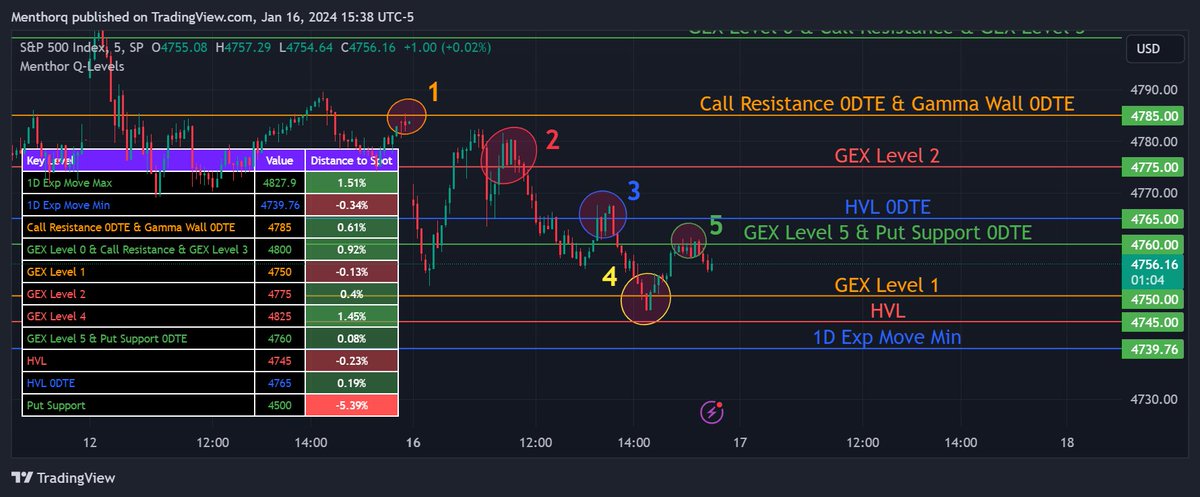

1/ A quick look at Gamma in Options including for 0DTE to close the day. Gamma is a crucial Greek in options trading (we all know that at this point), indicating how sensitive an option's delta is to changes in the underlying asset's price. Let's explore the key factors affecting gamma next 🧵

2/ Strike Price vs. Spot Price. Gamma is highest for ATM options, as they are highly sensitive to spot price changes. Far OTM options, with a delta near 0%, show little to no gamma. Simple chart 👇

3/ ATM Options and Gamma. ATM options, hovering around a 50% delta, react significantly to even slight changes in the spot price. This heightened sensitivity results in higher gamma. Another simple chart here

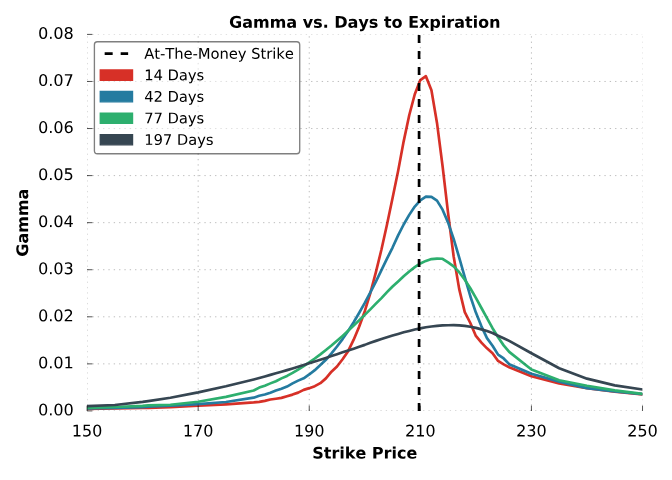

4/Time to Expiration: Shorter-dated options have greater gamma compared to longer-dated ones. This is because any spot price change is more impactful when there's less time for the option to expire (think of 0DTEs). Simple chart

5/ Understanding Time Effect. Consider a 0DTE ATM call option. A minor dip in the spot price dramatically changes its delta, indicating a high gamma. Conversely, a 2-year ATM option barely reacts, showing low gamma. Options with various expiration times display varying gamma levels - the closer to expiration, the higher the gamma. This reflects the urgency and impact of price changes

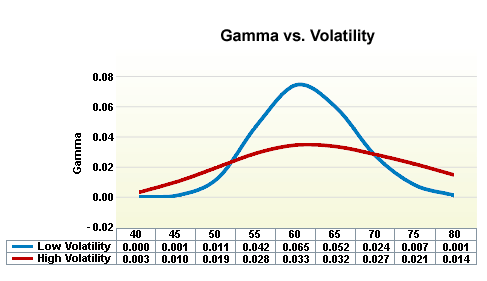

6/ Implied Volatility's Role: IV inversely affects gamma. Higher implied volatility leads to lower gamma, as small changes in spot price are less significant due to expected high fluctuations. With high IV, minor spot price movements don't greatly affect the option's delta, leading to lower gamma. Conversely, options with low implied volatility exhibit higher gamma. Simple but effective chart

7/Understanding gamma helps in evaluating the sensitivity of options across different market conditions. Our models can help you with that. We send free daily option data on SPX, QQQ and VIX here as well as more free educational material 👉 menthorq.com/start-free/

• • •

Missing some Tweet in this thread? You can try to

force a refresh