The Ionic Clay Rare Earth Hype on the ASX

They are considered to be two of the hottest stocks on the ASX right now: Meteoric Resources $MEI and Viridis Mining & Minerals $VMM

'Ionic Rare Earths Discovery' is the name of the game, and these two juniors have supposedly found the jackpot in Brazil.

$MEI is trading at fully dil. ~AUD$500M market cap, with the smaller $VMM trading at full dil. AUD$95M market cap.

There has been lots of hype in both plays, but especially $VMM is in focus among speculators for the fact it has similar geology + supposedly similar resource base as $MEI, while trading at a considerable discount to this peer.

However, when we dive into the details, it seems that it is not as simple as it might seem at first sight (as with many things in life).

Let's dive in. 🧵

They are considered to be two of the hottest stocks on the ASX right now: Meteoric Resources $MEI and Viridis Mining & Minerals $VMM

'Ionic Rare Earths Discovery' is the name of the game, and these two juniors have supposedly found the jackpot in Brazil.

$MEI is trading at fully dil. ~AUD$500M market cap, with the smaller $VMM trading at full dil. AUD$95M market cap.

There has been lots of hype in both plays, but especially $VMM is in focus among speculators for the fact it has similar geology + supposedly similar resource base as $MEI, while trading at a considerable discount to this peer.

However, when we dive into the details, it seems that it is not as simple as it might seem at first sight (as with many things in life).

Let's dive in. 🧵

Let's first start with the location.

Both companies have land holdings located in a unique geological complex called a caldeira (essentially a collapsed volcano) situated in South-Eastern Brazil, bordering the renowned mining province Minais Gerais.

The crater has provided some unique geological circumstances, which are ideal for the formation of ionic clays.

The main one being the fact that the crater (which is essentially formed like a bowl) prevented the outward transportation of the ionic rare earth mineralization and allowed for an effective concentration process.

Looking at the picture below, one can clearly discern the forested crater walls, which form an almost perfect circle.

Both companies have land holdings located in a unique geological complex called a caldeira (essentially a collapsed volcano) situated in South-Eastern Brazil, bordering the renowned mining province Minais Gerais.

The crater has provided some unique geological circumstances, which are ideal for the formation of ionic clays.

The main one being the fact that the crater (which is essentially formed like a bowl) prevented the outward transportation of the ionic rare earth mineralization and allowed for an effective concentration process.

Looking at the picture below, one can clearly discern the forested crater walls, which form an almost perfect circle.

The unique geological conditions of this area were quickly recognized by the Japanese who did exploration work in 2017-19, but decided not to follow up with a resource.

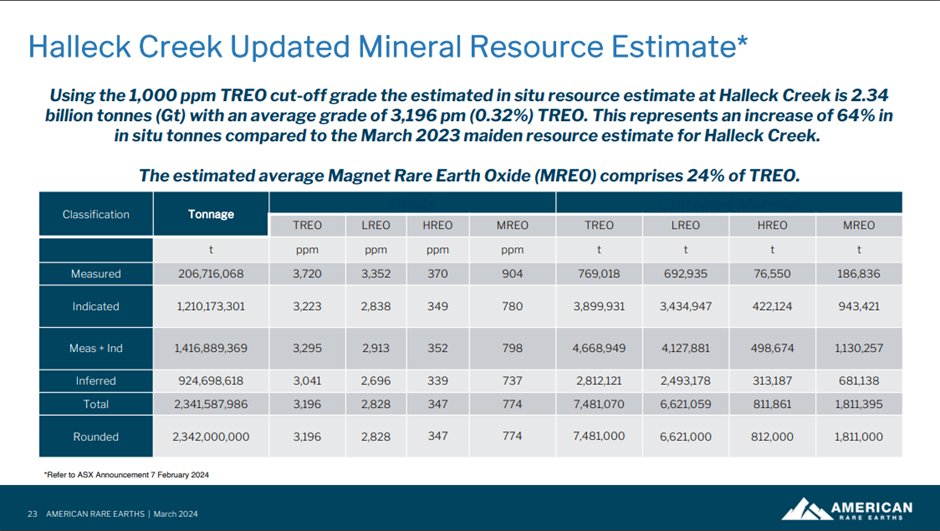

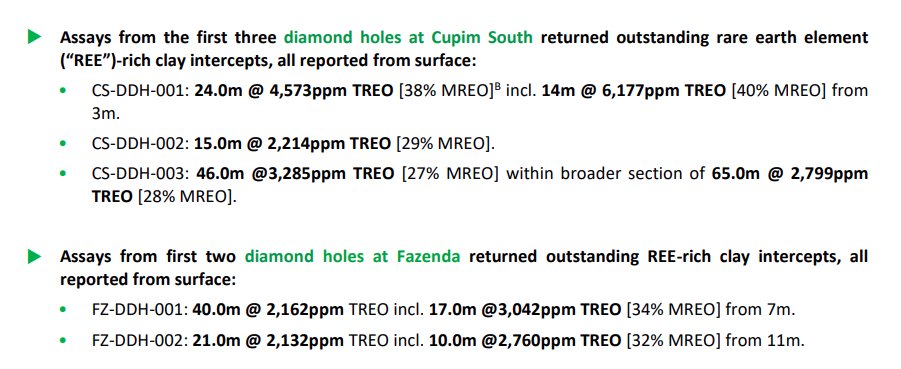

The project was subsequently acquired by Meteoric Resources $MEI who published a first MRE in May 2023, less than 6 months after taking ownership of the project.

