This chart is truly revealing.

The current macro environment across global equity markets presents a sharply divided investment setup for 2024 and the remainder of the decade.

It's time to buy low & sell high.

👇👇👇

The current macro environment across global equity markets presents a sharply divided investment setup for 2024 and the remainder of the decade.

It's time to buy low & sell high.

👇👇👇

While our concerns are fueled by the pervasive speculation in the US stock market, there also exists a parallel narrative where long-neglected economies present themselves with exceptional value and promising growth opportunities.

Utilizing Warren Buffett’s preferred valuation indicator, it becomes unmistakable that US stocks not only sit at historically expensive levels but also are the most overvalued among 28 of the world’s largest economies.

In our strong view:

Investors buying US equities are currently undertaking unjustified risks amid dangerously inflated valuations.

Investors buying US equities are currently undertaking unjustified risks amid dangerously inflated valuations.

Equally relevant, but on the positive side, observe the prevalence of economies with notably low valuations that also possess substantial exposure to broad commodities that have a favorable supply and demand outlook.

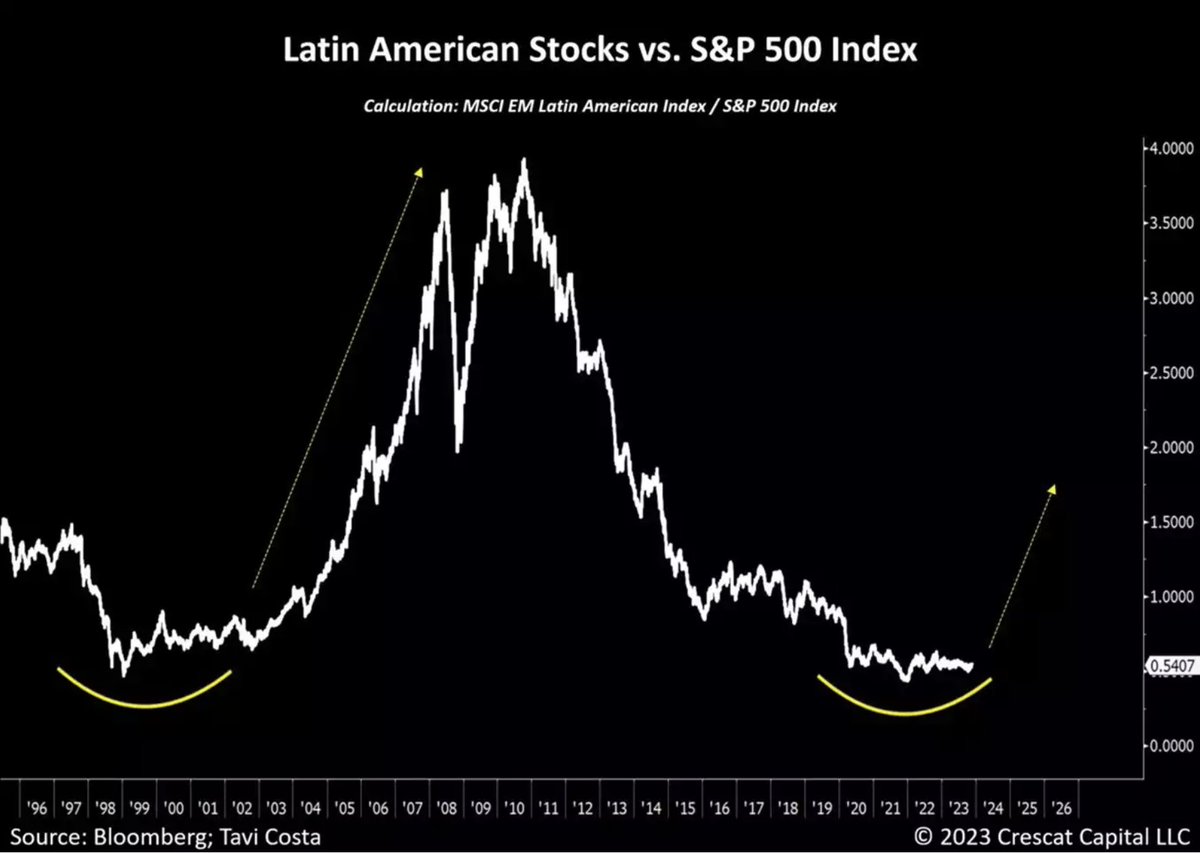

South America, in this context, stands out as a resource-rich region with incredibly undervalued markets, especially when juxtaposed with the US.

