Host Eurodollar University channel. Monetary science reborn. Putting central banks where they belong.

21 subscribers

How to get URL link on X (Twitter) App

There is no wiggle room on this. Rate cuts are 100% ineffective. Going back to 1982 when it began (and even before if you look at effective fed funds in '81-82), NOT ONCE has rate cuts done anything to alleviate unemployment.

There is no wiggle room on this. Rate cuts are 100% ineffective. Going back to 1982 when it began (and even before if you look at effective fed funds in '81-82), NOT ONCE has rate cuts done anything to alleviate unemployment.

The last time the core CPI did something like this was, of course, 2008 and 2009. In '09, the sudden downturn signaled there was no recovery; it had already gone off the rails and was never going to be put back on.

The last time the core CPI did something like this was, of course, 2008 and 2009. In '09, the sudden downturn signaled there was no recovery; it had already gone off the rails and was never going to be put back on.

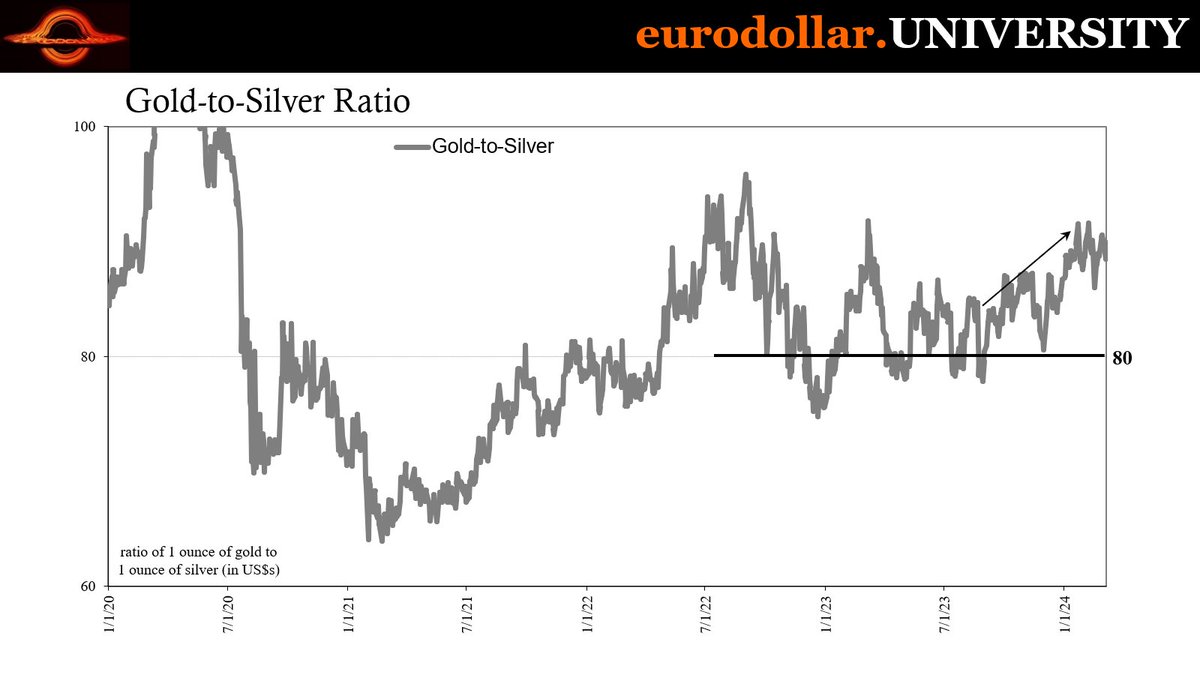

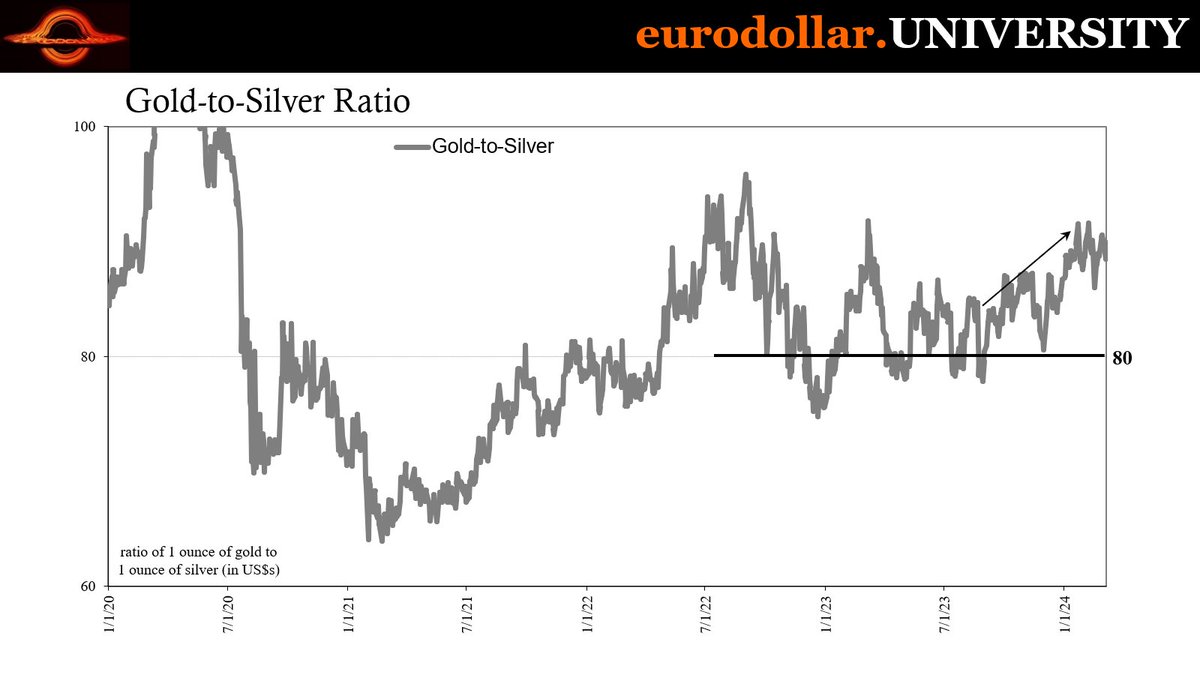

In recent years, gold/silver ratio surges when faced w/global recession risk/reality. Gold jumps on hedge demand while silver stays weak as industrial use falls off more than higher demand as other precious metal.

In recent years, gold/silver ratio surges when faced w/global recession risk/reality. Gold jumps on hedge demand while silver stays weak as industrial use falls off more than higher demand as other precious metal.

