🧵👇

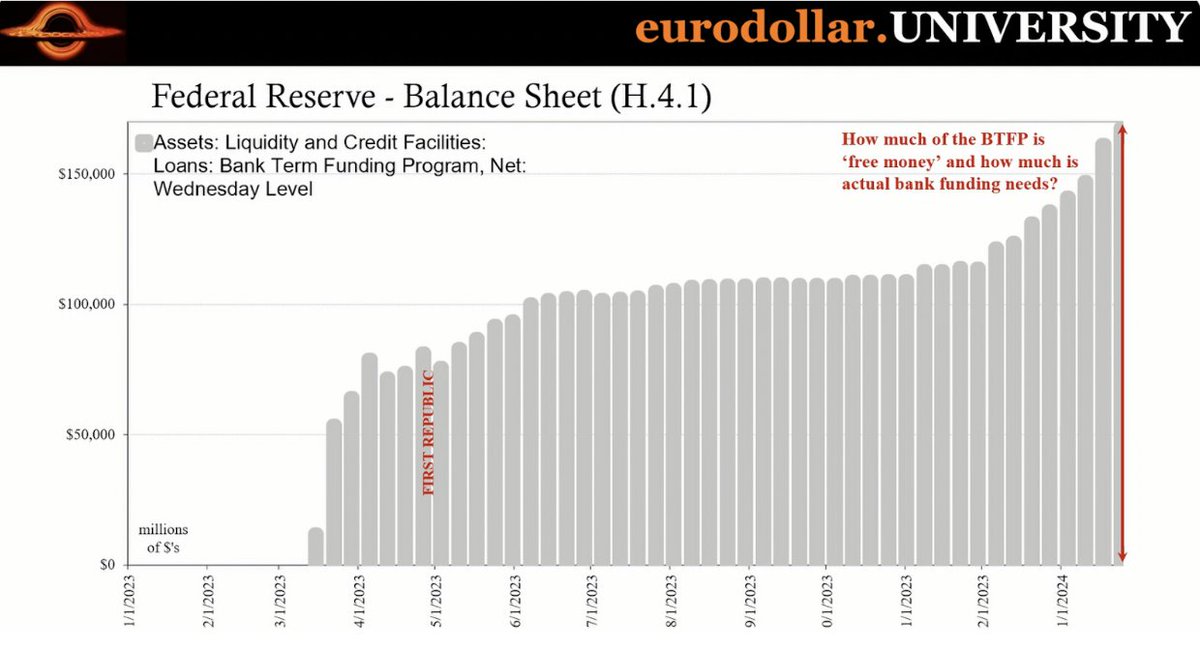

The Fed is winding down its Bank Term Funding Program (BTFP), the emergency tool created during last year's banking crisis. But there's more to this than meets the eye. Let's dive into what this really means.

The Fed is winding down its Bank Term Funding Program (BTFP), the emergency tool created during last year's banking crisis. But there's more to this than meets the eye. Let's dive into what this really means.

The BTFP was a quick fix during a crisis, offering banks easy loans. But as we've seen, easy fixes often lead to unanticipated consequences.

Now, the Fed is shifting gears back to the Discount Window as a BTFP replacement. But why the sudden shift to the Discount Window?

Now, the Fed is shifting gears back to the Discount Window as a BTFP replacement. But why the sudden shift to the Discount Window?

The BTFP, initially a crisis tool, turned into a “free money machine” for banks.

They borrowed cheaply and profited by leaving funds with the Fed. Sounds good, right?

Not quite.

BTFP was supposed to help struggling institutions that had nowhere else to turn.

They borrowed cheaply and profited by leaving funds with the Fed. Sounds good, right?

Not quite.

BTFP was supposed to help struggling institutions that had nowhere else to turn.

Fast forward, and the Fed's plan to phase out the BTFP by March 11th is raising questions.

How much of the $166 billion is “free money” and how much is due to banks genuinely unable to get private funding? Where will the latter go?

the Discount Window, the Fed's new focus. But why?

How much of the $166 billion is “free money” and how much is due to banks genuinely unable to get private funding? Where will the latter go?

the Discount Window, the Fed's new focus. But why?

