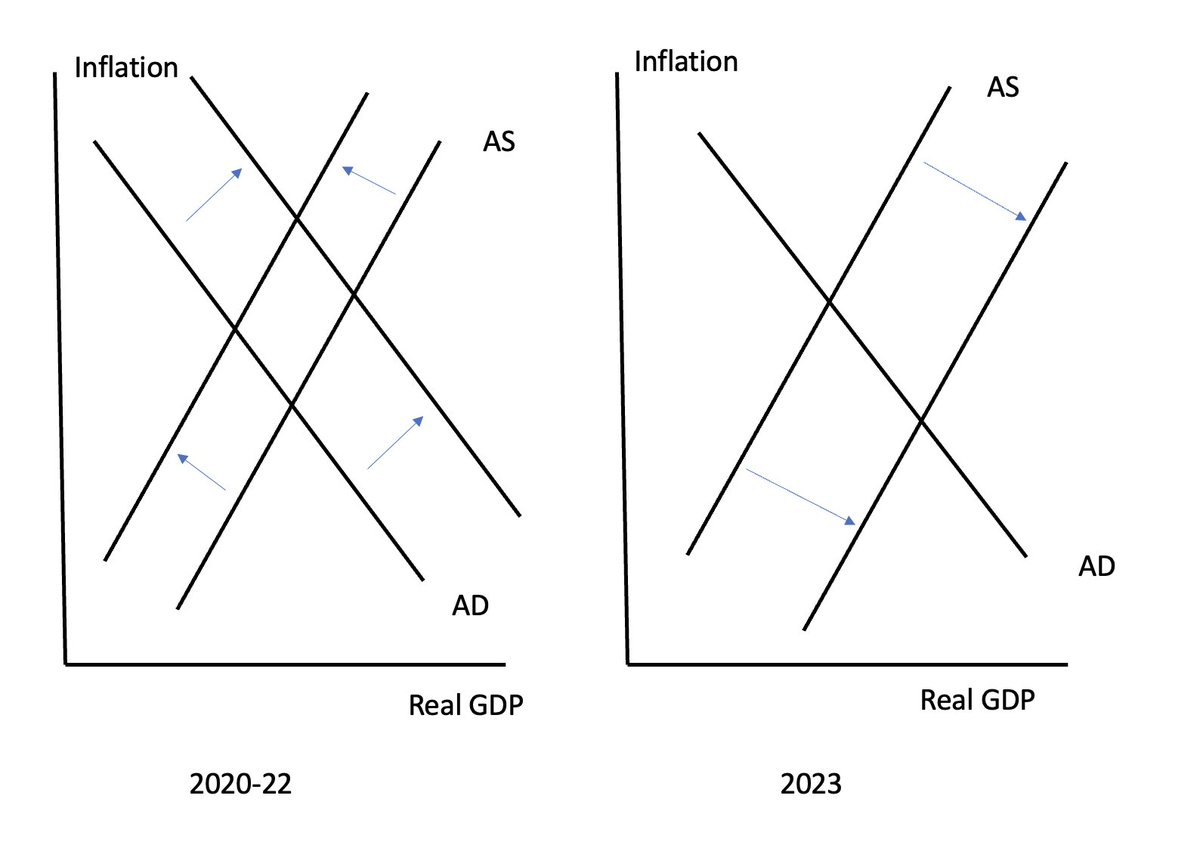

Immigration is looming larger in the campaign, partly because it's becoming harder for Republicans to run against Biden on the economy. But there's a strong case that immigration has been a key part of Biden's economic success 1/

