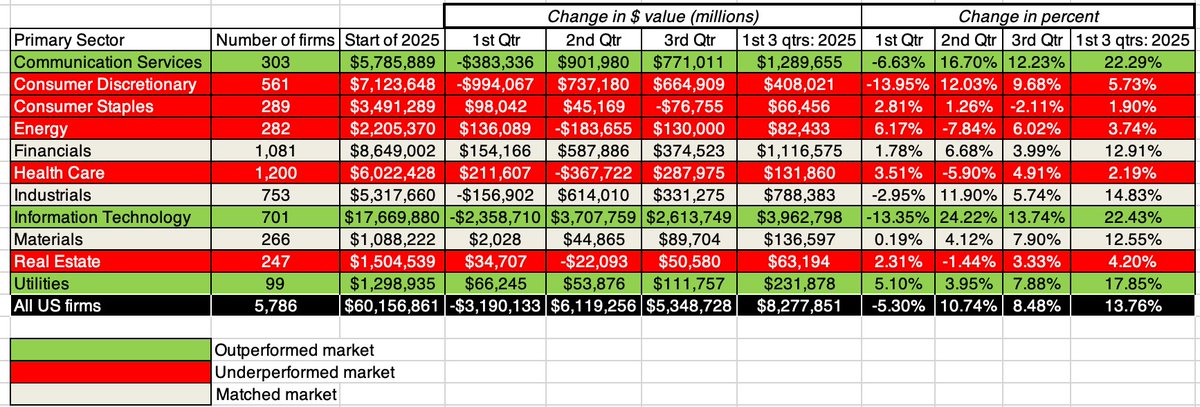

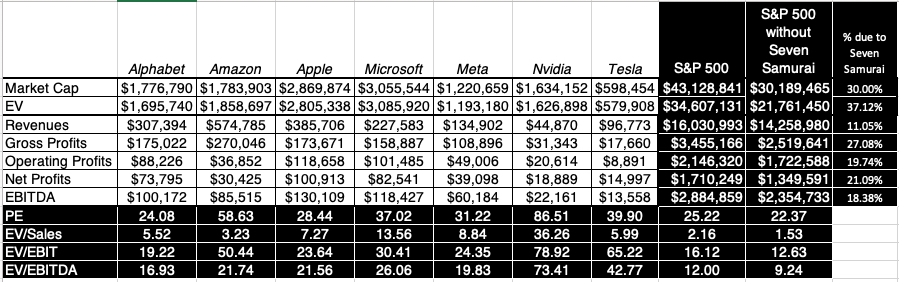

Seven stocks (Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia, Tesla) added $5.1 trillion to their market cap in 2023, accounting for about 55% of the $9.2 trillion added during the year by all 6658 US firms. bit.ly/4bsNEcB

Going back a decade, these seven stocks have climbed from 8% of the value of all US firms to more than 24% of the value, with 2022 the only serious drawdown year. At a $12 trillion market cap, the Mag Seven are now worth more than all listed Chinese stocks. bit.ly/4bsNEcB

