Forex 🔁 Crypto | $NQ | $BTC | $GOLD | Join community: https://t.co/2VUXsPeJJA

17 subscribers

How to get URL link on X (Twitter) App

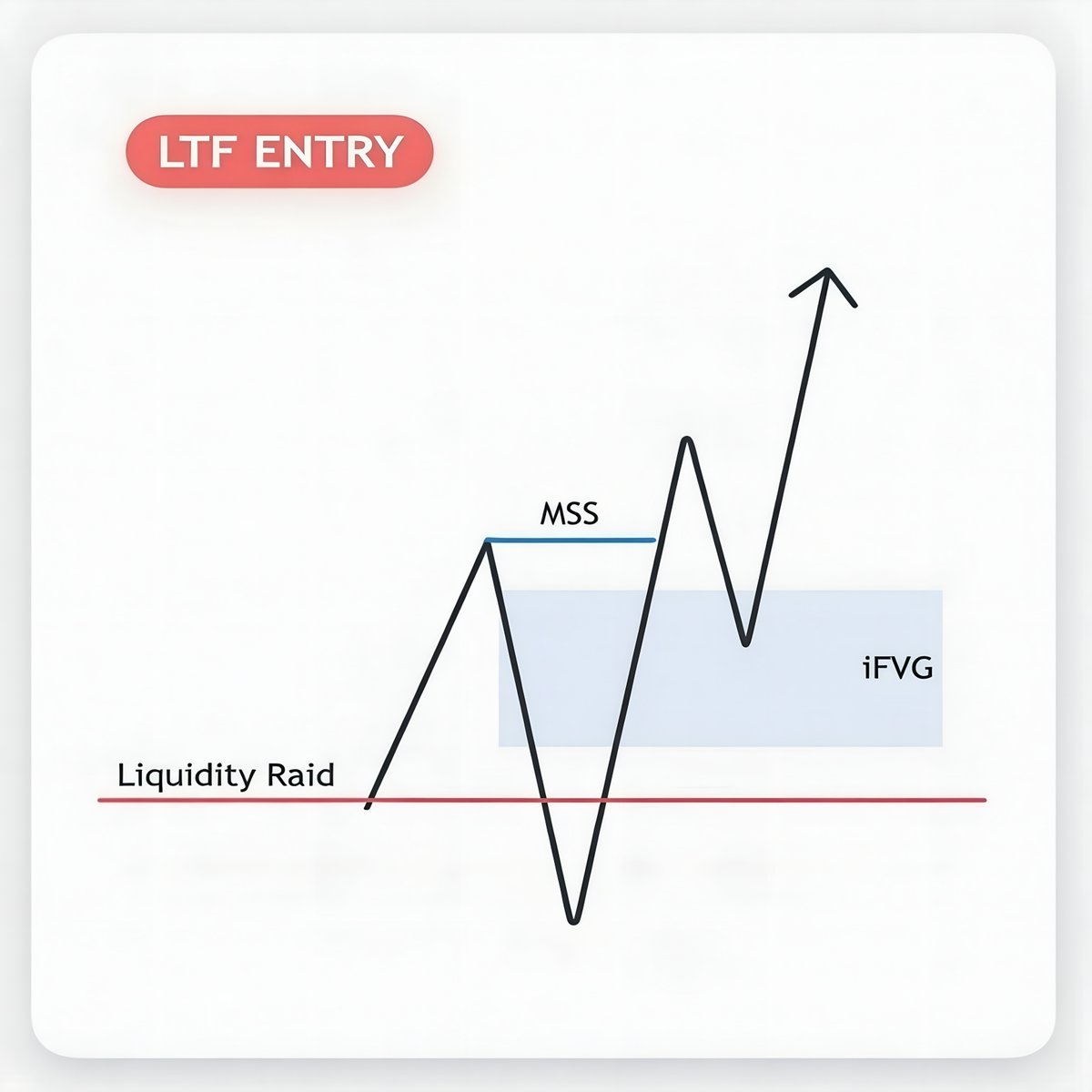

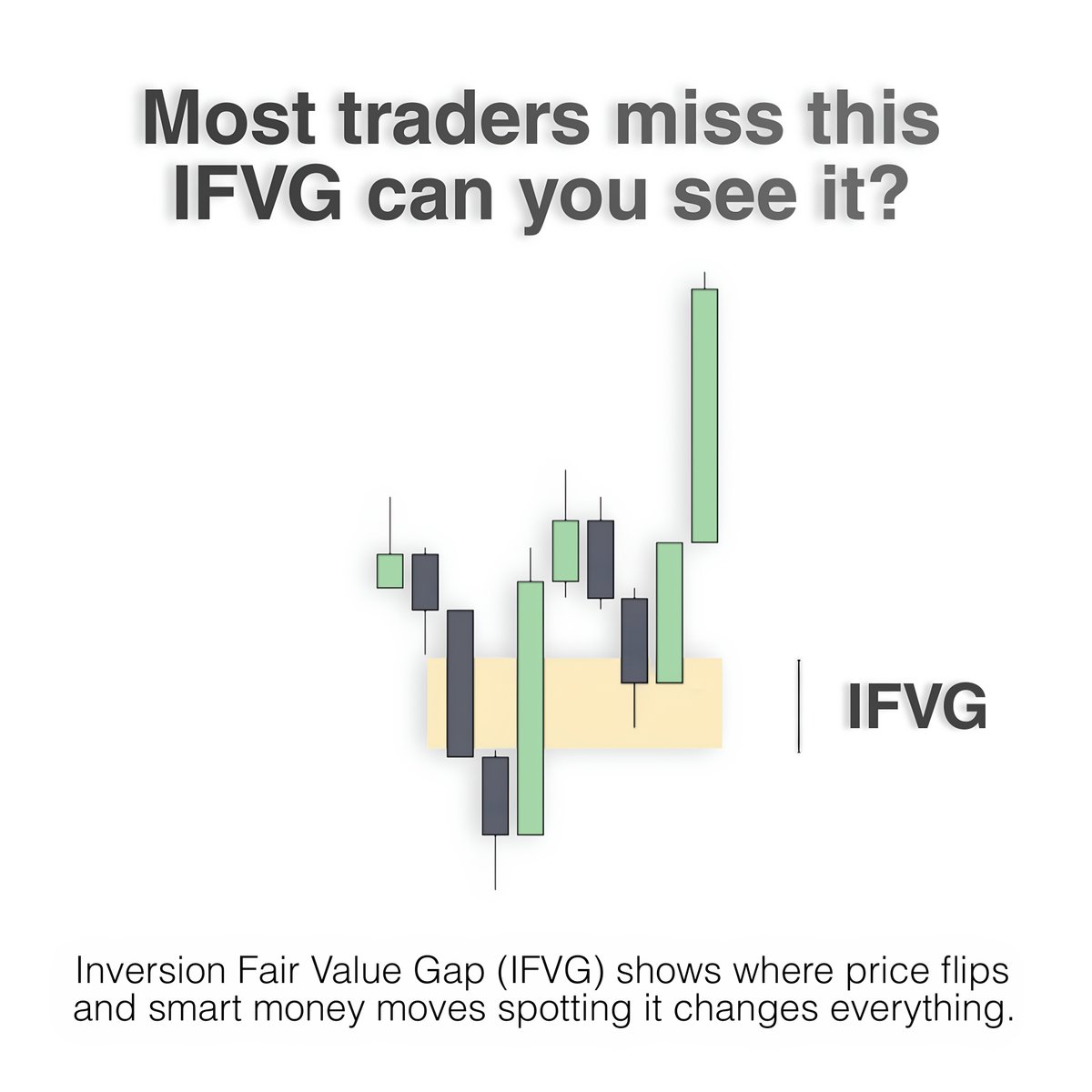