We would much rather own growing businesses at low single-digit P/E multiples than hyped-up US mega-cap technology stocks, which at the mean are trading at an exuberant 48 times annual profits with questionable potential to sustain their past growth rates.

Today’s stark divergence in valuation metrics globally highlights the potential for investors to uncover compelling opportunities in undervalued regions and industries.

This challenges the prevailing trend characterized by crowded optimism in US technology companies, which presently constitute more than one-third of the overall equity market – an extent of dominance not seen since the peak of the tech bubble.

More interestingly, the recent advancements in artificial intelligence could paradoxically have highly positive implications for emerging markets that have long grappled with a low-quality labor force.

Examining the evolution of entrepreneurship, the internet has enabled individuals to start businesses without the need for a physical location, significantly lowering barriers to entry for new enterprises.

Tools like ChatGPT, even in their early stages, act as true capability enablers.

Tools like ChatGPT, even in their early stages, act as true capability enablers.

Now, individuals can not only launch businesses from their dorm rooms but also access high-quality personal assistants, programmers, mathematicians, writers, historians, biologists, and more at virtually no cost.

When extrapolating this phenomenon globally, less developed economies gain access to the same tools, leveling the playing field in terms of labor quality.

The US has historically benefited tremendously from having top-tier school systems and attracting students and workers from around the world.

The US has historically benefited tremendously from having top-tier school systems and attracting students and workers from around the world.

However, these transformative changes suggest that the gap in company valuations between developed and less developed economies will likely shrink significantly.

In our view:

The market is underestimating these changes, especially at a time when the valuation of a US company has never been more expensive relative to an emerging market.

The market is underestimating these changes, especially at a time when the valuation of a US company has never been more expensive relative to an emerging market.

This idea can be extended further to posit that these new tools generate highly innovative and disruptive technologies that will also narrow the valuation gap between larger and smaller companies.

Concurrently:

Today’s market exhibits an unprecedented level of dominance by mega-cap technology stocks, which in our view is completely unsustainable.

Today’s market exhibits an unprecedented level of dominance by mega-cap technology stocks, which in our view is completely unsustainable.

An alternative representation of the opportunity to buy undervalued Latin American businesses and short overpriced US stocks is depicted in this chart.

The relative performance between these two regions is currently re-testing the levels we experienced in the early 2000s, a time that marked a major bottom for emerging versus developed markets.

The relative performance between these two regions is currently re-testing the levels we experienced in the early 2000s, a time that marked a major bottom for emerging versus developed markets.

The current market environment is remarkably similar to that period, and potentially even more compelling now.

Note that November 2021 likely marked the beginning of a new investment cycle, characterized by a critical shift in market correlations across different asset classes.

Note that November 2021 likely marked the beginning of a new investment cycle, characterized by a critical shift in market correlations across different asset classes.

During this period, businesses operating at unsustainable valuations faced a moment of reckoning, and the global fixed-income market underwent a complete collapse.

Safe-haven currencies, such as the Japanese Yen, notably faltered.

Safe-haven currencies, such as the Japanese Yen, notably faltered.

Additionally, the transition from growth to value stocks was initiated, benefiting commodity-related firms, while resource-rich emerging markets notably outperformed their developed counterparts.

Outside of mega-cap technology companies, these market trends have persisted and are likely to intensify in the years ahead.

