Great observation Jake. Please allow me to hijack your post and offer some DD.

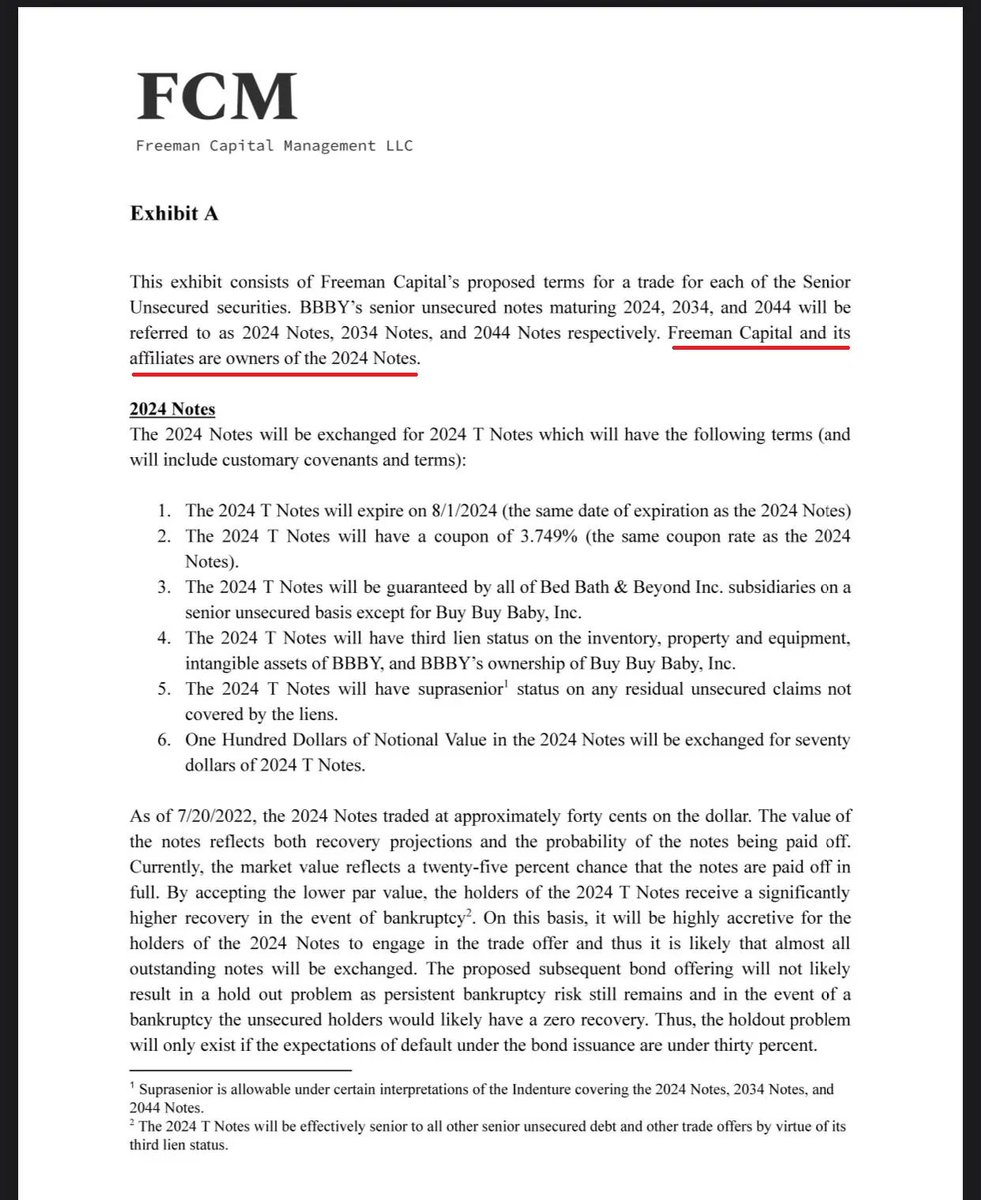

Freeman Capital Management were the owners of the 2024 bond notes, this was openly disclosed by Jake Freeman himself in a letter he wrote to the board.

