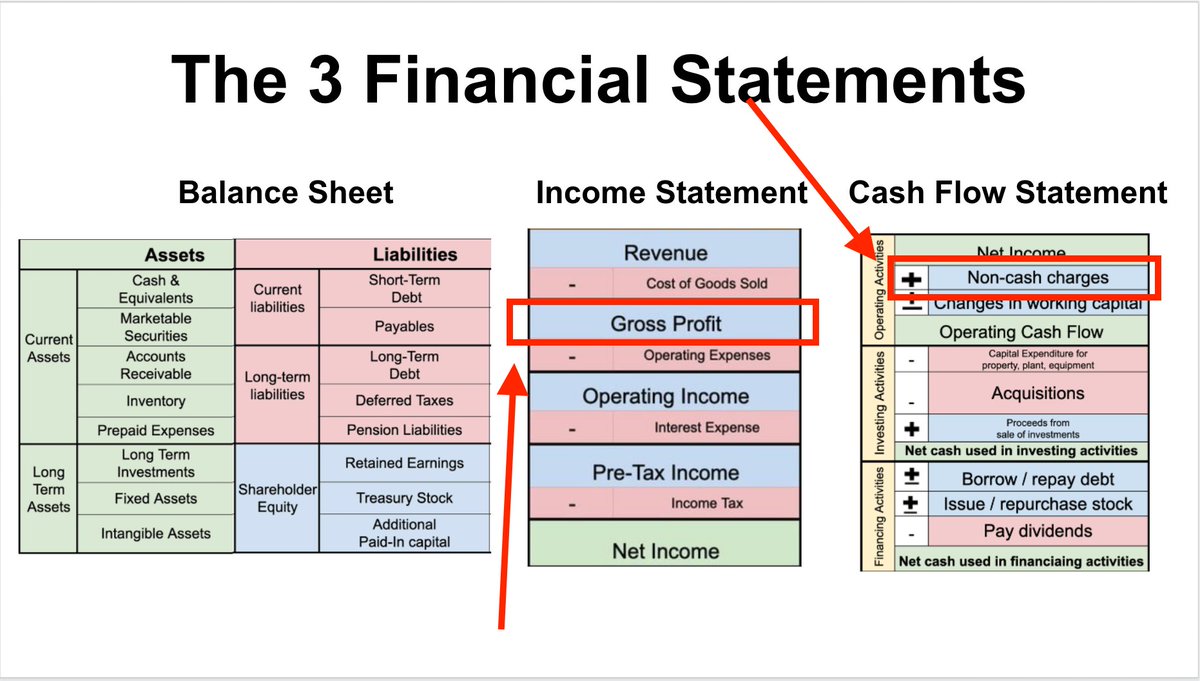

1: Gross Margin

🧮 Equation: Gross Profit / Revenue

👍 Rule of Thumb: 40% or higher

🤔 Buffett's Logic: A consistently high gross margin signals that the company isn’t competing exclusively on price.

🧮 Equation: Gross Profit / Revenue

👍 Rule of Thumb: 40% or higher

🤔 Buffett's Logic: A consistently high gross margin signals that the company isn’t competing exclusively on price.

2: SG&A Margin

🧮 Equation: SG&A Expense / Gross Profit

👍 Rule of Thumb: 30% or lower

🤔 Buffett's Logic: Wide-moat companies don’t need to spend a lot on overhead to operate & convince consumers to buy.

🧮 Equation: SG&A Expense / Gross Profit

👍 Rule of Thumb: 30% or lower

🤔 Buffett's Logic: Wide-moat companies don’t need to spend a lot on overhead to operate & convince consumers to buy.

3: R&D Margin

🧮 Equation: R&D Expense / Gross Profit

👍 Rule of Thumb: 30% or lower

🤔 Buffett's Logic: R&D expenses don't always create value for shareholders. Buffett doesn't want to own companies that need to invent the next great product to do well.