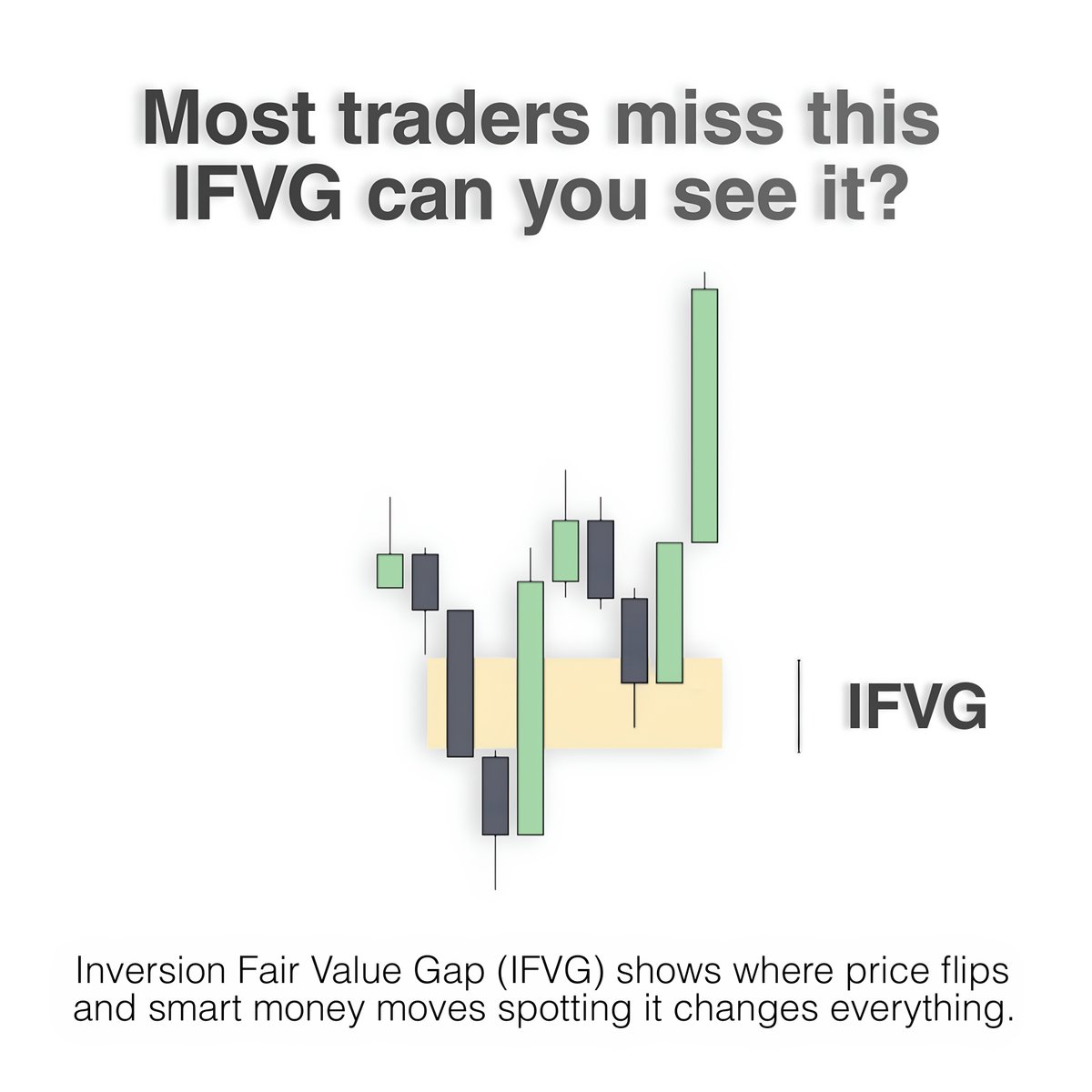

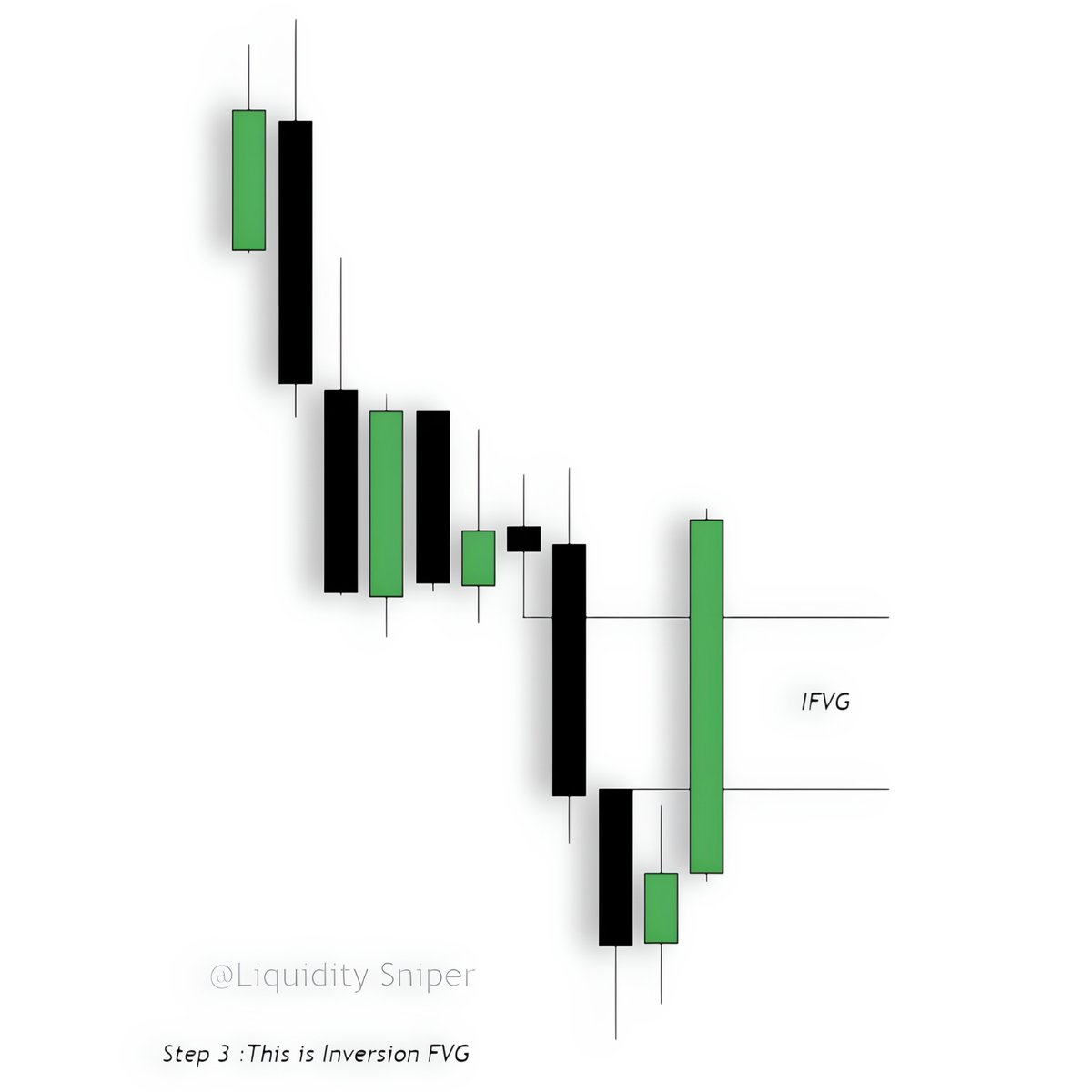

Do you know what IFVG is?

Do you know what IFVG is?

What is Inversion FVG (IFVG)?

What is Inversion FVG (IFVG)?