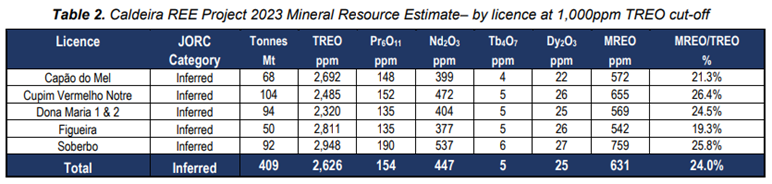

The MRE was based on the auger drilling done by the Japanese, and boasted an impressive resource of 409Mt at 2642ppm TREO, with a MREO/TREO proportion of 24%.

MREO = magnet rare earth oxides (i.e. Nd, Pr, Tb and Dy), and these are essentially the only payable rare earths contained.

It was after this resource publication that interest in the region increased dramatically, and it would not take long for other companies (like $VMM) to secure more 'strategic' land holdings in this complex.

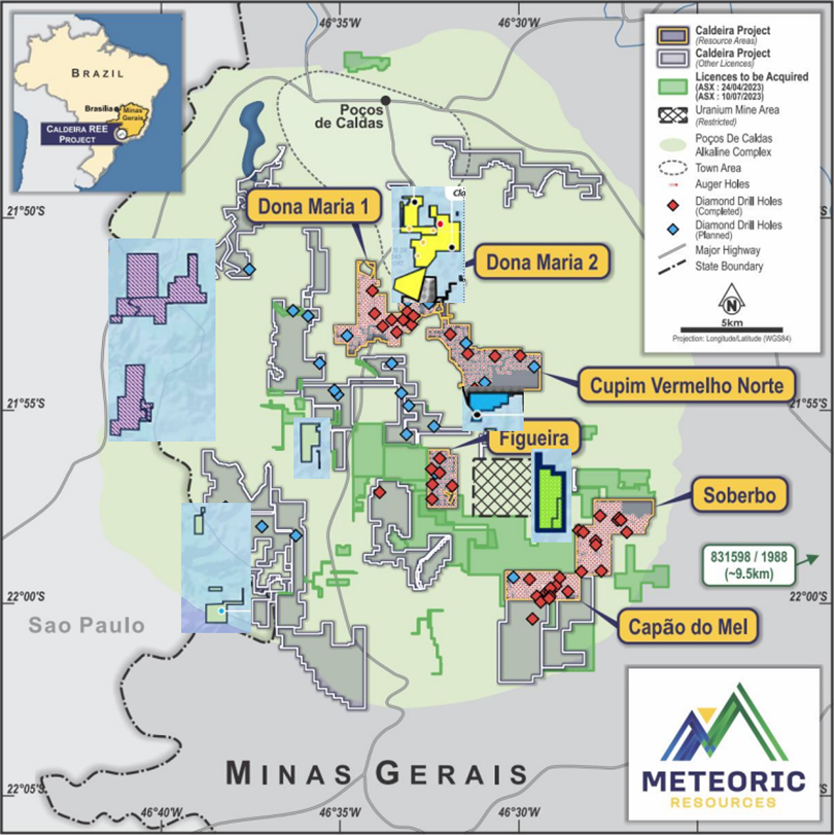

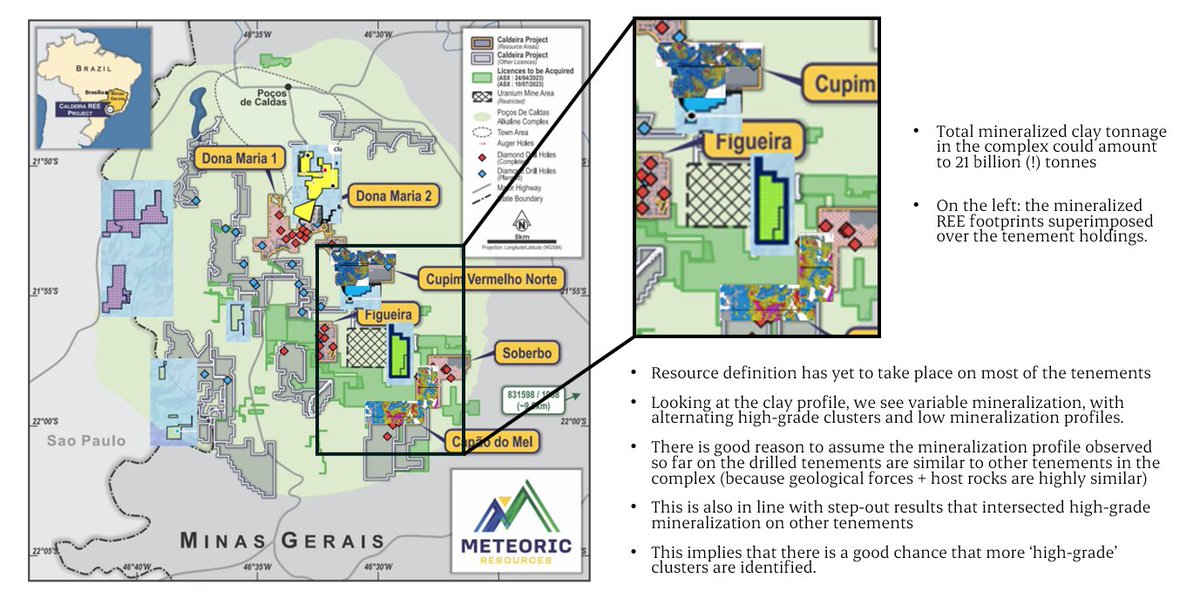

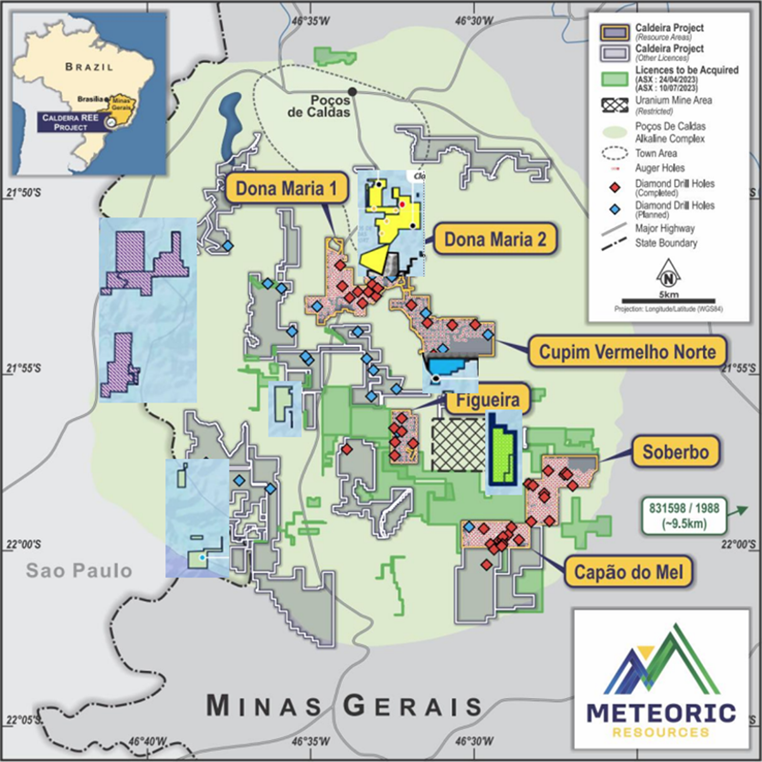

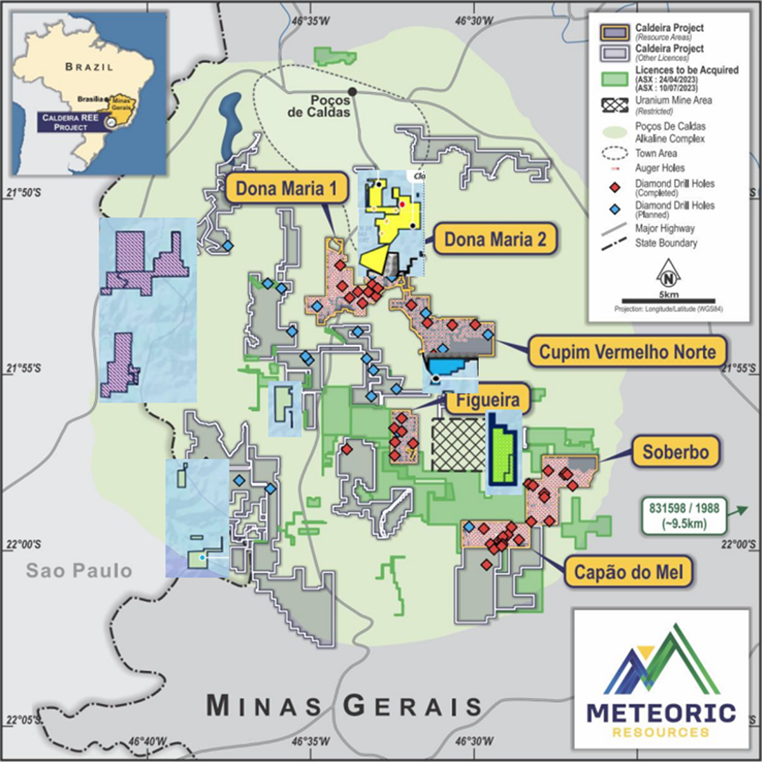

$MEI had the first mover advantage, which gave them a head start in securing a 'strategic' (I hate this wording, but for now it works) tenement holding, something which is clearly visible in the picture below.

