I've read and tested over 100 strategies since 2019.

There are countless bad ones,

And only a handful of good ones to draw from.

Here they are for free:

There are countless bad ones,

And only a handful of good ones to draw from.

Here they are for free:

Playing Gaps.

From "Trade Like a Hedge Fund: 20 Successful Uncorrelated Strategies and Techniques to Winning Profits"

By James Altucher

From "Trade Like a Hedge Fund: 20 Successful Uncorrelated Strategies and Techniques to Winning Profits"

By James Altucher

Using momentum to identify trends and reversals.

From "High Probability Trading Strategies: Entry to Exit Tactics for the Forex, Futures, and Stock Markets"

By Robert Miner

From "High Probability Trading Strategies: Entry to Exit Tactics for the Forex, Futures, and Stock Markets"

By Robert Miner

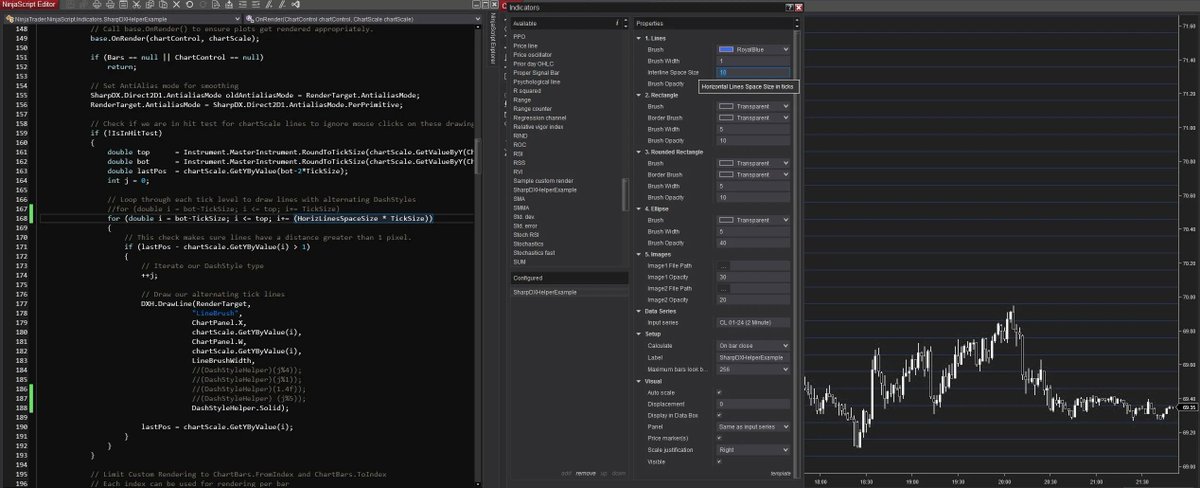

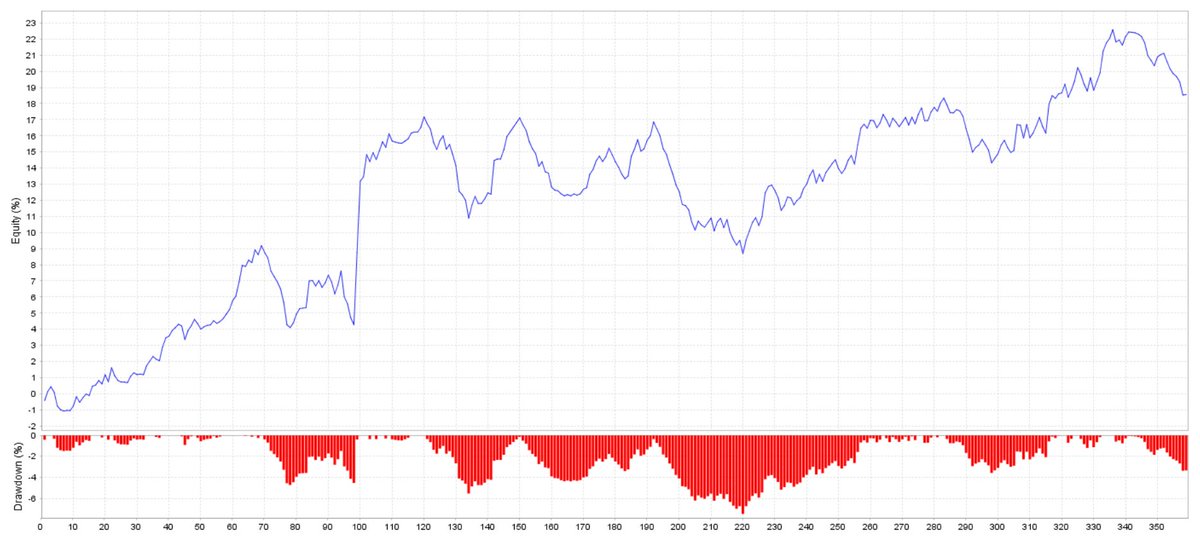

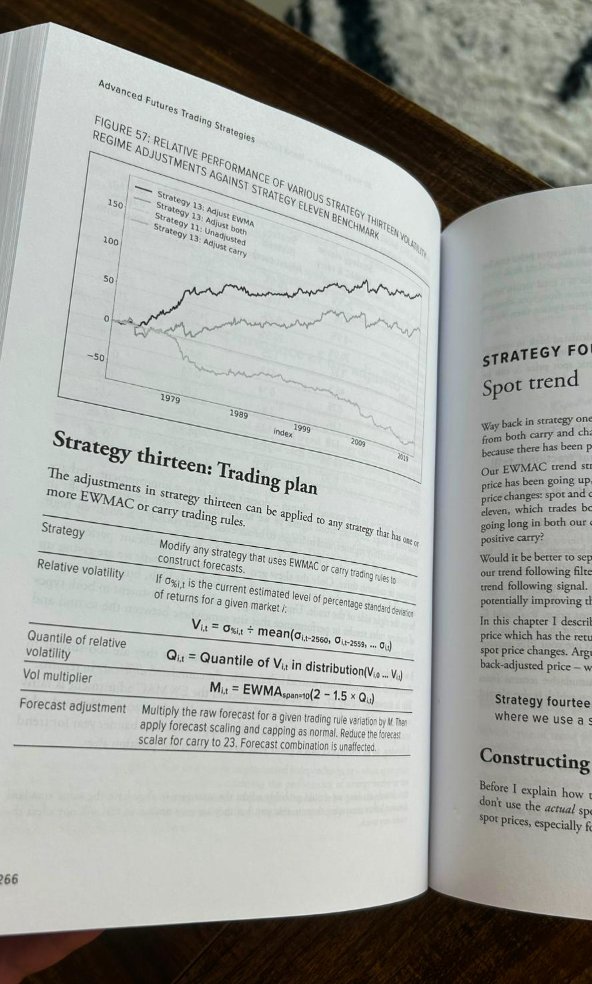

This is a built-upon version of an EWMAC trend filter / "Advanced Trend

Following and Carry Strategies".

From "Advanced Futures Trading Strategies: 30 fully tested strategies for multiple trading styles and time frames"

By Robert Carver

Following and Carry Strategies".

From "Advanced Futures Trading Strategies: 30 fully tested strategies for multiple trading styles and time frames"

By Robert Carver

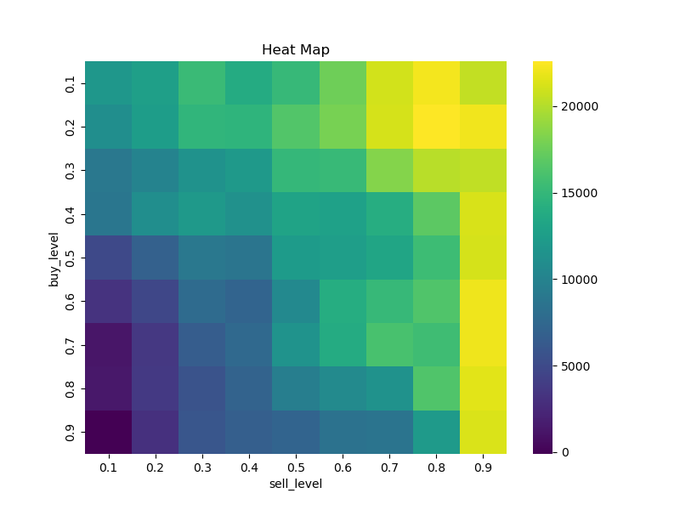

Calendar Spreads Mean reversion.

From "Algorithmic Trading: Winning Strategies and Their Rationale"

By Ernie Chan

