How to get URL link on X (Twitter) App

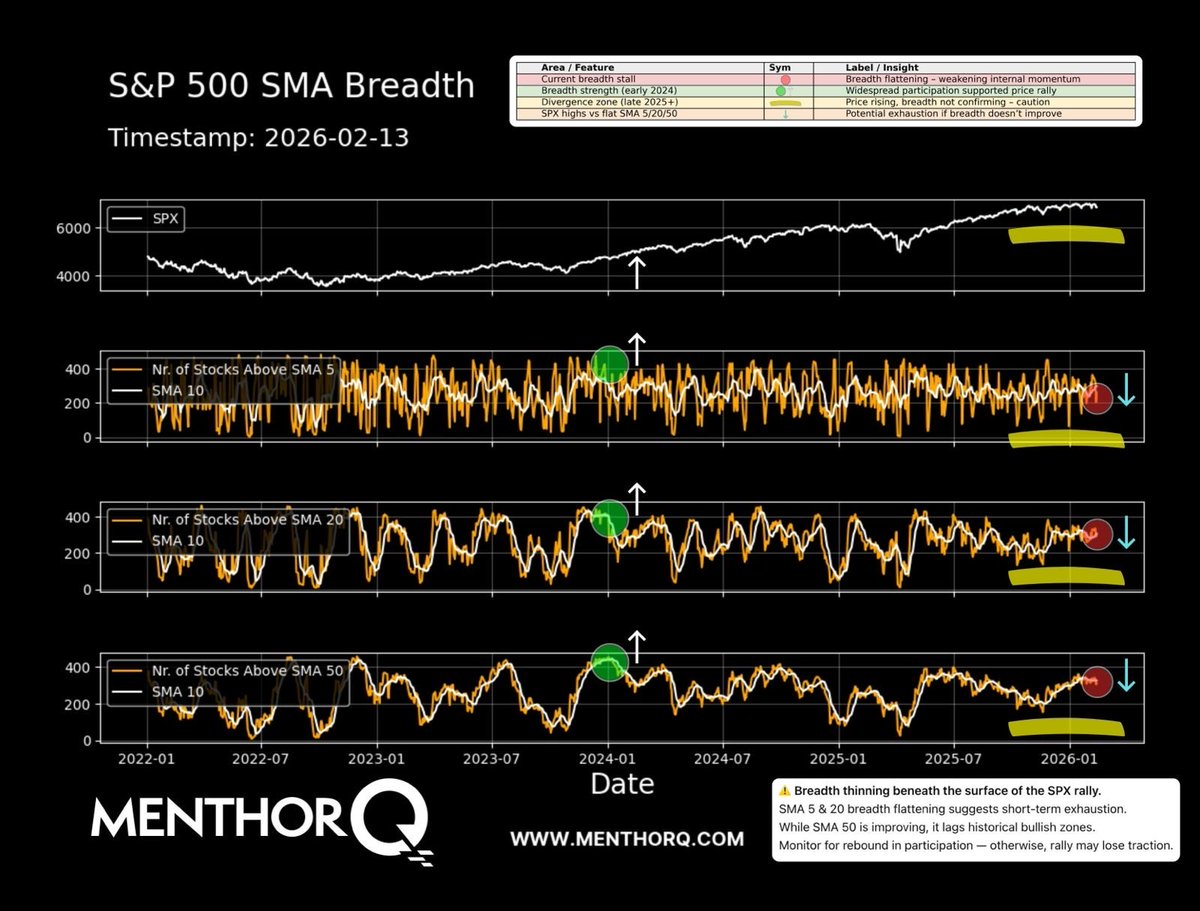

2/ Top panel: SPX price.

2/ Top panel: SPX price.

