Decoding the Sovereign Gold Bond Saga: A Comprehensive Thread on India's Gold Investment Evolution🪙

Launched in 2015 by the Government of India, the Sovereign Gold Bond (SGB) scheme provides a novel way for investors to own gold without the hassle of physical possession. The scheme aims to channelize idle gold into productive avenues and reduce the dependency on physical gold. #sgb

If you're looking for a comprehensive comparison of various gold investments (GOLD ETFs vs PHYSICAL GOLD vs SGB) before delving into this detailed thread on Sovereign Gold Bonds, you can check out the previous post on - GOLD INVESTMENT OPTIONS () Let’s unroll the thread 🧵🧵

🌟 Key Features of SGB:⭐

1. Issued by RBI for the Government of India :

SGBs are issued by the Reserve Bank of India (RBI) on behalf of the Government of India, ensuring credibility and government backing.

2. Denominated in Grams, Flexible Investment :

SGBs are denominated in grams of gold, allowing investors to start with a minimum investment of 1 gram and go up to a maximum of 4 kg per fiscal year for individuals and Hindu Undivided Families (HUFs).

3. Fixed Interest Rate - 2.5% Per Annum 📈:

SGBs carry a fixed annual interest rate of 2.5%, payable semi-annually on the nominal value of the bond. Taxable as the slab rate of individuals.

4. Maturity and Exit Options 📅:

SGBs have a maturity period of 8 years, but investors can opt to exit after the fifth year on the interest payment dates.

5. Secondary Market Trading and Loan Collateral :

SGBs can be traded in the secondary market through stock exchanges, providing liquidity. Additionally, they can be used as collateral for loans, offering a unique dimension to their utility.

Launched in 2015 by the Government of India, the Sovereign Gold Bond (SGB) scheme provides a novel way for investors to own gold without the hassle of physical possession. The scheme aims to channelize idle gold into productive avenues and reduce the dependency on physical gold. #sgb

If you're looking for a comprehensive comparison of various gold investments (GOLD ETFs vs PHYSICAL GOLD vs SGB) before delving into this detailed thread on Sovereign Gold Bonds, you can check out the previous post on - GOLD INVESTMENT OPTIONS () Let’s unroll the thread 🧵🧵

🌟 Key Features of SGB:⭐

1. Issued by RBI for the Government of India :

SGBs are issued by the Reserve Bank of India (RBI) on behalf of the Government of India, ensuring credibility and government backing.

2. Denominated in Grams, Flexible Investment :

SGBs are denominated in grams of gold, allowing investors to start with a minimum investment of 1 gram and go up to a maximum of 4 kg per fiscal year for individuals and Hindu Undivided Families (HUFs).

3. Fixed Interest Rate - 2.5% Per Annum 📈:

SGBs carry a fixed annual interest rate of 2.5%, payable semi-annually on the nominal value of the bond. Taxable as the slab rate of individuals.

4. Maturity and Exit Options 📅:

SGBs have a maturity period of 8 years, but investors can opt to exit after the fifth year on the interest payment dates.

5. Secondary Market Trading and Loan Collateral :

SGBs can be traded in the secondary market through stock exchanges, providing liquidity. Additionally, they can be used as collateral for loans, offering a unique dimension to their utility.

https://x.com/soicfinance/status/1748619046608843155?s=20

Let's dive into the performance of SGB (Sovereign Gold Bonds) over the years! 📈 The inaugural SGB came into existence in 2015, reaching maturity in 2023, completing a 8-year cycle. 🎉

When it was first issued in 2015, the rate stood at ₹2684/1gm. Fast forward to November 2023, and the issue rate had climbed to ₹6199/1gm. As an illustrative example, let's consider a gold purchase of 5 grams, equivalent to an investment of ₹13,420 at the time of the initial issue. Fast forward to the present, and with the current issue rate, that same 5 grams of gold is now valued at ₹30,995.0. 💰

Now we will calculate XIRR for the whole 8 yrs and surprising revelation as we calculate the for 8-year period, considering the semi-annual interest of 2.5%( which was ₹167.75 every 6 months) 🔄. See Below ⬇️⬇️

The XIRR for this period comes out to be 12.81%! ✨

We have attached the excel sheet for your calculation and also for future XIRR calculation of your SGB returns - docs.google.com/spreadsheets/d…

When it was first issued in 2015, the rate stood at ₹2684/1gm. Fast forward to November 2023, and the issue rate had climbed to ₹6199/1gm. As an illustrative example, let's consider a gold purchase of 5 grams, equivalent to an investment of ₹13,420 at the time of the initial issue. Fast forward to the present, and with the current issue rate, that same 5 grams of gold is now valued at ₹30,995.0. 💰