(the tenements with a blue background belong to $VMM, while the rest belongs to $MEI).

The project was subsequently acquired by Meteoric Resources $MEI who published a first MRE in May 2023, less than 6 months after taking ownership of the project.

The MRE was based on the auger drilling done by the Japanese, and boasted an impressive resource of 409Mt at 2642ppm TREO, with a MREO/TREO proportion of 24%.

MREO = magnet rare earth oxides (i.e. Nd, Pr, Tb and Dy), and these are essentially the only payable rare earths contained.

It was after this resource publication that interest in the region increased dramatically, and it would not take long for other companies (like $VMM) to secure more 'strategic' land holdings in this complex.

$MEI had the first mover advantage, which gave them a head start in securing a 'strategic' (I hate this wording, but for now it works) tenement holding, something which is clearly visible in the picture below.

(the tenements with a blue background belong to $VMM, while the rest belongs to $MEI).

Let's take a closer look at $MEI

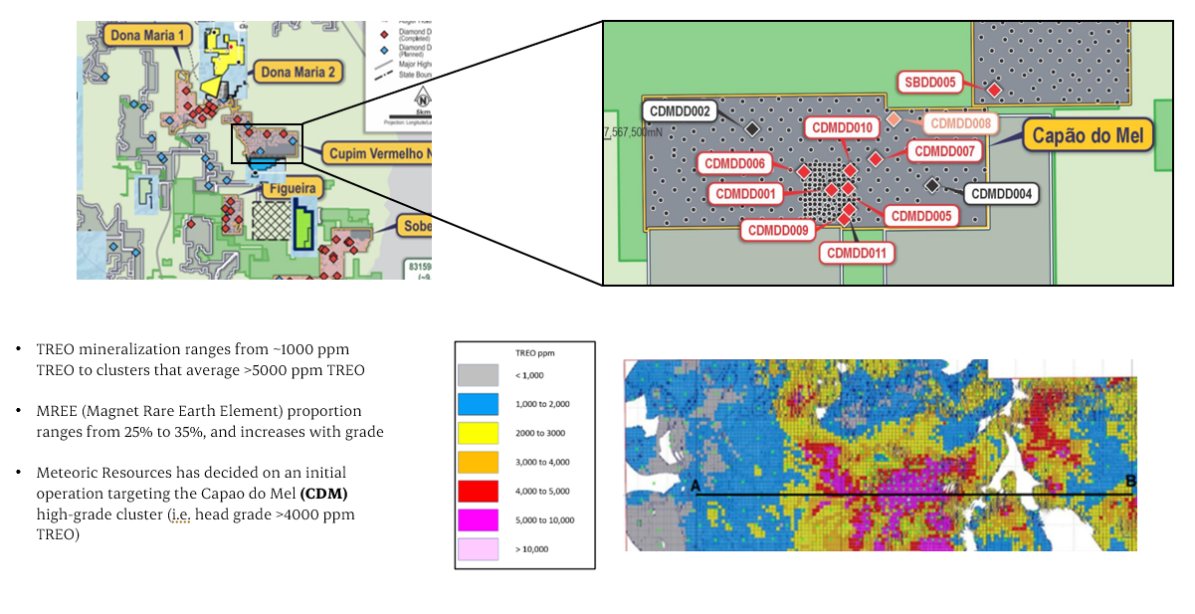

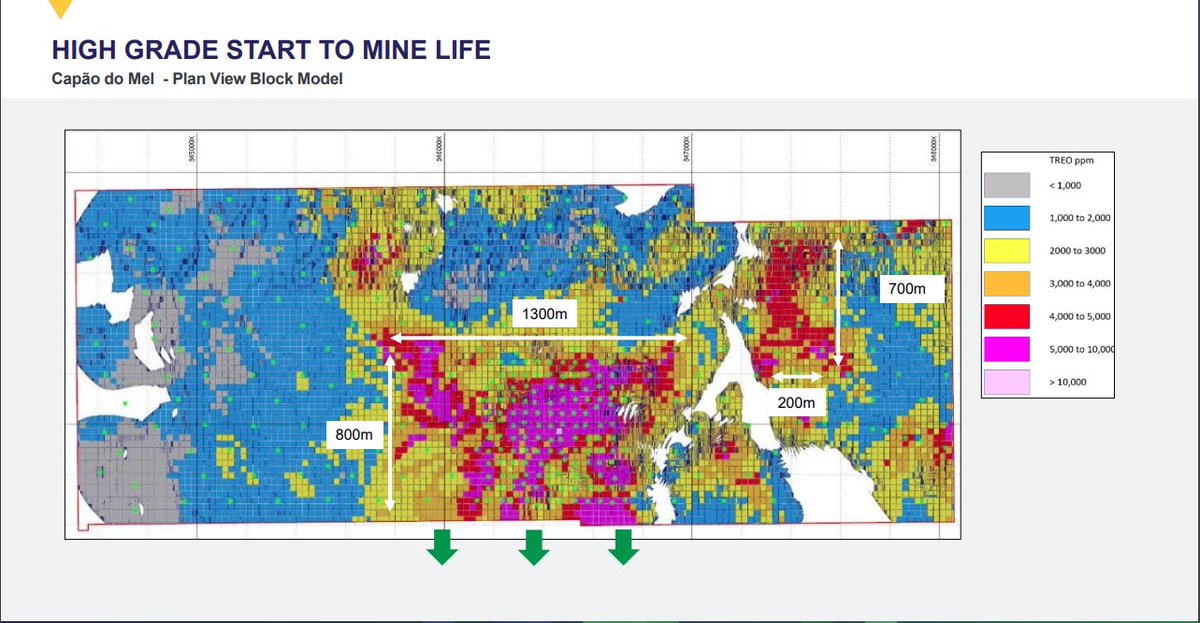

The ionic mineralization differs with grade from roughly 1000ppm to clusters averaging >5000ppm.

$MEI has decided on targeting the high grade cluster on their Capao do Mel tenement for an initial starting operation with the following metrics:

1. 5Mtpa ROM

2. ~5000ppm TREO head grade

Additionally, to estimate a preliminary NPV, I made the following assumptions:

3. MREO/TREO proportion of 32% (this is on the high end)

4. 10 year LOM (i.e. resource base of 50Mt @ ~5000ppm TREO)