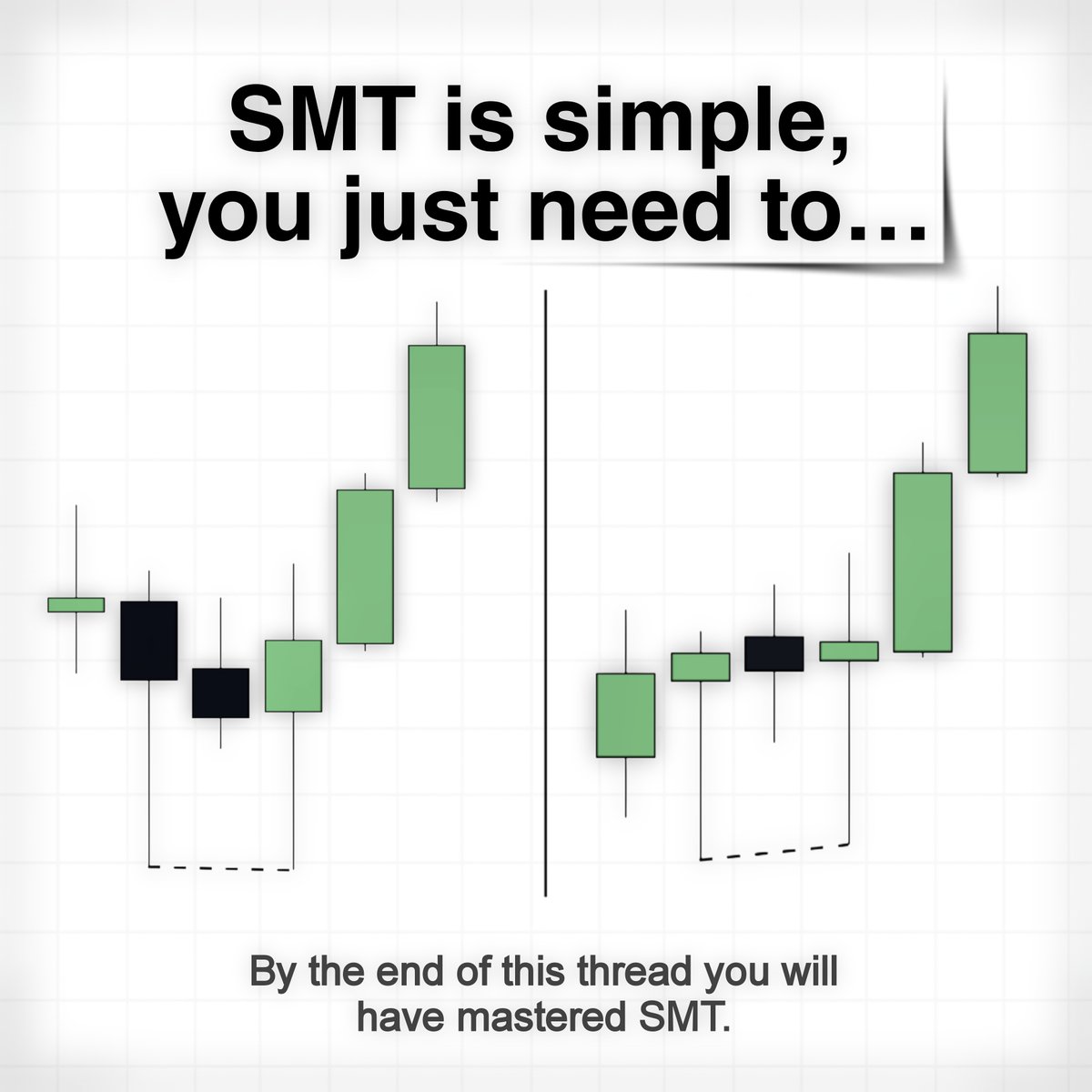

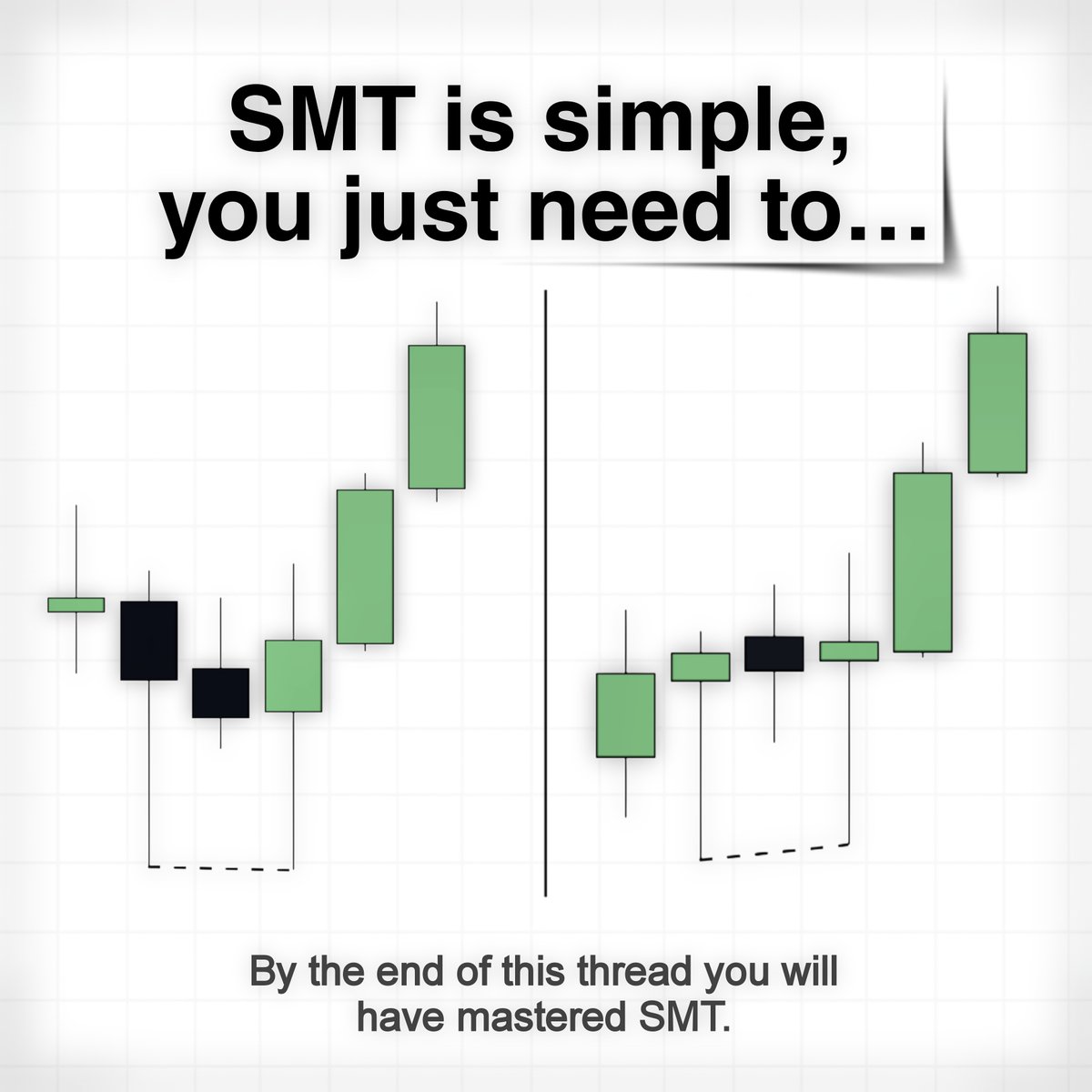