The next decade is likely to be influenced by a set of significant factors:

▪️ The deepening challenges associated with deglobalization

▪️ A critical shift for businesses to prioritize securing their logistics rather than focusing solely on cost-efficiency

▪️ The deepening challenges associated with deglobalization

▪️ A critical shift for businesses to prioritize securing their logistics rather than focusing solely on cost-efficiency

▪️ Rising social and political pressure favoring populist leaders in response to widespread global wealth disparities

▪️ Anticipated widespread labor strikes as workers seek better compensation in light of corporate profits

▪️ Anticipated widespread labor strikes as workers seek better compensation in light of corporate profits

▪️ And forthcoming issues arising from a prolonged period of underinvestment in natural resource industries that is yet to impact the supply of critical materials.

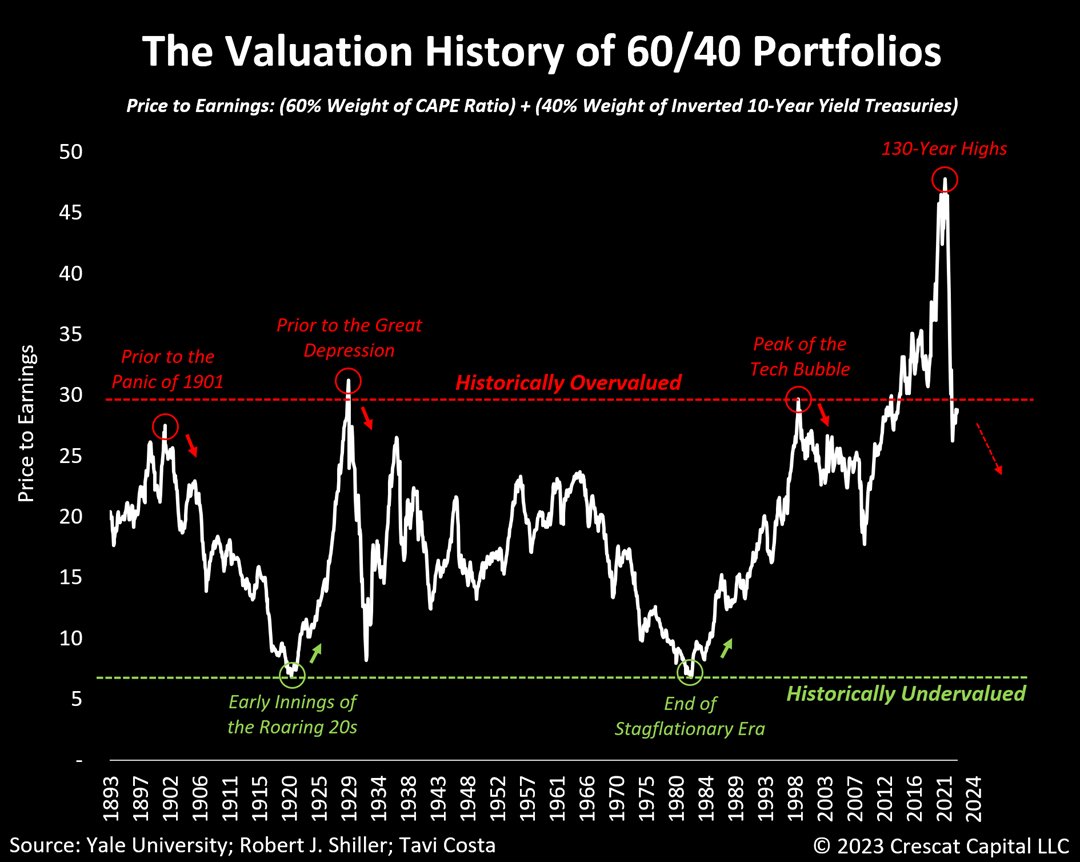

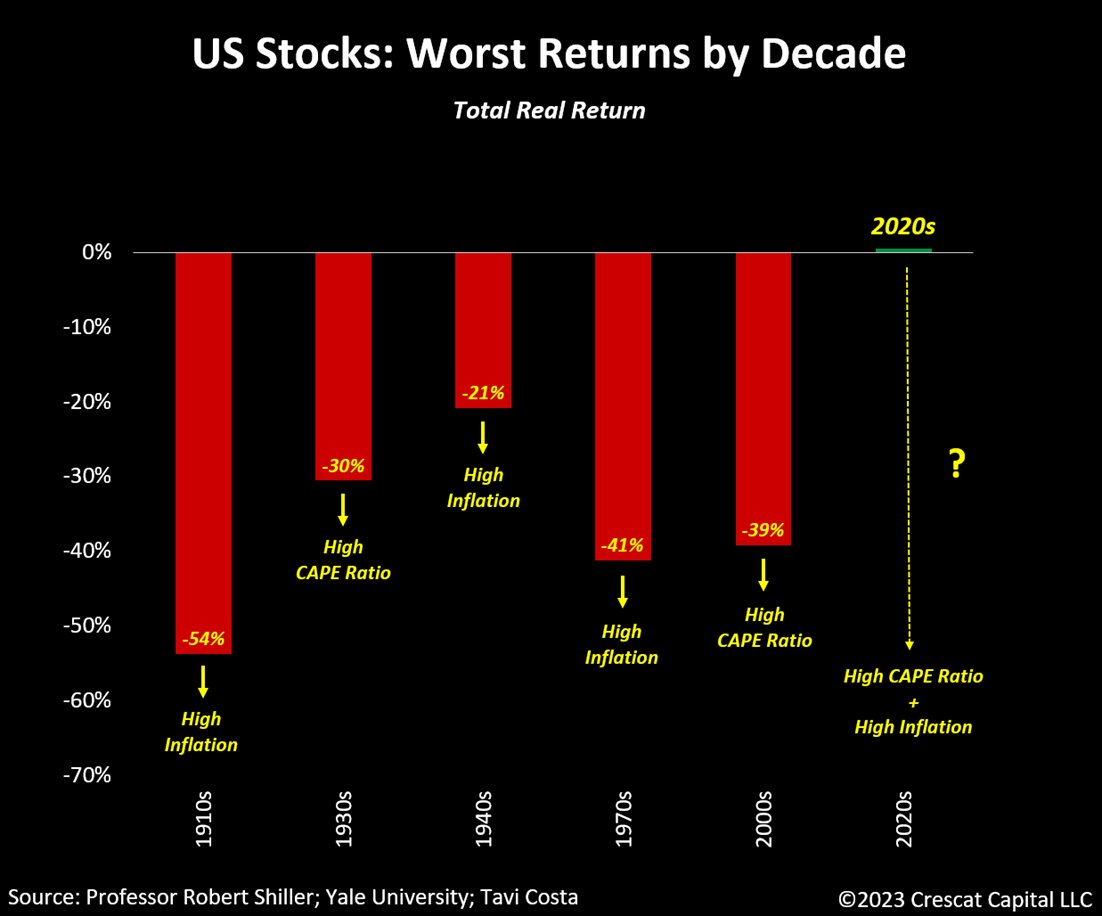

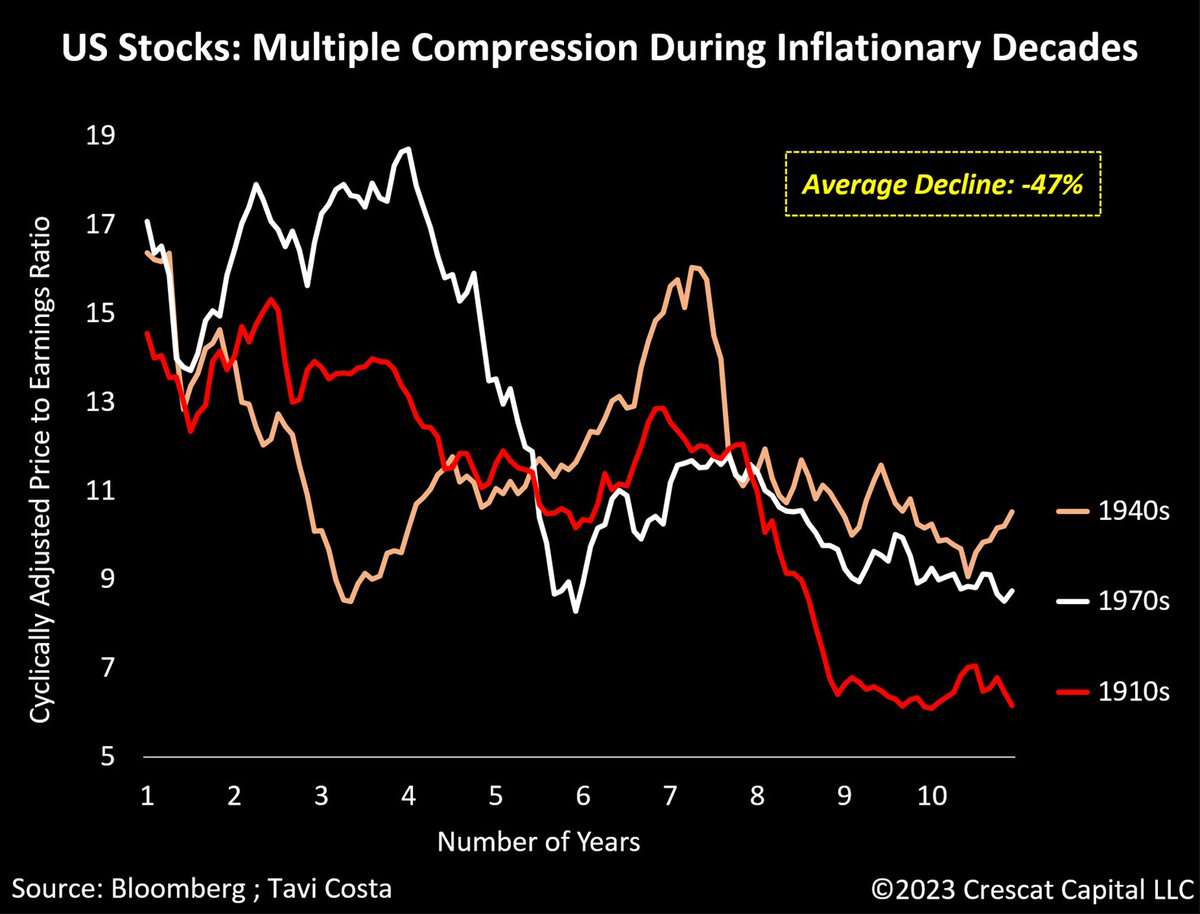