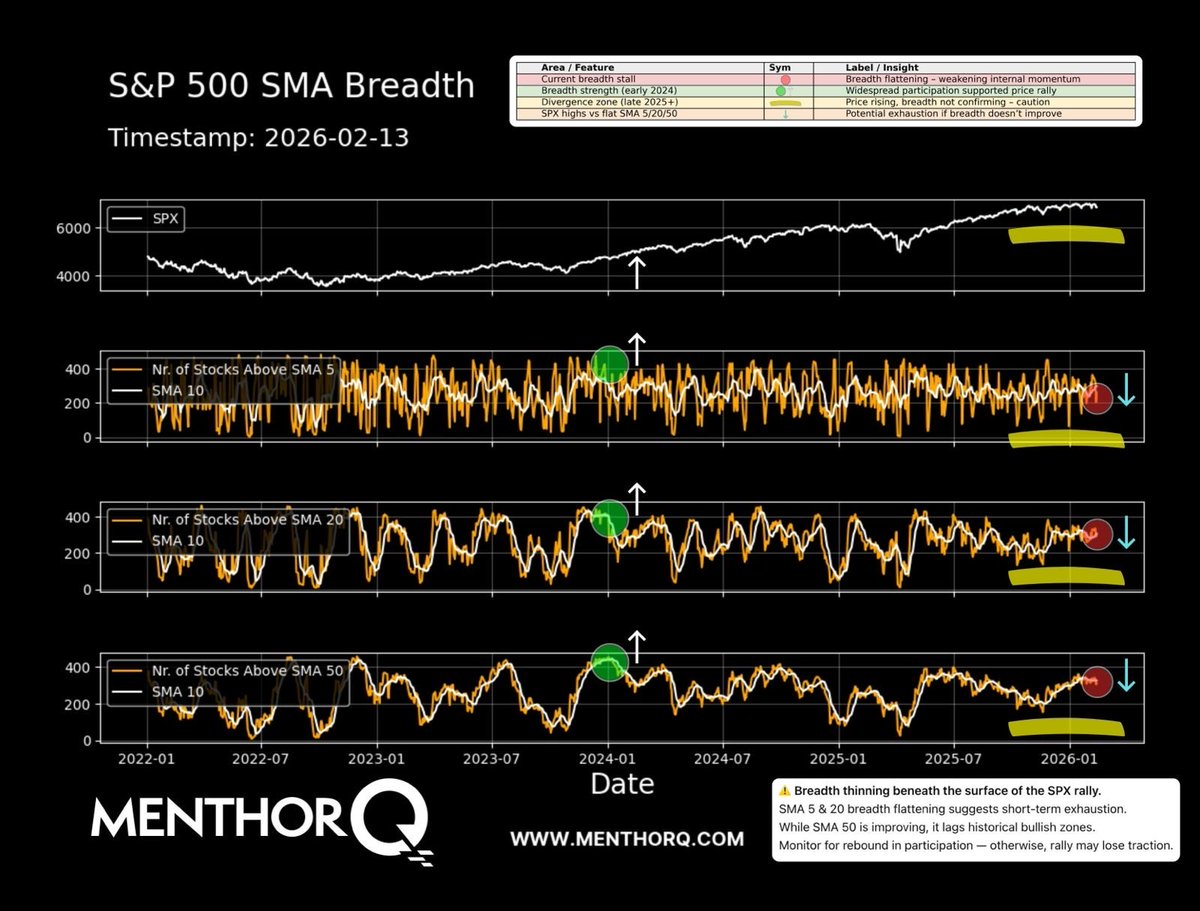

2/ Top panel: SPX price (candles).

2/ Top panel: SPX price (candles).