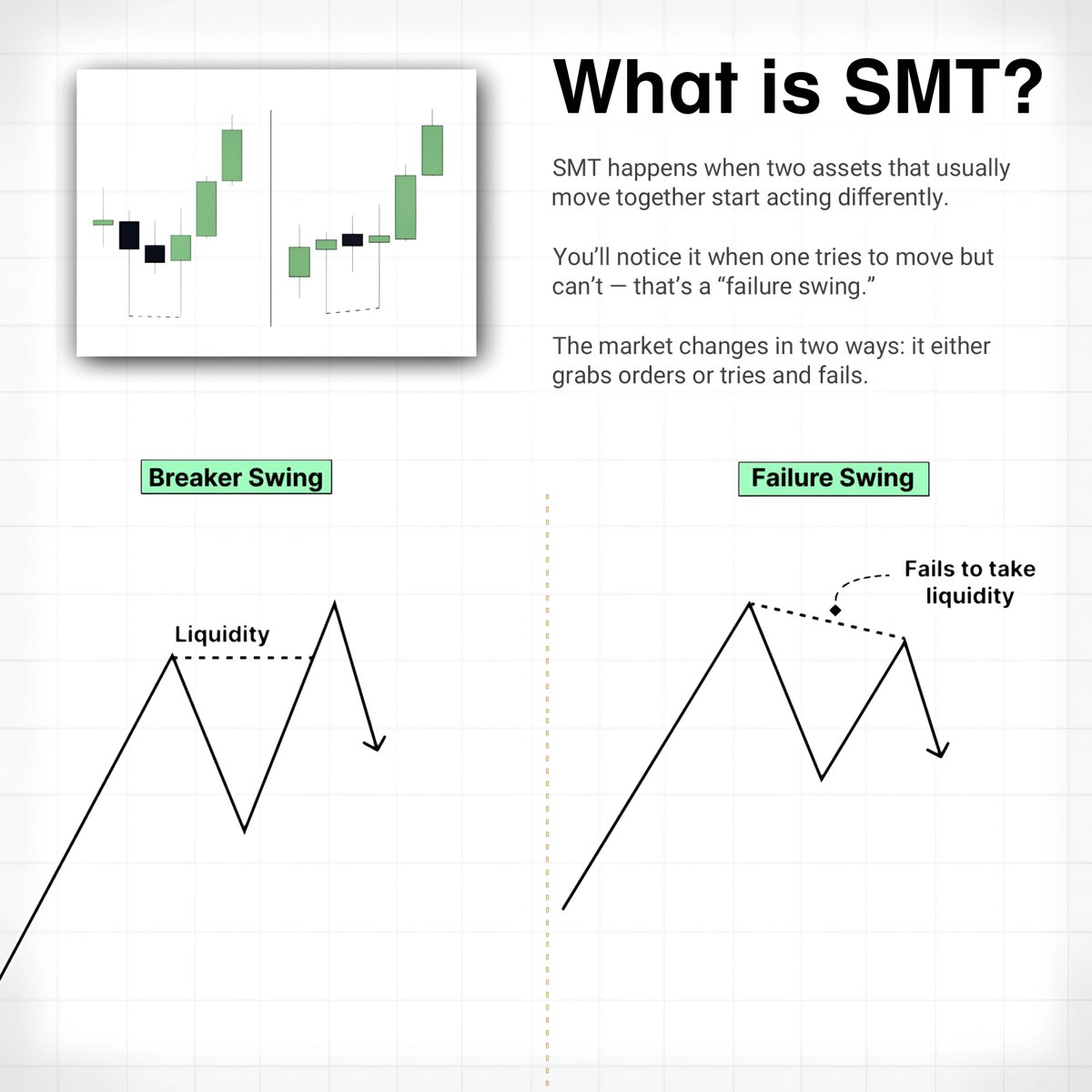

What is SMT?

What is SMT?