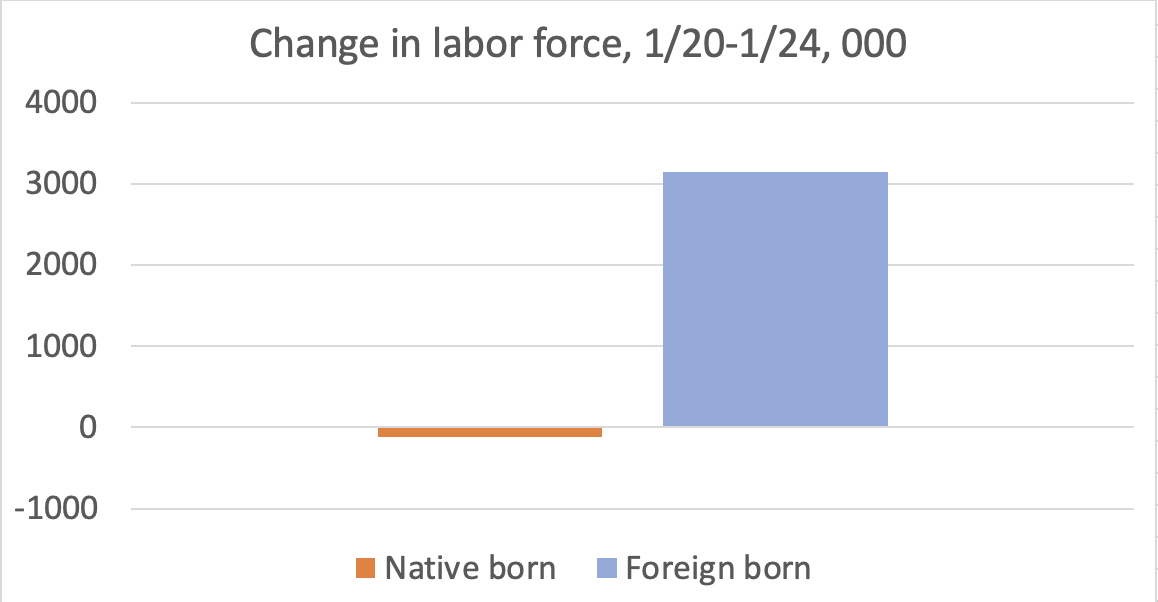

Inflation has come down so easily in part because of strong labor force growth. How much of that growth can be attributed to foreign-born workers? All of it 2/

Some people might look at that and say that foreigners have stolen 3 million jobs from Americans. But we have full employment, indeed a very tight labor market. Look at what the Conference Board survey says 3/

So employment is being constrained by supply, not demand. Foreign-born workers expand the supply. And lots of evidence that they are complementary to native-born workers, so that they let us run the economy hotter without inflation and hence *raise* native-born employment 4/

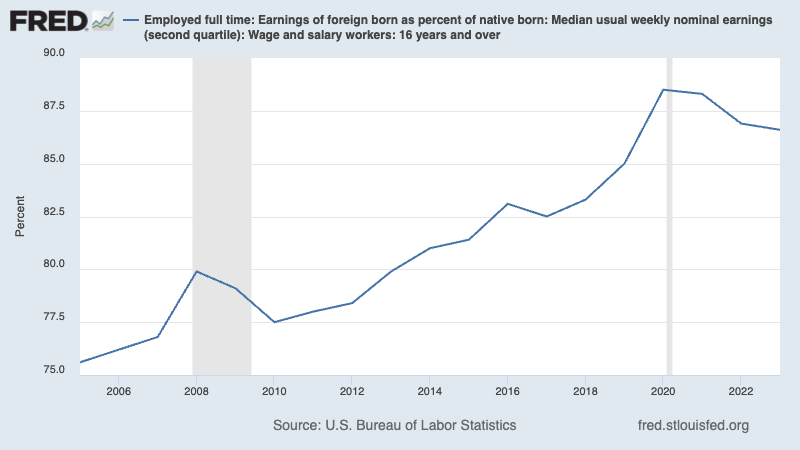

Some evidence to that effect: relative wages of foreign-born workers have fallen a bit relative to native-born since the pandemic. That's OK — they gain a lot from coming here, and their presence allows bigger gains for the native born 5/

All this is short-run; add in huge long-run benefits from immigration in helping us pay for Social Security, Medicare and so on. Immigrants are really good for the U.S. economy — and nativists really bad 6/

• • •

Missing some Tweet in this thread? You can try to

force a refresh