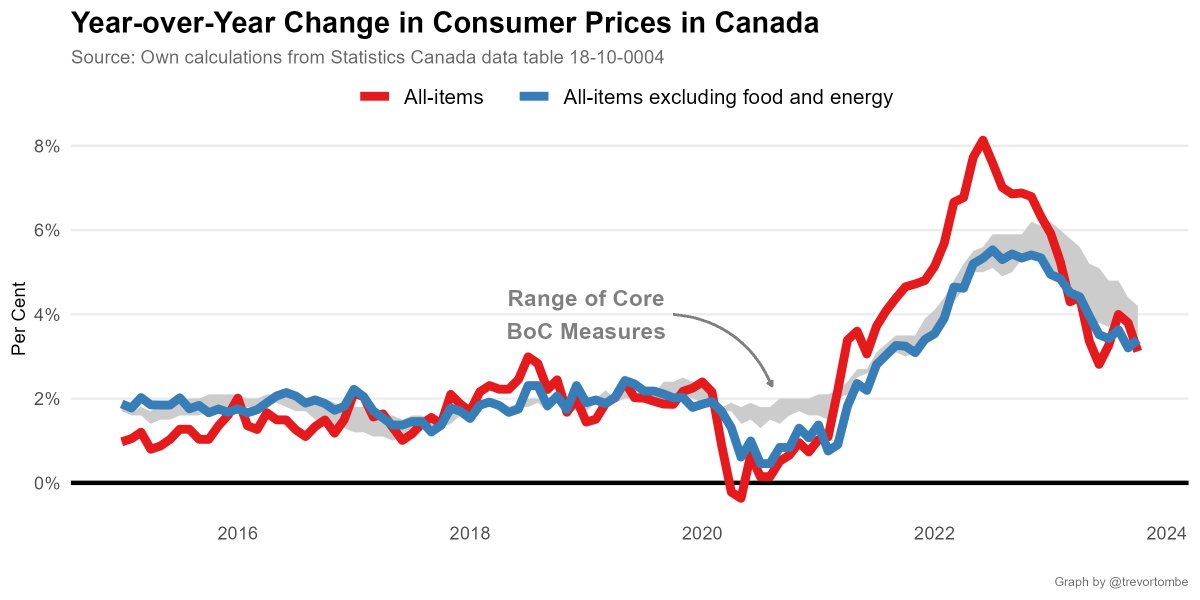

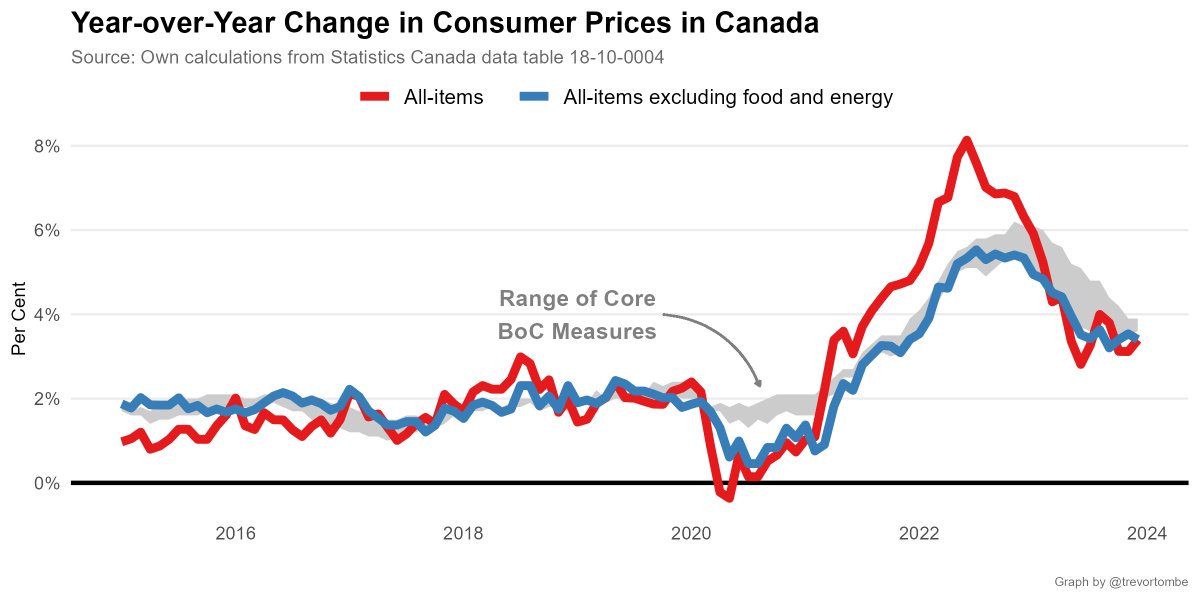

Today's data: inflation!! 📈 Consumer prices were 3.4% higher in December than one year earlier. That's up from 3.1% in November.