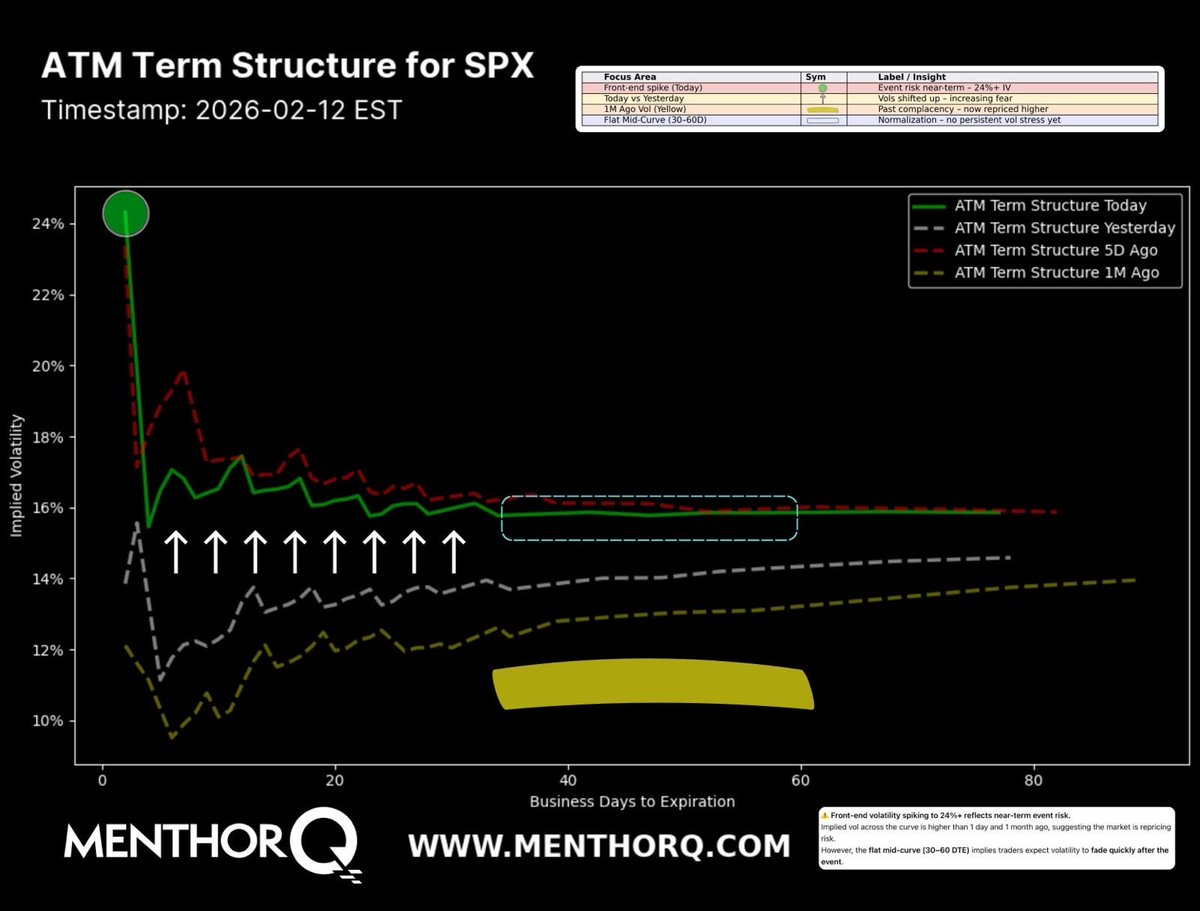

2/ First: What is “term structure”?

2/ First: What is “term structure”?

