Techno Funda Stock Selection Critera

A thread to pick stocks moving 20-30% in a week🧵

( Chartink link at the end of tweet )

A thread to pick stocks moving 20-30% in a week🧵

( Chartink link at the end of tweet )

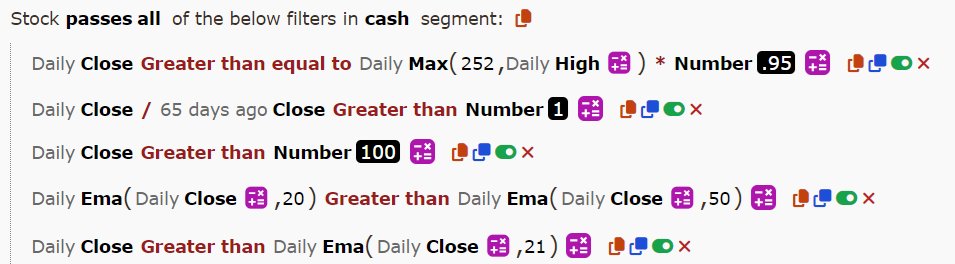

Technical Criteria

1. Stock near 5% of 52 week high

2. Stock above 30 weekly ema : Stage 1 uptrend

3. 21ema > 50ema signifying strong uptrend

4. RS >0

You can also add Volume criteria

1. Stock near 5% of 52 week high

2. Stock above 30 weekly ema : Stage 1 uptrend

3. 21ema > 50ema signifying strong uptrend

4. RS >0

You can also add Volume criteria

Fundamental Critera 2 :

Year on Year EPS growth

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow.

Year on Year EPS growth

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow.

Video 1 : Understanding the use of Screener

Video 2: Live application

Video 2: Live application

Swing Trading Mentorship in HINDI :

Mentorship starting in Feb on weekends only with recording

Whatsapp for doubts :

Payment Link :

IPO base trading , Stock Selection , Stage Analysis and much more !wa.link/si4jn4

bit.ly/SwingMegaWebin…

Mentorship starting in Feb on weekends only with recording

Whatsapp for doubts :

Payment Link :

IPO base trading , Stock Selection , Stage Analysis and much more !wa.link/si4jn4

bit.ly/SwingMegaWebin…

• • •

Missing some Tweet in this thread? You can try to

force a refresh