1) We are short Jin Medical International Ltd $ZJYL, a China Hustle-style charade. Jin sells wheelchairs and parts in China. In 2022, its revenues fell 8% to just $19M. $ZJYL trades at ~45x revenues. At reasonable "peer" levels of 1-6x sales, $ZJYL shares fall 90% or more.

2) $ZJYL went public in March 2023, underwritten by China-focused chop shop, Prime Number Capital. Prime Number is headquartered in a Long Beach home and has already been sued by investors at least twice for alleged roles in other China frauds. Their track record is horrific.

3) In Sept 2023, $ZJYL faced a NASDAQ delisting notice as it fell under the 300 shareholder threshold required for continued listing. On October 24, $ZJYL CEO Erqi Wang filed a Form 144 to sell 545,893 shares. Then $ZJYL fired its auditor, MarcumAsia, and hired DNTW Toronto.

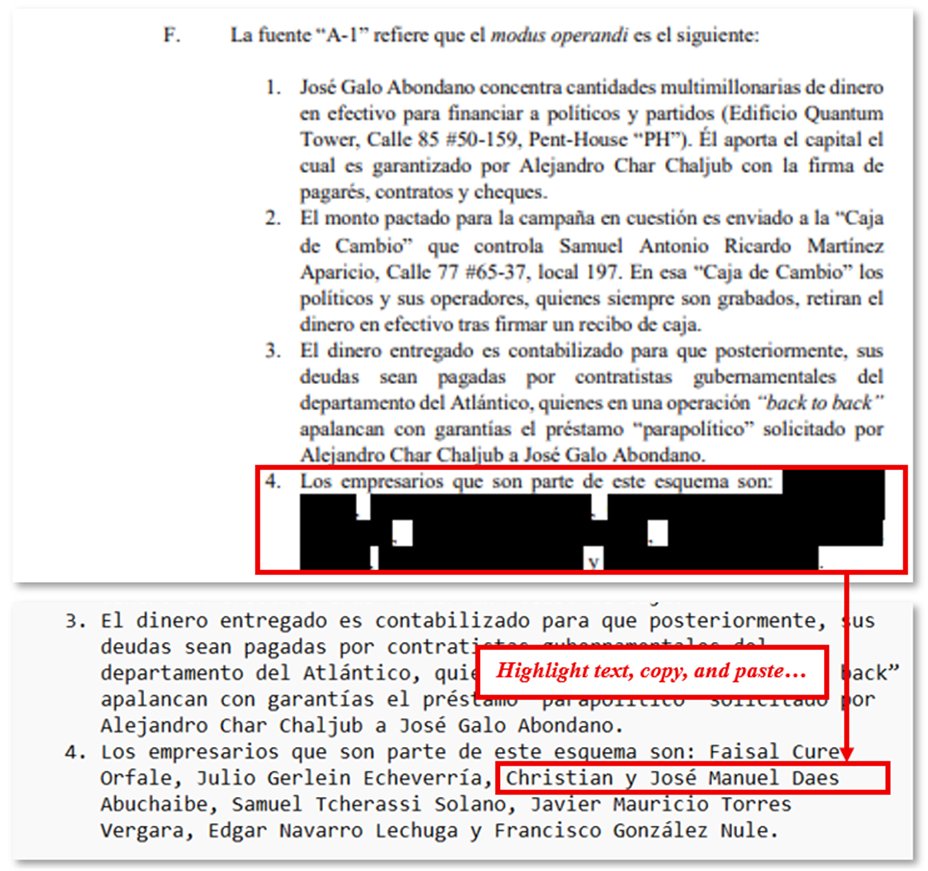

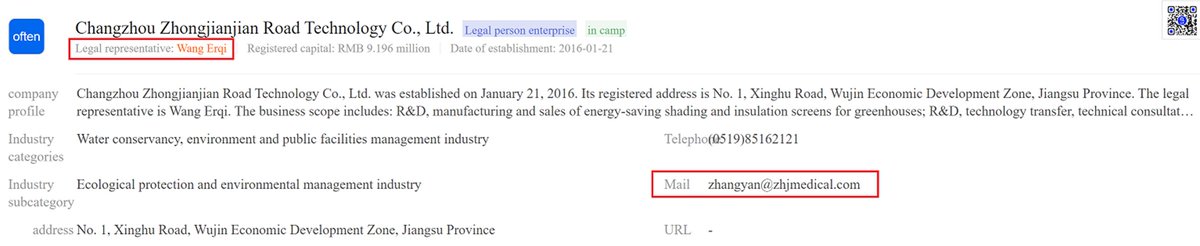

4) Current $ZJYL auditor DNTW appears to have been previously shut down and its partners charged by the SEC for its role in another China fraud, Subaye, which claimed to be running a cloud business that didn't exist. We think the $ZJYL story will end similarly...

5) We think $ZJYL's recent announcements coinciding with the stock's 10x rise are likely conjured up solely to pump shares and avoid pending delisting. We uncovered that each of Jin's December 11 and December 14 "deals" are with related parties - namely CEO Erqi Wang himself.

