Founder & Chief Investment Officer - Bristlemoon Capital

Global L/S equities

Subscribe https://t.co/qMdR4HXhka

Views not investment advice

2 subscribers

How to get URL link on X (Twitter) App

...and the personal side of starting a fund. Most analysts harbor ambitions, whether secretly or overtly, to start their own fund. I hope this piece provides useful color on the fund launch journey.

...and the personal side of starting a fund. Most analysts harbor ambitions, whether secretly or overtly, to start their own fund. I hope this piece provides useful color on the fund launch journey.

signal loss from cookie deprecation, risks around the scalability and regulatory scrutiny re $TTD's alt. ID called UID2, as well as supply path optimization risks. We do our best to cut through the complexity and provide a balanced view.

signal loss from cookie deprecation, risks around the scalability and regulatory scrutiny re $TTD's alt. ID called UID2, as well as supply path optimization risks. We do our best to cut through the complexity and provide a balanced view.

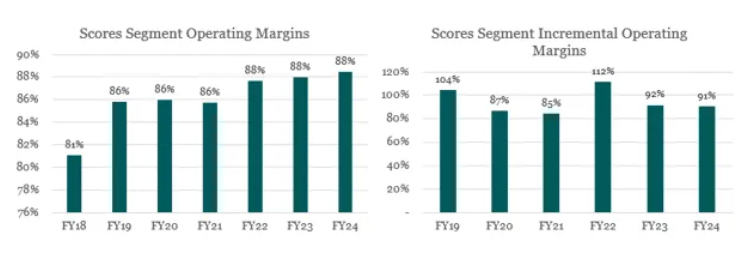

This, along with relatively stronger growth from the much lower mgn international biz, will likely see mgns struggle to hold these elevated levels. The stock is richly valued and falls far short of our return thresholds.

This, along with relatively stronger growth from the much lower mgn international biz, will likely see mgns struggle to hold these elevated levels. The stock is richly valued and falls far short of our return thresholds.

In 1Q23 mgt guided to "much stronger" Tinder sequential payer adds by the end of the yr and later that month @ JPM conf. guided to them being back in "positive territory" in Q4. That got walked back in Q2 with MSD % net payer declines guided for the rest of the year.

In 1Q23 mgt guided to "much stronger" Tinder sequential payer adds by the end of the yr and later that month @ JPM conf. guided to them being back in "positive territory" in Q4. That got walked back in Q2 with MSD % net payer declines guided for the rest of the year.

Einhorn's point is an important one bc it recognises this and how changes to the mkt structure re how capital is being deployed now means that there's less capital that sympathises with a value investing strategy.

Einhorn's point is an important one bc it recognises this and how changes to the mkt structure re how capital is being deployed now means that there's less capital that sympathises with a value investing strategy.

https://twitter.com/GHadjia/status/1579890642502955008MSFT's move to integrate Office 365 and Teams into Horizon Workrooms takes a page out of its PC-era playbook of being hardware agnostic. MSFT has its own HoloLens product but backing the current VR hardware leader (META) is strategic re maintaining productivity sw dominance.

https://twitter.com/GHadjia/status/1422221370126217217?s=20Tencent has many opportunities to realise option value, whether it be the metaverse, the creator economy, e-commerce, or healthcare. However, the company is pushing up the cloud stack which could generate enormous value that is currently being ignored by the market. 2/

Your guess probably involved some sort of tapering of the growth rate. In other words, you extrapolated the trend of the past three years to inform your view for the next three years. This is problematic when forecasting, but especially so for companies with optionality. 2/

Your guess probably involved some sort of tapering of the growth rate. In other words, you extrapolated the trend of the past three years to inform your view for the next three years. This is problematic when forecasting, but especially so for companies with optionality. 2/