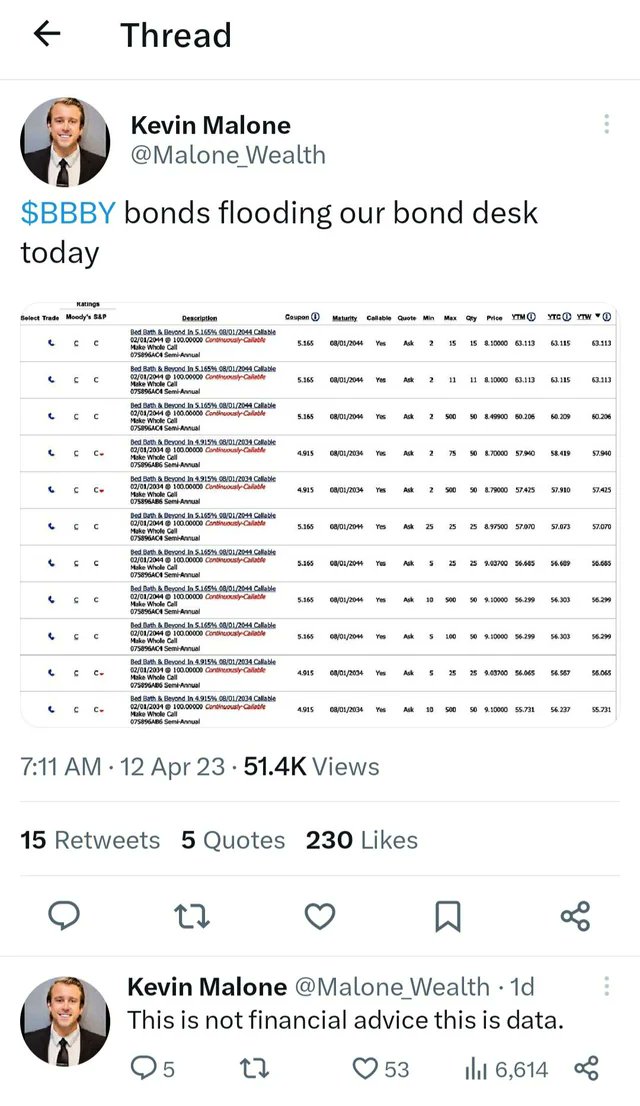

When we discovered the “Make Whole Call” provisions exercised by the company on April 12th (Kevin Malone’s reporting), one thing stood out is that they only applied to the 2034 and 2044 notes, leaving the 2024 notes untouched.

Now imagine the company hasn’t died off, and instead engages in a complex M&A transaction after a long Chapter 11 restructuring process. Imagine also that this process involved delisting the old stock, resulting in defaulted or lost shares and debt obligations. Well then if at some future point, former shareholders receive a return in value based on the proportion of their invested stakes, that same advantage wouldn’t extend to bondholders. They’ll have no compensation. And because the company handed the bondholders an option, on several occasions, to convert the debt to shares, any concern about fairness to bond holders is immediately disregarded.

Some comments on the bond exchange deal brokered by Lazard in late 2022:

Although the public exchange was meant to commence on October 18th and expire by November 15th, it was extended again and again and again, ultimately terminated on January 5th, but after each dreadful extension there were supposedly hard efforts to renegotiate the offerings; what’s weird is that when we reviewed the amendments they made it looked like very little was actually changed by the BBBY management to make the offering more persuasive. But despite the failure on surface level, we do see interesting developments occur in two private offerings:

Private Offering #1 involves a single existing holder, contributing to a 3.5M$ debt-to-equity conversion.

Private Offering #2 engages several institutional holders, leading to a much more substantial debt-to-equity conversion.

So despite the unfavorable outlook publicly, these behind-the-scenes actions revealed some progress with significant institutional participation (only concerning the 2034 and 2044 bonds).

One week after terminating the bond exchange deal, on January 13th we found on Pitchbook, a $25,000/year data service, reported the company had undergone a leveraged buyout (LBO), meaning some aspects had already been acquired through a private sale. Another pitchbook data entry revealed that buybuyBABY was the subject of a leveraged buyout on January 13, 2023. That same January 13th, and this is very important, BBBY defaulted on their ABL with JPM.

In August, we received a notice about an at-the-money offering of shares, specifically 12 million shares to be sold via Jeffreys. Cool, they demonstrated the capacity to raise capital by selling shares. An updated Form S-4/A on October 28th made available an additional $150 million for an At-the-Money (ATM) offering.

When BBBY held their Q3 shareholders meeting on January 10th, they disclosed using the revenue from holiday sales to purchase more inventory. There were references to missing targets, possibly related to the going concern notice. Why the fuck didn’t they take advantage of the ATM offering and sell shares for the $150 million they announced?