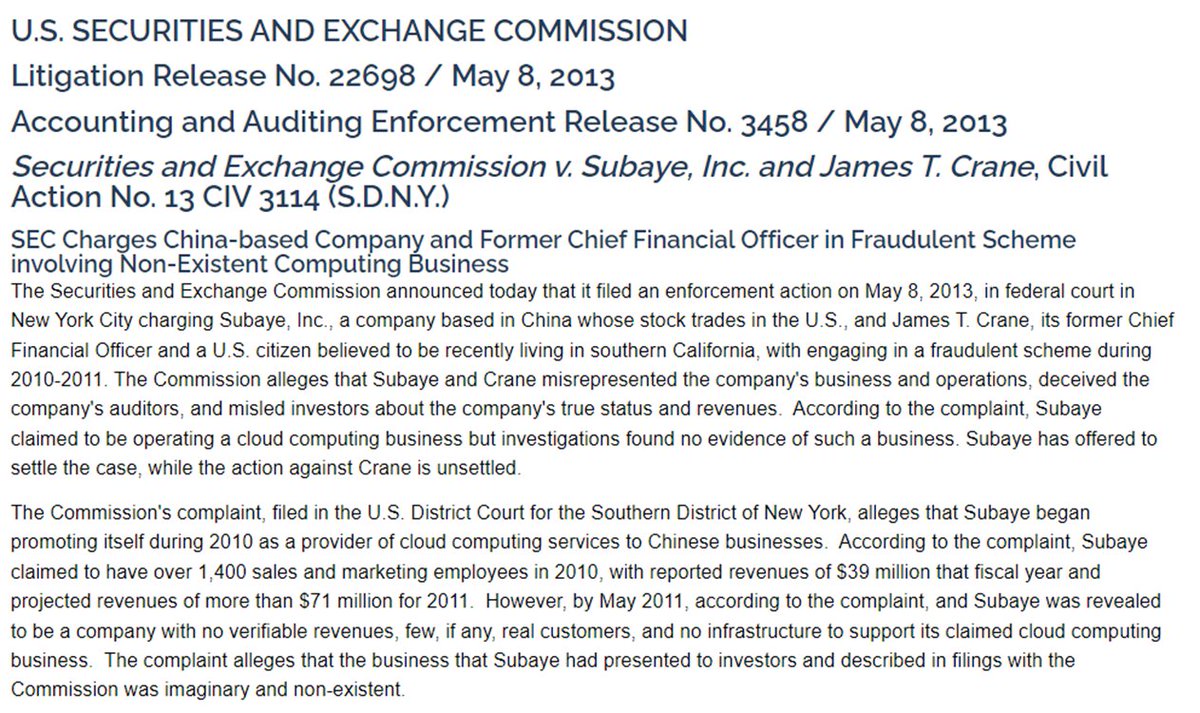

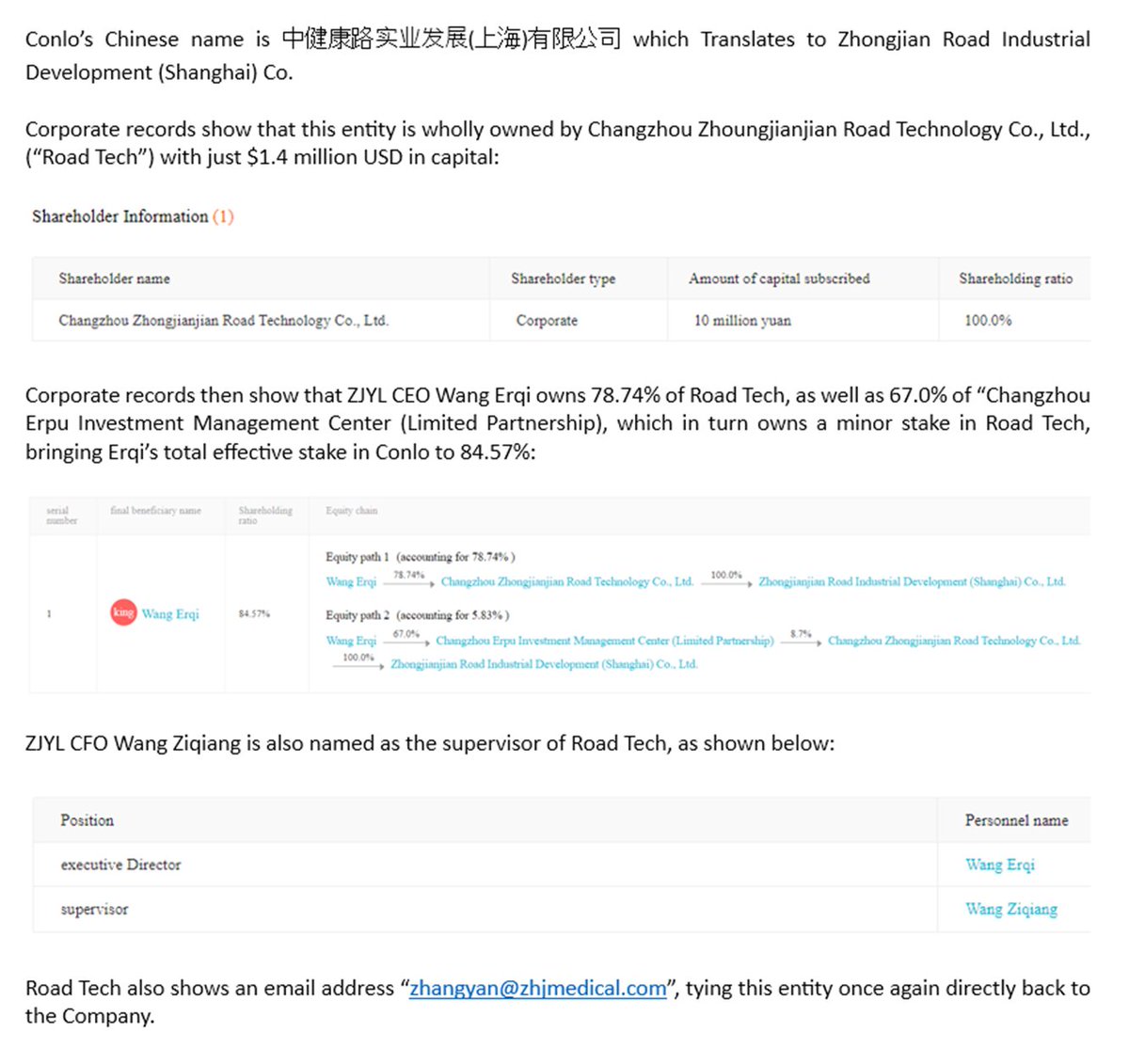

6) On December 11, $ZJYL claimed it won a 66M RMB ($9M USD) order to sell oxygen chambers to "Conlo Industrial Development." However, Conlo's records show that Conlo is majority-owned by $ZJYL CEO Wang, while records also name $ZJYL CFO Ziqiang Wang and an $ZJYL email address.

