Bristlemoon just published a deep dive on The Trade Desk. $TTD is a solid business exposed to two high growth digital ad channels (CTV + retail media) but we question the extent to which TTD will benefit, explore the likely take rate pressure, and other risks such as...

signal loss from cookie deprecation, risks around the scalability and regulatory scrutiny re $TTD's alt. ID called UID2, as well as supply path optimization risks. We do our best to cut through the complexity and provide a balanced view.

open.substack.com/pub/bristlemoo…

open.substack.com/pub/bristlemoo…

$TTD is one of the greatest stock compounding stories, achieving a 40x stock return in 7 years since it listed.

We set the stage by exploring the various programmatic buying models and give an overview of the ad tech industry participants.

We then explore $TTD's positioning as a programmatic ad buying platform. As a pure-play DSP, TTD doesn’t own or operate any of its own ad inventory. Instead, it obtains a supply of omnichannel inventory from over 100 directly integrated ad exchanges and SSPs.

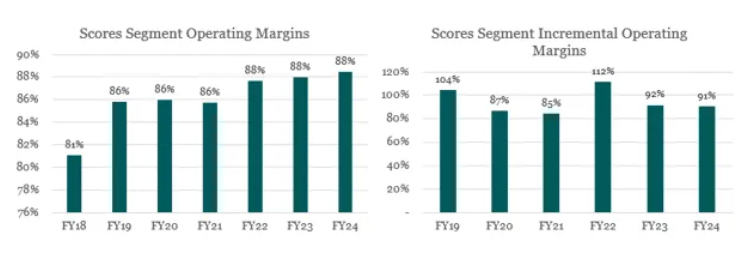

We give a brief recap of $TTD's phenomenal financial performance. Since the company’s IPO in 2016, it has compounded gross spend and revenue at a 38% CAGR, handily outgrowing the broader open programmatic market and taking 700 bps of market share between 2017 and 2022.

We dive into the technical details of $TTD's platform. Bid factoring is TTD’s original technical claim to fame and allows traders to apply a factor or weight to elements of the bidstream such as ad size, site, device etc. that are more likely to produce the best ad performance.

We discuss $TTD's competitive differentiation, looking at the companies scale, independence, close relationship with agencies, and greater transparency and control for ad buyers.

We challenge $TTD mgt's assessment of the CTV opportunity and highlight risks around walled gardening and agencies going direct to publishers. There is also an outstanding question on what % of CTV ad buying shifts to programmatic biddable which informs CPMs and fees for $TTD.

There are material differences in fees for the different forms of programmatic ad buying, and we believe that this will create a negative mix headwind for $TTD as CTV growth continues to outpace the remainder of TTD's business.

We strongly push back on mgt's assertion that CTV CPMs as a rule of thumb are higher for biddable inventory than guaranteed inventory. Their investor day disclosures were, shall we say, massaged.

We then explore the retail media opportunity; we are skeptical that the opportunity for $TTD is as large as mgt paints it to be due to a lack of capabilities to serve onsite retail media.

We call into question the sustainability of $TTD's take rate due to the impact of CTV mix as well as 3rd party cookie deprecation.

There is much more contained in the report - it is our most detailed and comprehensive report to date and hopefully sheds some light on a complex/opaque industry. Please feel free to subscribe and share our report with others if you feel that it's valuable!

• • •

Missing some Tweet in this thread? You can try to

force a refresh