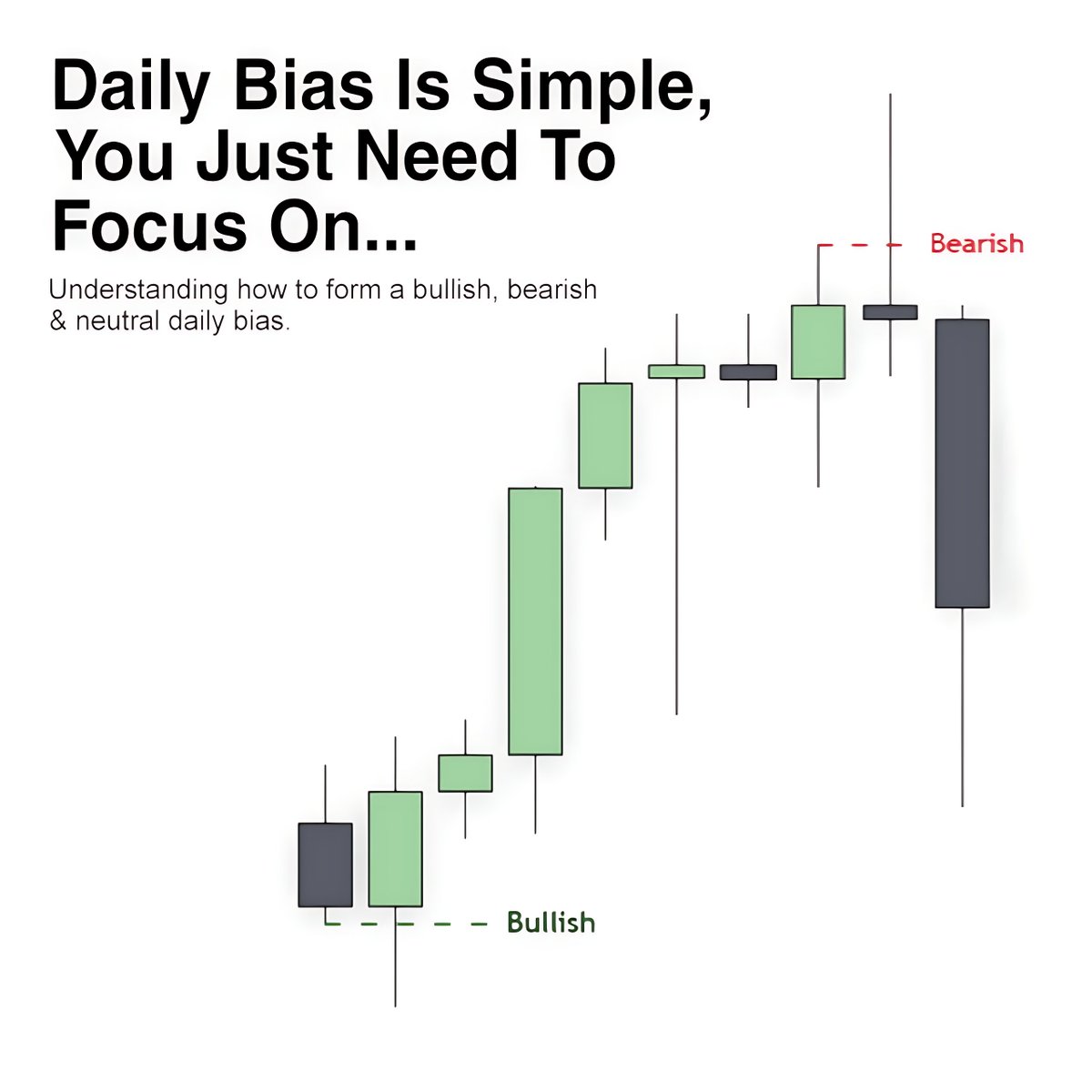

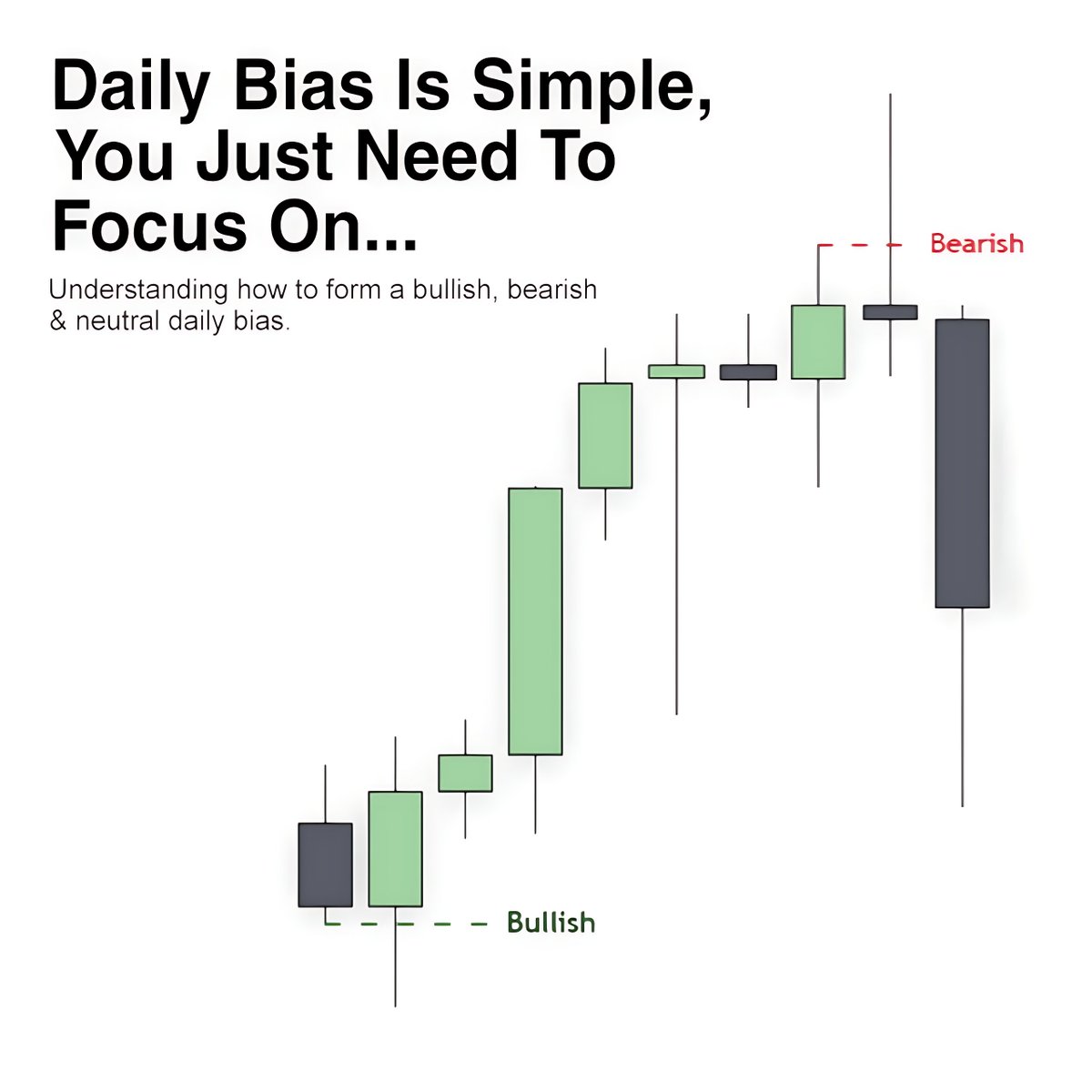