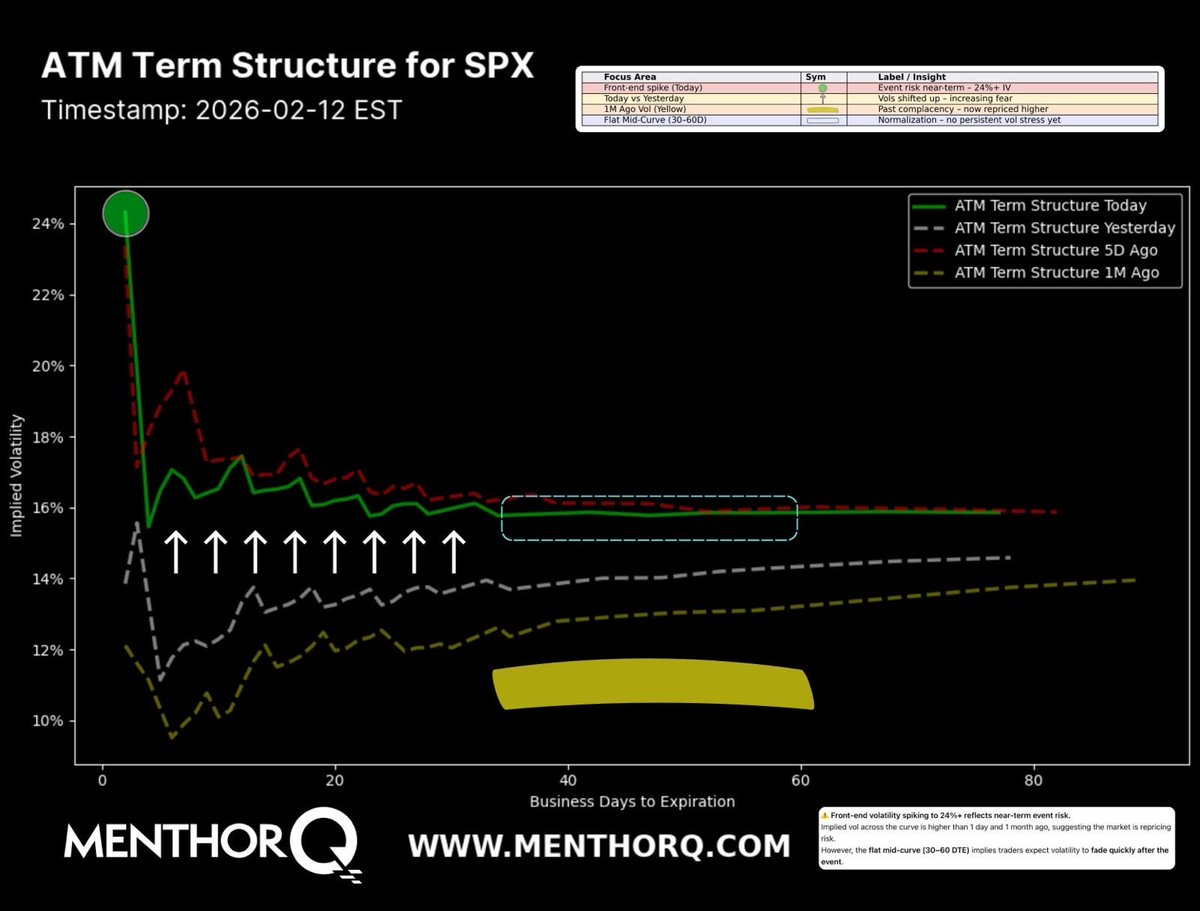

2/ First: What is “skew”?

2/ First: What is “skew”?