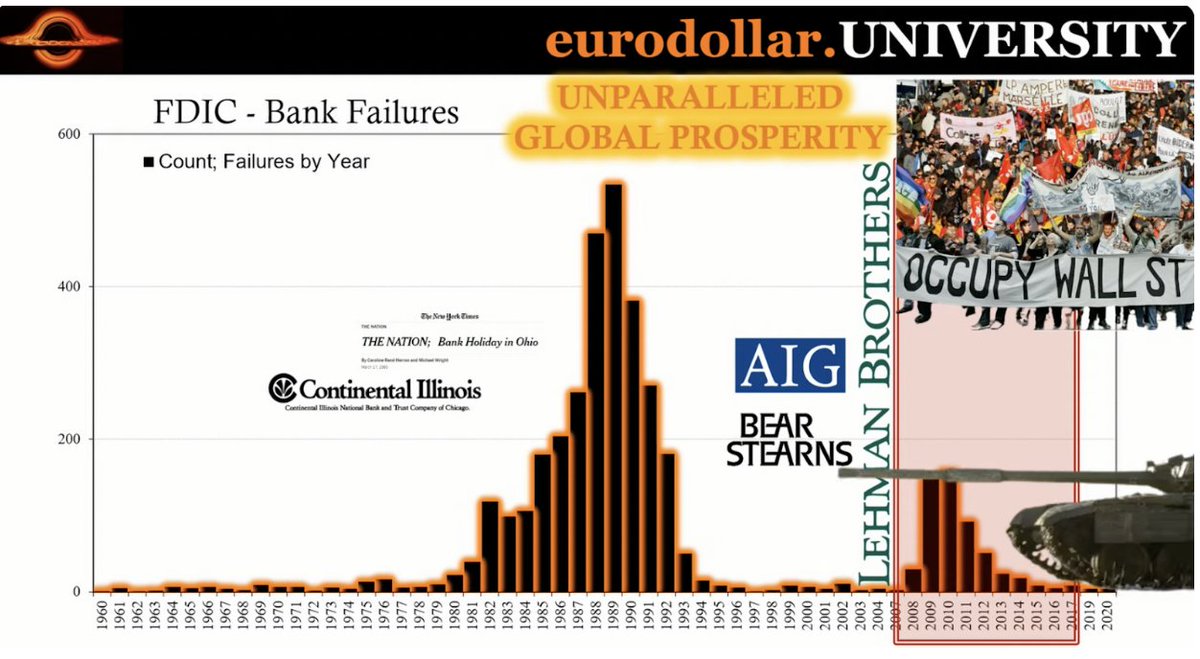

But here's the real issue: Why does the Fed keep having to reinvent its tools? Shouldn't the primary focus be on being an effective lender of last resort? It seems like they're always playing catch-u