The convergence of these long-term macro trends is profound and leads us to anticipate that inflation will surpass its historical averages over the last 30 years.

Consequently, we expect the cost of capital to rise significantly and sustainably in the decade ahead.

Consequently, we expect the cost of capital to rise significantly and sustainably in the decade ahead.

The potential for such an environment sets the stage for profound changes in the price behavior of financial markets.

As the overall cost of issuing debt and equity becomes more cumbersome, it is highly improbable that volatility will remain as subdued as it currently is.

As the overall cost of issuing debt and equity becomes more cumbersome, it is highly improbable that volatility will remain as subdued as it currently is.

As a result, a return to a more disciplined approach is inevitable, prompting companies to shift their focus back toward profitability.

With these shifts unfolding, investors are likely to reward improvements in the bottom line, leading to a resurgence of fundamental-driven analysis.

With these shifts unfolding, investors are likely to reward improvements in the bottom line, leading to a resurgence of fundamental-driven analysis.

Similar to the preceding 30 years:

These changes are not expected to be permanent; they are merely part of the cyclical nature inherent in long-term investment cycles.

These changes are not expected to be permanent; they are merely part of the cyclical nature inherent in long-term investment cycles.

We believe that this evolving environment will present incredible opportunities, and the market behavior observed from November 2021 to the end of 2022 is more likely to replicate itself than to be characterized by trends similar to those experienced in 2023.

As central banks become politically constrained due to the exponential growth in overall debt, these institutions are likely to be compelled to use monetary policy as a funding mechanism to ensure the financial stability of their respective government securities markets.

Consequently:

Even more meaningfully than in prior decades, the debasement of fiat currencies will probably be an important macro theme worldwide as a hard asset cycle is unleashed, particularly on a relative basis compared to historically expensive financial assets.