🧮 Equation: R&D Expense / Gross Profit

👍 Rule of Thumb: 30% or lower

🤔 Buffett's Logic: R&D expenses don't always create value for shareholders. Buffett doesn't want to own companies that need to invent the next great product to do well.

4: Depreciation Margin

🧮 Equation: Depreciation / Gross Profit

👍 Rule of Thumb: 10% or lower

🤔 Buffett's Logic: Buffett doesn't like businesses that constantly need to invest in depreciating assets to maintain their competitive advantage.

🧮 Equation: Depreciation / Gross Profit

👍 Rule of Thumb: 10% or lower

🤔 Buffett's Logic: Buffett doesn't like businesses that constantly need to invest in depreciating assets to maintain their competitive advantage.

5: Interest Expense Margin

🧮 Equation: Interest Expense / Operating Income

👍 Rule of Thumb: 15% or lower

🤔 Buffett's Logic: Great businesses have such incredible economics that they don’t need debt to finance themselves.

🧮 Equation: Interest Expense / Operating Income

👍 Rule of Thumb: 15% or lower

🤔 Buffett's Logic: Great businesses have such incredible economics that they don’t need debt to finance themselves.

If you're enjoying this thread, you'll love my cohort-based course starting next week, Financial Statements Explained Simply

DM me for a coupon code:

maven.com/brian-feroldi/…

DM me for a coupon code:

maven.com/brian-feroldi/…

6: Income Tax Expenses

🧮 Equation: Taxes Paid / Pre-Tax Income

👍 Rule of Thumb: Current Corporate Tax Rate

🤔 Buffett's Logic: Great businesses make so much money that they are consistently forced to pay their full share of taxes.

🧮 Equation: Taxes Paid / Pre-Tax Income

👍 Rule of Thumb: Current Corporate Tax Rate

🤔 Buffett's Logic: Great businesses make so much money that they are consistently forced to pay their full share of taxes.

7: Net Margin (Profit Margin)

🧮 Equation: Net Income / Sales

👍 Rule of Thumb: 20% or higher

🤔 Buffett's Logic: Companies that consistently convert 20% of their revenue into net income are more likely to have a durable competitive advantage.

🧮 Equation: Net Income / Sales

👍 Rule of Thumb: 20% or higher

🤔 Buffett's Logic: Companies that consistently convert 20% of their revenue into net income are more likely to have a durable competitive advantage.

8: Earnings Per Share Growth

🧮 Equation: Year 2 EPS / Year 1 EPS

👍 Rule of Thumb: Positive & Growing

🤔 Buffett's Logic: Great companies consistently generate profits and increase them every year regardless of the operating environment.

🧮 Equation: Year 2 EPS / Year 1 EPS

👍 Rule of Thumb: Positive & Growing

🤔 Buffett's Logic: Great companies consistently generate profits and increase them every year regardless of the operating environment.

Caveats:

1: These “rules of thumb” are only useful when a company is mature and fully optimized for profits (stage 4/5).

2: CONSISTENCY is key.

3: There are PLENTY of exceptions & nuances to these rules.

1: These “rules of thumb” are only useful when a company is mature and fully optimized for profits (stage 4/5).

2: CONSISTENCY is key.

3: There are PLENTY of exceptions & nuances to these rules.

Want to dive deeper into financial statements?

Send me a DM if you're interested in a coupon code for Financial Statements Explained Simply:

twitter.com/messages/compo…

Send me a DM if you're interested in a coupon code for Financial Statements Explained Simply:

twitter.com/messages/compo…

Follow me @BrianFeroldi for more content like this.

I demystify finance with 1-2 threads each week.

Want to share? Retweet the first tweet below:

I demystify finance with 1-2 threads each week.

Want to share? Retweet the first tweet below:

https://twitter.com/61558281/status/1743246785705852944

• • •

Missing some Tweet in this thread? You can try to

force a refresh