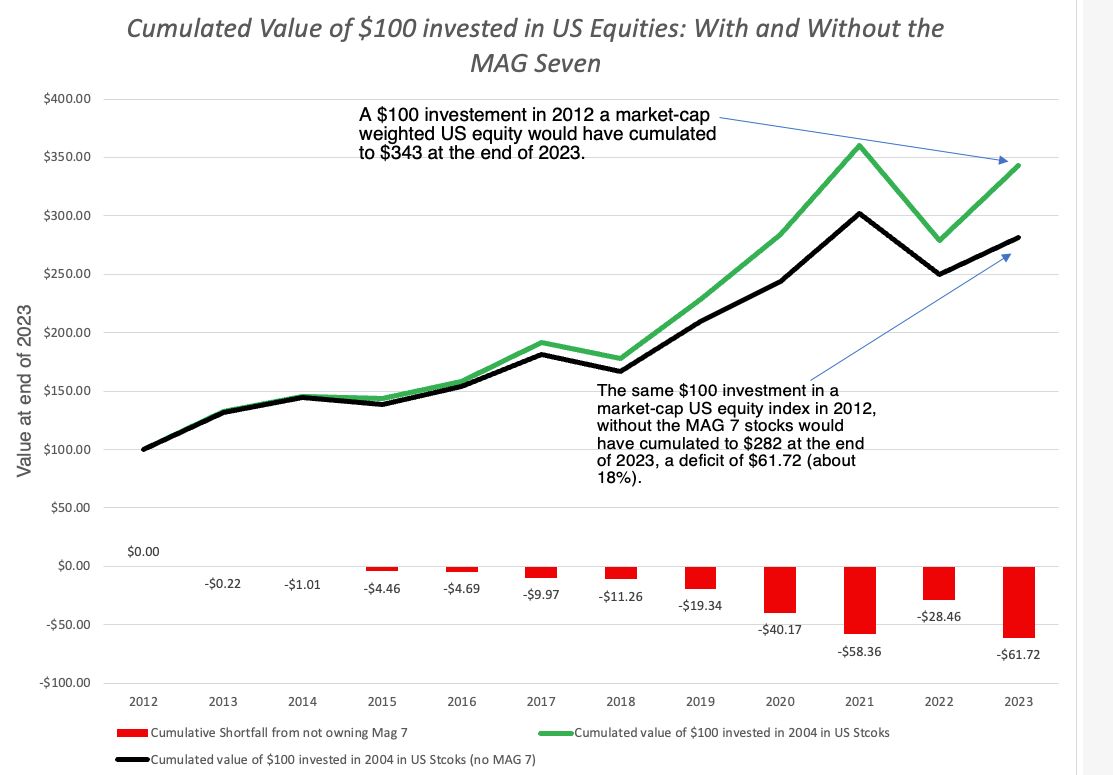

A US stock portfolio created in Dec 2012 without the Mag Seven stocks in it, would have had a shortfall of about 18% in cumulated value by the end of 2023, relative to a portfolio with these stocks. Small stock and value investors suffered! bit.ly/4bsNEcB

One explanation for the Mag Seven performance in 2023 is that it represented a recovery from a catastrophic 2022, when these seven stocks lost $4 trillion in market value. But it is only partial, since they outperformed other 2022 losers. bit.ly/4bsNEcB

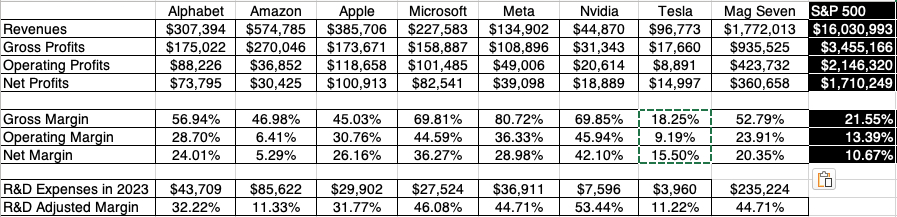

Another is that is these companies are being rewarded for their superior business models, with pricing power, in the face of inflation, earnings growth, in the face of economic challenges and very little debt overhang. bit.ly/4bsNEcB

A third and longer term explanation is that these companies (Google, Meta, Amazon) are either already examples of winner-take-all phenomena in their businesses, or perceived (Tesla & Nvidia) to have a chance of getting there in the future.