This is by no means perfect, but does give us a sense of what we're dealing with.

The ionic mineralization differs with grade from roughly 1000ppm to clusters averaging >5000ppm.

$MEI has decided on targeting the high grade cluster on their Capao do Mel tenement for an initial starting operation with the following metrics:

1. 5Mtpa ROM

2. ~5000ppm TREO head grade

Additionally, to estimate a preliminary NPV, I made the following assumptions:

3. MREO/TREO proportion of 32% (this is on the high end)

4. 10 year LOM (i.e. resource base of 50Mt @ ~5000ppm TREO)

This is by no means perfect, but does give us a sense of what we're dealing with.

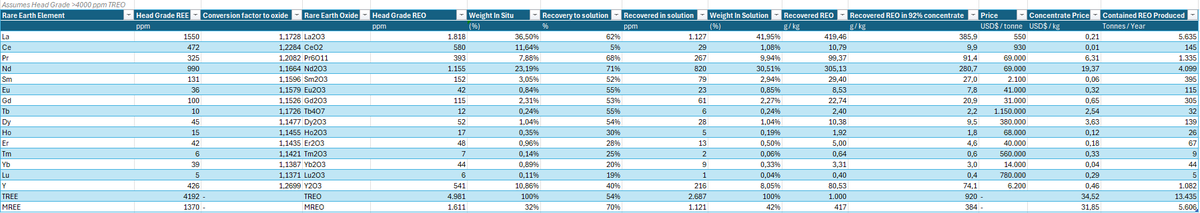

In the picture below, I made a production forecast of yearly MREC (mixed rare earth carbonate) production for a 5Mtpa ROM operation with a head-grade of 4981ppm TREO.

The recovery factors are sourced from the metallurgical tests published by Meteoric.

Note that there are no published recoveries for most other rare earth elements, so these are based on personal estimates, but since they are not significant to payability (i.e. revenue), this suffices.

The result is 13,435mt of yearly MREC production, of which NdPr (the main payable) contained in MREC is 5,434mt.

The recovery factors are sourced from the metallurgical tests published by Meteoric.

Note that there are no published recoveries for most other rare earth elements, so these are based on personal estimates, but since they are not significant to payability (i.e. revenue), this suffices.

The result is 13,435mt of yearly MREC production, of which NdPr (the main payable) contained in MREC is 5,434mt.