The BTFP was a quick fix during a crisis, offering banks easy loans. But as we've seen, easy fixes often lead to unanticipated consequences.

The BTFP was a quick fix during a crisis, offering banks easy loans. But as we've seen, easy fixes often lead to unanticipated consequences.

2/ 🧵

2/ 🧵

2/6 Gold surged. Recent move is geopolitics, sure, but there's a lot more than just the Middle East here, especially that last two days.

2/6 Gold surged. Recent move is geopolitics, sure, but there's a lot more than just the Middle East here, especially that last two days.

2/ Rising oil prices are a significant contributor to this problem.

2/ Rising oil prices are a significant contributor to this problem.

2/ Elasticity is important in reserve currencies, but so is discipline and restraint. There has to be a middle ground. Hard money, like #BTC or gold, advocates for limited currency supply, encouraging efficiency in economic systems though at the expense of flexibility.

2/ Elasticity is important in reserve currencies, but so is discipline and restraint. There has to be a middle ground. Hard money, like #BTC or gold, advocates for limited currency supply, encouraging efficiency in economic systems though at the expense of flexibility.

"Everyone" kept saying it was the dollar going to collapse. Why do they all get it backward?

"Everyone" kept saying it was the dollar going to collapse. Why do they all get it backward?

In 2017, emerging markets flooded Eurobond markets.

In 2017, emerging markets flooded Eurobond markets.