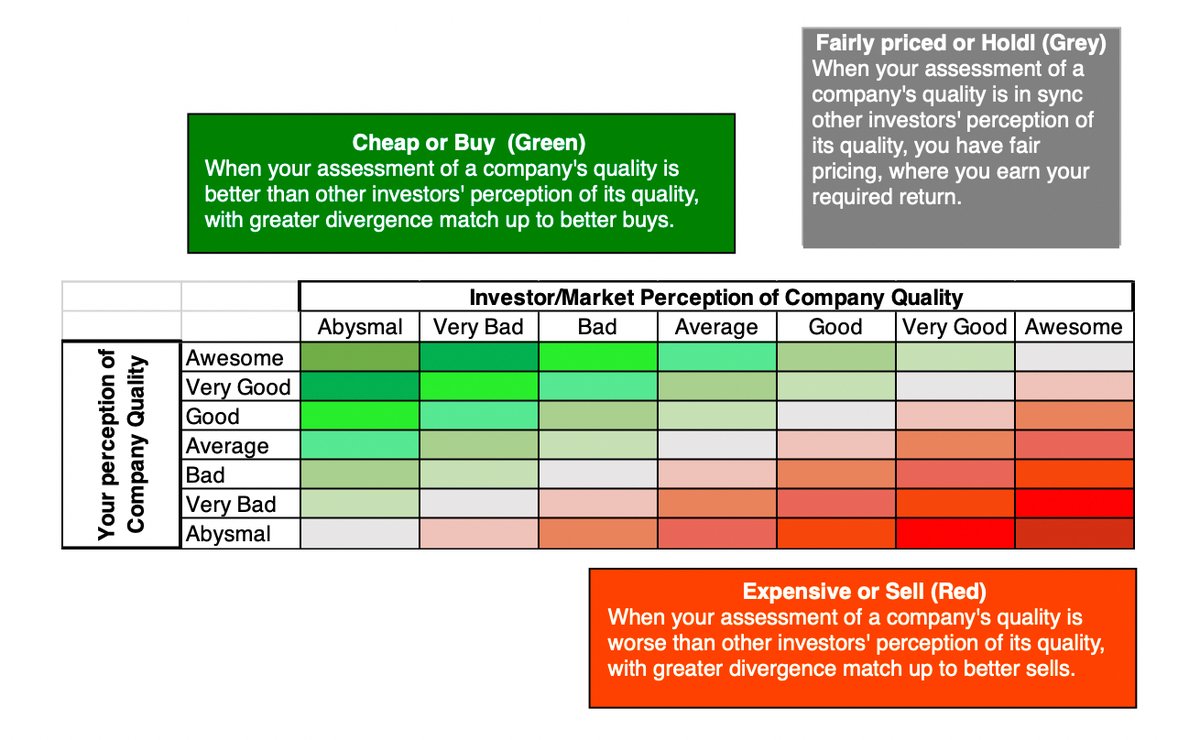

The Mag Seven are clearly great businesses, but to assess whether they are good investments, you have to get a mismatch between your perceptions of a company and other investors' perceptions of the same company. bit.ly/4bsNEcB

The problem with using pricing ratios to make this assessment is that they are blunt instruments, and are difficult to adapt to reflect differences in growth and risk across companies. The Mag Seven trade at premium prices, but is the premium too high? bit.ly/4bsNEcB

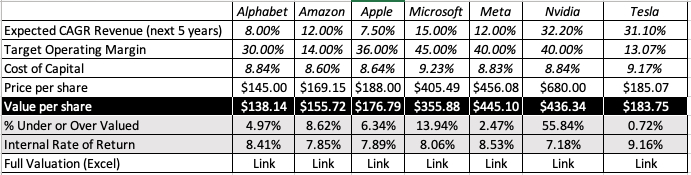

Intrinsic valuations require assumptions that will be always wrong, in hindsight, and your best estimates for the future. That said, they represent a tool that I use to convert my perceptions of a company into value. bit.ly/4bsNEcB

With the addition of Tesla two weeks ago, I own all seven of these stocks, but the other six have been in my portfolio for much longer. I can live with the mild over valuation in $GOOG, $AAPl, $AMZN & $META, and even the larger over valuation in $MSFT. bit.ly/4bsNEcB

$NVDA is a bridge too far for me, and having halved my holding In Nvidia last summer, I plan to halve it again now. I have left money on the table by doing so, but there is no point having an investment philosophy, if you don't act on it. bit.ly/4bsNEcB

• • •

Missing some Tweet in this thread? You can try to

force a refresh