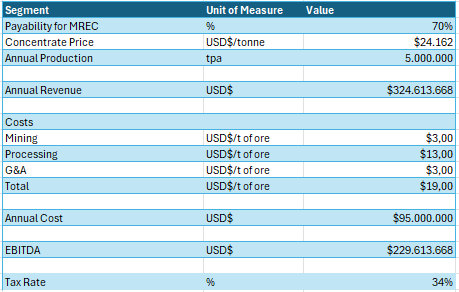

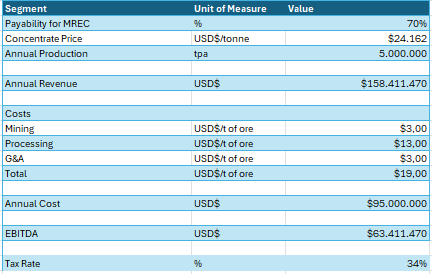

To estimate a preliminary NPV for the project, I made the following input estimates.

Note that especially on OPEX there is significant uncertainty (since there is no direct peer project to derive estimates from), and these should be taken with a grain of salt.

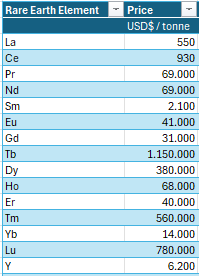

Rare Earth Price assumptions are shown in the second picture.

Most importantly is the NdPr price, which I've set at USD$69,000mt

(spot price for NdPr is currently at USD$60,000mt)

Note that especially on OPEX there is significant uncertainty (since there is no direct peer project to derive estimates from), and these should be taken with a grain of salt.

Rare Earth Price assumptions are shown in the second picture.

Most importantly is the NdPr price, which I've set at USD$69,000mt

(spot price for NdPr is currently at USD$60,000mt)

Initial CAPEX I've set at USD$250M

NPV Tenor (i.e. life of mine - in this case resource base of 50Mt @ 4981ppm TREO) of 10 years for a 5Mtpa operation.

Result: NPV10 of USD$480M (or AUD$730M)

Note that the project is subject to a ~5% NSR, which I've not included in this estimate (but which should be). So that lowers the NPV significantly.

NPV Tenor (i.e. life of mine - in this case resource base of 50Mt @ 4981ppm TREO) of 10 years for a 5Mtpa operation.

Result: NPV10 of USD$480M (or AUD$730M)

Note that the project is subject to a ~5% NSR, which I've not included in this estimate (but which should be). So that lowers the NPV significantly.

This is actually a pretty decent result for MEI, which currently trades at a market cap of ~AUD$500M

However, it is good to note the following:

Even though it is clay, a resource base of 50Mt is a lot, and a 5Mtpa operation is MASSIVE.

Also it can prove be a pain finding sufficient tonnages with ~5000ppm TREO.

I've superimposed the grade profiles of $MEI's resource on their tenements, and it is clearly visible that there is a lot of variation.

The bull case for both $MEI and $VMM is that they will manage to find more of these 50Mt @ ~5000ppm TREO resource bases.

This is certainly not impossible, given the caldeira covers approx 800km^2 and is wholly mineralized with clay.

However, it is good to note the following:

Even though it is clay, a resource base of 50Mt is a lot, and a 5Mtpa operation is MASSIVE.

Also it can prove be a pain finding sufficient tonnages with ~5000ppm TREO.

I've superimposed the grade profiles of $MEI's resource on their tenements, and it is clearly visible that there is a lot of variation.

The bull case for both $MEI and $VMM is that they will manage to find more of these 50Mt @ ~5000ppm TREO resource bases.

This is certainly not impossible, given the caldeira covers approx 800km^2 and is wholly mineralized with clay.

However, how much acreage do you actually need for a resource base consisting of 50Mt?

The specific gravity of the saprolitic clays is about 1,3

This would imply that in order to find a resource base of 50Mt, the clay horizon would need to measure at least 1400m by 1400m and 20m in depth.

The scale of this cannot be understated.

When we look at $MEI's starting operation in the Capao do Mel tenement, we see that their high grade cluster will likely not reach 50Mt, but probably closer to 20Mt.

In $MEI's case, they can supplement this with the high grade cluster at their nearby Soberbo tenement + Capao do Mel high-grade cluster expansion, which is still open in the southern direction.

The specific gravity of the saprolitic clays is about 1,3

This would imply that in order to find a resource base of 50Mt, the clay horizon would need to measure at least 1400m by 1400m and 20m in depth.

The scale of this cannot be understated.

When we look at $MEI's starting operation in the Capao do Mel tenement, we see that their high grade cluster will likely not reach 50Mt, but probably closer to 20Mt.

In $MEI's case, they can supplement this with the high grade cluster at their nearby Soberbo tenement + Capao do Mel high-grade cluster expansion, which is still open in the southern direction.

With this in mind, it is quite reasonable to assume that MEI has a good chance of actually achieving a high-grade operation at scale, with a NPV that might resemble my estimate.

Only a fraction of $MEI's land package has been drilled, and there is potential for more high-grade mineralization to be found.

$VMM has compiled a significant land package in the region as well. Let's take a closer look.

Remember that the tenements with the blue background are $VMM's

Only a fraction of $MEI's land package has been drilled, and there is potential for more high-grade mineralization to be found.