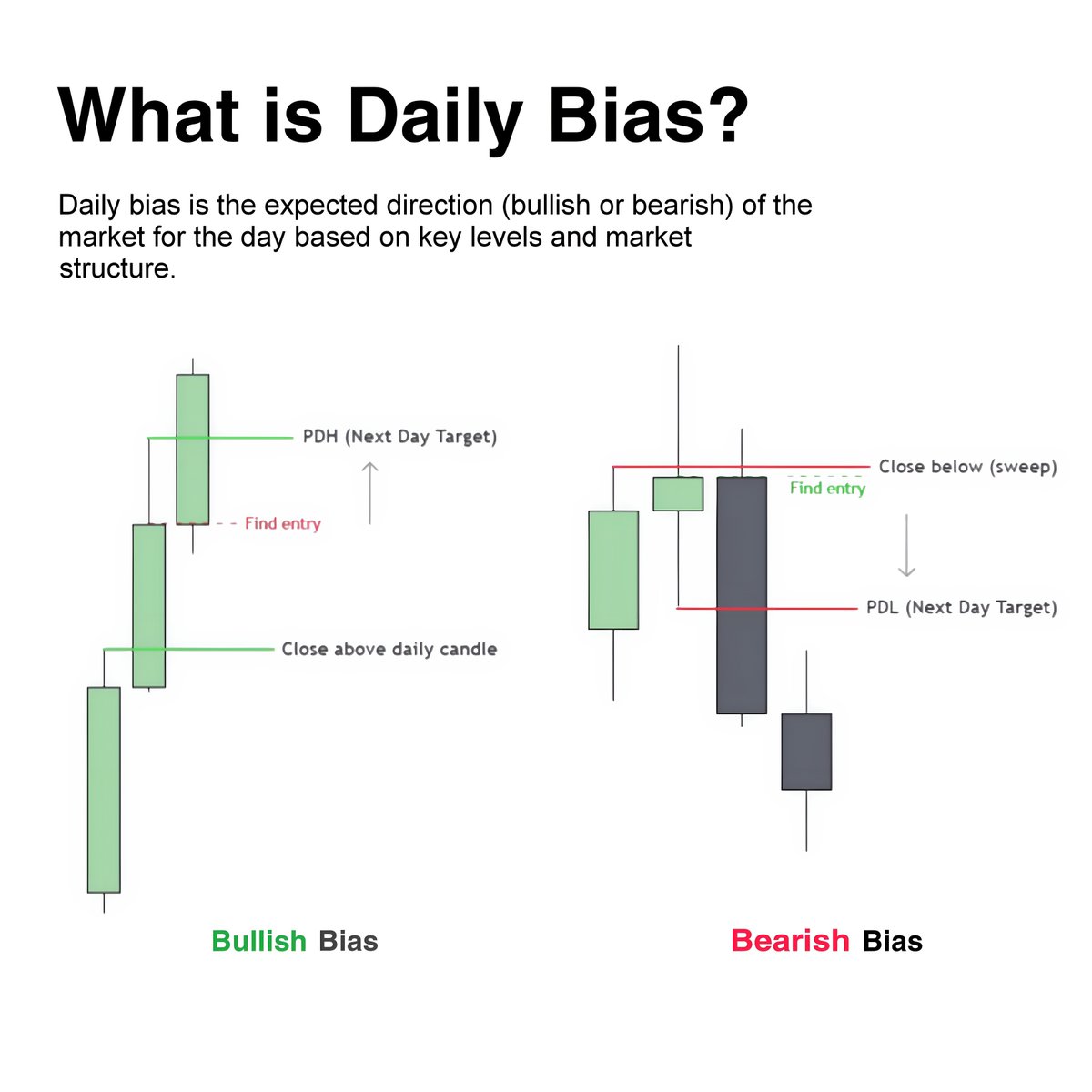

What is an Daily Bias?

