American Hedge Fund billionaire Bill Ackman is a learning machine.

"You can learn investing by reading books."

Here are his 9 favorite investing books everyone should read:

"You can learn investing by reading books."

Here are his 9 favorite investing books everyone should read:

1. Security Analysis

This book is a valuation masterclass.

"The stock market is a voting machine in the short run and a weighing machine in the long run."

This book is a valuation masterclass.

"The stock market is a voting machine in the short run and a weighing machine in the long run."

2. Quality of Earnings

This book shows the importance of examining a company's financial statements and earnings to determine their true quality and reliability

This book shows the importance of examining a company's financial statements and earnings to determine their true quality and reliability

3. Beating the Street

In this book Peter Lynch emphasizes the idea that individual investors can achieve market-beating returns by investing in companies they understand and believe in

In this book Peter Lynch emphasizes the idea that individual investors can achieve market-beating returns by investing in companies they understand and believe in

4. The Intelligent Investor

In the end, all intelligent investing is value investing.

The Intelligent Investor teaches investors to approach the stock market with a focus on long-term, rational, and conservative strategies.

In the end, all intelligent investing is value investing.

The Intelligent Investor teaches investors to approach the stock market with a focus on long-term, rational, and conservative strategies.

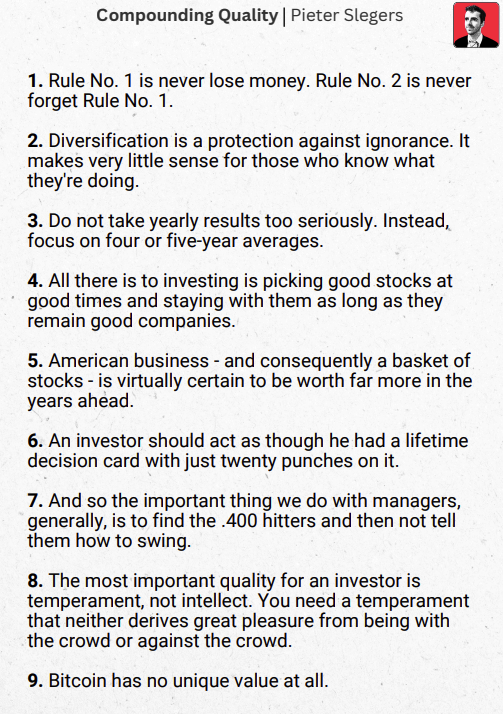

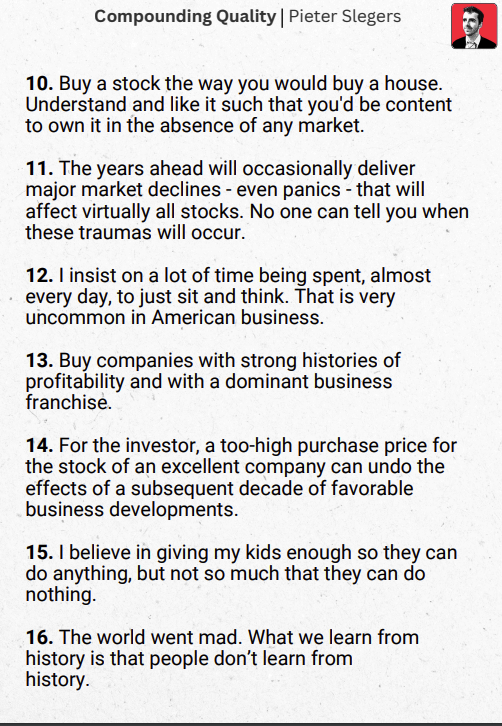

5. The Essays of Warren Buffett

Are you a fan of Warren Buffett? Then you should read this book.

This book tells you exactly how Buffett has built his empire.

Are you a fan of Warren Buffett? Then you should read this book.

This book tells you exactly how Buffett has built his empire.

6. Margin of Safety

Investors are all too often lured by the prospect of instant millions and fall prey to the many fads of Wall Street.

Don't be like this. Act like an investor and not as a speculator.

Investors are all too often lured by the prospect of instant millions and fall prey to the many fads of Wall Street.

Don't be like this. Act like an investor and not as a speculator.

7. You can be a Stock Market Genius

Joel Greenblatt is a great teacher and investor.

This book offers a practical guide to investing in the stock market.

Joel Greenblatt is a great teacher and investor.

This book offers a practical guide to investing in the stock market.

8. The Warren Buffett Way

This book breaks down Warren Buffett's investment philosophy.

It's a helpful book for those who want to invest in a sound and rational way.

This book breaks down Warren Buffett's investment philosophy.

