Physical trader

Free longform posts that don't fit on X: https://t.co/UN5ANLcHlC

How to get URL link on X (Twitter) App

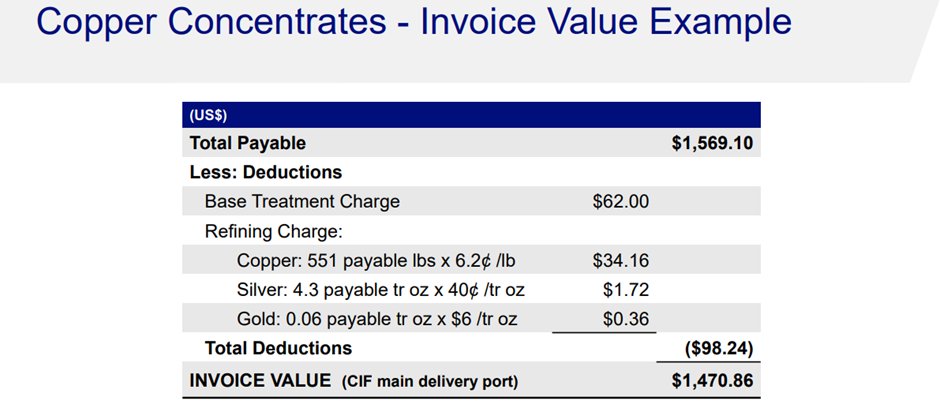

1. Treatment- and Refining charges (TC/RC)

1. Treatment- and Refining charges (TC/RC)

Looking at the recent share price performance, one might assume that rare earths has indeed made a wild discovery, and is bound to be the rare earth treasure trove the USA was searching for all this time

Looking at the recent share price performance, one might assume that rare earths has indeed made a wild discovery, and is bound to be the rare earth treasure trove the USA was searching for all this time

https://twitter.com/MiningCatalyst/status/1724834913986421080However, in most cases, only 4 rare earth oxides are of importance for an economic mining operation