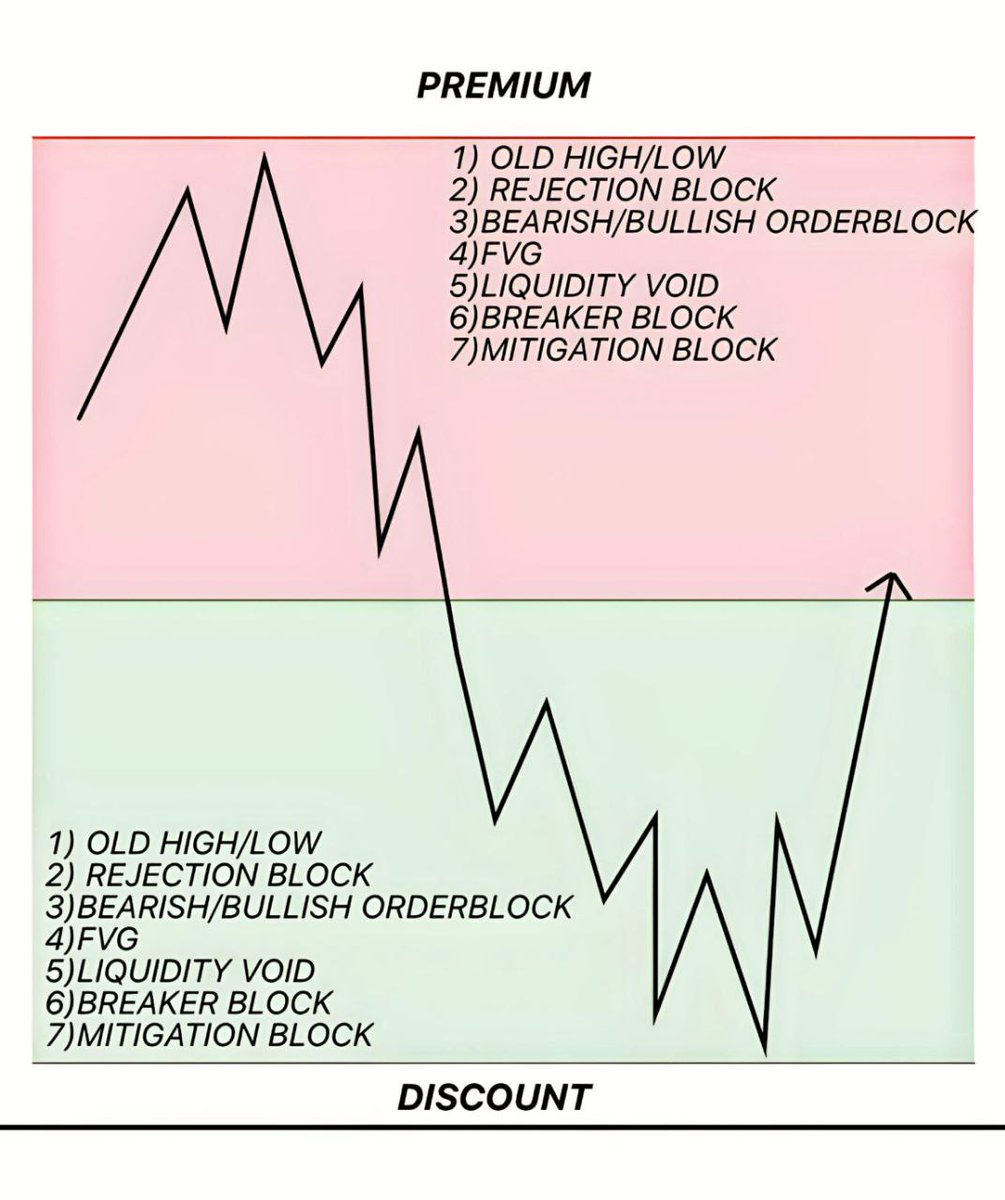

What is Balance price range?

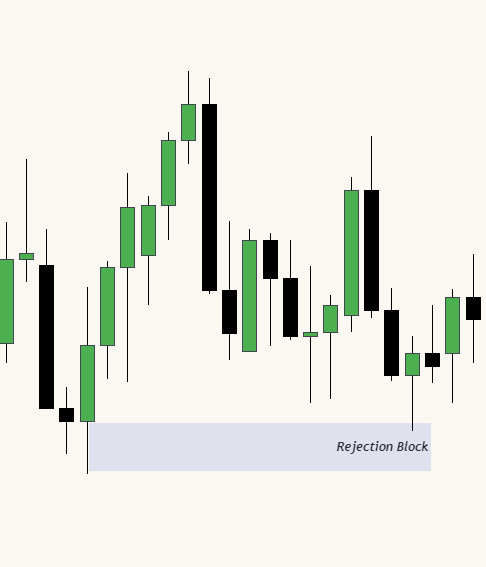

- BPR refers to a specific area in price history where there has been a significant movement to the upside and a significant movement to the downside.

- This can be used as a key level of support and resistance for traders and investors to watch.

- BPR refers to a specific area in price history where there has been a significant movement to the upside and a significant movement to the downside.

- This can be used as a key level of support and resistance for traders and investors to watch.

