Jan jobs report🧵- here's what you need to know that the talking heads and gov't statisticians won't tell you, including why the real unemployment rate is btwn 6.3% and 7.4%...

First the headlines:

Nonfarm payrolls rose 353k last month

Unemployment rate steady at 3.7% (more on that later)

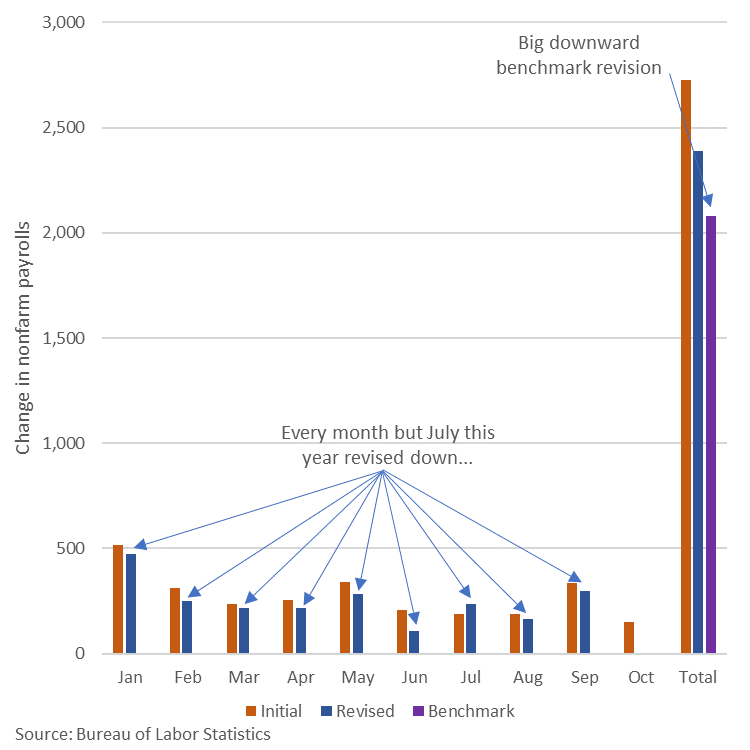

Note that updates to the BLS' data make it difficult to compare Jan '24 to prior months, so this monthly change needs an important qualifier...

Nonfarm payrolls rose 353k last month

Unemployment rate steady at 3.7% (more on that later)

Note that updates to the BLS' data make it difficult to compare Jan '24 to prior months, so this monthly change needs an important qualifier...

https://x.com/RealEJAntoni/status/1753416226812948683?s=20

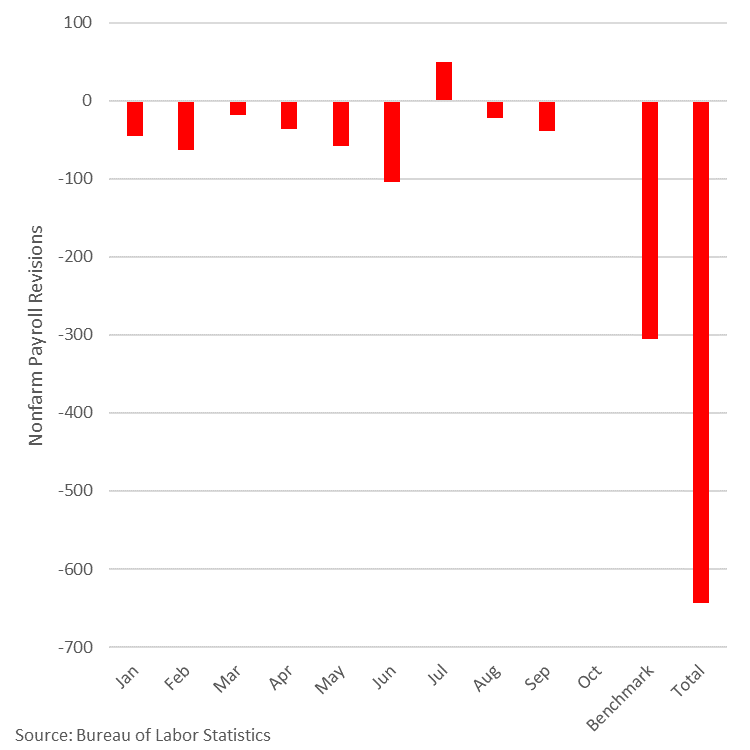

In brief, things once again look good b/c prior periods were revised down; the new seasonal adjustments and other changes reduced the number of payrolls in every month last year except Dec; cumulative monthly difference is -1.3 million w/ average monthly difference -126k...