I'll explore some of what's going on. #cdnecon #cdnpoli 🧵 www150.statcan.gc.ca/n1/daily-quoti…

I'll explore some of what's going on. #cdnecon #cdnpoli 🧵 www150.statcan.gc.ca/n1/daily-quoti…

This is higher than last month, true, but it doesn't mean the inflation situation is worsening. I noted this yesterday, saying 3.4% was the number to watch.

https://x.com/trevortombe/status/1746926368896549304?s=20

This is a *very* important point to keep in mind for the next *several* months. Even if things are completely normal month-by-month, the headline rate won't fall much over the next quarter.

What was the main reason for the increase to 3.4% from the 3.1% in November? Energy prices. Here's a breakdown.

It's not that gasoline went up in December. It's that they fell more in Dec 2022 than in Dec 2023.

It's not that gasoline went up in December. It's that they fell more in Dec 2022 than in Dec 2023.

Here's a full summary of recent price changes over the past three months (annualized). Big pressures remain mainly within shelter.

Some have strong negative feelings about this graph. Well, it's as good as I can make it so here you go anyway ... :(

Some have strong negative feelings about this graph. Well, it's as good as I can make it so here you go anyway ... :(

Interestingly, it looks like December is the first time in a while that we haven't seen an increase in mortgage interest costs contributing more to CPI than the month prior. The start of turning the corner for this item? Rates are a policy choice, so we'll see.

As for what the Bank will do, here's the key measures they look to. These strip out volatile components. Unfortunately, all started adding more over the past three-months than they did in November. Not great. 😳

To end: as inflation returns to normal, it may be increasingly relevant to recognize people experience price changes differently depending on what they buy. I estimate the "personal inflation" rate varied in Dec 2023 from 2.6% (owners, no mortgage) to 3.7% (renters). #cdnecon

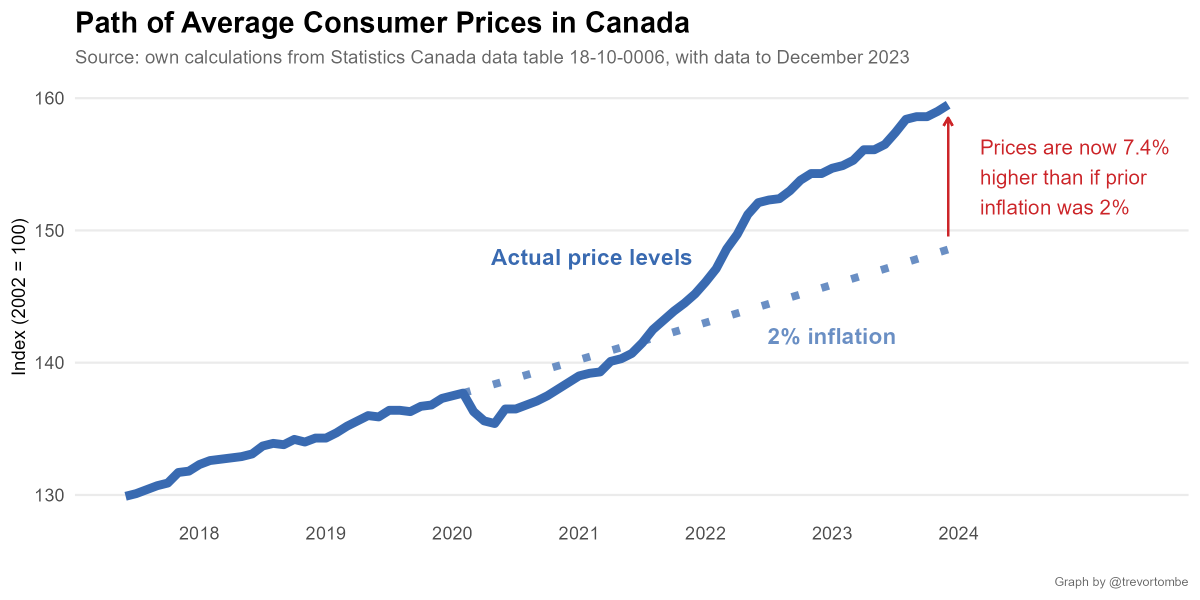

It's also worth noting (I make this point regularly) that even as inflation normalizes, price levels remain higher than they otherwise would have been. This makes the affordability challenge top of mind -- and may remain so for years if/until earnings catch up.

• • •

Missing some Tweet in this thread? You can try to

force a refresh