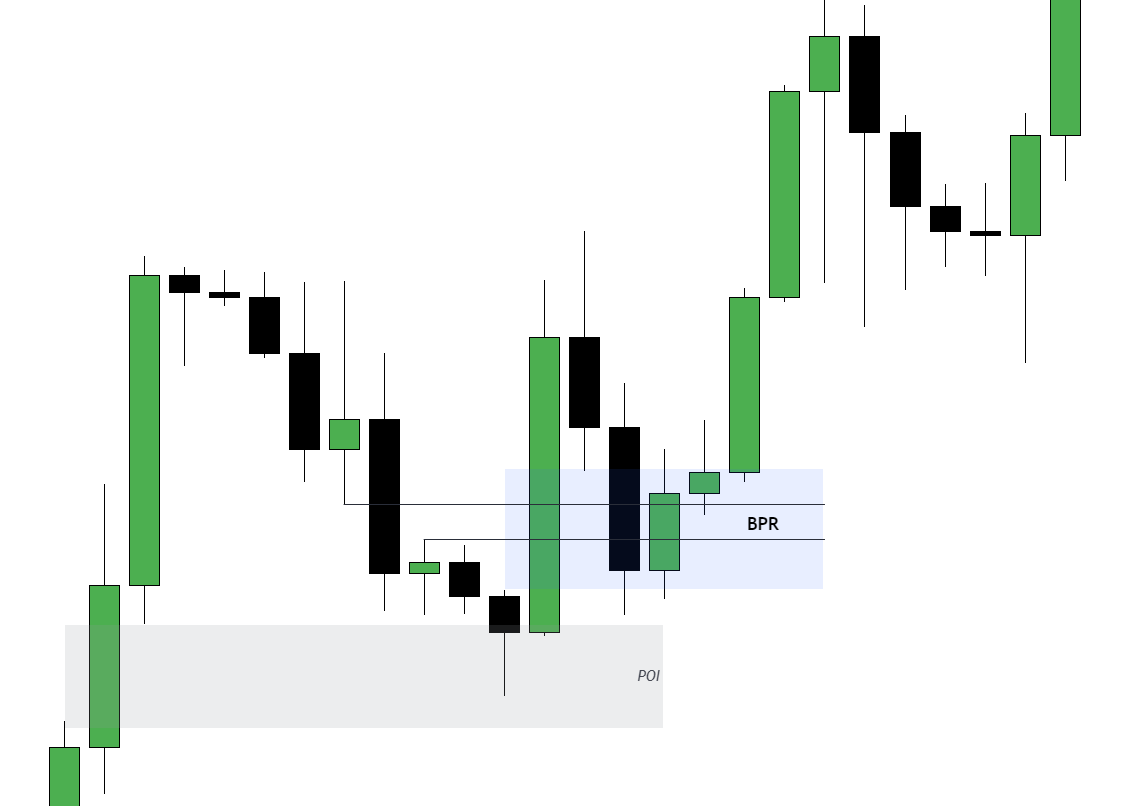

- The Balance Price Range (BPR) serves as critical support and resistance.

- When the price reaches the upper or lower BPR bounds, it often rebounds.

- Such rebounds indicate possible buying or selling chances.

- When the price reaches the upper or lower BPR bounds, it often rebounds.

- Such rebounds indicate possible buying or selling chances.