So, do we have more jobs or not? Depends on which survey you look at: establishment survey, which allows for double counting, continues rising while household survey declines - there's an unprecedented gap btwn the 2 right now:

Another important divergence is part-time vs. full-time; even after adjusting for seasonal changes which are huge in Jan, economy still lost full-time jobs and only gained part-time jobs...

That's a continuation of an established trend: part-time has trended upward fairly consistently while full-time has leveled off; economy has lost ~1.6 million full-time jobs since Jun '23 and replaced them w/ ~1.6 million part-time jobs, which helps explain the next red flag...

Weekly hours are plummeting, now down to lowest level since covid lockdowns; aside from abnormalities of '20, it's at the lowest level since the Great Recession w/ housing meltdown and global financial crisis; firms are cutting hours and replacing full-time jobs w/ part-time:

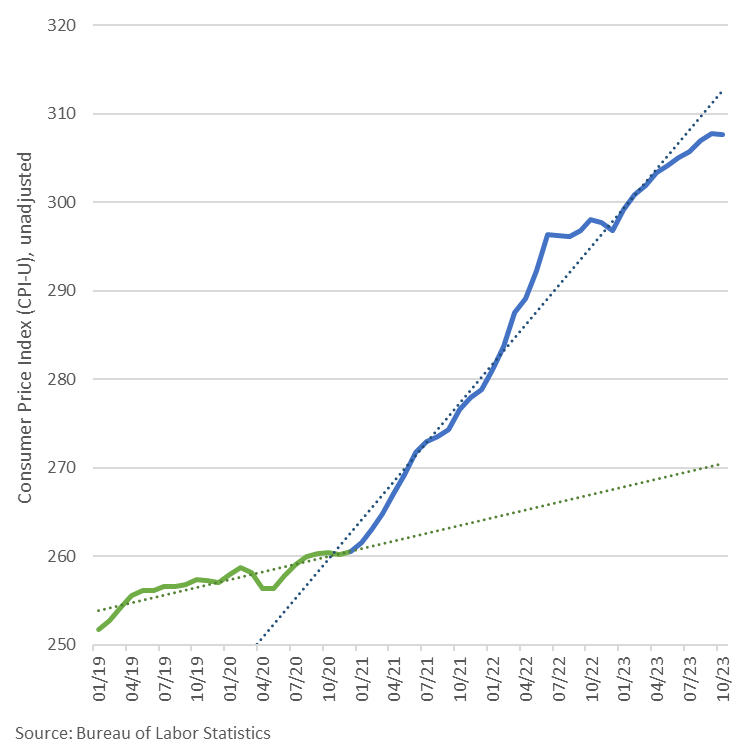

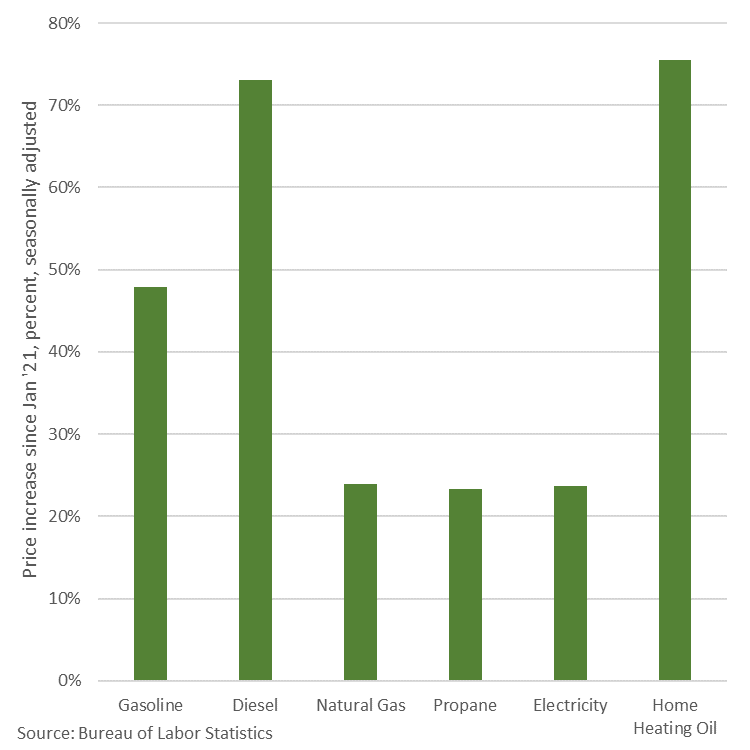

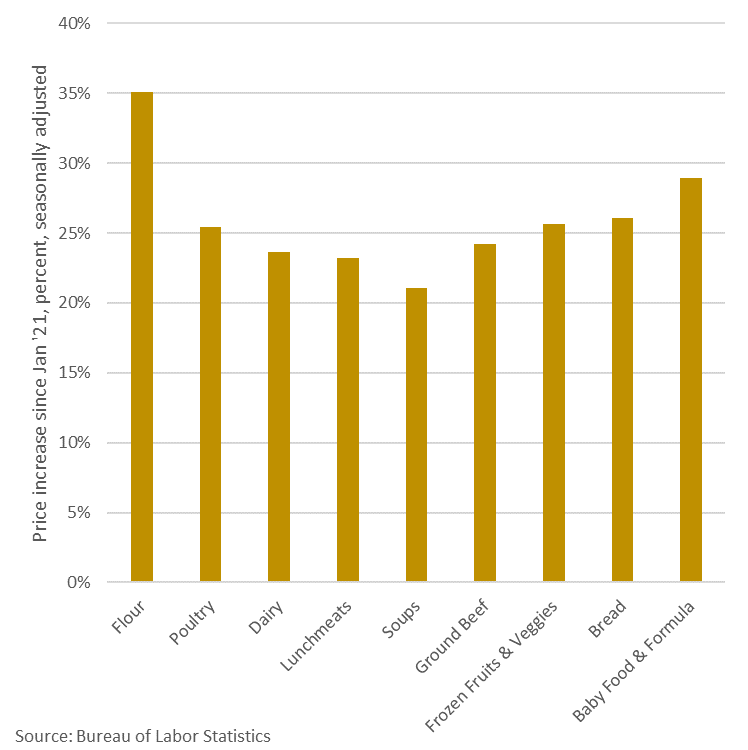

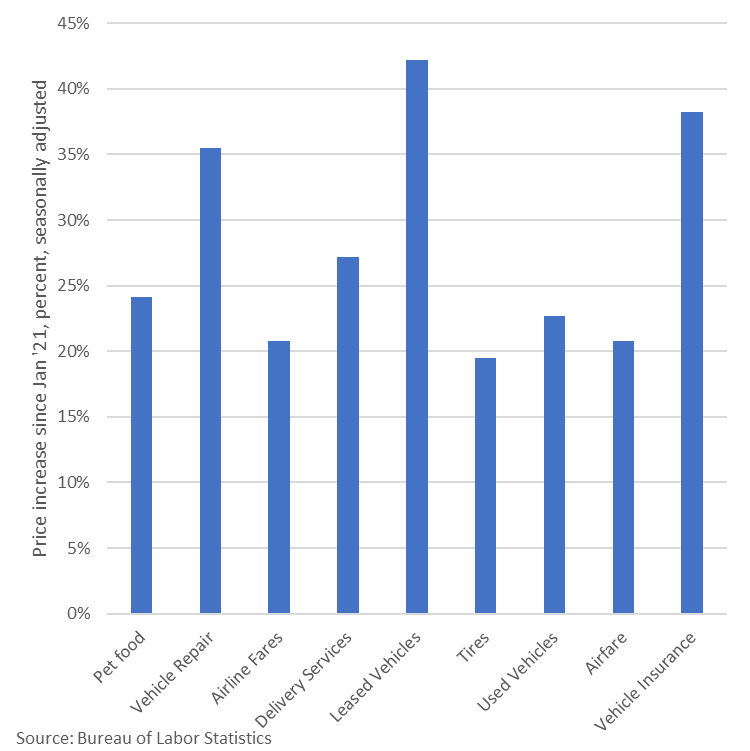

As people work fewer hours, their paychecks buy less, even w/ hourly raises, b/c prices are still rising faster than weekly earnings; significantly higher hourly wages still leave workers behind - about 4.3% behind Jan '21...

As far as where the jobs are, they have overwhelmingly been created in gov't and gov't dominated/funded healthcare sector - take away both direct and indirect gov't expenditures funded by debt and Y/Y job growth turns negative, pointing to unsustainability...

Interesting to note who has the jobs: they've all gone to foreign-born workers; not only are native-born workers way below their pre-pandemic trend, but they're even below the pre-pandemic level (Jan '24 vs. Jan '20):

In just the last year, a net 193k native-born workers lost their jobs, while a net 1.2 million foreign-born workers gained jobs (important to use Y/Y comparisons w/ these datasets b/c they're not seasonally adjusted):

And the number of people missing from the labor force remains stubbornly high, artificially reducing the unemployment rate...

Depending on which methodology you prefer, you can calculate a more realistic unemployment rate that accounts for all of these missing workers: somewhere btwn 6.3% and 7.4% - that's not horrific, but significantly higher than "official" 3.7%...

TLDR: economy is still adding jobs, but they're overwhelmingly lower pay, fewer hours, and either directly or indirectly paid by gov't; also, Fed will need to look for a different excuse to cut rates and end QT - another banking crisis would fit the bill perfectly...

• • •

Missing some Tweet in this thread? You can try to

force a refresh