$VMM has compiled a significant land package in the region as well. Let's take a closer look.

Remember that the tenements with the blue background are $VMM's

Let's look at their yellow northern tenement first.

What's not clear in the map, but what is in fact a material issue to consider, is that this tenement package is located literally next to the city of Pocos de Caldas.

This can bring considerable problems along, like local opposition.

However, let's set this apart for a second and look at the reported drill results.

We see some drill results >5000ppm, but poor continuation and nothing of size yet.

(remember a 50Mt resource base would need a 1400m by 1400m by 20m clay horizon).

A high-grade cluster may be found here, but for now the prospects look poor imo.

What's not clear in the map, but what is in fact a material issue to consider, is that this tenement package is located literally next to the city of Pocos de Caldas.

This can bring considerable problems along, like local opposition.

However, let's set this apart for a second and look at the reported drill results.

We see some drill results >5000ppm, but poor continuation and nothing of size yet.

(remember a 50Mt resource base would need a 1400m by 1400m by 20m clay horizon).

A high-grade cluster may be found here, but for now the prospects look poor imo.

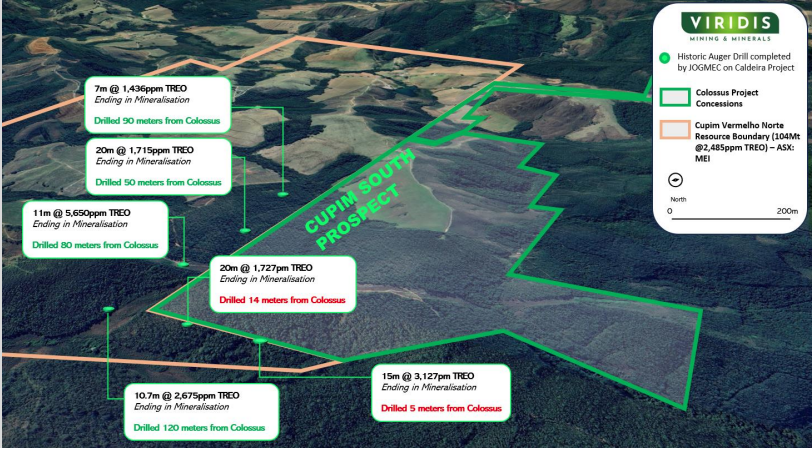

Their Collosus tenement reported some nice intercepts (with varying grade) but when we look at the Collosus tenement size, we see that it is just way too small to sustain a significant (high grade) resource base.

It measures approx 400m by 400m, and not all of this will be high grade.

It measures approx 400m by 400m, and not all of this will be high grade.

$VMM has more tenement holdings in the complex.

However, the south-eastern green tenement is located in a restricted uranium-mine area. Viridis makes no statement about this in their filings, and what this implies... (🚩).

Practically their only chance at finding a high-grade resource base of size are the purple tenements in the West.

Let me state that there is certainly a possibility that such a resource base will exist there.

However, when one compares this with $MEI's land holdings, it is clear who's the true leader in town.

Let me state that $MEI also has tenements close to the Pocos de Caldas city, which is situated in the north of the complex, and where it could be subject to the same risks as $VMM.

However, even with this in mind, the narrative that $VMM should catch up with $MEI is futile to say the least.

However, the south-eastern green tenement is located in a restricted uranium-mine area. Viridis makes no statement about this in their filings, and what this implies... (🚩).

Practically their only chance at finding a high-grade resource base of size are the purple tenements in the West.

Let me state that there is certainly a possibility that such a resource base will exist there.

However, when one compares this with $MEI's land holdings, it is clear who's the true leader in town.

Let me state that $MEI also has tenements close to the Pocos de Caldas city, which is situated in the north of the complex, and where it could be subject to the same risks as $VMM.

However, even with this in mind, the narrative that $VMM should catch up with $MEI is futile to say the least.