On January 13th, BBBY was forced to default on the ABL terms, as indicated by JPMorgan, the administrative agent. The 10Q that was later released on January 26th highlighted certain events of default, emphasizing the failure to prepay an over-advance and satisfy a financial covenant, among other things.

But even that same 10Q balance sheet suggested that BBBY actually had sufficient liquidity to fulfill the defaulted payment. So BBBY seemingly had multiple avenues to meet the debt obligation payment on January 13th, either through the liquidity seen on their balance sheets, maneuvering accessible funds, using revenue from holiday sales to service the debt and buying less inventory, or fucking offering shares from the $150 million ATM they already authorized. BBBY seemingly intentionally did not meet their obligations, resulting in the default with JPM. What “among other things” could have caused the default?

Looking into the original ABL loan agreement, which Whoopass actually managed to find from June 19th 2020, you can explore ARTICLE VII Events of Default.

Notable reasons include events requiring full payment of material indebtedness, forced proceedings related to liquidation or bankruptcy, and a change in control. Well at that time, BBBY had neither filed for bankruptcy nor undergone liquidation. Did a change in control occur? Interestingly, one criterion for a change in control was defined as the acquisition of over 40% of the company's voting power by any person or group.

Quick tinfoil, five days after the LBO was reported on Pitchbook, five days after the default that I’m thinking was likely caused by a change in control, which entails the acquisition of over 40% of the company’s voting power, RC tweets a meme containing the headline “Ryan Cohen Buys all stocks”. And the time that was indicated on the image is seen to be 4:07. The price of BBBY on the exact minute candle at which time he posted his tweet was $4.07. You can’t make that up. A week earlier he had tweeted a quote from the Titanic in which Rose asks Jack to draw her like one of his French Girls, wearing this, only this. Importantly, that scene features the famous blue diamond necklace, which is thought to be lost, Rose later reveals to be holding unknowing to everyone the entire story, it also features the butterfly hairclip resembling the butterfly featured in BBBY's final tweet before selling their IP to Overstock. And since we’re on the topic, the Kirkland and Ellis repeatedly referred to Sue Gove as having the job of turning around the Titanic, and everyone seems to be in agreement on the theme.

But let’s lay off the tinfoil. Do we have any other evidence a change of control occurred on January 13th?

Here’s evidence I don’t think anyone else noticed, during the bond deal, we saw an attempt to remove of some the restrictive covenants on the old bonds.

Specifically on page 75 of the original offering it states

“The proposed amendments with respect to the old Notes would remove the following sections in their entirety from the Supplemental Indentures.

Section 5.1 Offer to purchase upon Change of Control Triggering Event.

a) If a change of control triggering event occurs, unless the company has exercised its right to redeem the notes of a seires, the company will make an offer to each Holder of the Notes of such series to repurchase all or any part of that Holder’s Notes of such series on the terms set forth in such Notes. In the Change of Control Offer, the Company will be required to offer payment in cash equal to 101% of the aggregate principal amount of Notes repurchased, plus accrued an unpaid interest, if any on the Notes repurchased.

b) With respect to the Notes of each series, within 30 days following any change of control triggering event, or at the company’s option, prior to any change of control, but after the public announcement of the transaction that constitutes or may constitute the change of control, a notice will be mailed to holders of the Notes of the applicable series …. And repurchase the Notes of such series no later than 60 days from the date on which the Change of Control Triggering event occurs."

So in smooth brain terms, the old bonds have a covenant in their agreement basically saying that if there’s a change of control triggering event, defined as the consequence of a “non-involved party” becoming a majority owner of 40% or more of the company’s common stock, then BBBY would notify the bondholders within 30 days and will be forced to buy back their bonds at 101% face value 60 days from the date of that notice being mailed before the change of control actually occurs. If LBO of January 13th was the triggering event, 30+60 is 90 days afterwards we should have seen the company repurchase their bonds. 90 days from January 13th is April 12th. On the exact date, April 12th, we get a tweet from our friend Kevin Malone who suddenly discovers an influx of “Make Whole Call” provisions exercised by the company, essentially resulting in the repurchase and cancellation of large numbers of their bonds.

"Make Whole Calls" pertain to corporate bonds and represent a contractual clause enabling the company to retire the bond prematurely by settling the remaining debt. The January 13th LBO was not a failure, it was a triggering event for a change of control transaction which has likely been hidden by NDAs and had not yet occurred hence the lack of any SEC filings disclosing the new ownership.