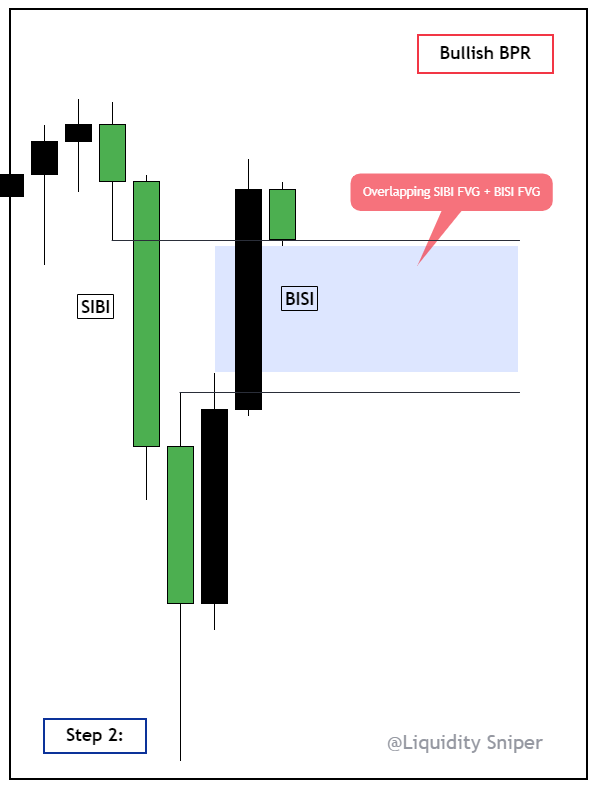

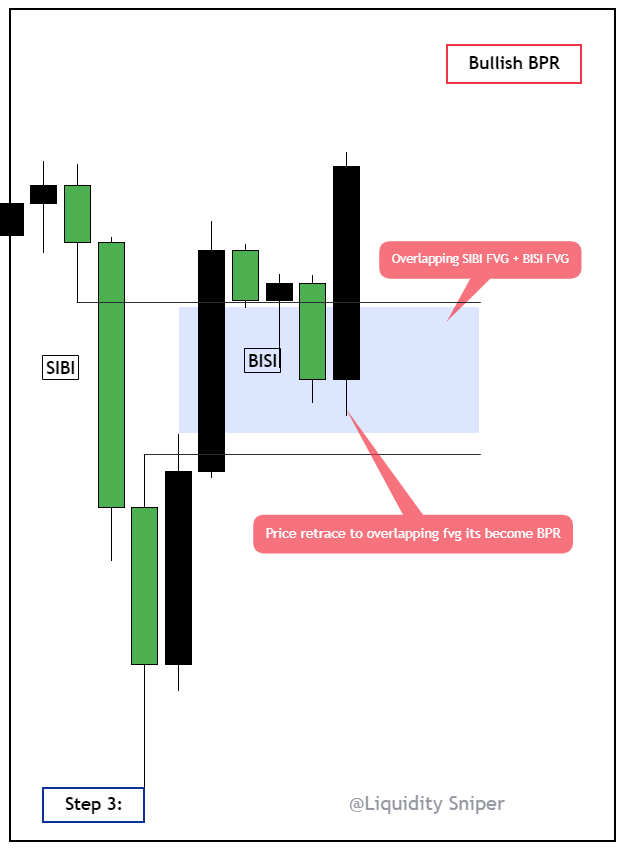

To properly mark BPR, arrangements are made in different steps as mentioned below.

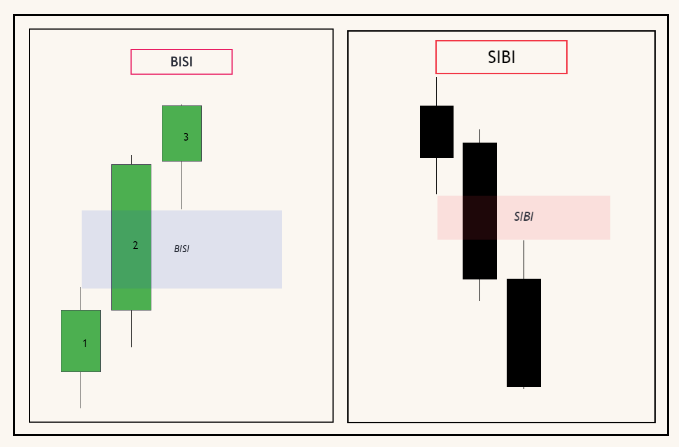

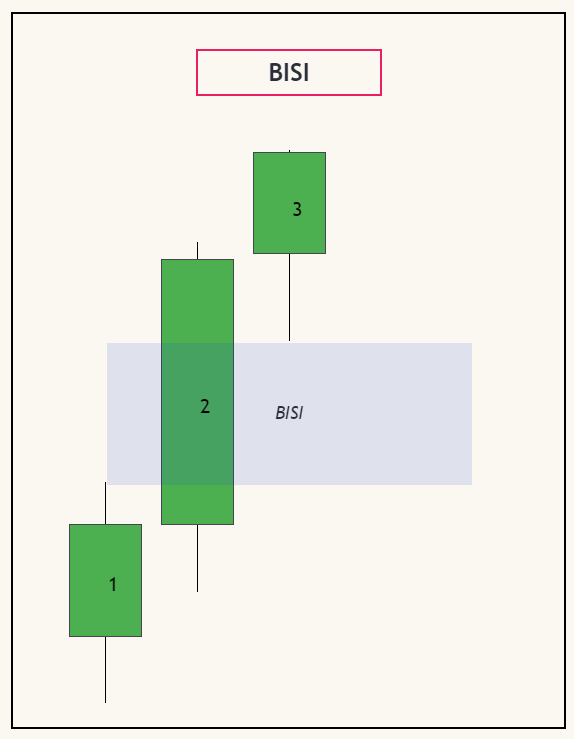

Bullish BPR Example:-

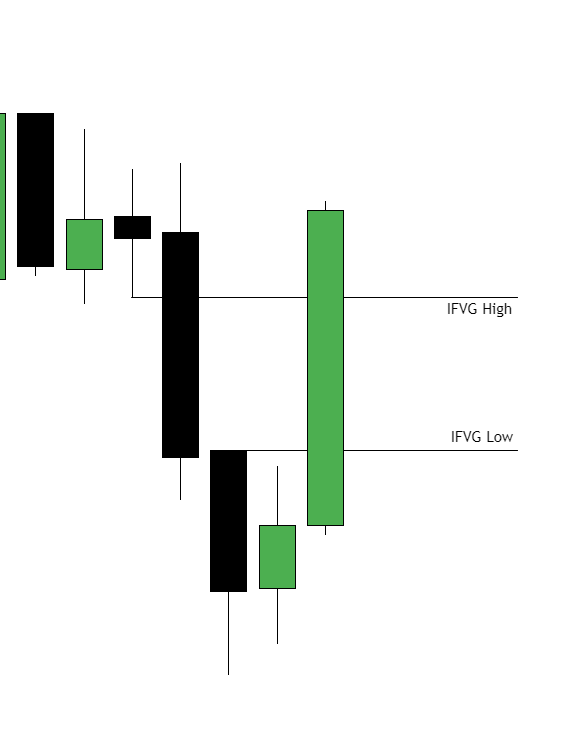

Step 1 : Mark SIBI (FVG)

