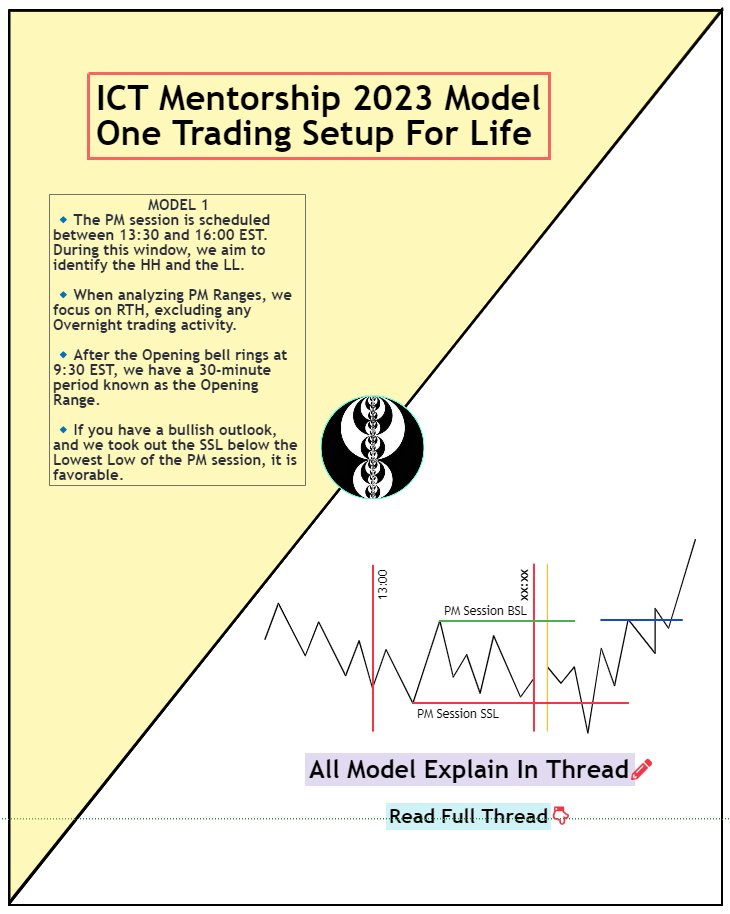

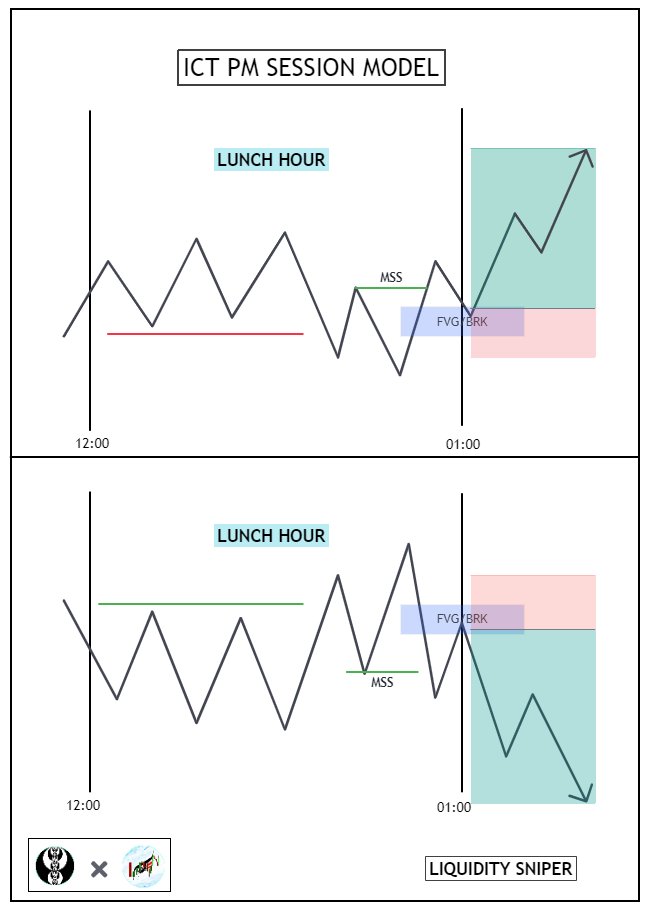

ICT PM Session Entry Model :

- Watch Price action in Lunch hour [ 12:00 - 01:00 ]