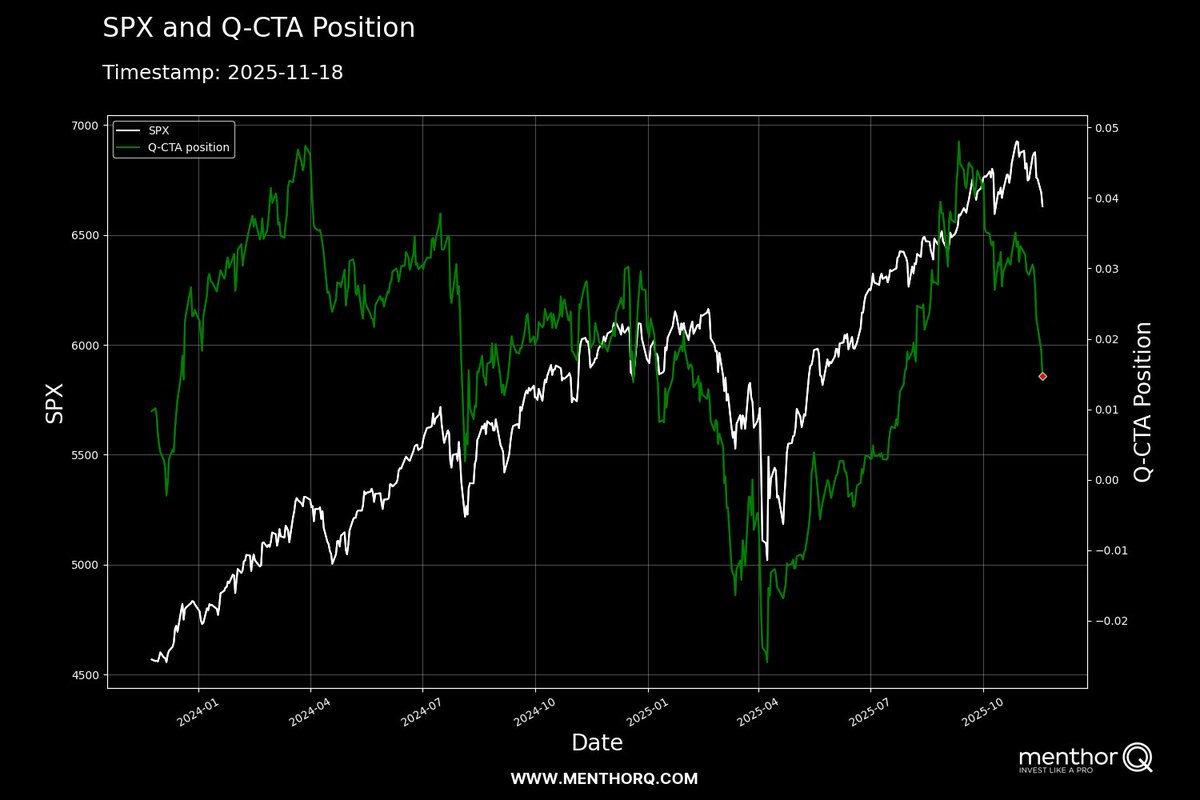

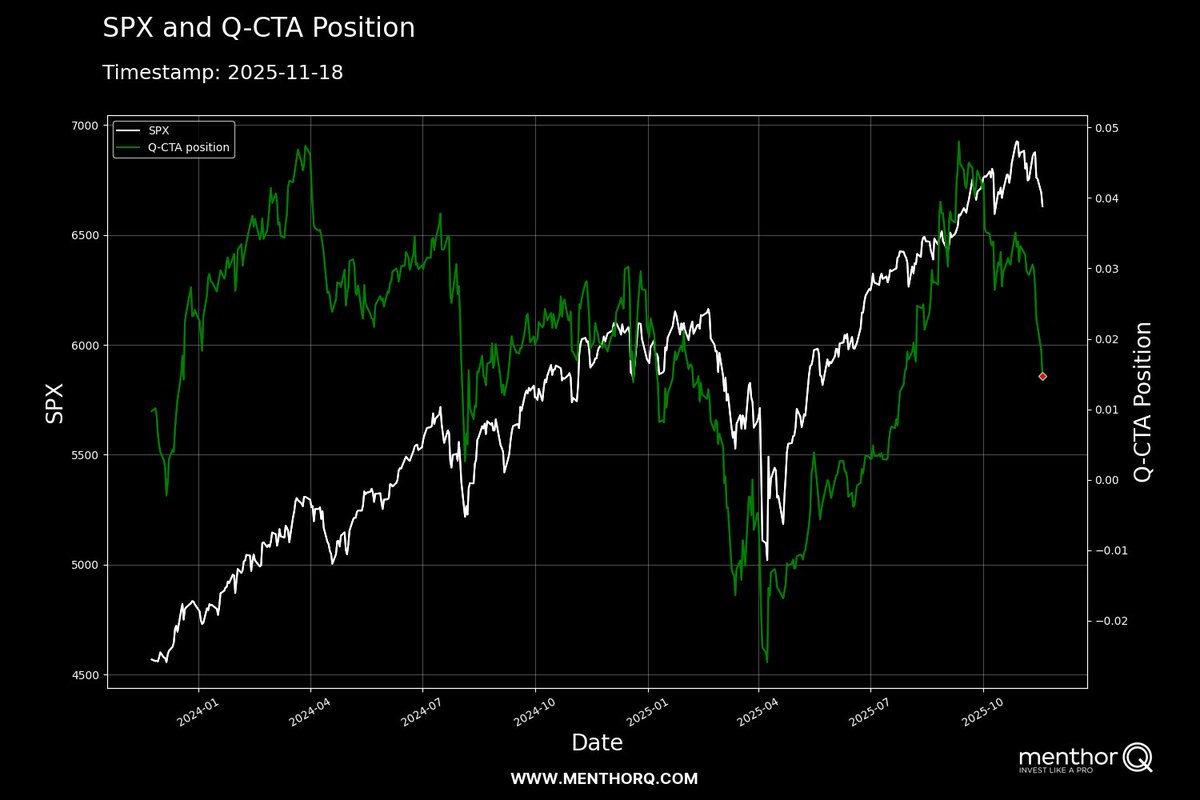

2/ When the green line rises, CTAs are adding exposure.

2/ When the green line rises, CTAs are adding exposure.