Bullish BPR Example:-

Step 1 : Mark SIBI (FVG)

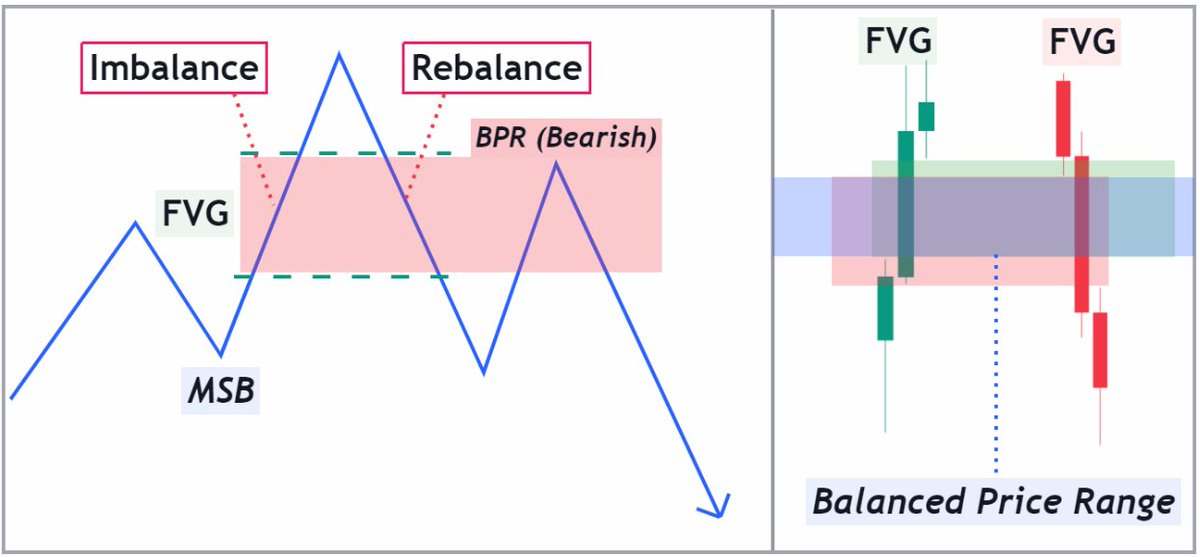

There are two types of Balanced Price Ranges (BPR): Bullish and Bearish BPRs, which can occur on all timeframes.

In this thread, I will explain both types, provide examples, and offer guidance on how to use them for both short-term and long-term trading.

In this thread, I will explain both types, provide examples, and offer guidance on how to use them for both short-term and long-term trading.

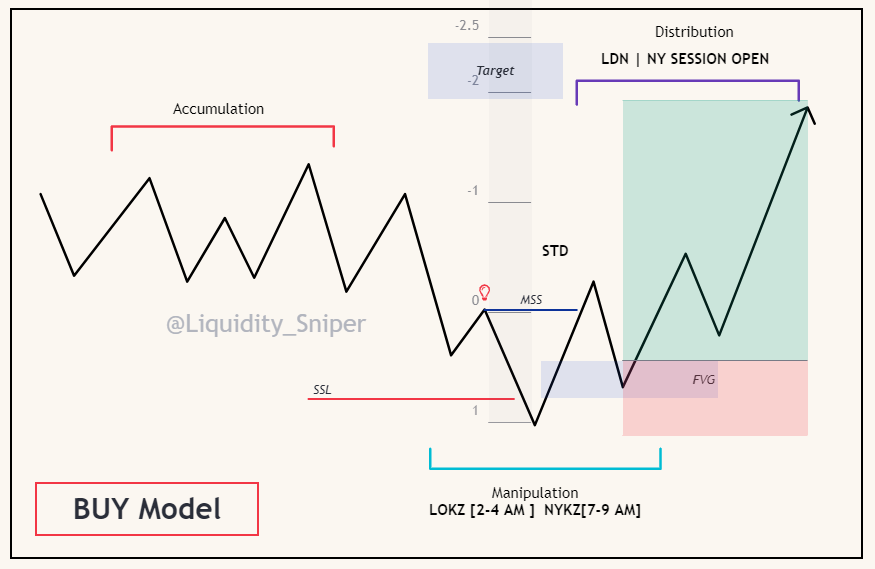

Bullish BPR (+BPR)