From "Algorithmic Trading: Winning Strategies and Their Rationale"

By Ernie Chan

A interesting idea of unilateral pairs trading.

From "Trade Like a Hedge Fund: 20 Successful Uncorrelated Strategies and Techniques to Winning Profits"

By James Altucher

From "Trade Like a Hedge Fund: 20 Successful Uncorrelated Strategies and Techniques to Winning Profits"

By James Altucher

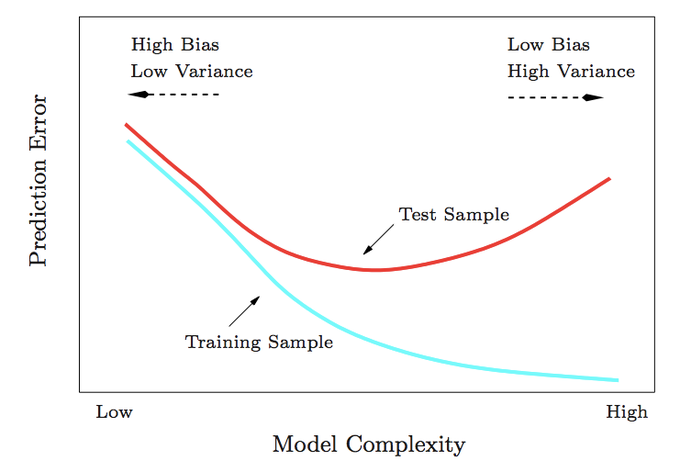

Most free strategies online have countless backtest errors,

But some hold value you can extract.

Be sure to check the books out as well.

If you find this type of content valuable and want more every week:

1. Follow me @GoshawkTrades for more.

2. Jump to the top & retweet.

But some hold value you can extract.

Be sure to check the books out as well.

If you find this type of content valuable and want more every week:

1. Follow me @GoshawkTrades for more.

2. Jump to the top & retweet.

https://twitter.com/1336829759884550155/status/1749534983444730110

I recently crossed 105 traders that I've assisted in turning their strategy ideas into code.

One trader's algo now manages $1,000,000 of capital.

If you know a trader of 2+ years looking to grow their trading to the next level using code.

Click below:

unbiasedtrading.info

One trader's algo now manages $1,000,000 of capital.

If you know a trader of 2+ years looking to grow their trading to the next level using code.

Click below:

unbiasedtrading.info

• • •

Missing some Tweet in this thread? You can try to

force a refresh