Now we will calculate XIRR for the whole 8 yrs and surprising revelation as we calculate the for 8-year period, considering the semi-annual interest of 2.5%( which was ₹167.75 every 6 months) 🔄. See Below ⬇️⬇️

The XIRR for this period comes out to be 12.81%! ✨

We have attached the excel sheet for your calculation and also for future XIRR calculation of your SGB returns - docs.google.com/spreadsheets/d…

To simplify tracking of Sovereign Gold Bond (SGB) prices, we've created an Excel sheet that gets updated with each new issue. ✨ Save this sheet for future reference to easily monitor and stay informed about SGB prices. docs.google.com/spreadsheets/d…

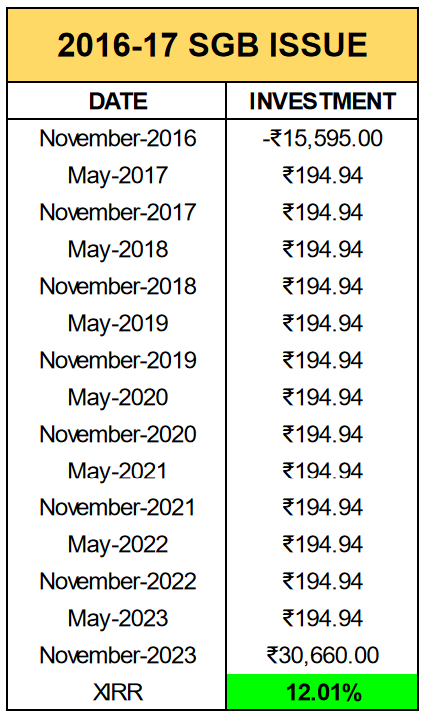

We've conducted an in-depth analysis spanning seven years, starting from the 2nd issue in 2016 through 2023. Back then, the issue price stood at ₹3119 per gram. Fast forward to the most recent December issue, and the price has surged to ₹6199 per gram.

Our analysis factored in the semi-annual interest rate of 2.5%, providing a comprehensive perspective on the performance over this period.🔄

Our analysis factored in the semi-annual interest rate of 2.5%, providing a comprehensive perspective on the performance over this period.🔄

🚨 Drawbacks and Risks:

1. Market Risk - Price Fluctuations :

SGBs are subject to market risk as the redemption price is based on the prevailing gold price at maturity or premature exit. Investors should be mindful of potential fluctuations in gold prices.

2. Liquidity Challenges and Waiting Periods :

Unlike physical gold, SGBs may lack the same liquidity and convenience. Investors must adhere to issuance and redemption dates or rely on the availability of buyers and sellers in the secondary market.

3.Not Ideal for Short-term Investors :

SGBs may not be suitable for short-term investors due to a lock-in period of 5 years. The lower interest rate compared to some fixed-income instruments might deter those seeking quick returns.

1. Market Risk - Price Fluctuations :

SGBs are subject to market risk as the redemption price is based on the prevailing gold price at maturity or premature exit. Investors should be mindful of potential fluctuations in gold prices.

2. Liquidity Challenges and Waiting Periods :

Unlike physical gold, SGBs may lack the same liquidity and convenience. Investors must adhere to issuance and redemption dates or rely on the availability of buyers and sellers in the secondary market.

3.Not Ideal for Short-term Investors :

SGBs may not be suitable for short-term investors due to a lock-in period of 5 years. The lower interest rate compared to some fixed-income instruments might deter those seeking quick returns.

The recent issue of SGB Series IV at price of ₹6263/- Subscription time period - 12 Feb 24 - 16 Feb 24.

In conclusion, we strongly encourage you to conduct your own research and leverage the provided data. 💡

Additionally, if you're keen on exploring further investment options, remember to subscribe to our YouTube channel for insightful content. SOIC - YouTube -

Thank you so much for reading! 📖📖

We teach Fundamental and Business analysis at SOIC :)

Over the past 3 years we have taught more than 10,000 students and spurred them on the journey of becoming a Complete Investor. #investing

Link to our SOIC Membership: youtube.com/@SOICfinance

soic.in/soicmembership/

In conclusion, we strongly encourage you to conduct your own research and leverage the provided data. 💡

Additionally, if you're keen on exploring further investment options, remember to subscribe to our YouTube channel for insightful content. SOIC - YouTube -

Thank you so much for reading! 📖📖

We teach Fundamental and Business analysis at SOIC :)

Over the past 3 years we have taught more than 10,000 students and spurred them on the journey of becoming a Complete Investor. #investing

Link to our SOIC Membership: youtube.com/@SOICfinance

soic.in/soicmembership/

• • •

Missing some Tweet in this thread? You can try to

force a refresh