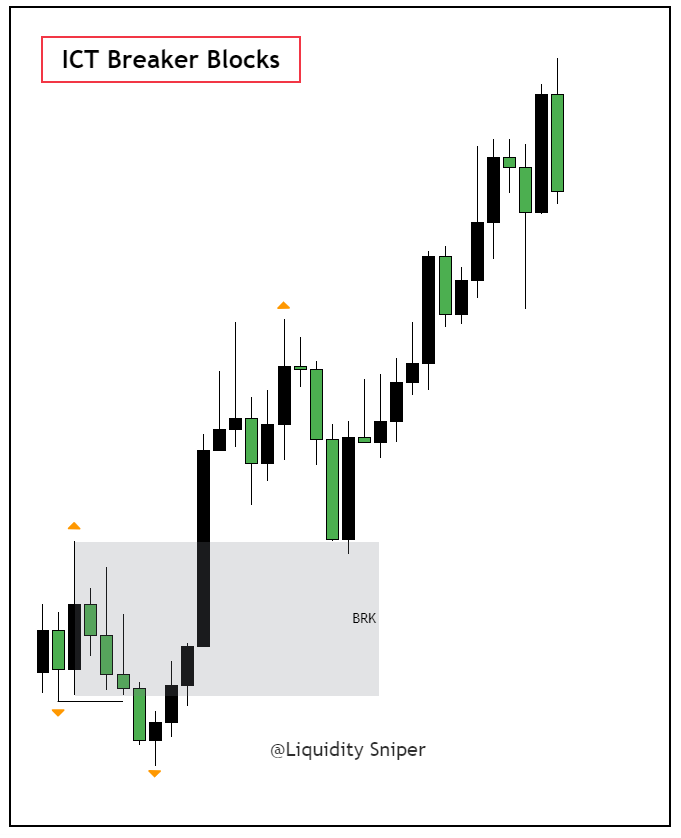

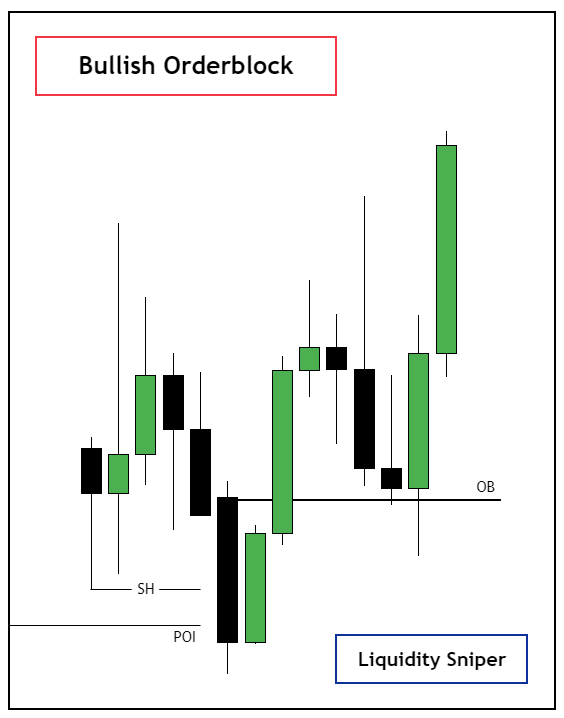

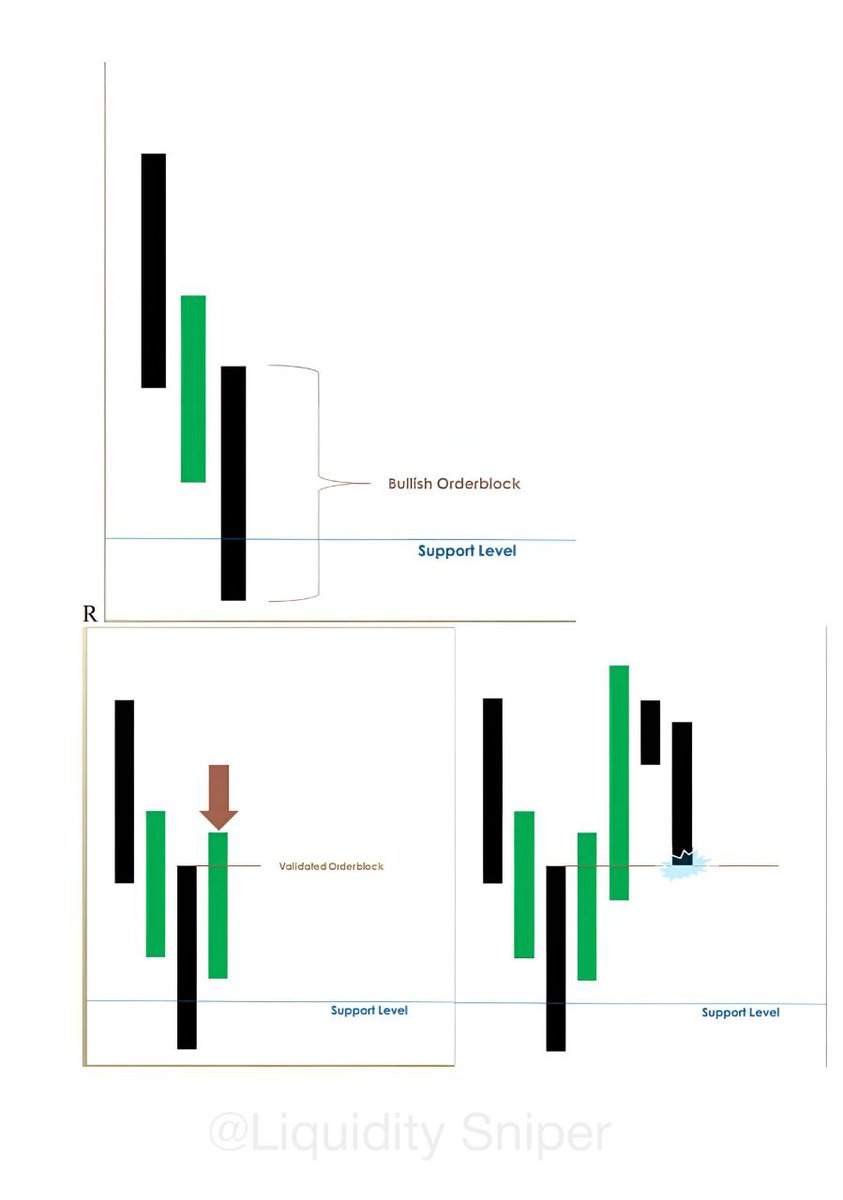

- BPR+ occurs when there's an aggressive move down immediately followed by an aggressive move up.

- The move down creates a SIBI FVG, and the move up creates a BISI FVG, which overlaps the SIBI FVG.

- It becomes a BPR once price retests where the FVGs overlap.

- BPR+ occurs when there's an aggressive move down immediately followed by an aggressive move up.

- The move down creates a SIBI FVG, and the move up creates a BISI FVG, which overlaps the SIBI FVG.

- It becomes a BPR once price retests where the FVGs overlap.

