The debate over Fed policy, especially about when to start cutting rates, seems to have become disconnected from the reality of rapid disinflation. Thinking about it reminded me of ... an experience I once had on a cycling trip 1/

In 2015, I think, I went on a week-long cycling tour in Vermont. I was in pretty good shape, but hadn't done a trip like that for a while, and was slightly worried about my stamina 2/

On the second day, I was getting close to what the notes from Discovery Tours said was a major climb. As I approached, there were a series of short, sharp uphills, and I thought "if this is the approach, the real thing must be really hard" 3/

Then the road leveled off — and I suddenly realized that I had already done the "major climb" I was worried about 4/

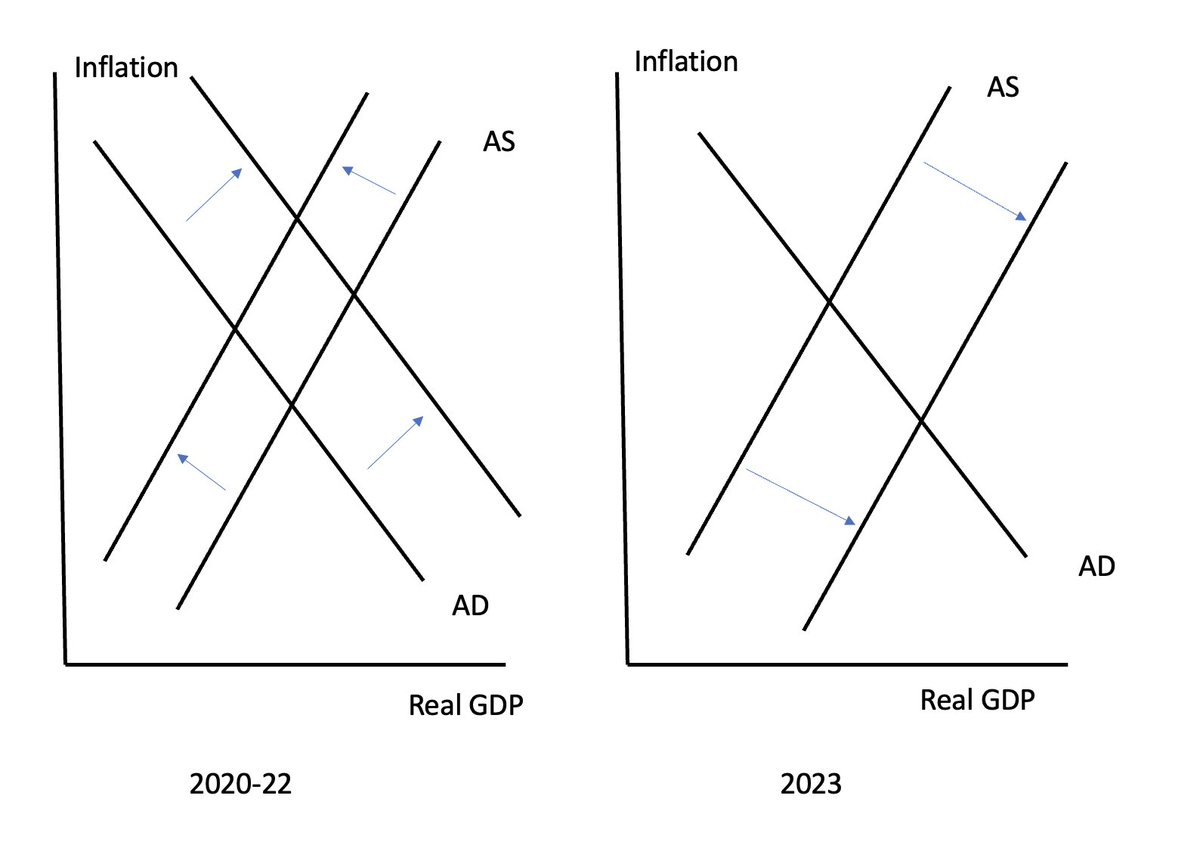

On inflation, there's still a lot of handwringing about what it will take to get inflation down to target, and whether the "last mile" will be the hardest. To which the question should be, "what last mile"? Like that major climb on my bike trip, we've already done it 5/

Core PCE has risen at <2% for the last 6 months; unless forecasts are way off, Friday's data won't change that. More sophisticated efforts to extract the signal from the noise also show us close to target 6/

Where does the idea that there's still a lot of work to do come from? Partly from looking at yoy changes, which are a lagging indicator when inflation is falling fast; partly from the CPI, also lagging bc of how it measures shelter 7/

And partly, I guess, people who were warning sternly about stubborn inflation in early 2023 are having trouble adjusting to the way the problem evaporated. But seriously, time to stop talking about inflation's last mile 8/

• • •

Missing some Tweet in this thread? You can try to

force a refresh