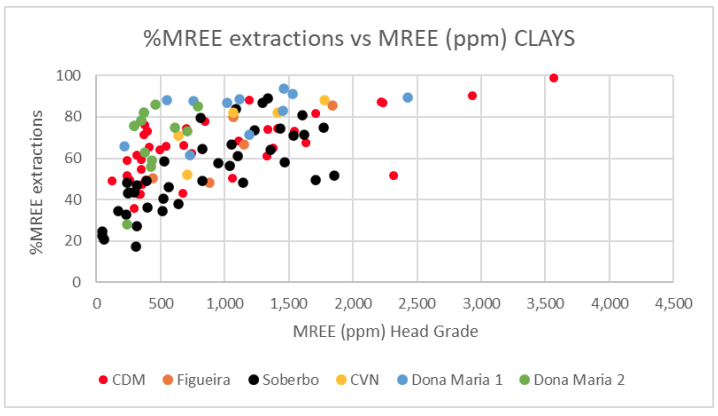

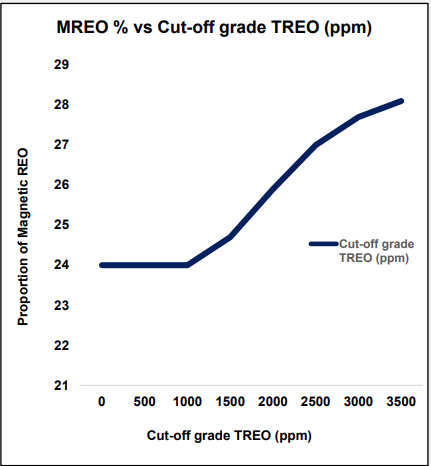

Now I see you thinking already: 'Okay, but why put in this arbitrary barrier of finding a resource base of 50Mt @ ~5000ppm TREO? A resource base with lower grade is also very feasible!"

One way to increase the resource is indeed by lowering the cut-off grade.

There is actually a reasonable chance $VMM can find a resource base of 50Mt at say 3,000ppm TREO.

However this slashes operational profitability on three fronts:

1. Lower grade means less payable product recovered per tonne mined and processed

2. Lower grade results in lower recoveries

3. Lower grade results in lower MREO/TREO proportion - i.e. payable proportion.

One way to increase the resource is indeed by lowering the cut-off grade.

There is actually a reasonable chance $VMM can find a resource base of 50Mt at say 3,000ppm TREO.

However this slashes operational profitability on three fronts:

1. Lower grade means less payable product recovered per tonne mined and processed

2. Lower grade results in lower recoveries

3. Lower grade results in lower MREO/TREO proportion - i.e. payable proportion.

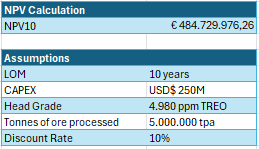

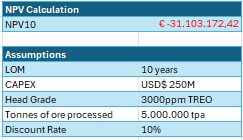

When I incorporate this in a new NPV estimate using the same inputs (except grade + concomitant recoveries and lower MREO proportion) I get the following NPV estimate.

We directly see a lower grade operation is expected to be only marginally profitable, if at all.

Again, don't attach too much value to this NPV estimate as OPEX estimates could be off considerably - It is only to paint a clearer picture of how much less attractive a lower grade (i.e. 3000ppm TREO vs 5000ppm TREO) is.

We directly see a lower grade operation is expected to be only marginally profitable, if at all.

Again, don't attach too much value to this NPV estimate as OPEX estimates could be off considerably - It is only to paint a clearer picture of how much less attractive a lower grade (i.e. 3000ppm TREO vs 5000ppm TREO) is.

To the people tooting on $VMM's horn on how undervalued it is, I'd consider to take a more conservative stance.

Yes, it could be undervalued if OPEX estimates are considerably off, but it is not RELATIVELY undervalued to $MEI

Note that the NPV is project based only and doesn't incorporate the ~5% NSR which most tenements are subject to - this is also the case at $MEI!

Yes, it could be undervalued if OPEX estimates are considerably off, but it is not RELATIVELY undervalued to $MEI

Note that the NPV is project based only and doesn't incorporate the ~5% NSR which most tenements are subject to - this is also the case at $MEI!

To Conclude

$MEI and $VMM are two of the hottest stock picks in Aussie town at the moment.

Both have true ionic clay geology, and this is something quite remarkable from a global perspective.

However, be careful when you hear the narrative

' $VMM is the next $MEI - if VMM catches up with MEI it's a 5x!'

They don't score the same on:

a) tenement holdings (i.e. exploration potential)

b) existing resource base

Making an apples to apples comparison here is thus futile.

Sure, there is a chance that $VMM may in fact find a high-grade resource base of scale.

However, it is certainly not a given - something many speculators seem to think.

P.S.

These are my personal estimates and in reality this could play out wildly different. There are A LOT of assumptions made in this thread.

Lastly, I hold no short or long position in either $VMM or $MEI

Cheers,

Sutainabledude

$MEI and $VMM are two of the hottest stock picks in Aussie town at the moment.

Both have true ionic clay geology, and this is something quite remarkable from a global perspective.

However, be careful when you hear the narrative

' $VMM is the next $MEI - if VMM catches up with MEI it's a 5x!'

They don't score the same on:

a) tenement holdings (i.e. exploration potential)

b) existing resource base

Making an apples to apples comparison here is thus futile.

Sure, there is a chance that $VMM may in fact find a high-grade resource base of scale.

However, it is certainly not a given - something many speculators seem to think.

P.S.

These are my personal estimates and in reality this could play out wildly different. There are A LOT of assumptions made in this thread.

Lastly, I hold no short or long position in either $VMM or $MEI

Cheers,

Sutainabledude

• • •

Missing some Tweet in this thread? You can try to

force a refresh