And here’s an interesting oddity to consider, on January 26th, BlackRock submitted a Form 13G where they simply disclosed a 14% ownership stake in the company. But the filing was an amendment to an earlier 13G filed on January 20th. The key modification that was made from the previous filing was an update on the voting rights for their shares, they went from lacking voting rights to having them. What motivations would lead a company like BlackRock that doesn’t typically concern itself with the corporate governance of a dying home goods retailer want with shareholder voting rights? I can only imagine it was intended to dilute the voting rights of a particular individual who has secured control over the company with a >40% stake.

TLDR; 2034 and 2044 bonds will be converted to equity, 2024 bonds (held by Jake Freeman) will not. The bonds were likely involved in an LBO that began on January 13th but did not consummate until post-Chapter 11. This is why nothing but the IP was offered during the auctions. RC holds the majority of shares.

Freeman Capital Management were the owners of the 2024 bond notes, this was openly disclosed by Jake Freeman himself in a letter he wrote to the board.

When we discovered the “Make Whole Call” provisions exercised by the company on April 12th (Kevin Malone’s reporting), one thing stood out is that they only applied to the 2034 and 2044 notes, leaving the 2024 notes untouched.

Now imagine the company hasn’t died off, and instead engages in a complex M&A transaction after a long Chapter 11 restructuring process. Imagine also that this process involved delisting the old stock, resulting in defaulted or lost shares and debt obligations. Well then if at some future point, former shareholders receive a return in value based on the proportion of their invested stakes, that same advantage wouldn’t extend to bondholders. They’ll have no compensation. And because the company handed the bondholders an option, on several occasions, to convert the debt to shares, any concern about fairness to bond holders is immediately disregarded.

Some comments on the bond exchange deal brokered by Lazard in late 2022:

Although the public exchange was meant to commence on October 18th and expire by November 15th, it was extended again and again and again, ultimately terminated on January 5th, but after each dreadful extension there were supposedly hard efforts to renegotiate the offerings; what’s weird is that when we reviewed the amendments they made it looked like very little was actually changed by the BBBY management to make the offering more persuasive. But despite the failure on surface level, we do see interesting developments occur in two private offerings:

Private Offering #1 involves a single existing holder, contributing to a 3.5M$ debt-to-equity conversion.

Private Offering #2 engages several institutional holders, leading to a much more substantial debt-to-equity conversion.

So despite the unfavorable outlook publicly, these behind-the-scenes actions revealed some progress with significant institutional participation (only concerning the 2034 and 2044 bonds).

One week after terminating the bond exchange deal, on January 13th we found on Pitchbook, a $25,000/year data service, reported the company had undergone a leveraged buyout (LBO), meaning some aspects had already been acquired through a private sale. Another pitchbook data entry revealed that buybuyBABY was the subject of a leveraged buyout on January 13, 2023. That same January 13th, and this is very important, BBBY defaulted on their ABL with JPM.

In August, we received a notice about an at-the-money offering of shares, specifically 12 million shares to be sold via Jeffreys. Cool, they demonstrated the capacity to raise capital by selling shares. An updated Form S-4/A on October 28th made available an additional $150 million for an At-the-Money (ATM) offering.

When BBBY held their Q3 shareholders meeting on January 10th, they disclosed using the revenue from holiday sales to purchase more inventory. There were references to missing targets, possibly related to the going concern notice. Why the fuck didn’t they take advantage of the ATM offering and sell shares for the $150 million they announced?

On January 13th, BBBY was forced to default on the ABL terms, as indicated by JPMorgan, the administrative agent. The 10Q that was later released on January 26th highlighted certain events of default, emphasizing the failure to prepay an over-advance and satisfy a financial covenant, among other things.

But even that same 10Q balance sheet suggested that BBBY actually had sufficient liquidity to fulfill the defaulted payment. So BBBY seemingly had multiple avenues to meet the debt obligation payment on January 13th, either through the liquidity seen on their balance sheets, maneuvering accessible funds, using revenue from holiday sales to service the debt and buying less inventory, or fucking offering shares from the $150 million ATM they already authorized. BBBY seemingly intentionally did not meet their obligations, resulting in the default with JPM. What “among other things” could have caused the default?

Looking into the original ABL loan agreement, which Whoopass actually managed to find from June 19th 2020, you can explore ARTICLE VII Events of Default.