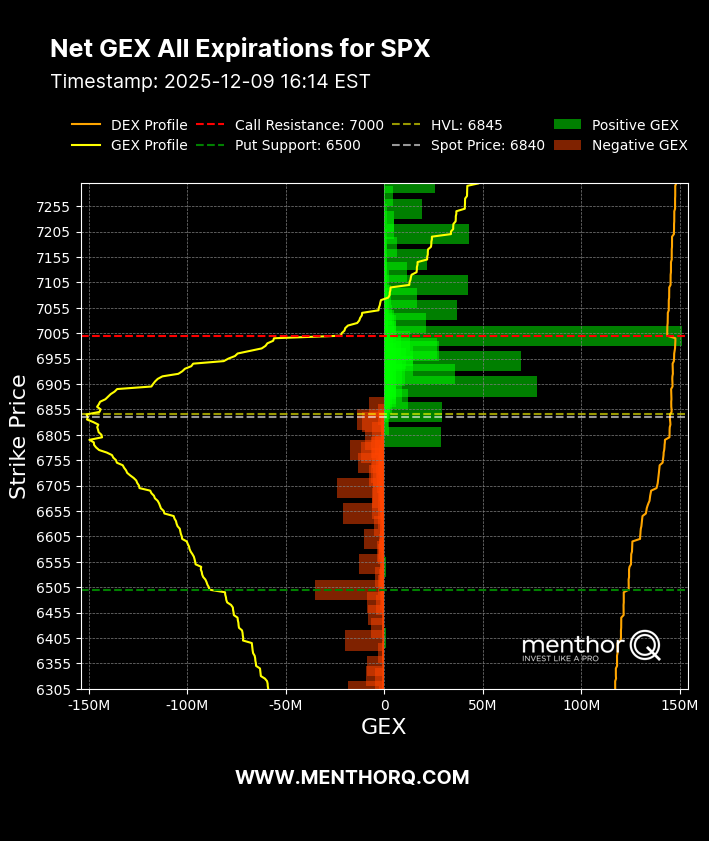

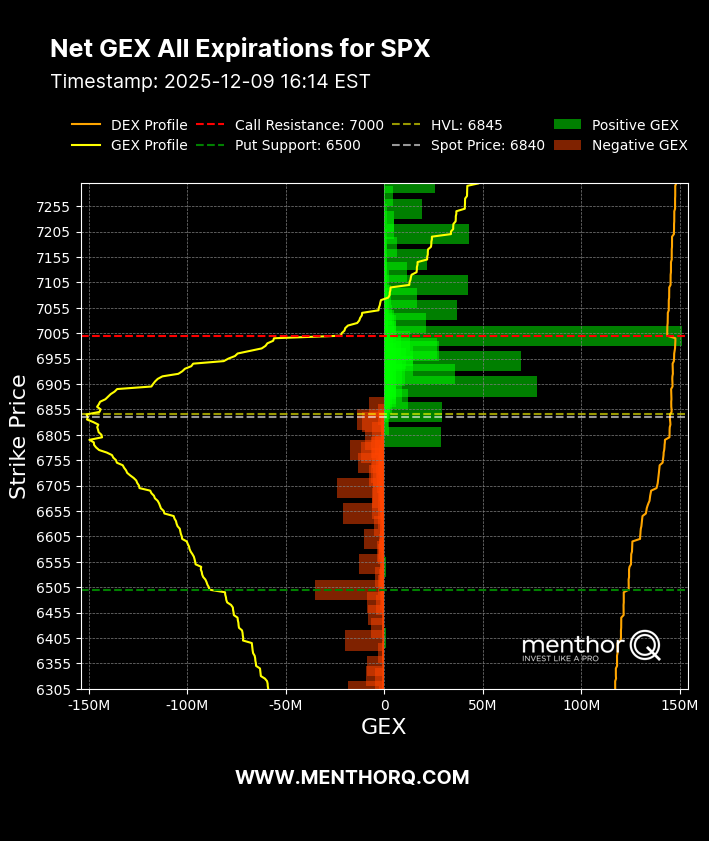

2/ Gamma Exposure (GEX) Levels:

2/ Gamma Exposure (GEX) Levels:

2/ This chart tracks two lines:

2/ This chart tracks two lines:

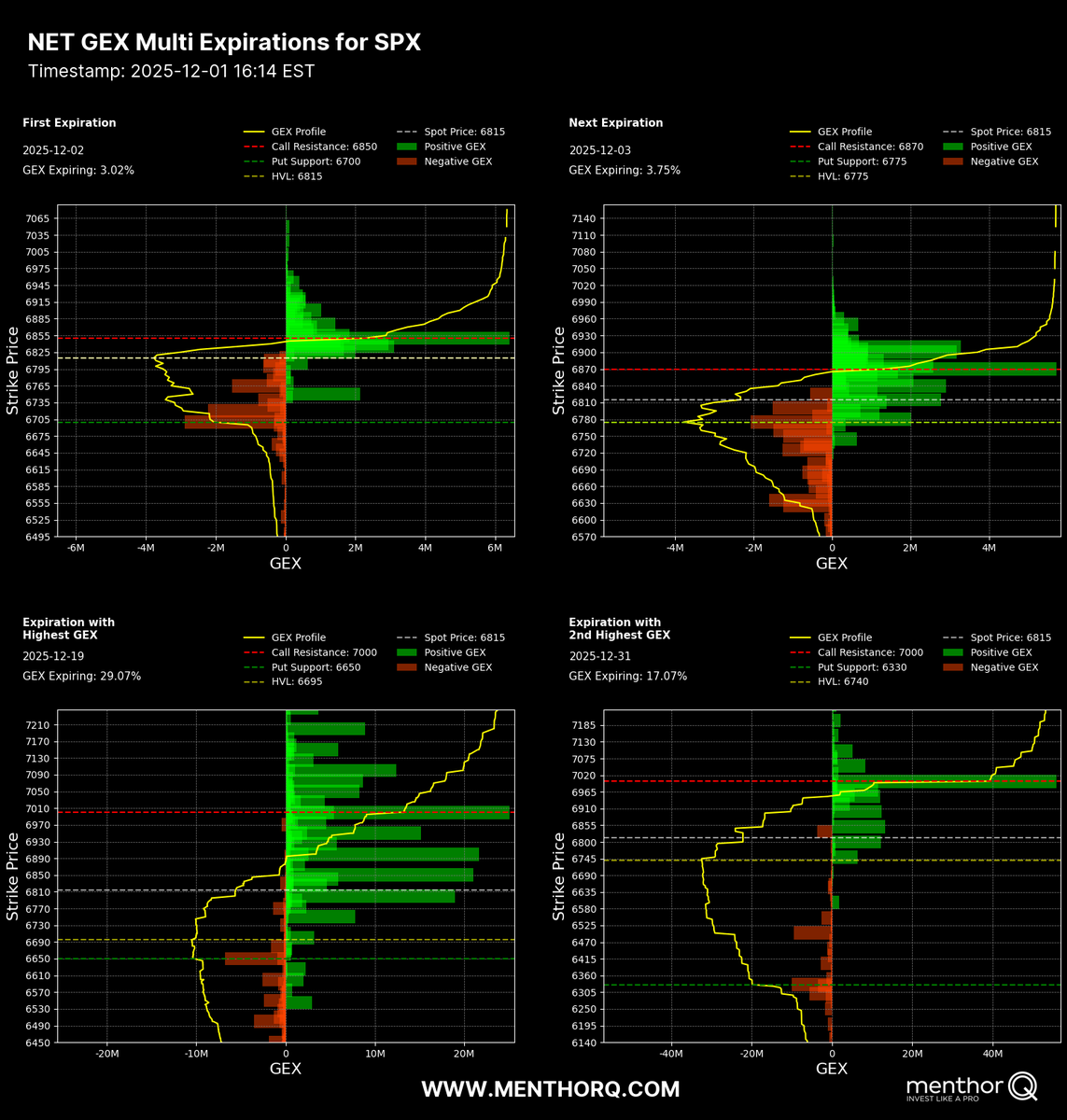

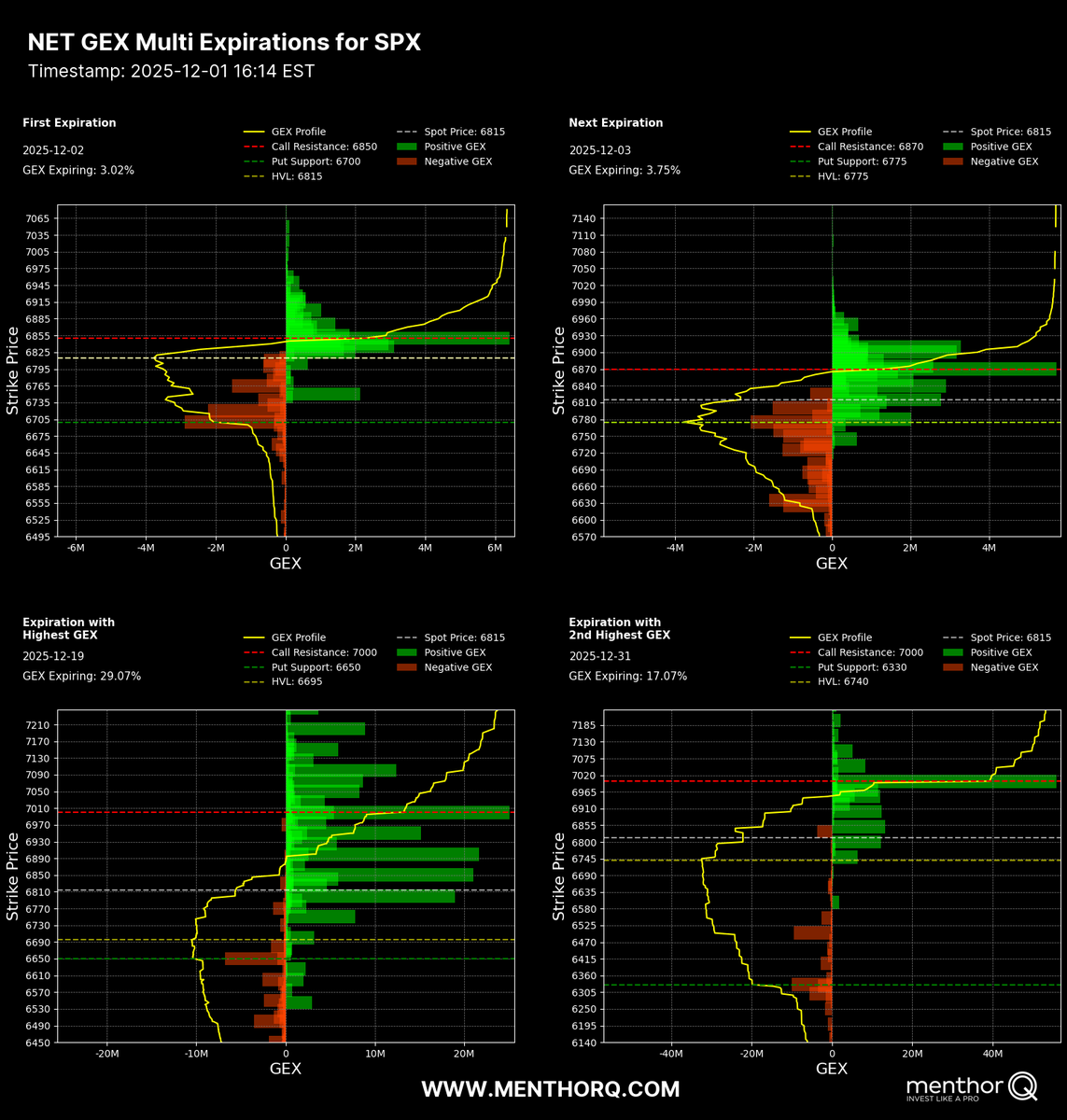

2/ Each panel shows Gamma Exposure (GEX) across different SPX option expirations.

2/ Each panel shows Gamma Exposure (GEX) across different SPX option expirations.

2/ In this chart:

2/ In this chart:

2/ What happens as price approaches Put Support?

2/ What happens as price approaches Put Support?

We know by now that markets not efficient machines.

We know by now that markets not efficient machines.

2/ Key takeaways from this surface

2/ Key takeaways from this surface

2/ Why It’s Called a “Smile” 😬

2/ Why It’s Called a “Smile” 😬

2/ The Fort Knox Controversy & U.S. Gold Reserves

2/ The Fort Knox Controversy & U.S. Gold Reserves

2/ 🔎 What is the 1D Expected Move Indicator?

2/ 🔎 What is the 1D Expected Move Indicator?

2/ What is Put Support?

2/ What is Put Support?