- Wait for MSS after 01:00 PM

- Look for price has takes any BSL or SSL Liquidity

- Takes 2-3 RR trades

Credit : @I_Am_The_ICT

Chart Examples explain in Thread 👇

- Watch Price action in Lunch hour [ 12:00 - 01:00 ]

- Wait for MSS after 01:00 PM

- Look for price has takes any BSL or SSL Liquidity

- Takes 2-3 RR trades

Credit : @I_Am_The_ICT

Chart Examples explain in Thread 👇

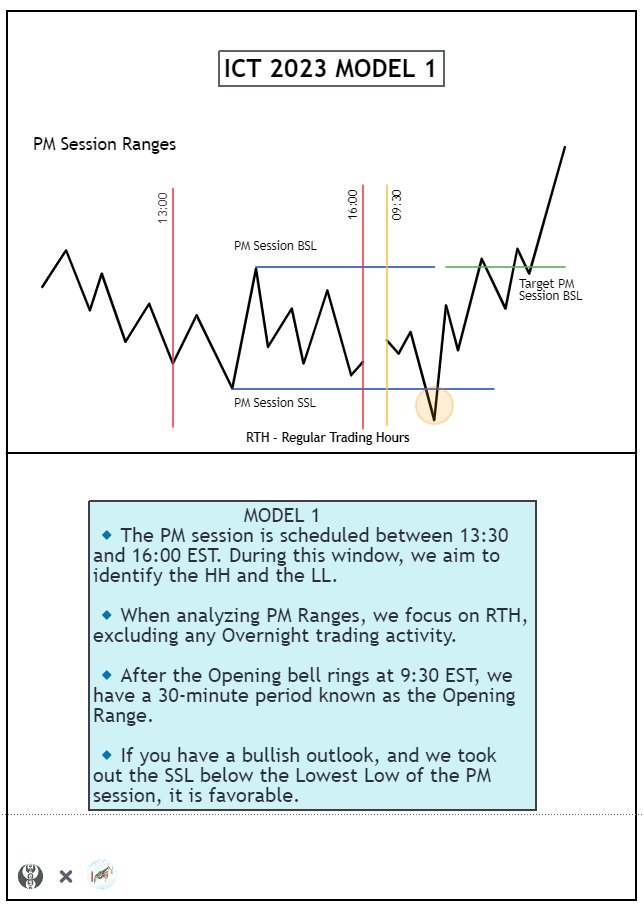

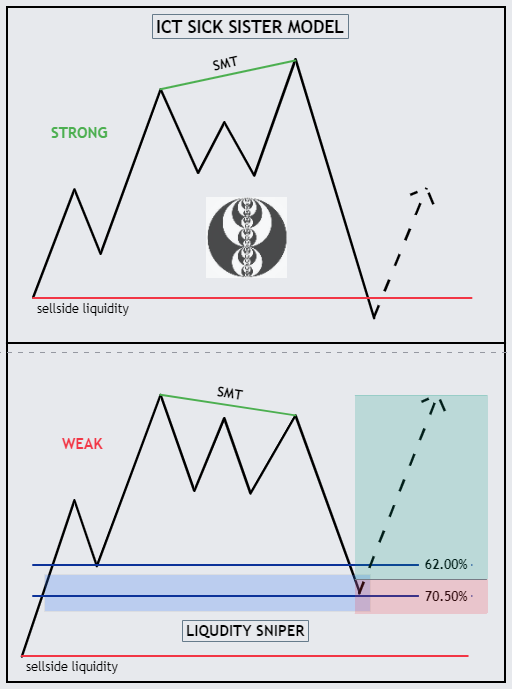

ICT PM Session Entry Model Example 1:

1. Consolidation: Leverage the Lunch Hour, a prime time for price consolidation, setting the stage for potential market movements.

2. Patience is Key: wait for Market Swing Signals (MSS) typically surfacing after 1:00 PM.

1. Consolidation: Leverage the Lunch Hour, a prime time for price consolidation, setting the stage for potential market movements.