It's a helpful book for those who want to invest in a sound and rational way.

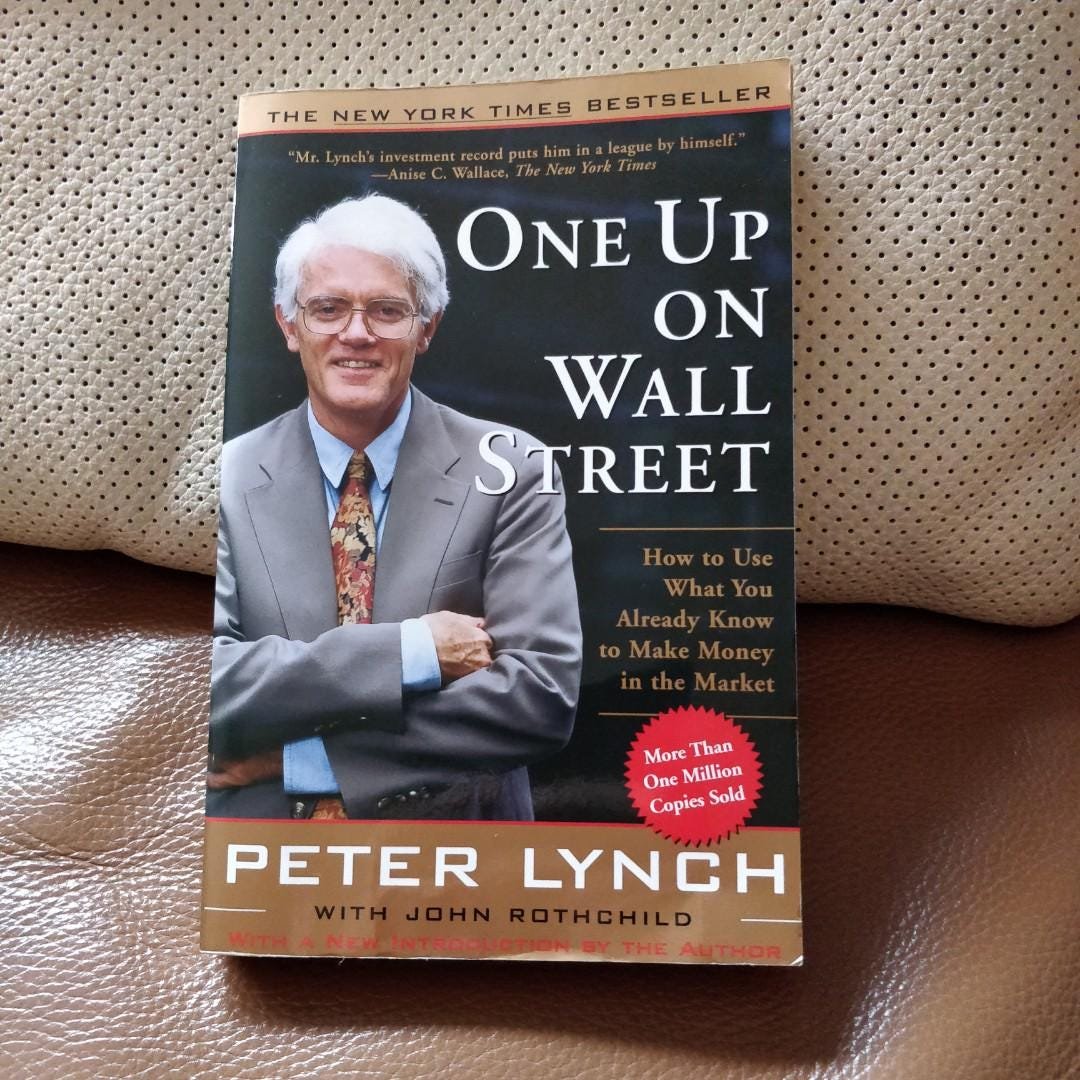

9. One Up On Wall Street

This is one of my favorite investment books ever.

"One Up on Wall Street" focuses on helping regular investors defeat Wall Street professionals, who are skilled and highly paid.

This is one of my favorite investment books ever.

"One Up on Wall Street" focuses on helping regular investors defeat Wall Street professionals, who are skilled and highly paid.

That's it for today.

If you liked this, you'll love a PDF I compiled with more than 200 pages of Bill Ackman's wisdom.

Sign up here to receive it : compounding-quality.ck.page/3192d630f8

If you liked this, you'll love a PDF I compiled with more than 200 pages of Bill Ackman's wisdom.

Sign up here to receive it : compounding-quality.ck.page/3192d630f8

• • •

Missing some Tweet in this thread? You can try to

force a refresh