1/ Today we'll touch on Dynamic Risk & Risk management . Understanding dynamic risk is crucial. It's not just about current exposure but how market changes impact risk profiles of your position. While static risk shows immediate exposure, dynamic risk reflects how changes like spot price movements or volatility shifts alter risk profiles. This is an important thread for risk management 🧵

2/ Factors Affecting Dynamic Risk: for the purpose of this thread we will focus on changes in the spot price, the passing of time, and shifts in implied volatility. You can find more on other Greeks here

https://twitter.com/MenthorQpro/status/1608865284689121281?s=20

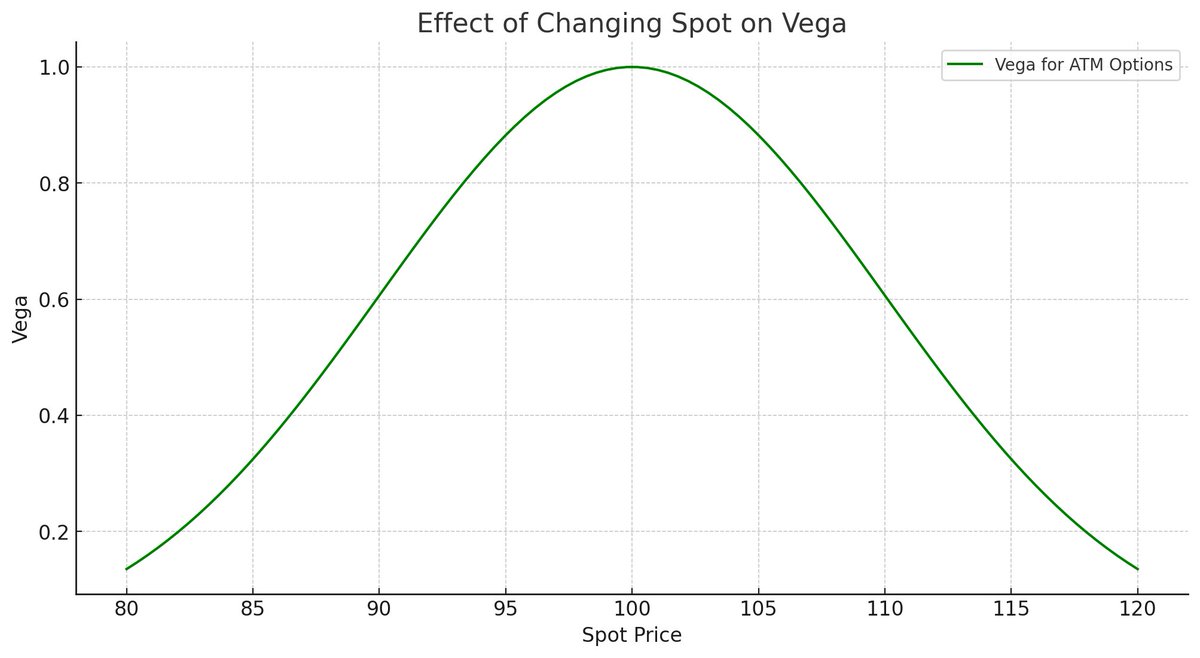

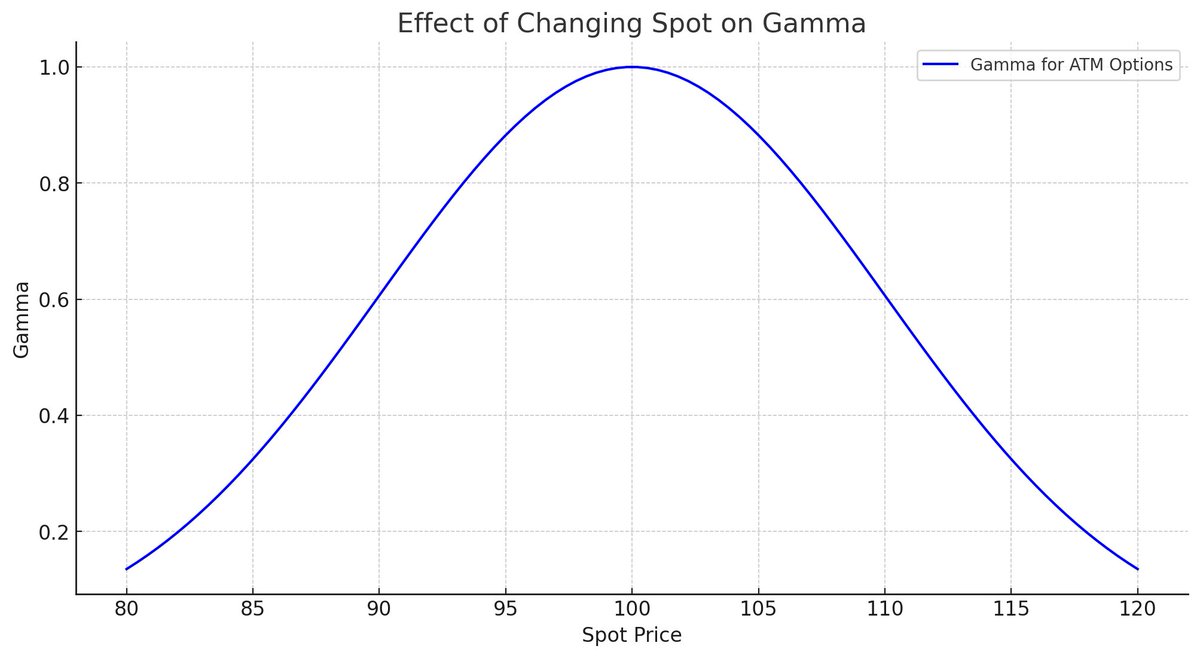

3/ Changing Spot Price ie spot price movement. Risk intensifies as the spot nears the option's strike, especially for ATM options. Conversely, moving away reduces risk. The gamma, vega, and theta are particularly sensitive to this.

This is the effect of changes of spot on gamma

This is the effect of changes of spot on gamma

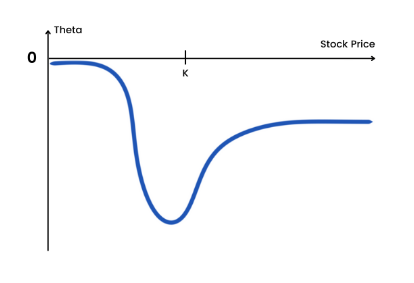

5/ Effect of changing spot on theta - for ATM theta is large and negative. Theta increases as you move from OTM to ATM and decreases as we move from ATM to ITM

6/ Focusing on the Passing of Time, we know that passage of Time affects risk differently. Nominal Vega typically declines over time. Shorter-term options have higher theta. Moving away from ATM reduces it. Overall, risk tends to decline with time. As time passes, an option's risk profile changes - from ATM to more of a wing option. This gradual shift affects the delta and other Greeks, influencing risk exposure.

7/ Focusing on IV, its changes affect risk in two ways: a general shift across the curve and relative shifts among different options. These changes impact the position's vega and other risk dimensions. As IV falls, risk should also go down as potential for action is also reduced, the opposite when IV moves up

In a next thread we will discuss how these affect your delta

In a next thread we will discuss how these affect your delta

• • •

Missing some Tweet in this thread? You can try to

force a refresh