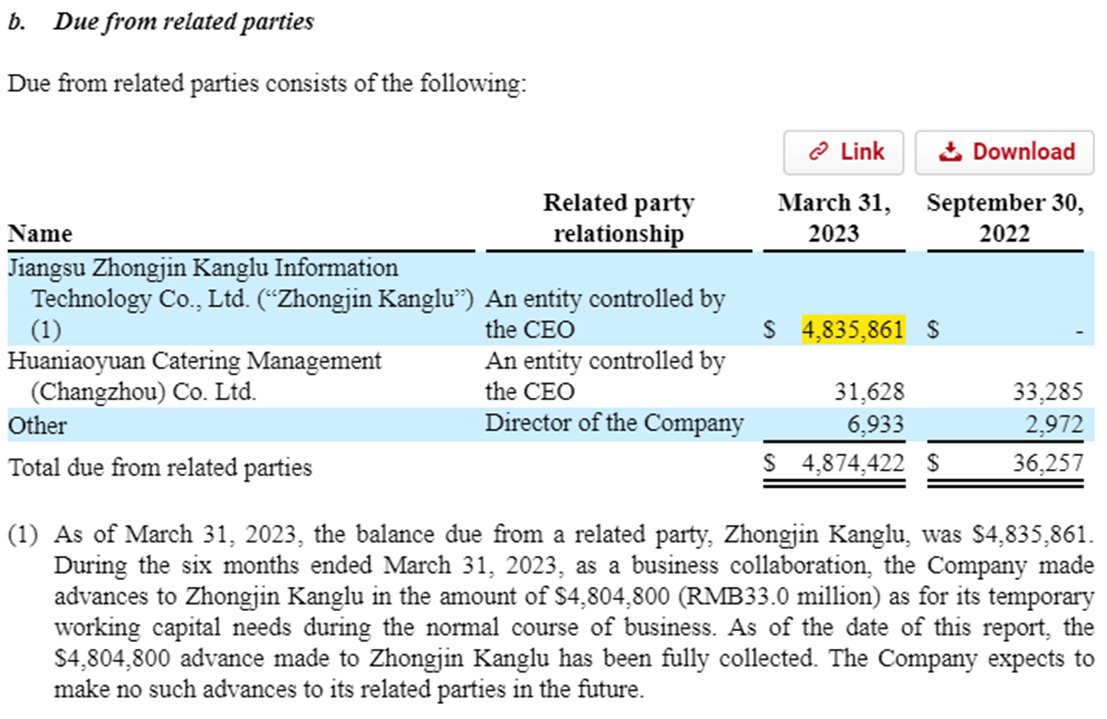

7) Similarly, on December 14, $ZJYL claimed to enter an MOU to acquire all or a part of Juangsu Zhongjin Kanglu Information Tech Co. ("Kanglu"). Yet again, Kanglu is controlled by $ZJYL CEO Erqi Wang, and Kanglu owes $4.8M to $ZJYL. In this light, the "MOU" looks like a bailout.

8) $ZJYL hasn't filed results since 3/31 and reported material weaknesses in each 2020, 2021, and 2022. $ZJYL makes related party loans to its CEO Erqi Wang and guarantees loans to Wang's outside entities. To us, $ZJYL's public listing looks like an insider enrichment scheme.