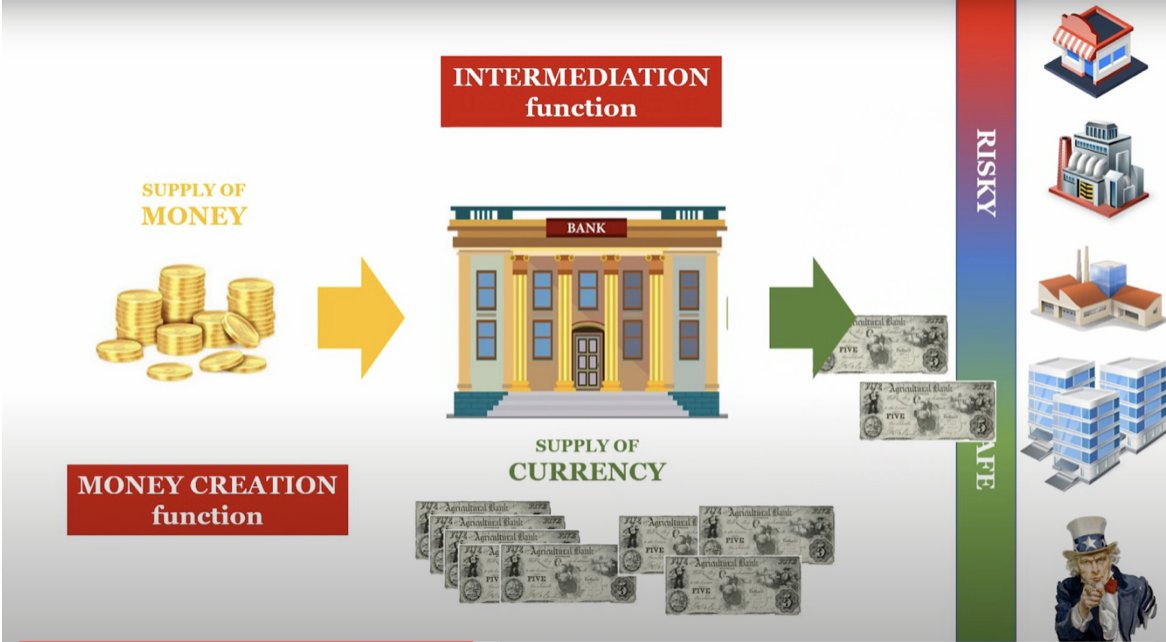

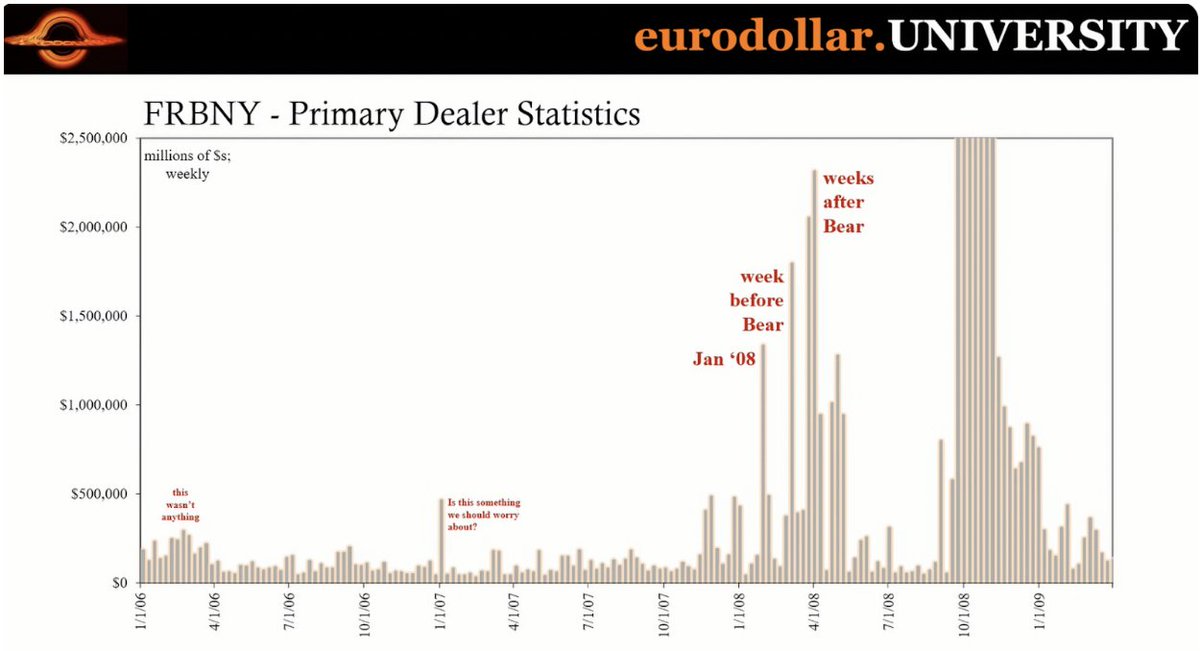

The difference between a financial crisis and a monetary crisis is key here. The former is about bad assets and economic pain, but the latter? It's when markets dry up, good assets can't be sold, and liquidity vanishes. And that's where we are.

the Fed is pushing the Discount Window, but with a twist. They're focusing on collateral requirements. But if banks had enough good collateral, wouldn't they just use the repo market?

This brings us to the heart of the matter: the repo market and its breakdowns. It's not just about individual banks or Fed tools. It's about systemic issues in the monetary system, often ignored but crucial.

the Fed is struggling. They're not just tweaking tools; they're facing a fundamental challenge in managing the monetary system. They're like a janitor, constantly cleaning up without really addressing the root cause.

this is just a small part of the problem and potential issues with the BTFP if you want to find out more check out this video here

• • •

Missing some Tweet in this thread? You can try to

force a refresh