How to get URL link on X (Twitter) App

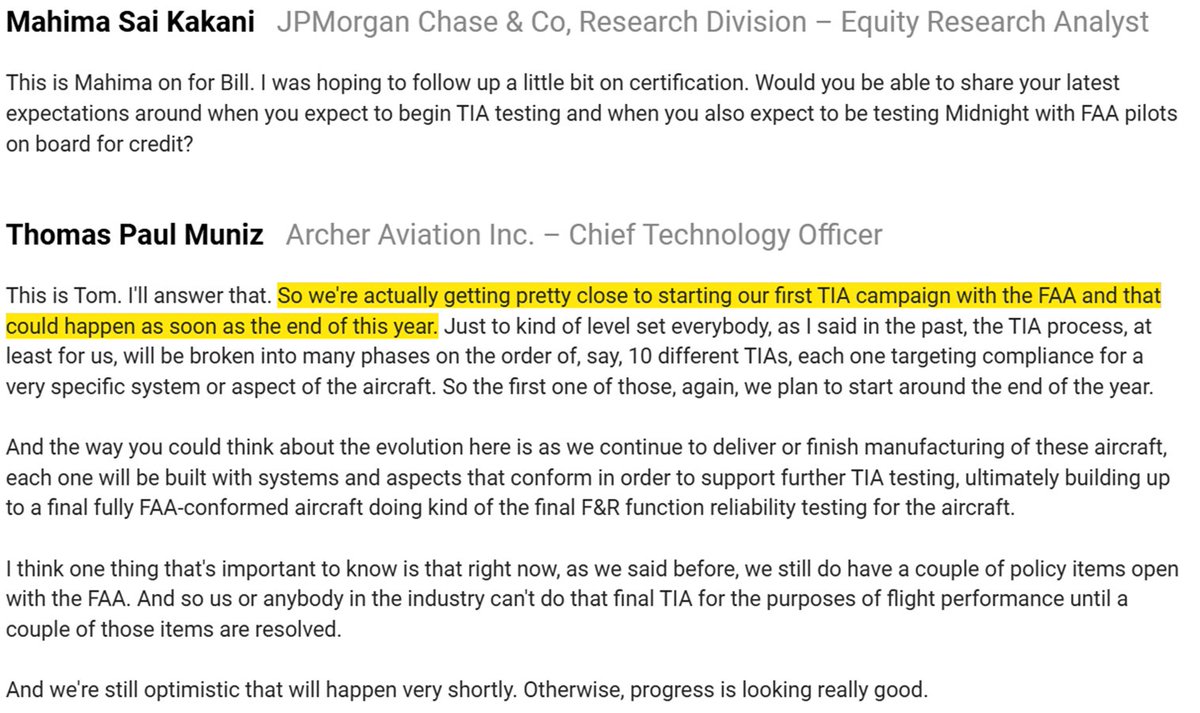

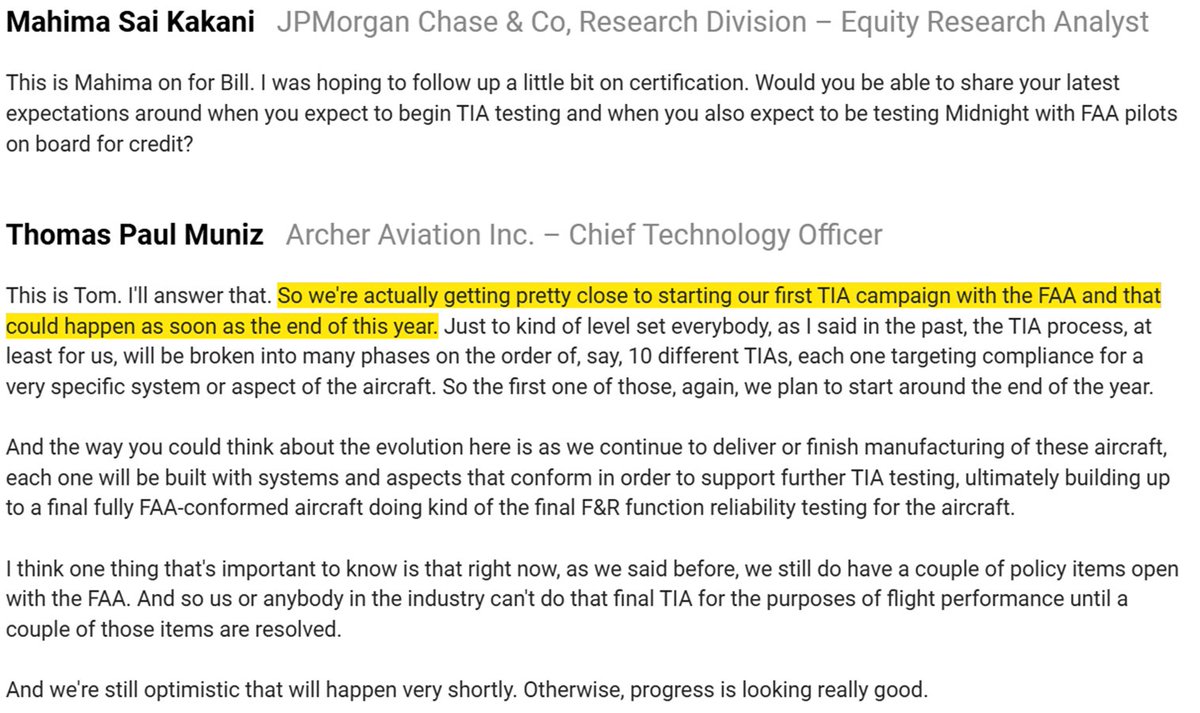

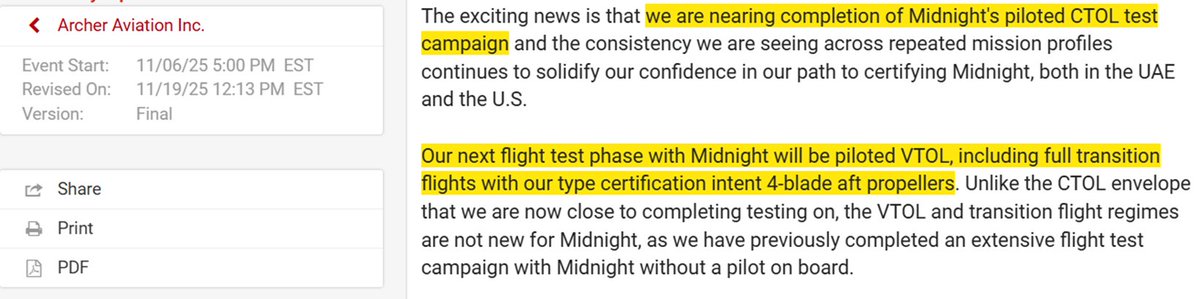

https://twitter.com/CulperResearch/status/19248149200858687802) On $ACHR's November 6, 2025 conf. call, CTO Muniz said "our first TIA campaign with the FAA…could happen as soon as the end of this year." CEO Goldstein said "we're now nearing completion of the piloted CTOL flight regime" and that piloted VTOL testing would be next.

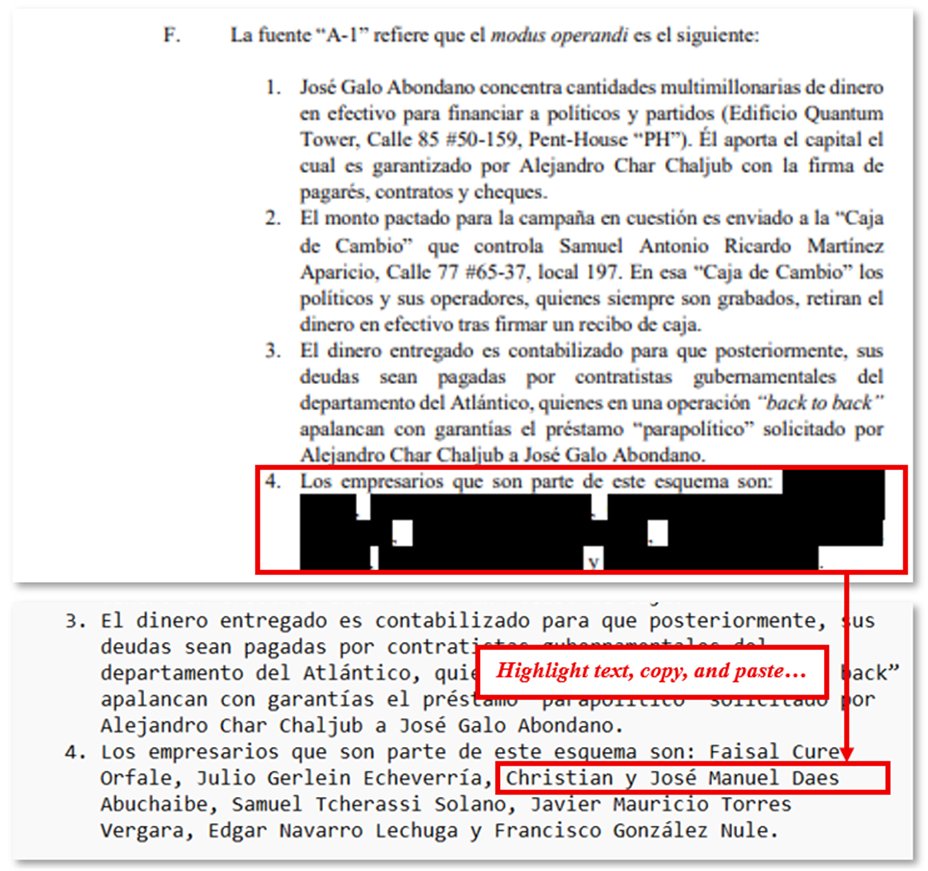

@jimmyfallon 2) We believe $ACHR has systematically lied about Midnight's progress in the LTM, to conceal underlying aircraft stability issues and its sham transition flight. Archer’s claim to near-term commercialization is not only premature, but reckless. Don't just take our word for it...

@jimmyfallon 2) We believe $ACHR has systematically lied about Midnight's progress in the LTM, to conceal underlying aircraft stability issues and its sham transition flight. Archer’s claim to near-term commercialization is not only premature, but reckless. Don't just take our word for it...