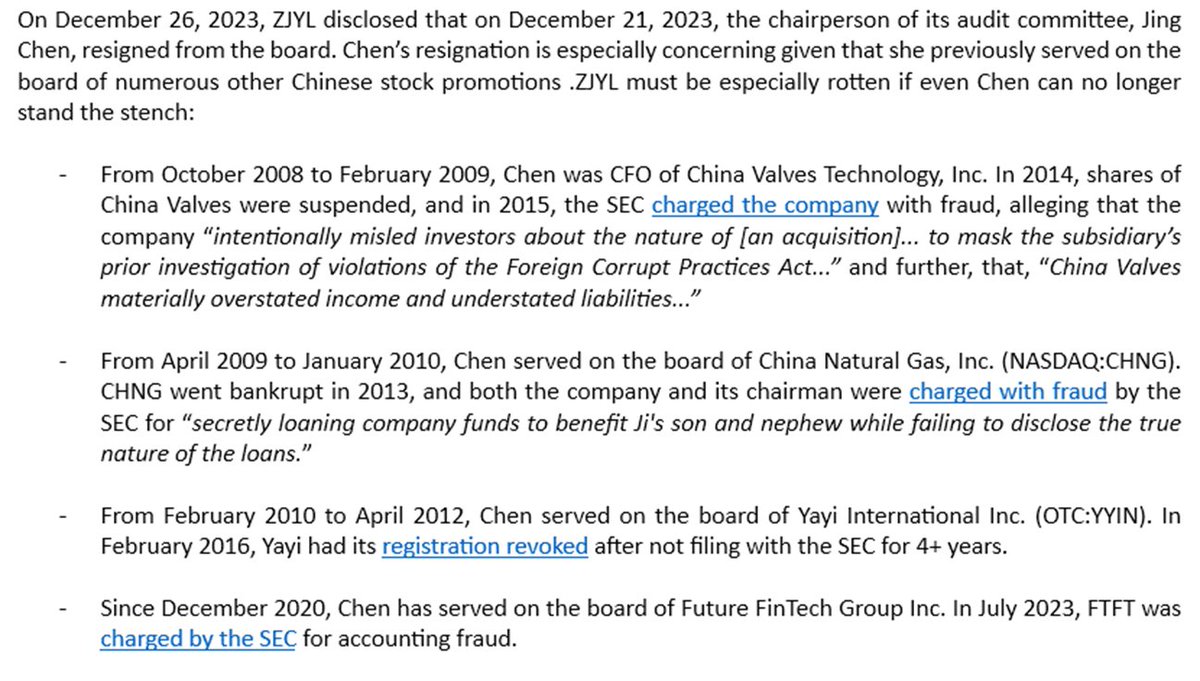

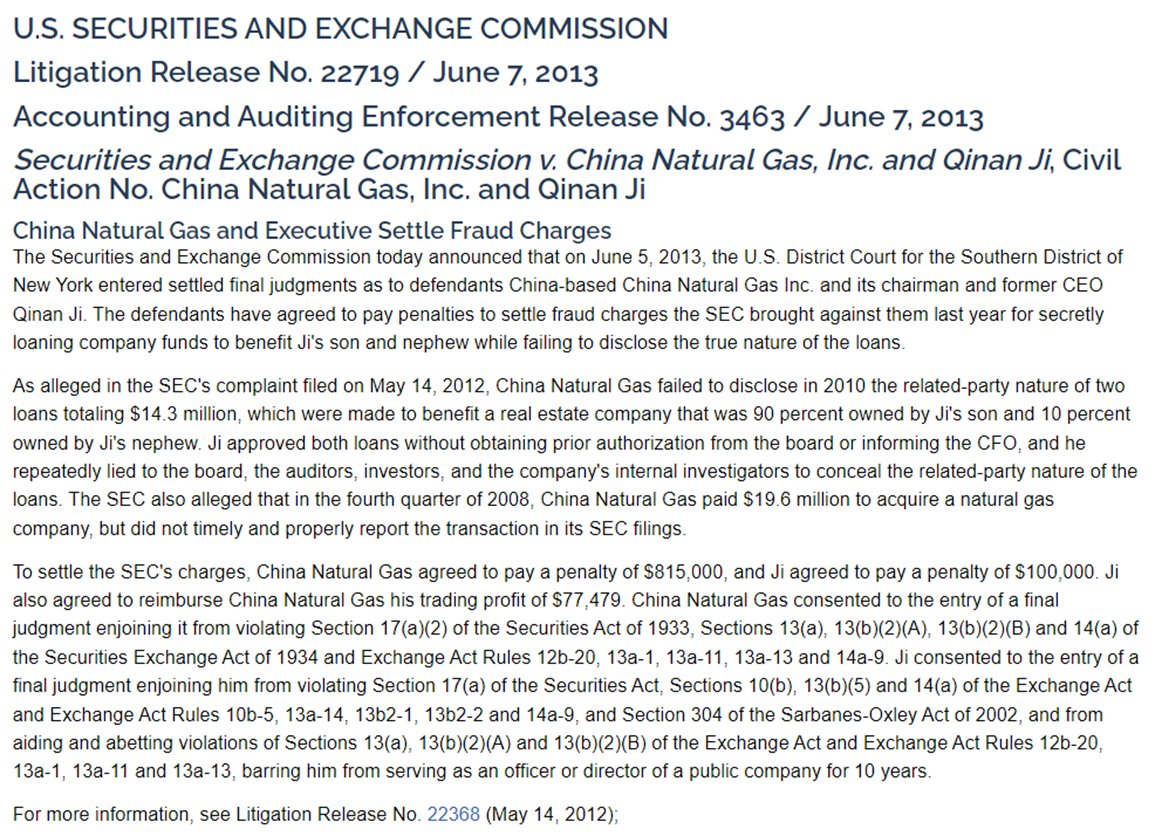

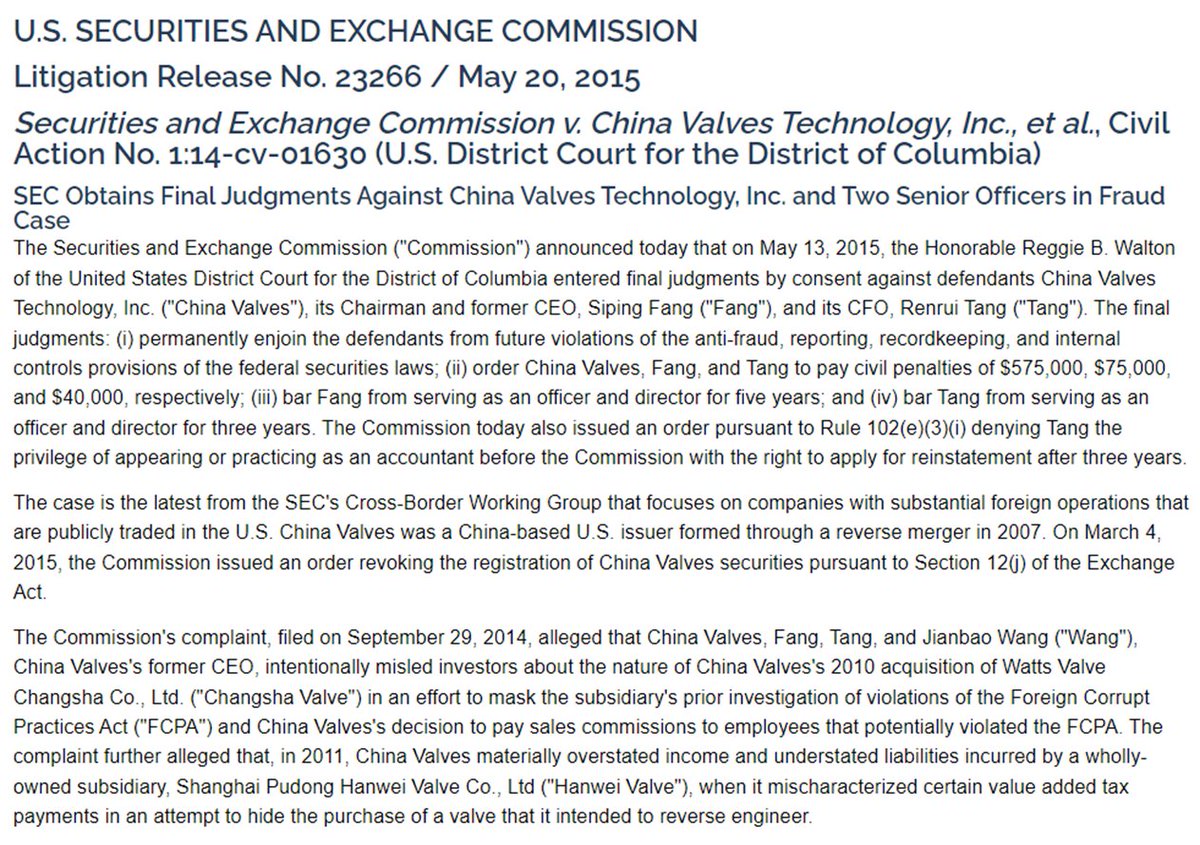

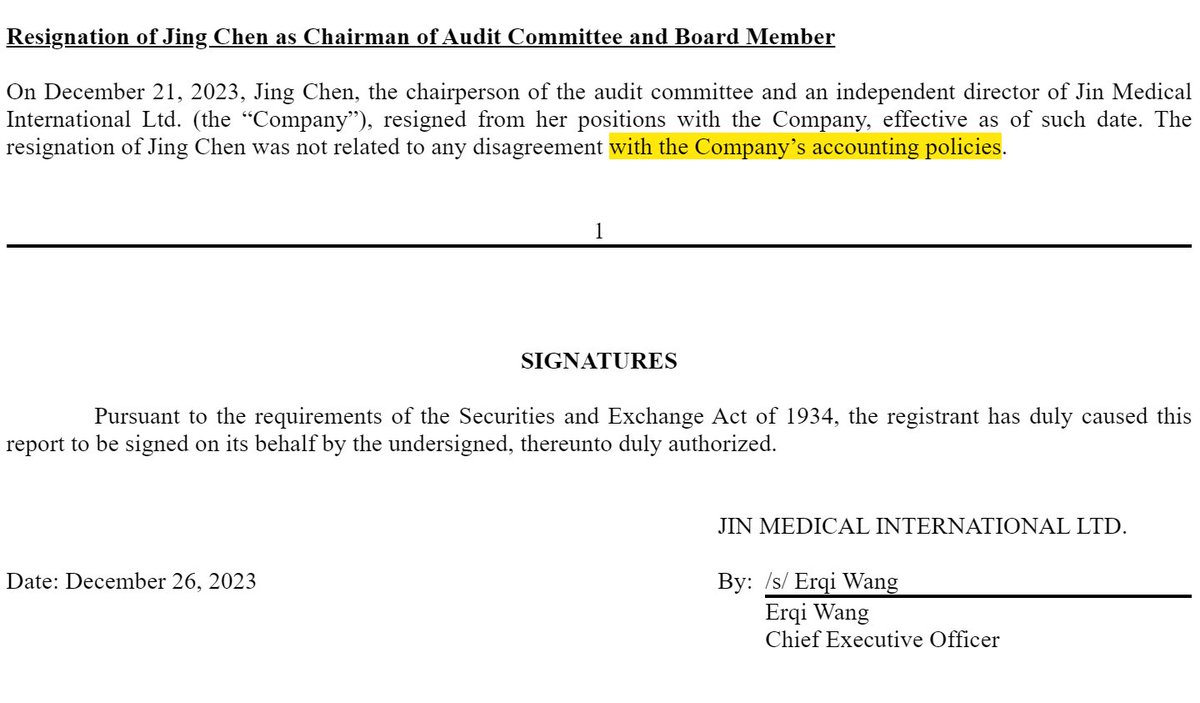

9) On December 26, $ZYJL disclosed that its audit committee chair, Jing Chen, resigned. Chen's resignation is especially concerning given Chen previously served numerous other China frauds. $ZJYL must be especially spoiled if Chen can no longer stand the stench.

10) $ZJYL cleverly reassured investors that Chen's resignation was not due to "disagreement with the Company's accounting policies," but $ZJYL has yet to file financials since the bogus deals, and the notice excludes standard language covering general business disagreements.

11/11) $ZJYL has an appeal hearing set with the NASDAQ for March 14 to stave off delisting. We see no reason that $ZJYL ought to continue trading. We think that NASDAQ and the SEC ought to halt shares to protect investors from yet another obvious China-based con. @NasdaqExchange @Nasdaq

• • •

Missing some Tweet in this thread? You can try to

force a refresh