What is an Daily Bias?

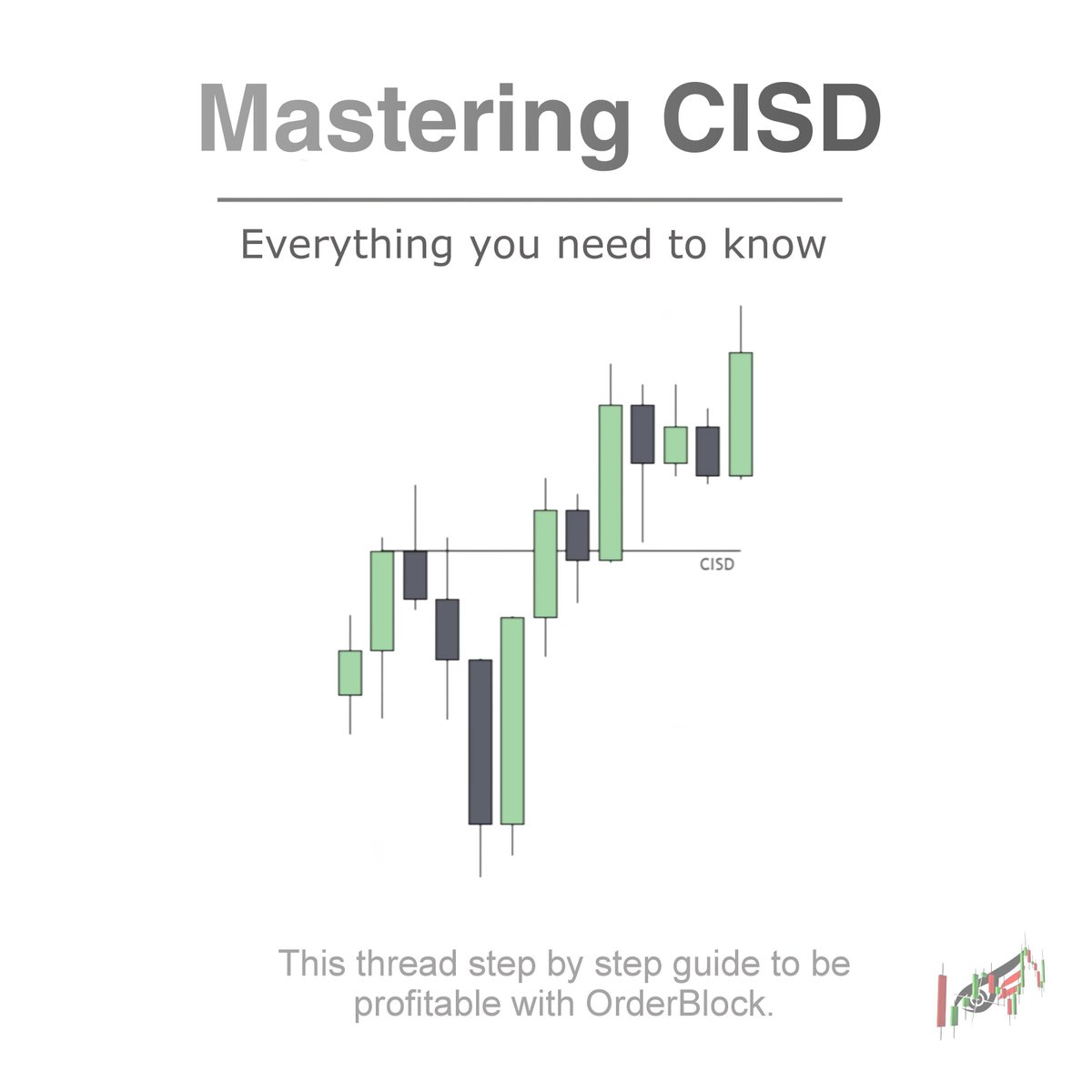

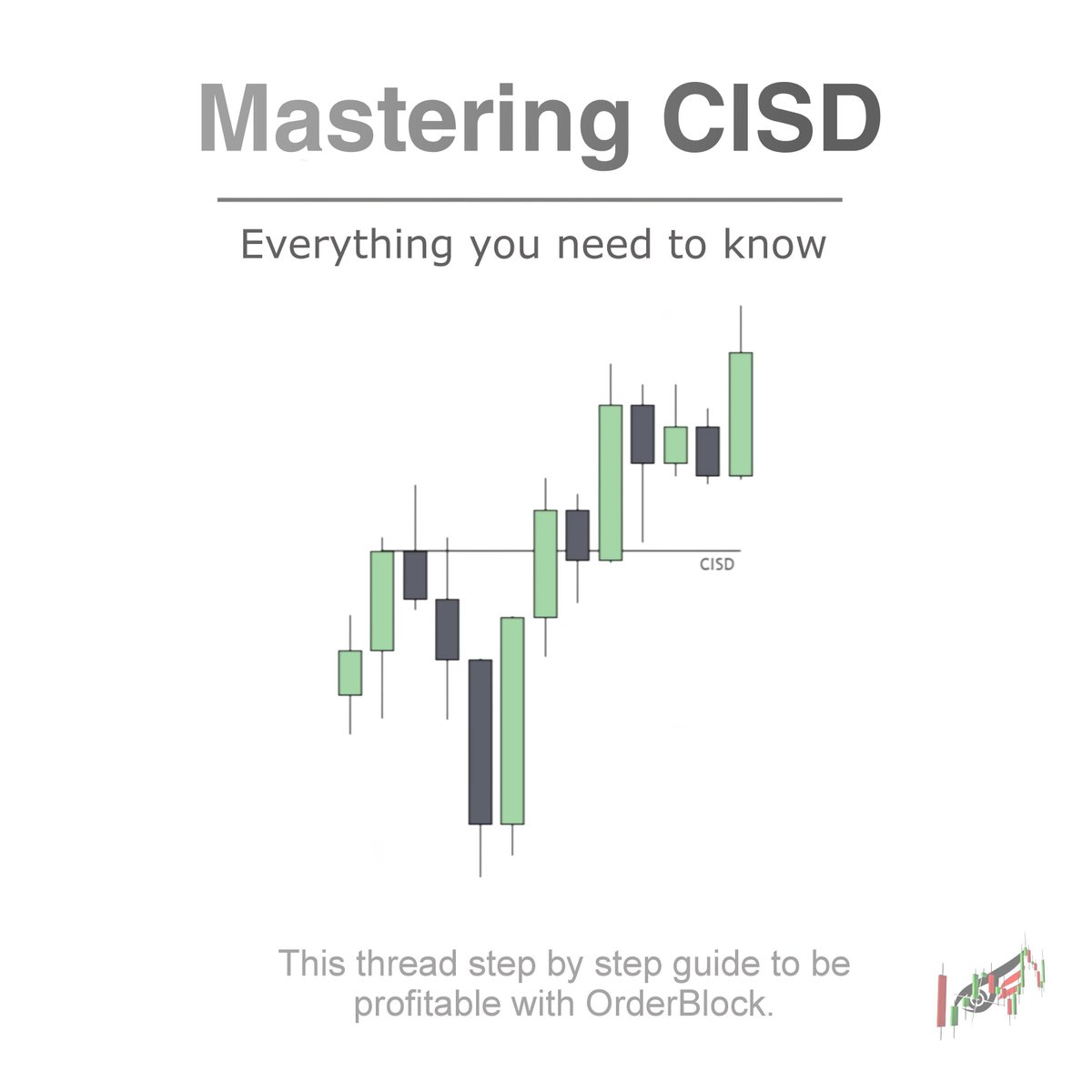

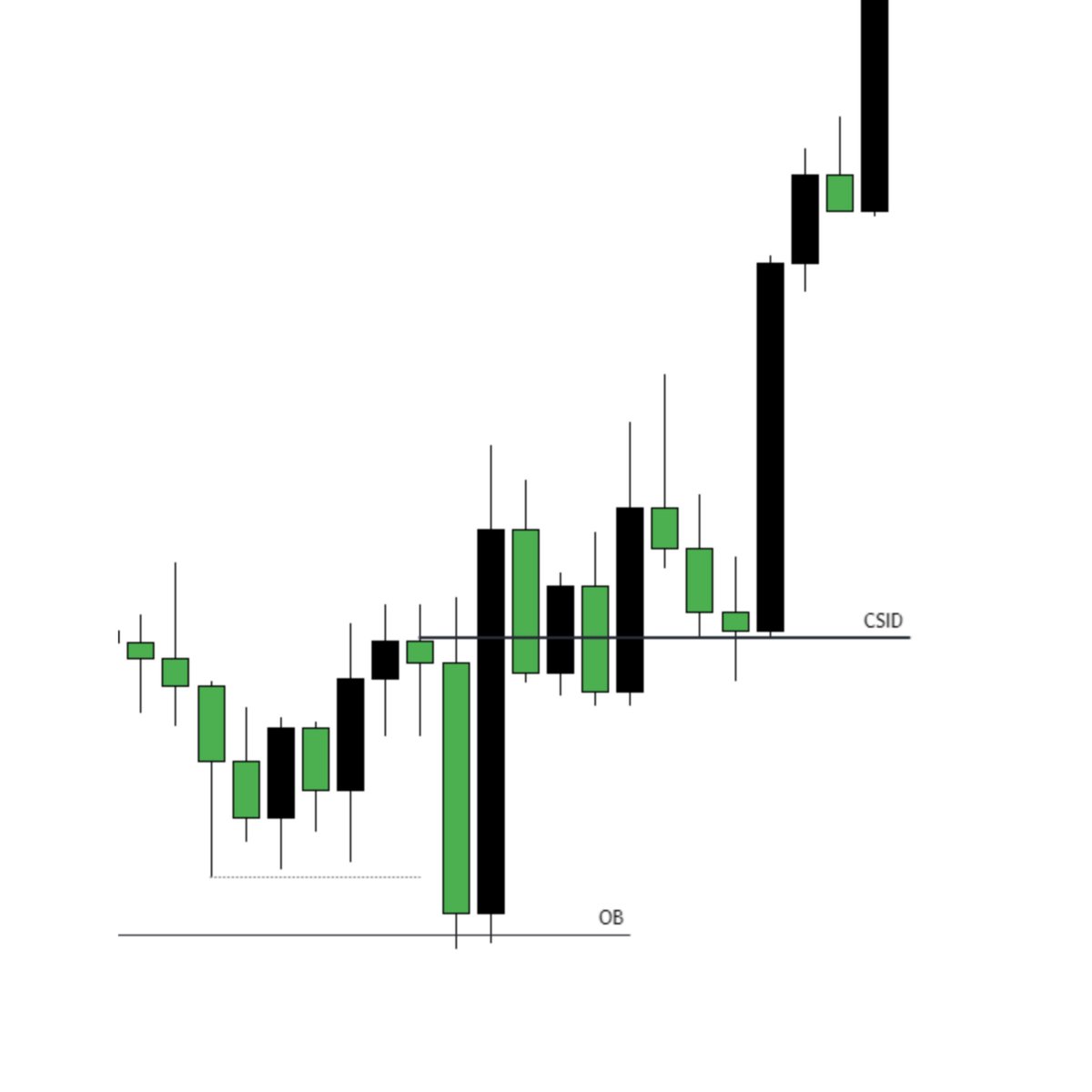

What is CISD?

What is CISD?

What is institutional order flow?

What is institutional order flow?

What is Standard deviation projections (STDV)?

What is Standard deviation projections (STDV)?