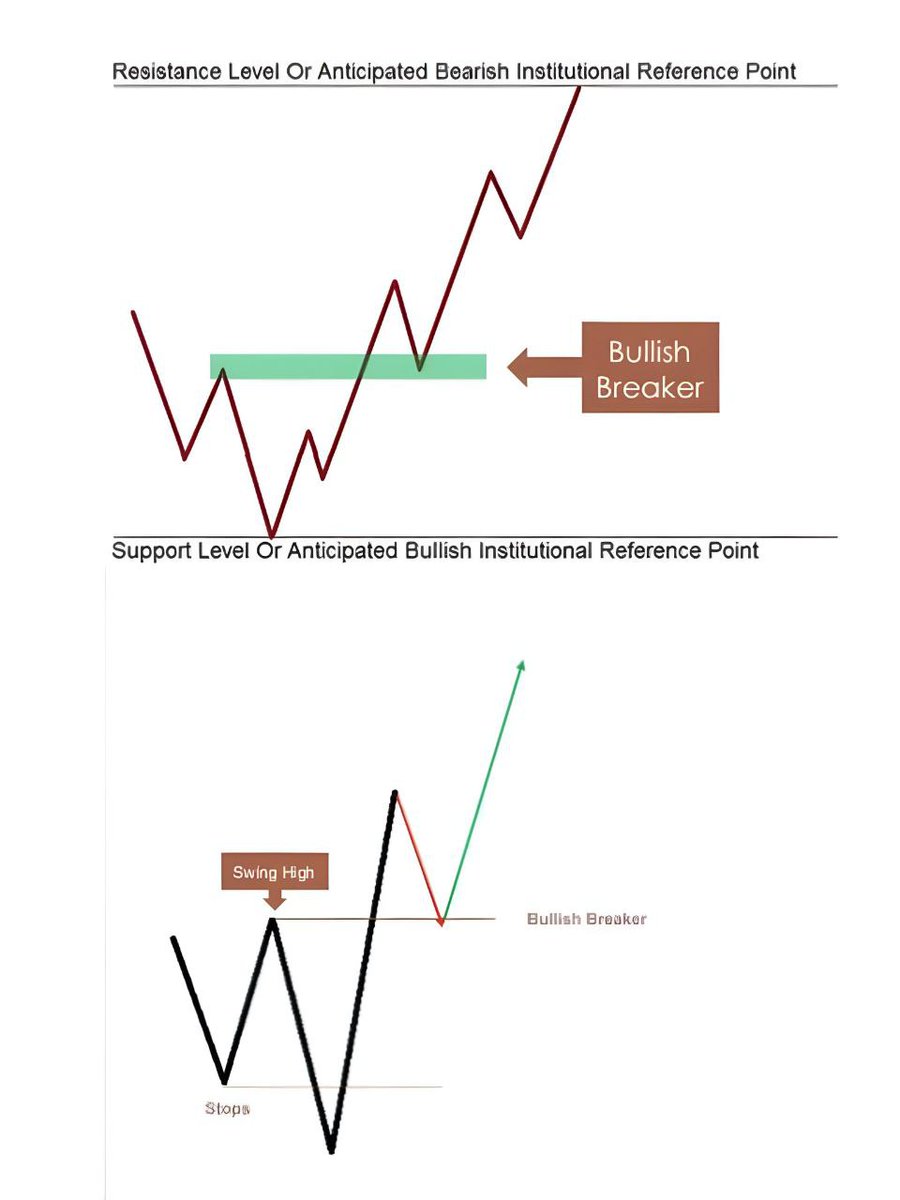

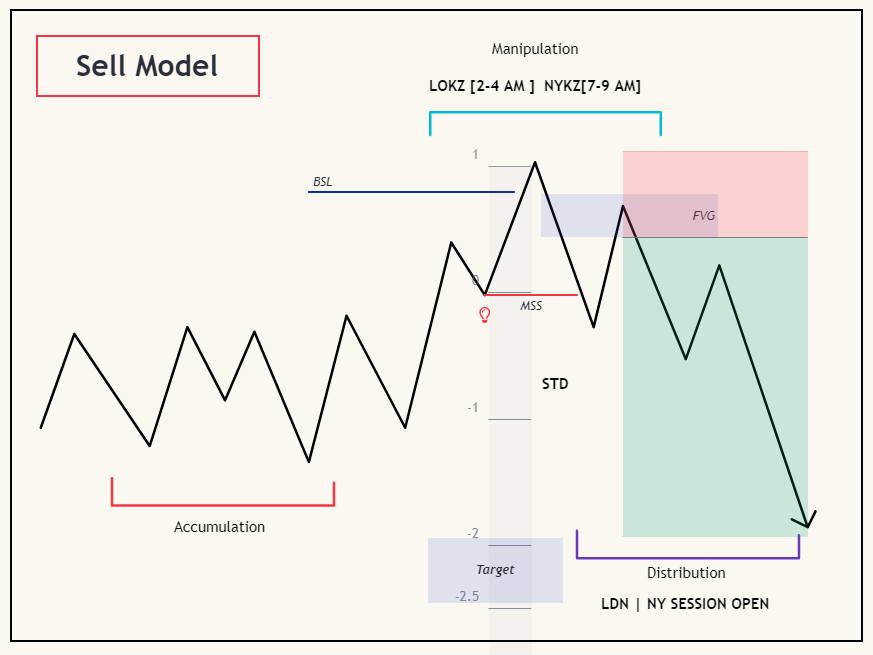

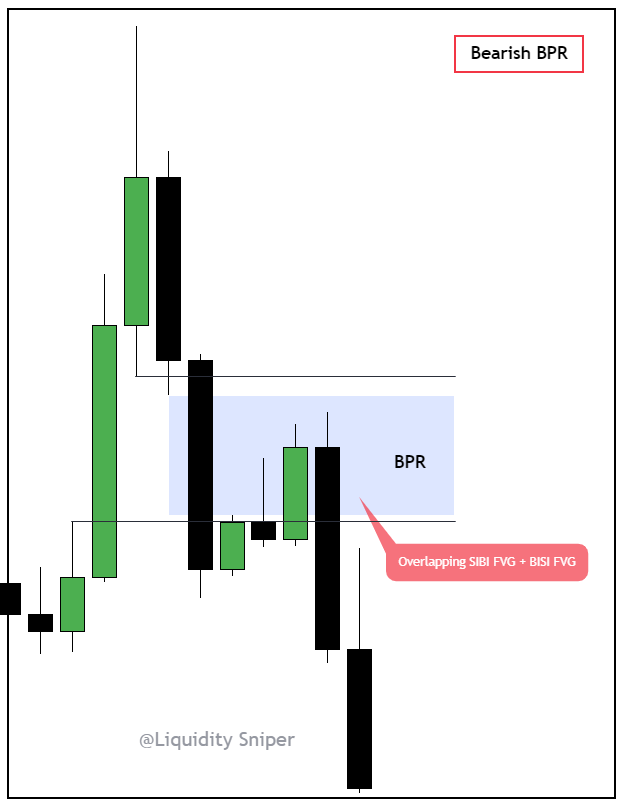

Bearish BPR (-BPR)

- BPR- occurs when there's an aggressive move up immediately followed by an aggressive move down.

- The move up creates a BISI FVG, and the move down creates a SIBI FVG, which overlaps the BISI FVG.

- It becomes a BPR once price retests where the FVGs overlap.

- BPR- occurs when there's an aggressive move up immediately followed by an aggressive move down.

- The move up creates a BISI FVG, and the move down creates a SIBI FVG, which overlaps the BISI FVG.

- It becomes a BPR once price retests where the FVGs overlap.