2. Patience is Key: wait for Market Swing Signals (MSS) typically surfacing after 1:00 PM.

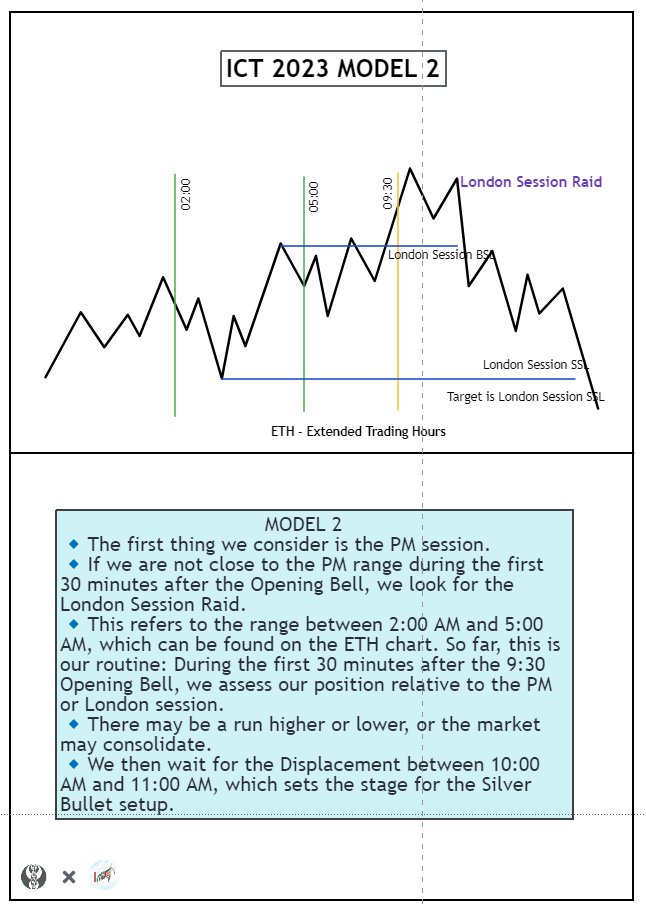

ICT PM Session Entry Model Example 2:

3. Lunch Hour Window: Capitalize on the specific window within the lunch hour, strategically identifying and acting upon price movements as they break through crucial levels like BSL or SSL.

3. Lunch Hour Window: Capitalize on the specific window within the lunch hour, strategically identifying and acting upon price movements as they break through crucial levels like BSL or SSL.

ICT PM Session Entry Model Example 3:

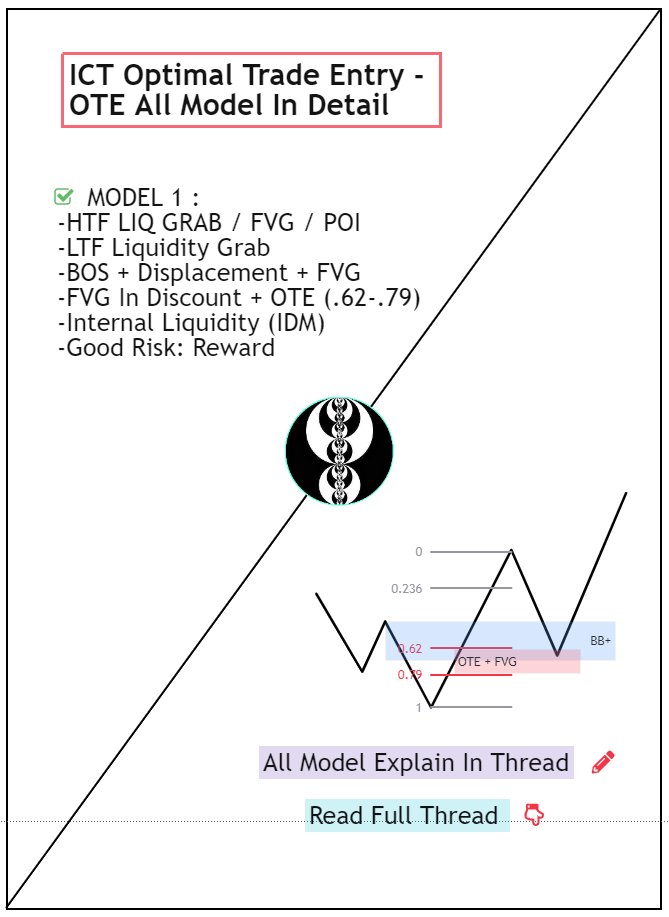

Encounter the enchanting Unicorn setup, gracing your trading canvas 3 to 4 times weekly, promising a delightful yield of 2 to 3 Risk-Reward ratios effortlessly.

Encounter the enchanting Unicorn setup, gracing your trading canvas 3 to 4 times weekly, promising a delightful yield of 2 to 3 Risk-Reward ratios effortlessly.

• • •

Missing some Tweet in this thread? You can try to

force a refresh