Even more meaningfully than in prior decades, the debasement of fiat currencies will probably be an important macro theme worldwide as a hard asset cycle is unleashed, particularly on a relative basis compared to historically expensive financial assets.

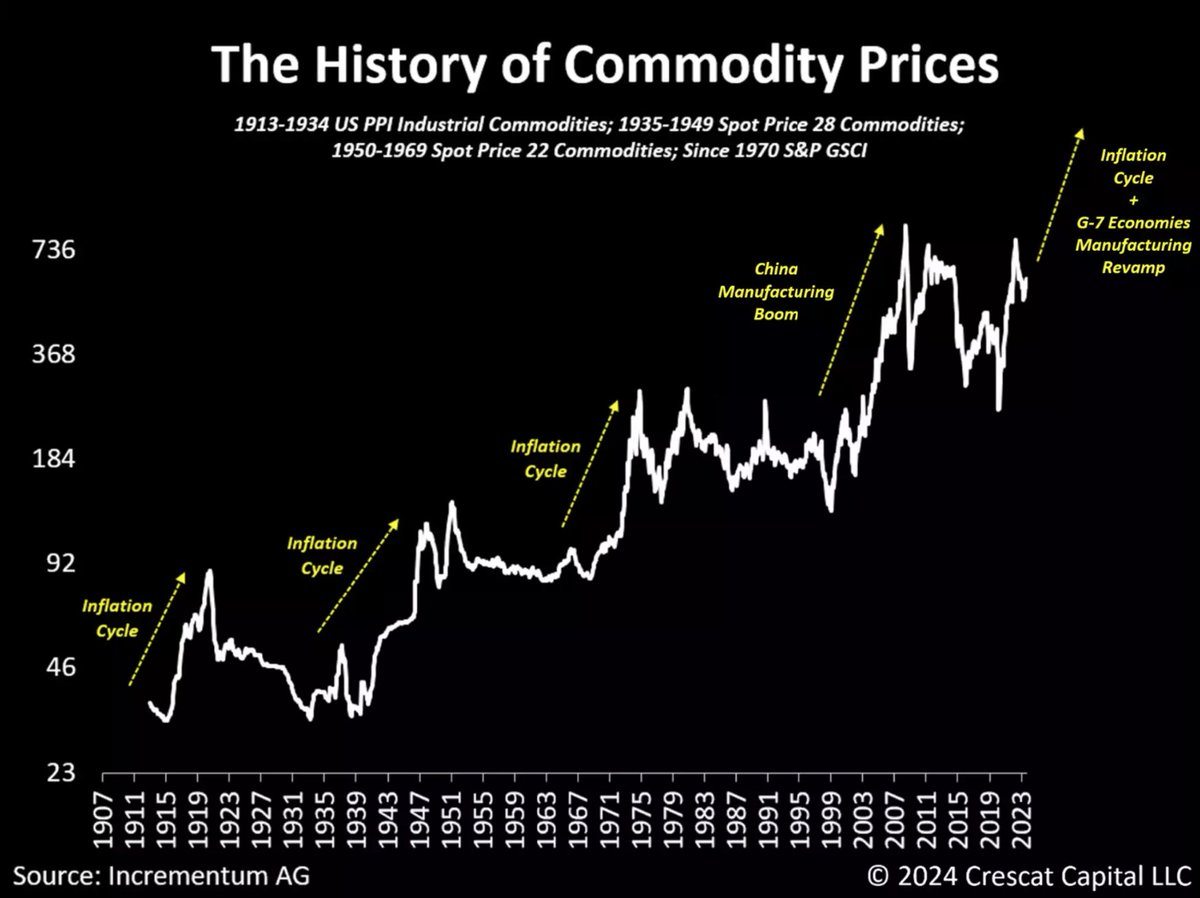

Courtesy of our friends at Incrementum AG, the following chart gives us an insightful historical perspective. Since the 1900s, we have had four notable commodity cycles. Three of them occurred during inflationary periods: the 1910s, 1940s, and 1970s.

• • •

Missing some Tweet in this thread? You can try to

force a refresh