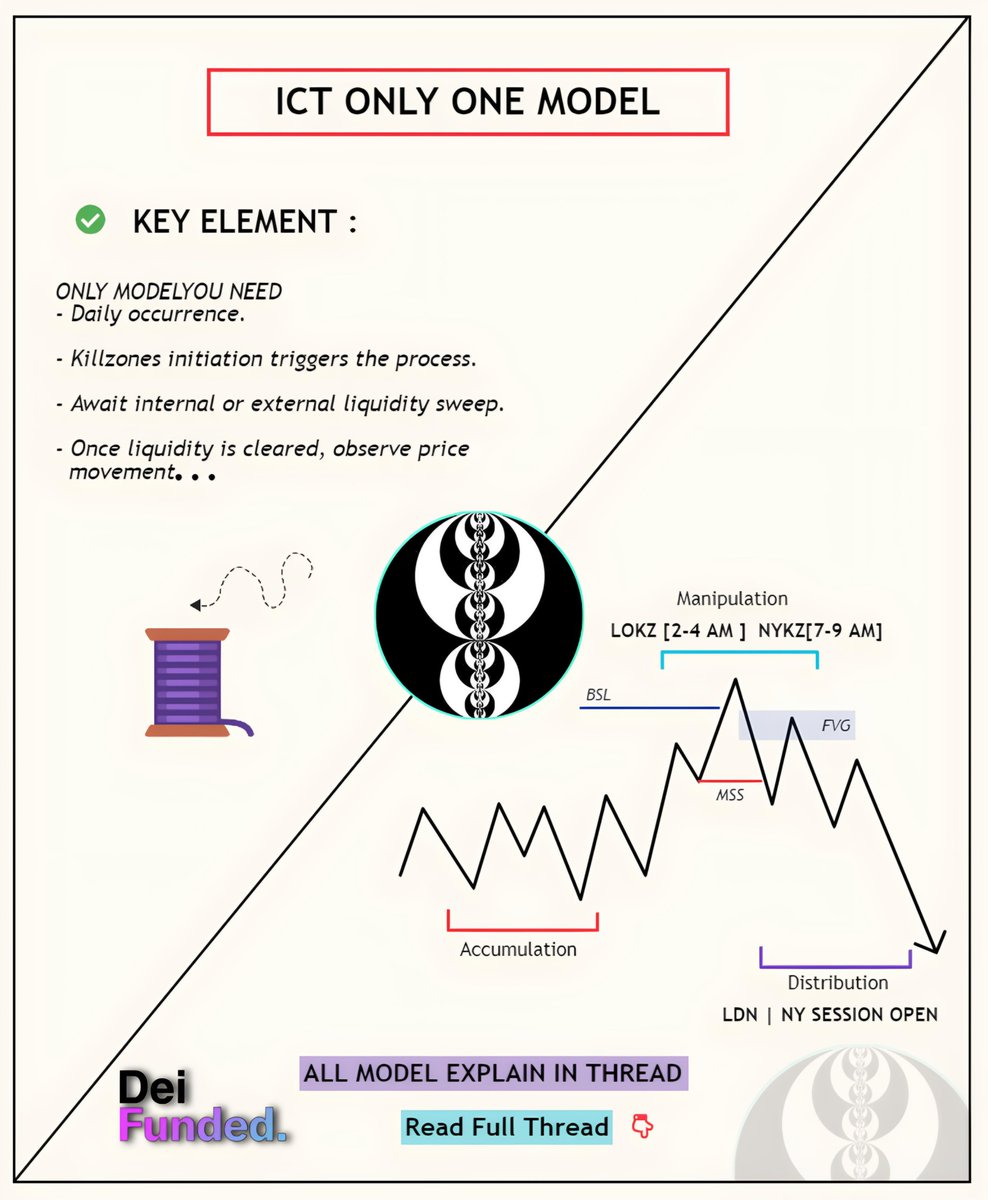

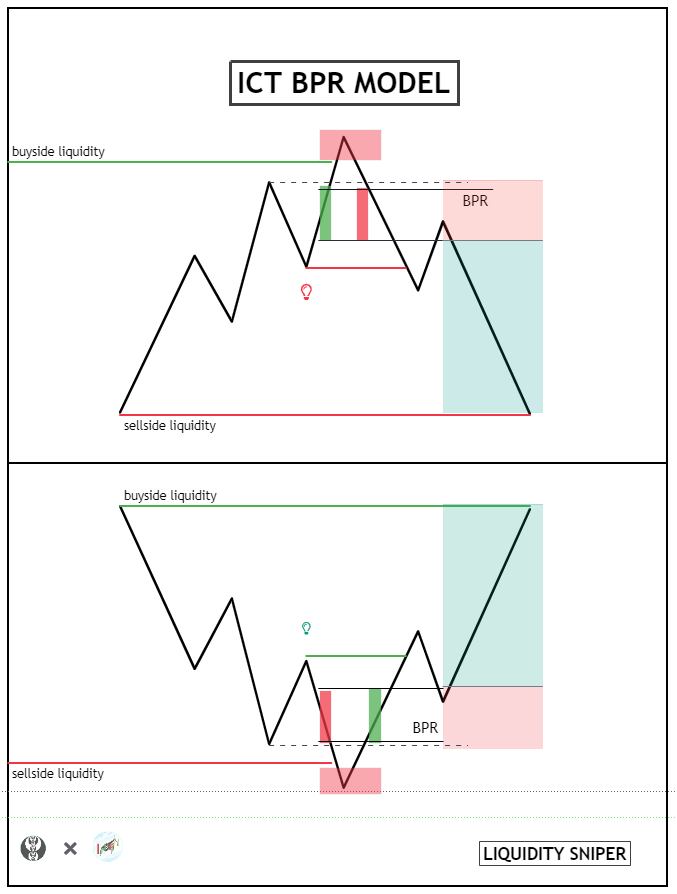

ICT BPR MODEL :

- Wait for price to hit a higher time frame (HTF) resistance level.

- Wait for the price to close below the BPR.

- When the next candle closes below the BPR, anticipate a rapid shift from Buy Side to Sell Side.

- Aim for a profit of at least 2R.

- Wait for price to hit a higher time frame (HTF) resistance level.

- Wait for the price to close below the BPR.

- When the next candle closes below the BPR, anticipate a rapid shift from Buy Side to Sell Side.

- Aim for a profit of at least 2R.

Join for Educational content and weekly layout👇 :

t.me/Liquidity_Snip…

t.me/Liquidity_Snip…

• • •

Missing some Tweet in this thread? You can try to

force a refresh