Notable reasons include events requiring full payment of material indebtedness, forced proceedings related to liquidation or bankruptcy, and a change in control. Well at that time, BBBY had neither filed for bankruptcy nor undergone liquidation. Did a change in control occur? Interestingly, one criterion for a change in control was defined as the acquisition of over 40% of the company's voting power by any person or group.

Quick tinfoil, five days after the LBO was reported on Pitchbook, five days after the default that I’m thinking was likely caused by a change in control, which entails the acquisition of over 40% of the company’s voting power, RC tweets a meme containing the headline “Ryan Cohen Buys all stocks”. And the time that was indicated on the image is seen to be 4:07. The price of BBBY on the exact minute candle at which time he posted his tweet was $4.07. You can’t make that up. A week earlier he had tweeted a quote from the Titanic in which Rose asks Jack to draw her like one of his French Girls, wearing this, only this. Importantly, that scene features the famous blue diamond necklace, which is thought to be lost, Rose later reveals to be holding unknowing to everyone the entire story, it also features the butterfly hairclip resembling the butterfly featured in BBBY's final tweet before selling their IP to Overstock. And since we’re on the topic, the Kirkland and Ellis repeatedly referred to Sue Gove as having the job of turning around the Titanic, and everyone seems to be in agreement on the theme.

But let’s lay off the tinfoil. Do we have any other evidence a change of control occurred on January 13th?

Here’s evidence I don’t think anyone else noticed, during the bond deal, we saw an attempt to remove of some the restrictive covenants on the old bonds.

Specifically on page 75 of the original offering it states

“The proposed amendments with respect to the old Notes would remove the following sections in their entirety from the Supplemental Indentures.

Section 5.1 Offer to purchase upon Change of Control Triggering Event.

a) If a change of control triggering event occurs, unless the company has exercised its right to redeem the notes of a seires, the company will make an offer to each Holder of the Notes of such series to repurchase all or any part of that Holder’s Notes of such series on the terms set forth in such Notes. In the Change of Control Offer, the Company will be required to offer payment in cash equal to 101% of the aggregate principal amount of Notes repurchased, plus accrued an unpaid interest, if any on the Notes repurchased.

b) With respect to the Notes of each series, within 30 days following any change of control triggering event, or at the company’s option, prior to any change of control, but after the public announcement of the transaction that constitutes or may constitute the change of control, a notice will be mailed to holders of the Notes of the applicable series …. And repurchase the Notes of such series no later than 60 days from the date on which the Change of Control Triggering event occurs."

So in smooth brain terms, the old bonds have a covenant in their agreement basically saying that if there’s a change of control triggering event, defined as the consequence of a “non-involved party” becoming a majority owner of 40% or more of the company’s common stock, then BBBY would notify the bondholders within 30 days and will be forced to buy back their bonds at 101% face value 60 days from the date of that notice being mailed before the change of control actually occurs. If LBO of January 13th was the triggering event, 30+60 is 90 days afterwards we should have seen the company repurchase their bonds. 90 days from January 13th is April 12th. On the exact date, April 12th, we get a tweet from our friend Kevin Malone who suddenly discovers an influx of “Make Whole Call” provisions exercised by the company, essentially resulting in the repurchase and cancellation of large numbers of their bonds.

"Make Whole Calls" pertain to corporate bonds and represent a contractual clause enabling the company to retire the bond prematurely by settling the remaining debt. The January 13th LBO was not a failure, it was a triggering event for a change of control transaction which has likely been hidden by NDAs and had not yet occurred hence the lack of any SEC filings disclosing the new ownership.

And here’s an interesting oddity to consider, on January 26th, BlackRock submitted a Form 13G where they simply disclosed a 14% ownership stake in the company. But the filing was an amendment to an earlier 13G filed on January 20th. The key modification that was made from the previous filing was an update on the voting rights for their shares, they went from lacking voting rights to having them. What motivations would lead a company like BlackRock that doesn’t typically concern itself with the corporate governance of a dying home goods retailer want with shareholder voting rights? I can only imagine it was intended to dilute the voting rights of a particular individual who has secured control over the company with a >40% stake.

TLDR; 2034 and 2044 bonds will be converted to equity, 2024 bonds (held by Jake Freeman) will not. The bonds were likely involved in an LBO that began on January 13th but did not consummate until post-Chapter 11. This is why nothing but the IP was offered during the auctions. RC holds the majority of shares.

@sboho @BrunoSW9 @PhantomBlack699 @ThePPseedsShow

• • •

Missing some Tweet in this thread? You can try to

force a refresh