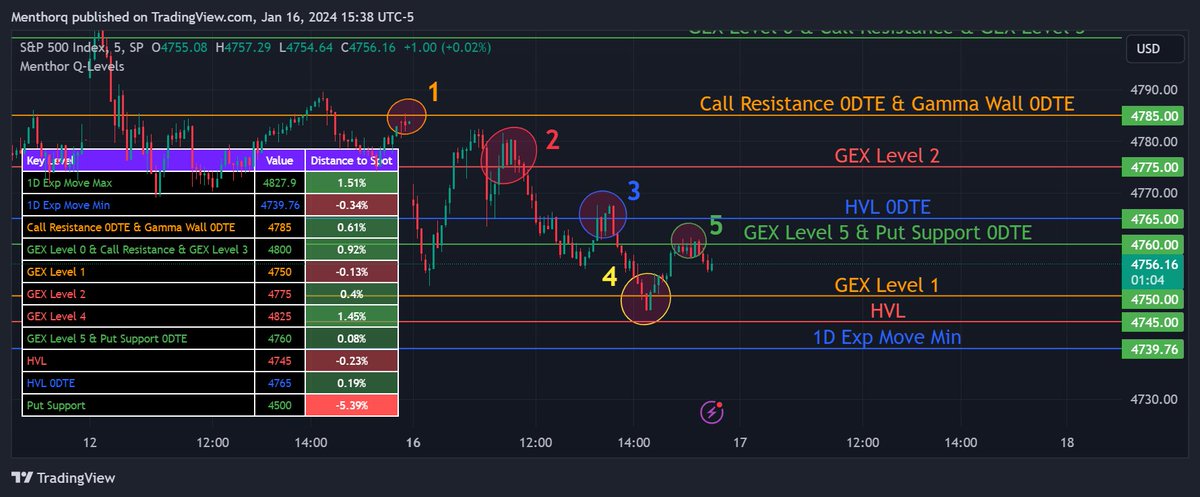

1/ A bit of Waller and pre Vixperation gave the market a little excitement. Today last trading day for VIX. Let's see how the key levels can help you risk manage. While it is impossible to have 100% accurate models, we can still use them as support. Let's take a look 👀🧵

2/ Starting from (1). We opened right at the Call resistance 0DTE. We could also see from NetGex, OI and BMO volumes that that looked like a solid level for the market to bounce off. We wrote a thread about it yesterday

3/ Then (2) we moved to the GEX level 2. This is a key level but not a major level. It uses NetGex to identify secondary key levels. You can find more about these levels here. Ultimately when the price reaches one of these levels, we want to look at what volumes are doing around that particular strikes. Working on intraday data, that should help you with this.

menthorq.com/guide/gex-leve…

menthorq.com/guide/gex-leve…

4/ We then bounced on the ODTE HighVolLevel (3). That is a key ODTE level, and also a volatility level you want to follow closely. If you take the GEX for each strike and create a cumulative sum, you get a curve that gives you the total GEX up to that strike. This curve is the GEX profile. The High Vol Level tells you at which point the slope of the GEX profile changes from negative to positive. This article breaks it down for you menthorq.com/guide/high-vol…

5/ Next the market moved right next the (4) HVL. While the previous HVL was the 0DTE HVL, this is the monthly HVL. You can find the different volatility level by downloading the different maturity NetGex. This was the chart before we started trading this morning

6/ Finally, the market bounced right off that HVL, that acted like a big support. Those key levels generally do and it just closed to the day (5) on the last GEX level. Hope these threads help you better understand our models and how you can use them to support your data driven decision making

• • •

Missing some Tweet in this thread? You can try to

force a refresh